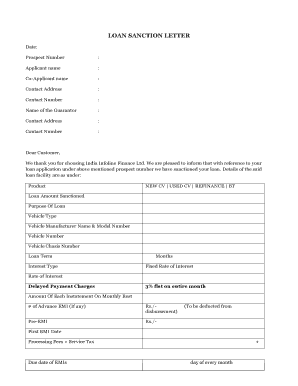

Iifl Home Loan Sanction Letter Form

Understanding the SBI Home Loan Sanction Letter

The SBI home loan sanction letter is a crucial document issued by the State Bank of India, confirming that a borrower has been approved for a home loan. This letter outlines the terms and conditions of the loan, including the sanctioned amount, interest rate, repayment tenure, and any other relevant details. It serves as a formal acknowledgment of the bank's commitment to provide the loan, enabling borrowers to proceed with their property purchase or construction plans.

How to Obtain the SBI Home Loan Sanction Letter

To obtain the SBI home loan sanction letter, borrowers typically need to complete the loan application process. This involves submitting necessary documents such as proof of identity, income statements, property documents, and credit history. Once the application is reviewed and approved, the bank will issue the sanction letter. Borrowers can often download the letter online through the SBI banking portal or mobile app, ensuring easy access to this important document.

Key Elements of the SBI Home Loan Sanction Letter

The SBI home loan sanction letter includes several key elements that are essential for borrowers to understand. These elements typically encompass:

- Loan Amount: The total amount approved by the bank.

- Interest Rate: The applicable interest rate for the loan, which can be fixed or floating.

- Repayment Tenure: The duration over which the loan must be repaid.

- EMI Details: Information about the monthly installment payments.

- Terms and Conditions: Specific conditions that apply to the loan agreement.

Legal Use of the SBI Home Loan Sanction Letter

The SBI home loan sanction letter holds legal significance as it acts as proof of the loan agreement between the borrower and the bank. It is essential for borrowers to keep this document secure, as it may be required for various legal and financial transactions, such as property registration and tax purposes. Additionally, the letter must be presented when claiming any benefits associated with the home loan, such as tax deductions.

Steps to Complete the SBI Home Loan Sanction Letter

Completing the SBI home loan sanction letter involves several important steps. After receiving the sanction letter, borrowers should:

- Review the details carefully to ensure accuracy.

- Sign the letter where indicated, if required.

- Submit any additional documents requested by the bank.

- Follow up with the bank for any clarifications or further instructions.

Digital vs. Paper Version of the SBI Home Loan Sanction Letter

With the rise of digital banking, borrowers can choose between a digital and a paper version of the SBI home loan sanction letter. The digital version, often available for download from the bank's online portal, offers convenience and easy access. It is considered legally valid, provided it complies with eSignature laws. The paper version, while traditional, may be preferred for formal presentations or legal requirements. Both versions contain the same critical information.

Quick guide on how to complete iifl home loan sanction letter

Complete Iifl Home Loan Sanction Letter smoothly on any device

Digital document management has gained traction among companies and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed forms, as you can access the necessary document and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents swiftly without interruptions. Manage Iifl Home Loan Sanction Letter on any device using the airSlate SignNow Android or iOS applications and enhance any document-related workflow today.

The easiest way to modify and eSign Iifl Home Loan Sanction Letter without hassle

- Find Iifl Home Loan Sanction Letter and then click Get Form to commence.

- Employ the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that task.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and then click on the Done button to finalize your changes.

- Choose how you want to send your form, via email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies of documents. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Iifl Home Loan Sanction Letter and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the iifl home loan sanction letter

How to make an eSignature for your PDF document online

How to make an eSignature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

How to create an electronic signature straight from your smart phone

The best way to make an electronic signature for a PDF document on iOS

How to create an electronic signature for a PDF document on Android OS

People also ask

-

What is a loan sanction letter from SBI?

A loan sanction letter from SBI is a document issued by the bank that indicates the approval of a loan application along with the terms and conditions of the loan. Understanding how to get loan sanction letter from SBI is crucial for borrowers to assess their eligibility and the loan amount approved.

-

What documents are required to get a loan sanction letter from SBI?

To get a loan sanction letter from SBI, you typically need to provide identity proof, income proof, property documents, and your application form. Familiarizing yourself with these requirements can streamline the process when learning how to get loan sanction letter from SBI.

-

How long does it take to receive a loan sanction letter from SBI?

The time taken to receive a loan sanction letter from SBI can vary, but it usually takes around 7 to 15 working days post-application submission. To expedite this process, ensure all documents are complete and correct when considering how to get loan sanction letter from SBI.

-

What is the validity period of a loan sanction letter from SBI?

A loan sanction letter from SBI generally has a validity period of 3 to 6 months, depending on the bank's policies. Be mindful of this duration when planning how to get loan sanction letter from SBI so you can complete your property purchase or project within the timeframe.

-

Can I apply for multiple loans using the same loan sanction letter from SBI?

No, a loan sanction letter from SBI is specific to the application and borrower. Understanding how to get loan sanction letter from SBI is essential to ensure you apply for one loan at a time to avoid complications or rejections.

-

Are there any fees associated with obtaining a loan sanction letter from SBI?

Generally, there are no direct fees for obtaining a loan sanction letter from SBI; however, processing fees may apply based on the loan type. It’s advisable to inquire explicitly about any costs involved when learning how to get loan sanction letter from SBI.

-

What are the benefits of getting a loan sanction letter from SBI?

A loan sanction letter from SBI offers various benefits, including a clear understanding of your borrowing capacity and official confirmation of loan terms. Knowing how to get loan sanction letter from SBI can empower you to negotiate better terms and finalize your property plans.

Get more for Iifl Home Loan Sanction Letter

- Full text of ampquotindexampquot internet archive form

- Fillable online nslcity north salt lake city nslcityorg form

- Digitalbentleyumichedu form

- Authorized signatories for partnerships or corporations form

- Chapter 12 peer review and final revisionswriting for form

- 4108 report writinginternal revenue service form

- Do up a document that we will save as a form

- I have been unable to reach you by telephone form

Find out other Iifl Home Loan Sanction Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe