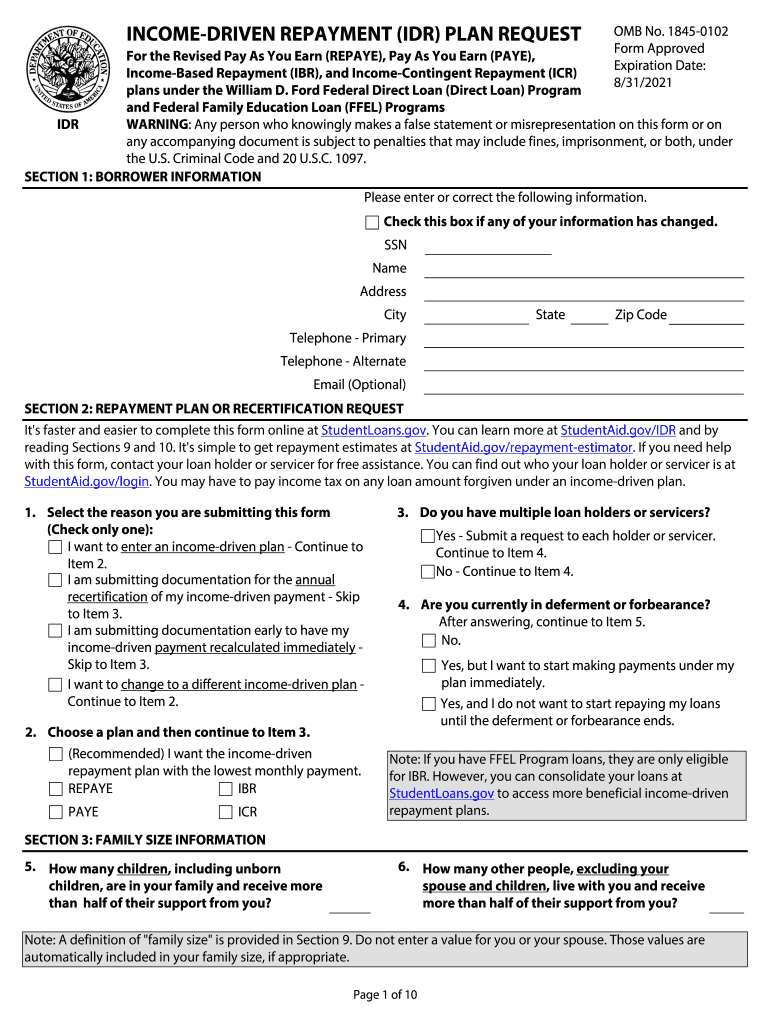

And Federal Family Education Loan FFEL Programs Form

Understanding the Federal Family Education Loan (FFEL) Programs

The Federal Family Education Loan (FFEL) Programs are a collection of federal student loan programs that were designed to help students and their families pay for education. These loans are issued by private lenders, but they are guaranteed by the federal government. This means that if a borrower defaults, the government will pay the lender a portion of the loan amount. FFEL includes various types of loans, such as subsidized and unsubsidized Stafford Loans, PLUS Loans for parents and graduate students, and consolidation loans.

Eligibility Criteria for FFEL Programs

To qualify for the FFEL Programs, borrowers must meet specific eligibility requirements. Generally, applicants must be U.S. citizens or eligible non-citizens, have a valid Social Security number, and be enrolled at least half-time in an eligible degree or certificate program. Additionally, borrowers should demonstrate financial need for certain types of loans, such as subsidized Stafford Loans. It's essential to check with the lender for any additional criteria that may apply.

Steps to Complete the FFEL Application Process

Completing the application process for the FFEL Programs involves several steps. First, students should fill out the Free Application for Federal Student Aid (FAFSA) to determine their eligibility for federal financial aid. Once the FAFSA is processed, students will receive a financial aid offer from their school, which outlines the types of loans they qualify for. After selecting a lender, borrowers must complete the necessary loan application forms and provide any required documentation. Finally, borrowers should review and sign the loan agreement to finalize the process.

Required Documents for FFEL Programs

When applying for FFEL loans, borrowers need to prepare several key documents. These typically include:

- Free Application for Federal Student Aid (FAFSA) confirmation

- Proof of identity, such as a driver's license or passport

- Social Security number

- Income documentation, like tax returns or W-2 forms

- Enrollment verification from the educational institution

Having these documents ready can help streamline the application process and ensure that all necessary information is submitted.

Legal Use of FFEL Programs

The FFEL Programs are governed by federal regulations, ensuring that borrowers are treated fairly and that their rights are protected. Borrowers must be informed of their rights and responsibilities, including repayment terms and options for deferment or forbearance. It is crucial for borrowers to understand the legal implications of taking out these loans, including the potential consequences of defaulting on repayment.

Form Submission Methods for FFEL Applications

FFEL loan applications can typically be submitted through various methods. Borrowers can apply online through the lender's website, which is often the quickest and most efficient method. Alternatively, borrowers may choose to submit their applications by mail or in person, depending on the lender's policies. Each submission method may have different processing times and requirements, so it is advisable to check with the lender for specific instructions.

Quick guide on how to complete and federal family education loan ffel programs

Effortlessly Prepare And Federal Family Education Loan FFEL Programs on Any Device

Online document management has gained traction among companies and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and efficiently. Manage And Federal Family Education Loan FFEL Programs on any device using the airSlate SignNow apps for Android or iOS and enhance any document-related procedure today.

The Easiest Way to Alter and eSign And Federal Family Education Loan FFEL Programs Seamlessly

- Obtain And Federal Family Education Loan FFEL Programs and click on Get Form to initiate.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive information using tools specifically designed for that purpose provided by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method for delivering your form, whether by email, text message (SMS), invite link, or download to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Modify and eSign And Federal Family Education Loan FFEL Programs while ensuring excellent communication throughout every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is income driven repayment?

Income driven repayment is a strategy that allows borrowers to make federal student loan payments based on their income and family size. This method adjusts monthly payments to ensure they remain affordable, which can help prevent default. Many borrowers benefit from this approach, making it easier to manage student loan debt.

-

How can airSlate SignNow assist with income driven repayment applications?

airSlate SignNow streamlines the process of signing and submitting documents related to income driven repayment applications. By providing an easy-to-use eSignature solution, you can quickly and securely complete necessary paperwork. This accelerates the application process, allowing you to focus on your repayment strategy.

-

Are there any costs associated with using airSlate SignNow for income driven repayment?

Using airSlate SignNow is a cost-effective solution, offering various pricing plans to fit your needs. The platform is designed to save you time and resources when managing your documents. By utilizing airSlate SignNow for income driven repayment, you can reduce paperwork costs over time.

-

What features does airSlate SignNow offer to enhance the income driven repayment process?

airSlate SignNow provides features such as document templates, batch sending, and real-time tracking to enhance your income driven repayment experience. These tools simplify the documentation process and help you stay organized. With airSlate SignNow, you'll have all the features needed to manage your repayment applications efficiently.

-

Can I track my income driven repayment documents with airSlate SignNow?

Yes, airSlate SignNow offers tracking capabilities that allow you to monitor the status of your income driven repayment documents. You will receive notifications when your documents are viewed and signed, ensuring you stay informed throughout the process. This added transparency helps you manage your repayment journey better.

-

How does airSlate SignNow integrate with other tools I use for income driven repayment?

airSlate SignNow seamlessly integrates with popular applications and software, enhancing your overall workflow when dealing with income driven repayment. Whether you're using customer relationship management (CRM) tools or cloud storage solutions, integration ensures you can manage documents from one central location. This integration makes your repayment process more efficient.

-

What benefits does airSlate SignNow provide specifically for income driven repayment?

The primary benefits of using airSlate SignNow for income driven repayment include reduced paperwork, faster processing times, and enhanced security. By digitizing your documents, you can minimize errors and speed up your applications. Additionally, the platform's secure eSignature capabilities provide peace of mind when submitting sensitive information.

Get more for And Federal Family Education Loan FFEL Programs

- Writing a property tax appeal letter with sample form

- Technology landscape for digital identification form

- Pestle analysis of mauritius and analysis of 1pdfnet form

- Scott alan english motion for contempt notice of motion form

- Government burden of proof form 05025

- As grantors do hereby grant convey and warrant unto a form

- Acknowledgement of satisfaction form

- Statutory appendix table of contents state page form

Find out other And Federal Family Education Loan FFEL Programs

- Electronic signature Delaware Equipment Sales Agreement Fast

- Help Me With Electronic signature Louisiana Assignment of Mortgage

- Can I Electronic signature Minnesota Assignment of Mortgage

- Electronic signature West Virginia Sales Receipt Template Free

- Electronic signature Colorado Sales Invoice Template Computer

- Electronic signature New Hampshire Sales Invoice Template Computer

- Electronic signature Tennessee Introduction Letter Free

- How To eSignature Michigan Disclosure Notice

- How To Electronic signature Ohio Product Defect Notice

- Electronic signature California Customer Complaint Form Online

- Electronic signature Alaska Refund Request Form Later

- How Can I Electronic signature Texas Customer Return Report

- How Do I Electronic signature Florida Reseller Agreement

- Electronic signature Indiana Sponsorship Agreement Free

- Can I Electronic signature Vermont Bulk Sale Agreement

- Electronic signature Alaska Medical Records Release Mobile

- Electronic signature California Medical Records Release Myself

- Can I Electronic signature Massachusetts Medical Records Release

- How Do I Electronic signature Michigan Medical Records Release

- Electronic signature Indiana Membership Agreement Easy