CT600 Company Tax Return Forms HMRC Andica Limited

What is the CT600 Company Tax Return Form?

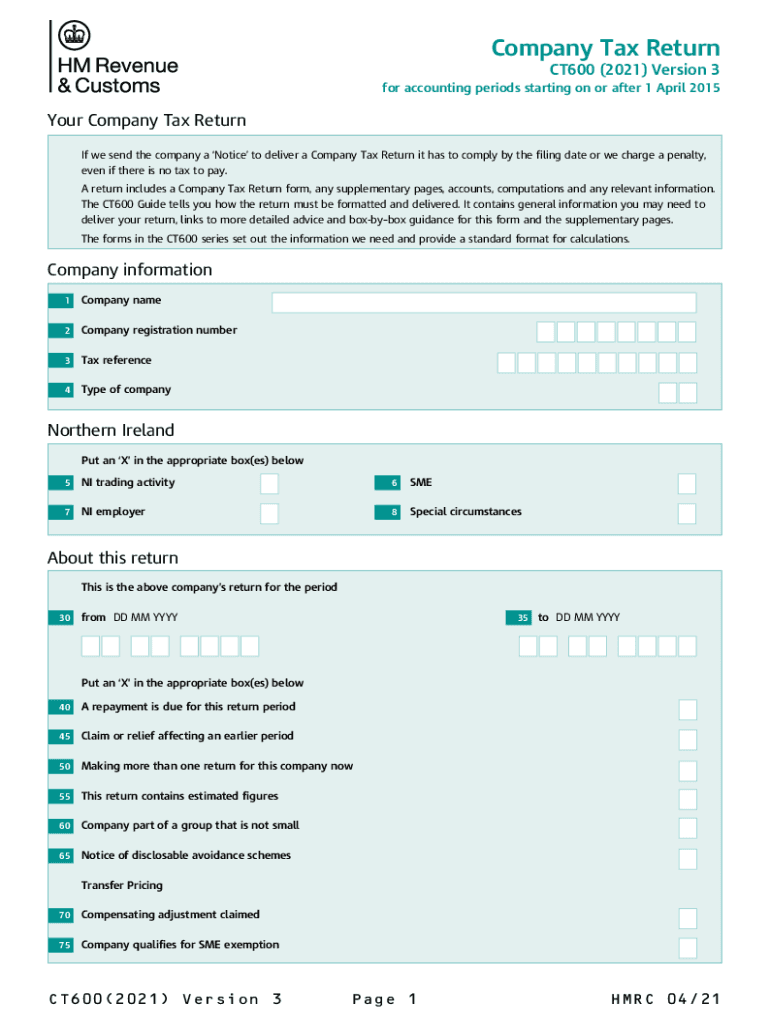

The CT600 Company Tax Return form is a crucial document used by corporations in the United Kingdom to report their income, gains, and tax liabilities to HM Revenue and Customs (HMRC). This form is essential for ensuring compliance with UK tax laws and is typically required for all limited companies, including those based in the UK but operating internationally. The CT600 form captures various financial details, including profits, losses, and tax reliefs, which are necessary for calculating the corporation tax owed by the company.

Steps to Complete the CT600 Company Tax Return Form

Completing the CT600 Company Tax Return form involves several key steps:

- Gather Financial Records: Collect all relevant financial documents, including profit and loss statements, balance sheets, and any other pertinent records.

- Fill Out the Form: Input the necessary information into the CT600 form, including your company's income, expenses, and tax calculations.

- Review for Accuracy: Double-check all entries for accuracy to ensure compliance and avoid potential penalties.

- Submit the Form: File the completed CT600 form with HMRC by the deadline, either electronically or via mail.

Legal Use of the CT600 Company Tax Return Form

The CT600 form serves as a legally binding document when submitted to HMRC, provided it meets specific requirements. It must be completed accurately and submitted on time to avoid penalties. E-signatures can be used to enhance the legal validity of the submission, ensuring compliance with eSignature laws. It is essential for businesses to maintain records of the submission and any correspondence with HMRC regarding the CT600 form.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the CT600 Company Tax Return form is critical for compliance. Generally, the form must be submitted within twelve months of the end of the accounting period it covers. Late submissions can result in penalties and interest on unpaid tax. It is advisable to mark important dates on your calendar to ensure timely filing and avoid complications.

Form Submission Methods

The CT600 Company Tax Return form can be submitted through various methods:

- Online Submission: Many companies opt to file their CT600 forms electronically through HMRC's online services, which can streamline the process.

- Paper Submission: Companies can also submit a printed version of the CT600 form via mail, although this method may take longer for processing.

- In-Person Submission: While less common, some businesses may choose to deliver their forms directly to HMRC offices.

Key Elements of the CT600 Company Tax Return Form

The CT600 form consists of several key sections that must be completed:

- Company Information: Basic details about the company, including name, address, and registration number.

- Financial Information: Detailed reporting of income, expenses, and any adjustments.

- Tax Calculations: Calculating the corporation tax owed based on the reported figures.

- Signatures: Required signatures to validate the submission, which can be completed electronically for added convenience.

Quick guide on how to complete ct600 company tax return forms hmrc andica limited

Complete CT600 Company Tax Return Forms HMRC Andica Limited seamlessly on any gadget

Digital document management has gained traction among businesses and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents promptly without delays. Handle CT600 Company Tax Return Forms HMRC Andica Limited on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign CT600 Company Tax Return Forms HMRC Andica Limited effortlessly

- Locate CT600 Company Tax Return Forms HMRC Andica Limited and click Get Form to begin.

- Utilize our tools to complete your form.

- Highlight pertinent sections of your documents or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click the Done button to save your revisions.

- Select your preferred method of sharing your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Modify and eSign CT600 Company Tax Return Forms HMRC Andica Limited to ensure excellent communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ct600 company tax return forms hmrc andica limited

The way to make an eSignature for your PDF online

The way to make an eSignature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

The way to make an electronic signature from your smartphone

The way to make an electronic signature for a PDF on iOS

The way to make an electronic signature for a PDF file on Android

People also ask

-

What is the CT600 form and why do I need to download it?

The CT600 form is a tax return for companies in the UK. Downloading the CT600 form is essential for accurately reporting your company's income and ensuring compliance with HM Revenue and Customs. By using the airSlate SignNow platform, you can easily manage and eSign your CT600 form download, streamlining your submission process.

-

How can I download the CT600 form using airSlate SignNow?

To download the CT600 form using airSlate SignNow, simply log into your account and navigate to the document section. You can find the CT600 form in our templates or upload an existing version for eSigning. Our platform makes it easy to complete your CT600 form download in just a few clicks.

-

Is there a cost associated with downloading the CT600 form through airSlate SignNow?

airSlate SignNow offers a cost-effective solution for managing your documents, including the CT600 form download. While creating an account is free, our subscription plans provide additional features and enhanced functionality at a reasonable price. You can choose a plan that fits your needs without breaking the bank.

-

What features does airSlate SignNow offer for handling the CT600 form?

airSlate SignNow provides several features to simplify your CT600 form download and submission. These include eSigning, document tracking, and integration capabilities with other platforms. Our user-friendly interface ensures that you can complete your forms efficiently and securely.

-

Can I integrate airSlate SignNow with other software for managing my CT600 form?

Yes, airSlate SignNow can be easily integrated with a variety of software tools, enhancing your document management process. This allows you to streamline workflows related to your CT600 form download and other important documents. Check our integration options to find the tools that best support your business needs.

-

What are the benefits of using airSlate SignNow for my CT600 form download?

Using airSlate SignNow for your CT600 form download offers numerous benefits, including time savings and improved accuracy. Our platform enables quick eSigning and access to your documents anytime, anywhere. This efficiency helps you stay compliant and focused on your business growth.

-

What security measures does airSlate SignNow provide for the CT600 form?

airSlate SignNow prioritizes your document security, including the CT600 form download. Our platform uses advanced encryption and secure cloud storage to protect sensitive information. You can trust that your documents are safe and accessible only by authorized users.

Get more for CT600 Company Tax Return Forms HMRC Andica Limited

- Civil rule 4f affidavit form

- Memorandum to set form

- Civ 300 judgment for possession civil forms

- Civ 405 certificate of facts civil forms 490101761

- Civ 401 cost bill 3 00 civil forms 490101762

- Analysis of potential bill padding state bar of california form

- Civ 500 general writ of execution 710 state of alaska form

- Of general writ of execution form

Find out other CT600 Company Tax Return Forms HMRC Andica Limited

- Can I Electronic signature Colorado Bill of Sale Immovable Property

- How Can I Electronic signature West Virginia Vacation Rental Short Term Lease Agreement

- How Do I Electronic signature New Hampshire Bill of Sale Immovable Property

- Electronic signature North Dakota Bill of Sale Immovable Property Myself

- Can I Electronic signature Oregon Bill of Sale Immovable Property

- How To Electronic signature West Virginia Bill of Sale Immovable Property

- Electronic signature Delaware Equipment Sales Agreement Fast

- Help Me With Electronic signature Louisiana Assignment of Mortgage

- Can I Electronic signature Minnesota Assignment of Mortgage

- Electronic signature West Virginia Sales Receipt Template Free

- Electronic signature Colorado Sales Invoice Template Computer

- Electronic signature New Hampshire Sales Invoice Template Computer

- Electronic signature Tennessee Introduction Letter Free

- How To eSignature Michigan Disclosure Notice

- How To Electronic signature Ohio Product Defect Notice

- Electronic signature California Customer Complaint Form Online

- Electronic signature Alaska Refund Request Form Later

- How Can I Electronic signature Texas Customer Return Report

- How Do I Electronic signature Florida Reseller Agreement

- Electronic signature Indiana Sponsorship Agreement Free