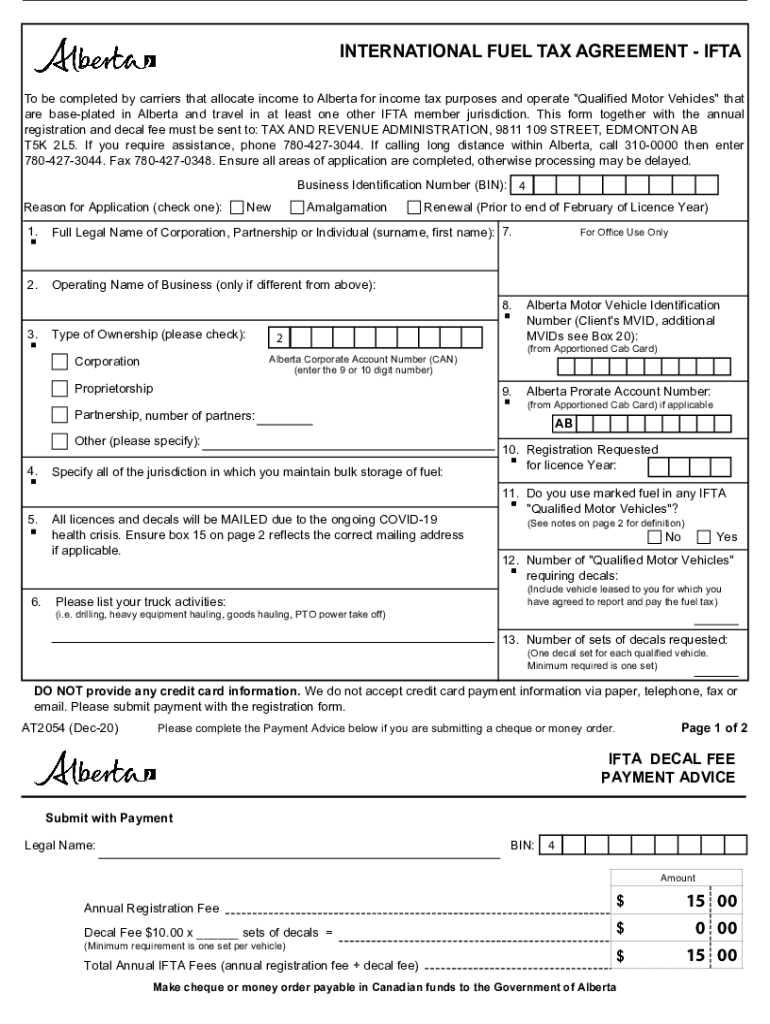

INTERNATIONAL FUEL TAX AGREEMENT IFTA Tax and Revenue Form

What is the International Fuel Tax Agreement (IFTA) Tax and Revenue?

The International Fuel Tax Agreement (IFTA) is a cooperative agreement among the contiguous United States and Canadian provinces that simplifies the reporting of fuel use by motor carriers operating in multiple jurisdictions. Under IFTA, carriers pay fuel taxes based on the miles driven in each jurisdiction, rather than paying separate taxes in each state or province. This agreement aims to streamline the tax collection process, ensuring that revenue is fairly distributed among the jurisdictions where fuel is consumed.

Steps to Complete the International Fuel Tax Agreement (IFTA) Tax and Revenue

Completing the IFTA tax and revenue form involves several key steps:

- Gather necessary documentation, including mileage records and fuel purchase receipts.

- Calculate total miles driven in each jurisdiction and the total fuel purchased.

- Determine the tax owed or refund due based on the rates applicable in each jurisdiction.

- Fill out the IFTA form accurately, ensuring all calculations are correct.

- Submit the completed form by the specified deadline, either online or by mail.

Legal Use of the International Fuel Tax Agreement (IFTA) Tax and Revenue

The IFTA tax and revenue form is legally binding when completed correctly. It must comply with the regulations set forth by the IFTA agreement and the individual jurisdictions involved. Proper completion and submission of the form ensure that carriers meet their tax obligations and avoid potential penalties. It is essential to maintain accurate records to support the information provided in the form, as these may be subject to audits by tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the IFTA tax and revenue form are typically quarterly. Carriers must submit their forms by the last day of the month following the end of each quarter. For example, the deadlines are usually April 30, July 31, October 31, and January 31. It is crucial for carriers to be aware of these dates to avoid late fees and penalties.

Required Documents for IFTA Tax and Revenue Form

To complete the IFTA tax and revenue form, carriers need to gather specific documents, including:

- Mileage records for each jurisdiction.

- Fuel purchase receipts from each jurisdiction.

- Previous IFTA tax returns, if applicable.

- Any correspondence from tax authorities regarding previous filings.

Penalties for Non-Compliance with IFTA Regulations

Failure to comply with IFTA regulations can result in significant penalties. These may include fines, interest on unpaid taxes, and potential audits. Carriers who do not file their IFTA forms on time or provide inaccurate information may face additional scrutiny from tax authorities. It is essential to adhere to all filing requirements to maintain compliance and avoid these consequences.

Quick guide on how to complete international fuel tax agreement ifta tax and revenue

Effortlessly Prepare INTERNATIONAL FUEL TAX AGREEMENT IFTA Tax And Revenue on Any Device

Managing documents online has become increasingly popular among companies and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can locate the right form and securely keep it online. airSlate SignNow provides all the necessary tools to create, edit, and electronically sign your papers quickly without delays. Handle INTERNATIONAL FUEL TAX AGREEMENT IFTA Tax And Revenue on any platform using the airSlate SignNow Android or iOS applications and enhance any document-driven process today.

How to Edit and Electronically Sign INTERNATIONAL FUEL TAX AGREEMENT IFTA Tax And Revenue with Ease

- Locate INTERNATIONAL FUEL TAX AGREEMENT IFTA Tax And Revenue and then click Get Form to begin.

- Utilize the tools provided to complete your document.

- Emphasize important sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes seconds and carries the same legal validity as a conventional handwritten signature.

- Review all details and then click on the Done button to save your changes.

- Select your preferred method to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or mistakes that require reprinting new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Edit and electronically sign INTERNATIONAL FUEL TAX AGREEMENT IFTA Tax And Revenue and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the international fuel tax agreement ifta tax and revenue

The way to make an eSignature for a PDF in the online mode

The way to make an eSignature for a PDF in Chrome

The way to create an eSignature for putting it on PDFs in Gmail

The way to make an eSignature straight from your smart phone

The way to make an eSignature for a PDF on iOS devices

The way to make an eSignature for a PDF document on Android OS

People also ask

-

What is the AT2054 feature in airSlate SignNow?

The AT2054 feature in airSlate SignNow enhances document management by allowing users to streamline the eSigning process. This feature not only makes it easier for businesses to send and receive documents but also boosts overall productivity. With AT2054, organizations can quickly execute contracts and agreements, improving turnaround times.

-

How does the pricing structure for AT2054 work?

The pricing for the AT2054 feature in airSlate SignNow is designed to be budget-friendly for businesses of all sizes. Various subscription plans are available, allowing organizations to choose an option that fits their needs without breaking the bank. By leveraging the AT2054 feature, companies can save money while efficiently managing their document workflows.

-

What benefits does AT2054 provide for businesses?

AT2054 offers multiple benefits, including increased efficiency in sending and signing documents. Businesses can automate their workflows, leading to quicker approvals and reducing the time spent on manual tasks. With AT2054, you’ll experience less paper waste and faster turnaround times, making it a smart choice for modern organizations.

-

What integrations are available with AT2054?

airSlate SignNow's AT2054 feature seamlessly integrates with various tools and platforms used by businesses today. This includes popular CRM systems, cloud storage solutions, and collaboration tools. Such integrations streamline the document signing process by allowing users to access and send documents directly from their existing platforms.

-

Is AT2054 suitable for small businesses?

Yes, the AT2054 feature is particularly beneficial for small businesses that need effective document management solutions without high costs. With its user-friendly interface and affordable pricing, small organizations can implement AT2054 easily without extensive training. It empowers these businesses to compete effectively by enhancing their operational efficiencies.

-

Can I customize templates using the AT2054 feature?

Absolutely! The AT2054 feature in airSlate SignNow allows users to create and customize templates for various document types. This means businesses can standardize their documents for consistency and save time by reusing templates. Customizable options make it easier to address specific needs while maintaining branding.

-

What security measures are in place for AT2054?

Security is a top priority for the AT2054 feature in airSlate SignNow. It employs advanced encryption protocols to ensure that all documents are safe during transmission and storage. With complete audit trails and compliance with industry standards, businesses can trust that their sensitive documents are protected when using AT2054.

Get more for INTERNATIONAL FUEL TAX AGREEMENT IFTA Tax And Revenue

- Landlord tenant law real estate law findlaw form

- 2018 chicago residential lease important message for form

- Cosigner agreement landlord lease forms

- Lease assignment application form omnitrax

- The purpose of this form is to catalogue all furniture furnishings fixtures appliances

- Letter to tenant before they move out mortgage investmentscom form

- Manager shall make all necessary and proper disbursements regarding the property form

- By and liable under the terms and conditions of this agreement form

Find out other INTERNATIONAL FUEL TAX AGREEMENT IFTA Tax And Revenue

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter