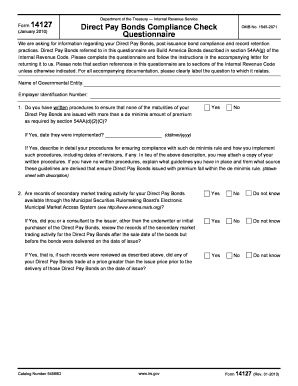

Form 14127, Direct Pay Bonds Compliance Check Questionnaire IRS Irs

What is the Form 14127, Direct Pay Bonds Compliance Check Questionnaire?

The Form 14127, also known as the Direct Pay Bonds Compliance Check Questionnaire, is a document utilized by the IRS to ensure compliance with federal tax regulations concerning direct pay bonds. This form is essential for entities that issue direct pay bonds, as it helps verify that the issuer is adhering to the necessary guidelines and requirements set forth by the IRS. By completing this questionnaire, organizations can demonstrate their compliance status and avoid potential penalties associated with non-compliance.

Steps to Complete the Form 14127

Completing the Form 14127 involves several key steps to ensure accuracy and compliance. First, gather all relevant information regarding the direct pay bonds issued, including details about the bond issuer and the specific bonds in question. Next, carefully fill out each section of the questionnaire, providing clear and concise responses to all inquiries. It is crucial to review the completed form for any errors or omissions before submission. Finally, submit the form according to the IRS guidelines, ensuring that it is sent to the correct address or submitted electronically if applicable.

Legal Use of the Form 14127

The legal use of the Form 14127 is governed by IRS regulations that outline the requirements for direct pay bonds. This form serves as an official declaration of compliance, which can be referenced in case of audits or inquiries by the IRS. Proper completion and submission of the form help protect the issuer from legal repercussions, as it demonstrates adherence to federal tax laws. It is important for organizations to understand the legal implications of this form and to ensure that all information provided is accurate and truthful.

Required Documents for the Form 14127

When preparing to complete the Form 14127, it is essential to have certain documents on hand. These may include bond issuance records, financial statements, and any prior correspondence with the IRS regarding direct pay bonds. Having these documents readily available will facilitate the accurate completion of the questionnaire and support the information provided. Additionally, organizations should ensure that they have access to any relevant tax compliance records that may be required for verification purposes.

Form Submission Methods

The Form 14127 can be submitted through various methods, depending on the preferences of the issuer and the requirements set by the IRS. Options typically include electronic submission through the IRS e-file system or mailing a physical copy to the designated IRS address. It is important to follow the specific instructions provided by the IRS regarding submission methods to ensure timely processing and compliance with regulatory standards.

Penalties for Non-Compliance

Failure to comply with the requirements associated with the Form 14127 can result in significant penalties for the issuer. These penalties may include fines, interest on unpaid taxes, and potential legal action from the IRS. Organizations should be aware of the implications of non-compliance and take proactive measures to ensure that they complete and submit the questionnaire accurately and on time. Understanding the potential consequences can help motivate timely compliance and adherence to IRS regulations.

Quick guide on how to complete form 14127 direct pay bonds compliance check questionnaire irs irs

Complete Form 14127, Direct Pay Bonds Compliance Check Questionnaire IRS Irs effortlessly on any gadget

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can locate the appropriate form and securely retain it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without holdups. Manage Form 14127, Direct Pay Bonds Compliance Check Questionnaire IRS Irs on any device using airSlate SignNow’s Android or iOS applications and streamline any document-based operation today.

The easiest method to modify and electronically sign Form 14127, Direct Pay Bonds Compliance Check Questionnaire IRS Irs without hassle

- Obtain Form 14127, Direct Pay Bonds Compliance Check Questionnaire IRS Irs and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize key sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Generate your signature using the Sign function, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your alterations.

- Select how you wish to share your form, by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Alter and electronically sign Form 14127, Direct Pay Bonds Compliance Check Questionnaire IRS Irs and guarantee effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 14127 direct pay bonds compliance check questionnaire irs irs

The best way to create an electronic signature for your PDF file online

The best way to create an electronic signature for your PDF file in Google Chrome

How to make an eSignature for signing PDFs in Gmail

The best way to generate an eSignature straight from your mobile device

The way to create an electronic signature for a PDF file on iOS

The best way to generate an eSignature for a PDF document on Android devices

People also ask

-

What is a direct compliance form and how does airSlate SignNow help with it?

A direct compliance form is essential for ensuring that your business adheres to legal and regulatory standards. airSlate SignNow provides a streamlined solution to create, send, and eSign these forms efficiently, reducing the risk of non-compliance and enhancing document security.

-

How does airSlate SignNow ensure the security of my direct compliance forms?

airSlate SignNow uses advanced encryption technologies and authentication measures to protect your direct compliance forms. This ensures that all data remains confidential and secure, meeting industry standards for regulatory compliance.

-

What are the pricing plans for using direct compliance forms with airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to different business needs. You can choose from monthly or annual subscriptions that provide access to features specifically designed for creating direct compliance forms at an affordable rate.

-

Can I integrate airSlate SignNow with other applications for managing direct compliance forms?

Yes, airSlate SignNow seamlessly integrates with a variety of applications, including CRM and project management tools. This integration allows for better workflow efficiency when managing direct compliance forms and other important documents.

-

What features does airSlate SignNow offer for creating direct compliance forms?

airSlate SignNow provides a user-friendly interface with customizable templates for direct compliance forms. Features like drag-and-drop editing, electronic signatures, and real-time collaboration enhance the form creation process, making it easy to meet compliance requirements.

-

How can airSlate SignNow improve the speed of processing direct compliance forms?

With airSlate SignNow, you can automate the sending and signing of direct compliance forms, which signNowly speeds up the process. Automated reminders and notifications ensure that all parties engage quickly, reducing the time it takes to complete compliance-related tasks.

-

Is it possible to track the status of my direct compliance forms using airSlate SignNow?

Absolutely! airSlate SignNow allows you to track the status of your direct compliance forms in real-time. You can see who has viewed, signed, or completed the forms, giving you full visibility and control over your compliance processes.

Get more for Form 14127, Direct Pay Bonds Compliance Check Questionnaire IRS Irs

Find out other Form 14127, Direct Pay Bonds Compliance Check Questionnaire IRS Irs

- How To eSign Illinois Business Operations Stock Certificate

- Can I eSign Louisiana Car Dealer Quitclaim Deed

- eSign Michigan Car Dealer Operating Agreement Mobile

- Can I eSign Mississippi Car Dealer Resignation Letter

- eSign Missouri Car Dealer Lease Termination Letter Fast

- Help Me With eSign Kentucky Business Operations Quitclaim Deed

- eSign Nevada Car Dealer Warranty Deed Myself

- How To eSign New Hampshire Car Dealer Purchase Order Template

- eSign New Jersey Car Dealer Arbitration Agreement Myself

- eSign North Carolina Car Dealer Arbitration Agreement Now

- eSign Ohio Car Dealer Business Plan Template Online

- eSign Ohio Car Dealer Bill Of Lading Free

- How To eSign North Dakota Car Dealer Residential Lease Agreement

- How Do I eSign Ohio Car Dealer Last Will And Testament

- Sign North Dakota Courts Lease Agreement Form Free

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later