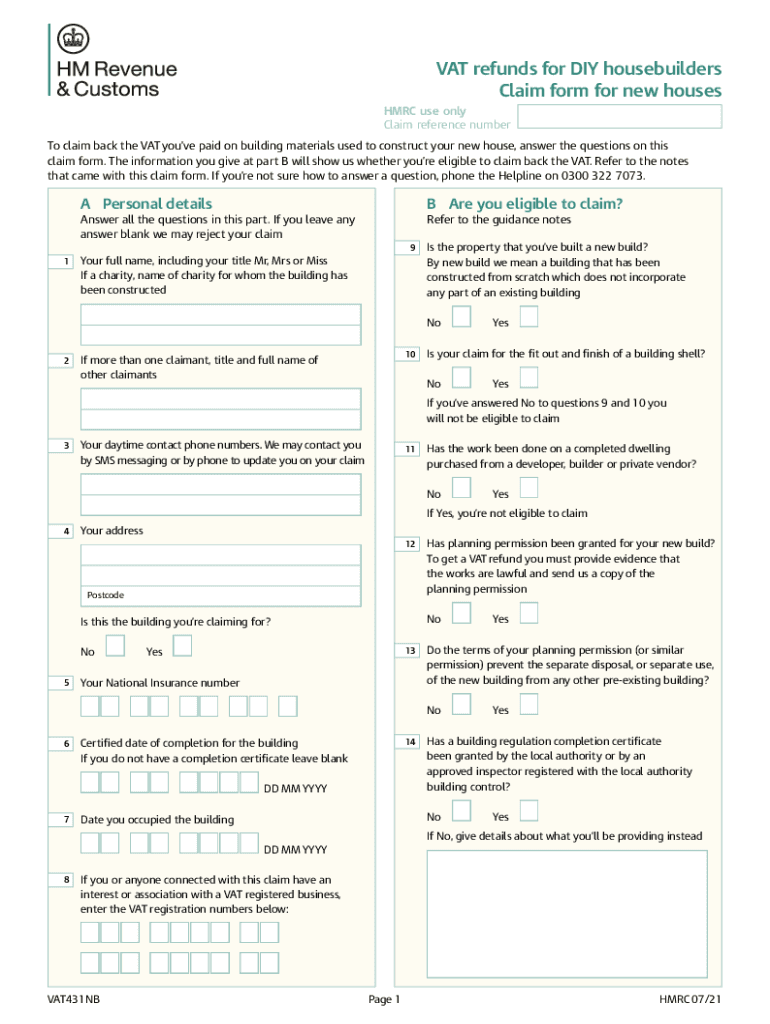

VAT431NB Form and Notes VAT Refunds for DIY Housebuilders Claim Form and Notes for New Houses

What is the VAT431NB Form?

The VAT431NB form is a crucial document for DIY housebuilders in the United States seeking to reclaim Value Added Tax (VAT) on eligible construction costs. This form serves as a claim for VAT refunds specifically related to new housing projects. It outlines the necessary details and requirements for individuals who have constructed their own homes or made significant alterations to existing properties. Understanding the purpose and function of the VAT431NB form is essential for ensuring that all claims are processed smoothly and efficiently.

Steps to Complete the VAT431NB Form

Completing the VAT431NB form involves several key steps to ensure accuracy and compliance. First, gather all relevant documentation, including receipts and invoices for materials and services related to the construction. Next, accurately fill out the form, providing details such as the total amount of VAT paid and the nature of the construction work. It is important to double-check all entries for correctness before submission. Finally, submit the completed form along with supporting documents to the appropriate tax authority, ensuring you adhere to any specified deadlines.

Eligibility Criteria for VAT Refunds

To qualify for a VAT refund using the VAT431NB form, certain eligibility criteria must be met. The claimant must be an individual who has constructed a new house or made significant modifications to an existing property. The construction must be completed within a specific timeframe, and all materials and services claimed must be directly related to the building project. Additionally, it is essential that the claimant retains all supporting documentation to substantiate their claim for VAT refunds.

Required Documents for Submission

When submitting the VAT431NB form, several documents are required to support the claim. These typically include:

- Receipts and invoices for all materials purchased.

- Contracts or agreements with contractors or builders.

- Proof of payment for services rendered.

- Any additional documentation that demonstrates the construction work completed.

Having these documents organized and readily available will facilitate a smoother claims process and help ensure that all necessary information is provided.

Legal Use of the VAT431NB Form

The VAT431NB form is legally recognized for claiming VAT refunds in the context of DIY housebuilding. To ensure that the form is used correctly, it must be filled out in accordance with the guidelines set forth by the relevant tax authorities. This includes providing accurate information and adhering to submission deadlines. Utilizing a reliable eSignature platform, such as signNow, can enhance the legal validity of the completed form by providing secure electronic signatures and maintaining compliance with eSignature regulations.

Form Submission Methods

The VAT431NB form can be submitted through various methods, depending on the preferences of the claimant and the requirements of the tax authority. Common submission methods include:

- Online submission via the tax authority's official website.

- Mailing a physical copy of the completed form and supporting documents.

- In-person submission at designated tax offices.

Choosing the right submission method can impact the processing time and efficiency of the claim.

Quick guide on how to complete vat431nb form and notes vat refunds for diy housebuilders claim form and notes for new houses

Prepare VAT431NB Form And Notes VAT Refunds For DIY Housebuilders Claim Form And Notes For New Houses effortlessly on any device

Digital document management has become a popular choice for businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, edit, and electronically sign your documents quickly without delays. Handle VAT431NB Form And Notes VAT Refunds For DIY Housebuilders Claim Form And Notes For New Houses on any device with airSlate SignNow applications for Android or iOS and simplify any document-related process today.

The simplest way to edit and electronically sign VAT431NB Form And Notes VAT Refunds For DIY Housebuilders Claim Form And Notes For New Houses with ease

- Obtain VAT431NB Form And Notes VAT Refunds For DIY Housebuilders Claim Form And Notes For New Houses and click Get Form to commence.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method for sharing your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require reprinting new copies. airSlate SignNow covers all your document management needs in just a few clicks from any device you choose. Edit and electronically sign VAT431NB Form And Notes VAT Refunds For DIY Housebuilders Claim Form And Notes For New Houses and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the vat431nb form and notes vat refunds for diy housebuilders claim form and notes for new houses

The way to make an electronic signature for your PDF file online

The way to make an electronic signature for your PDF file in Google Chrome

The best way to make an eSignature for signing PDFs in Gmail

The way to make an eSignature right from your mobile device

The way to generate an electronic signature for a PDF file on iOS

The way to make an eSignature for a PDF on Android devices

People also ask

-

What is apkzillaxyz and how does it relate to airSlate SignNow?

apkzillaxyz is a platform that provides mobile applications, including airSlate SignNow. It allows users to easily access and utilize the full features of airSlate SignNow for eSigning and document management on their mobile devices.

-

How much does airSlate SignNow cost when accessed through apkzillaxyz?

Pricing for airSlate SignNow via apkzillaxyz varies depending on the subscription plan. Users can choose from different pricing tiers that offer a range of features suitable for businesses of all sizes, ensuring a cost-effective solution.

-

What features does airSlate SignNow offer on the apkzillaxyz platform?

The airSlate SignNow app available on apkzillaxyz offers robust features such as document eSigning, templates, reminders, and integration capabilities with various third-party apps. These features make it easy for users to streamline their document workflows.

-

Can I integrate airSlate SignNow with other tools via apkzillaxyz?

Yes, airSlate SignNow can be seamlessly integrated with numerous tools and platforms through apkzillaxyz. This allows users to enhance their productivity by automating workflows and connecting with their preferred applications.

-

What are the main benefits of using airSlate SignNow through apkzillaxyz?

Using airSlate SignNow through apkzillaxyz provides signNow benefits including ease of access, mobile functionality, and a user-friendly interface. This empowers businesses to efficiently send and sign documents on the go without sacrificing security or compliance.

-

Is airSlate SignNow secure when downloaded from apkzillaxyz?

Absolutely, airSlate SignNow downloadeed from apkzillaxyz is designed with security in mind. The platform employs encryption and secure access protocols to ensure that all documents and data are protected throughout the signing process.

-

How does airSlate SignNow improve workflow efficiency?

airSlate SignNow improves workflow efficiency by enabling users to quickly prepare, send, and sign documents electronically. When accessed through apkzillaxyz, businesses can reduce turnaround times and minimize errors associated with traditional paper-based processes.

Get more for VAT431NB Form And Notes VAT Refunds For DIY Housebuilders Claim Form And Notes For New Houses

- Consumer loan application peoples bank texas form

- Waiver of lien corporation form

- Waiver of stop lending notice rights individual form

- Full text of ampquotcalifornia department of business oversight form

- Motor vehicle interrogatories to defendants form

- Alaska limited liability company operating agreement form

- Sec 3435100 action against contractor on lienthe form

- Bad check affidavit hill county montana form

Find out other VAT431NB Form And Notes VAT Refunds For DIY Housebuilders Claim Form And Notes For New Houses

- Can I Sign Massachusetts Credit Memo

- How Can I Sign Nevada Agreement to Extend Debt Payment

- Sign South Dakota Consumer Credit Application Computer

- Sign Tennessee Agreement to Extend Debt Payment Free

- Sign Kentucky Outsourcing Services Contract Simple

- Sign Oklahoma Outsourcing Services Contract Fast

- How Can I Sign Rhode Island Outsourcing Services Contract

- Sign Vermont Outsourcing Services Contract Simple

- Sign Iowa Interview Non-Disclosure (NDA) Secure

- Sign Arkansas Resignation Letter Simple

- Sign California Resignation Letter Simple

- Sign Florida Leave of Absence Agreement Online

- Sign Florida Resignation Letter Easy

- Sign Maine Leave of Absence Agreement Safe

- Sign Massachusetts Leave of Absence Agreement Simple

- Sign Connecticut Acknowledgement of Resignation Fast

- How To Sign Massachusetts Resignation Letter

- Sign New Mexico Resignation Letter Now

- How Do I Sign Oklahoma Junior Employment Offer Letter

- Sign Oklahoma Resignation Letter Simple