Supporting Documents to Prove the Child Tax Credit CTC and Form

Understanding the Supporting Documents for the Child Tax Credit (CTC)

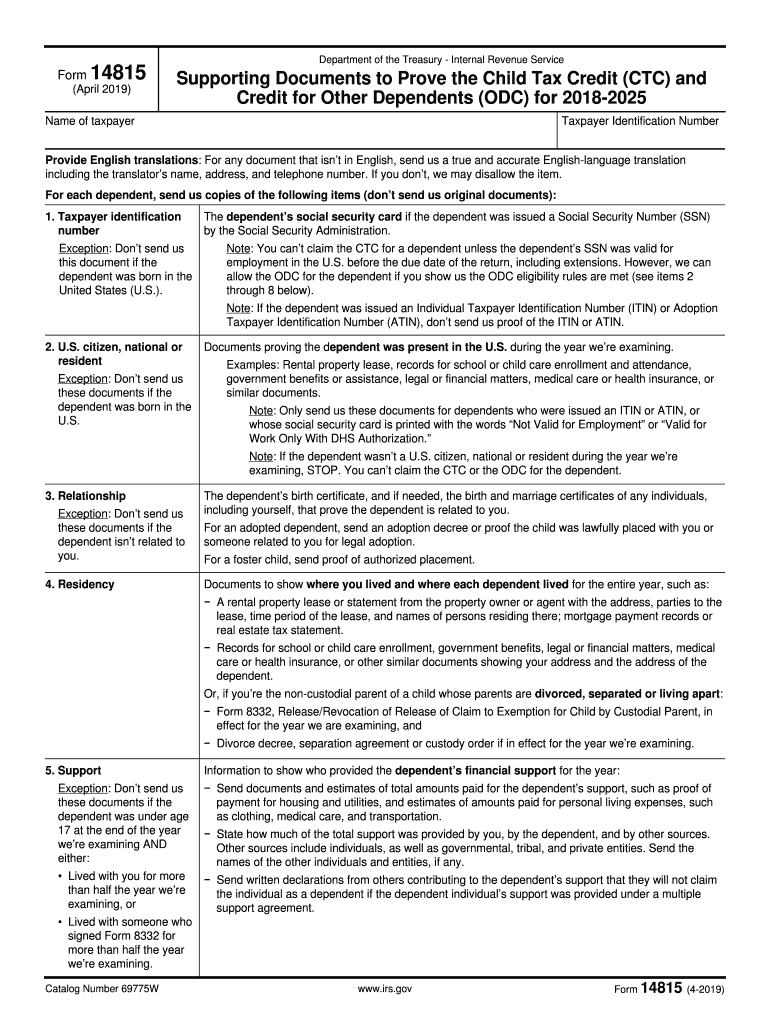

The Child Tax Credit (CTC) is a significant tax benefit available to eligible families in the United States. To qualify for this credit, taxpayers must provide specific supporting documents that demonstrate their eligibility. These documents typically include proof of residency for dependents, which confirms that the child lived with the taxpayer for more than half of the year. Acceptable forms of proof can include utility bills, lease agreements, or school records that list the child’s name and address. It is essential to gather these documents before filing your taxes to ensure a smooth process.

Steps to Complete the Supporting Documents for the Child Tax Credit (CTC)

Completing the supporting documents for the Child Tax Credit involves several key steps. First, gather all necessary documentation that proves the residency of your dependents. This may include:

- Utility bills

- Lease agreements

- School records

- Medical records

Next, ensure that each document clearly displays the child’s name and the address where they reside. Once you have collected the documents, organize them in a manner that makes it easy to submit them with your tax return. If you are filing electronically, check that your eSignature tool is compliant with IRS regulations to ensure the documents are legally binding.

Legal Use of the Supporting Documents for the Child Tax Credit (CTC)

To ensure that your supporting documents for the Child Tax Credit are legally recognized, they must meet specific criteria set by the IRS. The documents should be accurate, clearly legible, and relevant to the tax year for which you are claiming the credit. Additionally, using a reliable digital signature tool can help maintain the integrity of your documents. Compliance with eSignature laws, such as ESIGN and UETA, is crucial for the legal acceptance of your proof of residency for dependents.

IRS Guidelines for Supporting Documents

The IRS provides clear guidelines regarding the types of documents that can be used to support claims for the Child Tax Credit. According to IRS regulations, documents must verify the child’s residency and relationship to the taxpayer. It is advisable to review the IRS publication on the Child Tax Credit to ensure that you are submitting the correct forms and documentation. Keeping a record of all submitted documents can also be beneficial in case of future audits or inquiries.

Required Documents for the Child Tax Credit (CTC)

When applying for the Child Tax Credit, specific documents are required to substantiate your claim. These include:

- Proof of residency for each dependent

- Social Security numbers for all qualifying children

- Tax returns from previous years, if applicable

Having these documents ready will facilitate a smoother filing process and help ensure that you receive the full benefit of the credit.

Examples of Using Supporting Documents for the Child Tax Credit (CTC)

Examples of supporting documents that can be utilized when claiming the Child Tax Credit include:

- A utility bill showing the child’s name and home address

- A school enrollment form that lists the child’s address

- A letter from a healthcare provider confirming the child’s residence

These examples illustrate the variety of documentation that can be used to prove residency, helping to strengthen your claim for the credit.

Quick guide on how to complete supporting documents to prove the child tax credit ctc and

Complete Supporting Documents To Prove The Child Tax Credit CTC And effortlessly on any device

Online document management has become popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and efficiently. Manage Supporting Documents To Prove The Child Tax Credit CTC And on any platform with the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest method to edit and eSign Supporting Documents To Prove The Child Tax Credit CTC And without any hassle

- Obtain Supporting Documents To Prove The Child Tax Credit CTC And and then click Get Form to initiate.

- Use the tools we provide to fill out your form.

- Highlight important sections of the documents or redact sensitive information with tools offered by airSlate SignNow specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you prefer to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and eSign Supporting Documents To Prove The Child Tax Credit CTC And while ensuring excellent communication throughout the document preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the supporting documents to prove the child tax credit ctc and

The best way to create an eSignature for a PDF online

The best way to create an eSignature for a PDF in Google Chrome

The best way to create an eSignature for signing PDFs in Gmail

The best way to generate an electronic signature from your smartphone

The way to generate an eSignature for a PDF on iOS

The best way to generate an electronic signature for a PDF file on Android

People also ask

-

What is a proof of dependency letter?

A proof of dependency letter is a document that confirms the dependent status of an individual, usually for purposes of insurance or benefits. Within airSlate SignNow, creating and sending this letter is streamlined and efficient, allowing for quick turnaround times. Users can easily customize templates to meet specific needs.

-

How can I create a proof of dependency letter using airSlate SignNow?

Creating a proof of dependency letter with airSlate SignNow is simple. Users can utilize our customizable templates to start from scratch or modify existing documents. Once your content is finalized, you can quickly send it for eSignature, ensuring all parties can sign without delay.

-

Is airSlate SignNow cost-effective for creating a proof of dependency letter?

Yes, airSlate SignNow offers a cost-effective solution for generating documents, including proof of dependency letters. Our pricing plans are designed to suit various business needs, ensuring that everyone can access essential eSignature functionalities without breaking the bank.

-

What features does airSlate SignNow provide for managing proof of dependency letters?

airSlate SignNow provides various features for managing proof of dependency letters, including template creation, bulk sending, and status tracking. Additionally, our user-friendly interface and robust security measures ensure a smooth signing experience. Team collaboration tools also enhance efficiency during the document creation process.

-

Can I integrate airSlate SignNow with other applications for proof of dependency letters?

Yes, airSlate SignNow offers integrations with numerous applications, allowing for seamless workflow enhancements. You can connect with popular platforms like Google Drive, Salesforce, and more to manage your proof of dependency letters efficiently. This integration capability ensures that your documents are always accessible and organized.

-

What benefits does airSlate SignNow provide for businesses needing proof of dependency letters?

airSlate SignNow enhances business operations by making the process of creating and sending proof of dependency letters faster and more secure. Automated reminders, real-time tracking, and a variety of templates facilitate easier document management. This not only saves time but also boosts productivity.

-

Is technical support available for issues related to proof of dependency letters?

Absolutely! airSlate SignNow offers dedicated customer support to assist you with any issues related to your proof of dependency letters. Our knowledgeable team is available via multiple channels, ensuring you receive timely assistance and can resolve any concerns quickly.

Get more for Supporting Documents To Prove The Child Tax Credit CTC And

- New york form it 213 claim for empire state child credit

- Ccgc application form

- Guardians initial annual final form

- Form 1160

- Agricultural heavy vehicle zone map form

- Green shield prior authorization form

- List any and all names nicknames or aliases you have used in the past form

- Contact the county orange county california form

Find out other Supporting Documents To Prove The Child Tax Credit CTC And

- Help Me With Sign New Mexico Banking Word

- Help Me With Sign New Mexico Banking Document

- How Do I Sign New Mexico Banking Form

- How To Sign New Mexico Banking Presentation

- How Do I Sign New York Banking PPT

- Help Me With Sign Ohio Banking Document

- How To Sign Oregon Banking PDF

- Help Me With Sign Oregon Banking Presentation

- Can I Sign Pennsylvania Banking Form

- How To Sign Arizona Business Operations PDF

- Help Me With Sign Nebraska Business Operations Presentation

- How To Sign Arizona Car Dealer Form

- How To Sign Arkansas Car Dealer Document

- How Do I Sign Colorado Car Dealer PPT

- Can I Sign Florida Car Dealer PPT

- Help Me With Sign Illinois Car Dealer Presentation

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF