IRASIncome Tax Forms for Employers

What is the IRAS Income Tax Form for Employers?

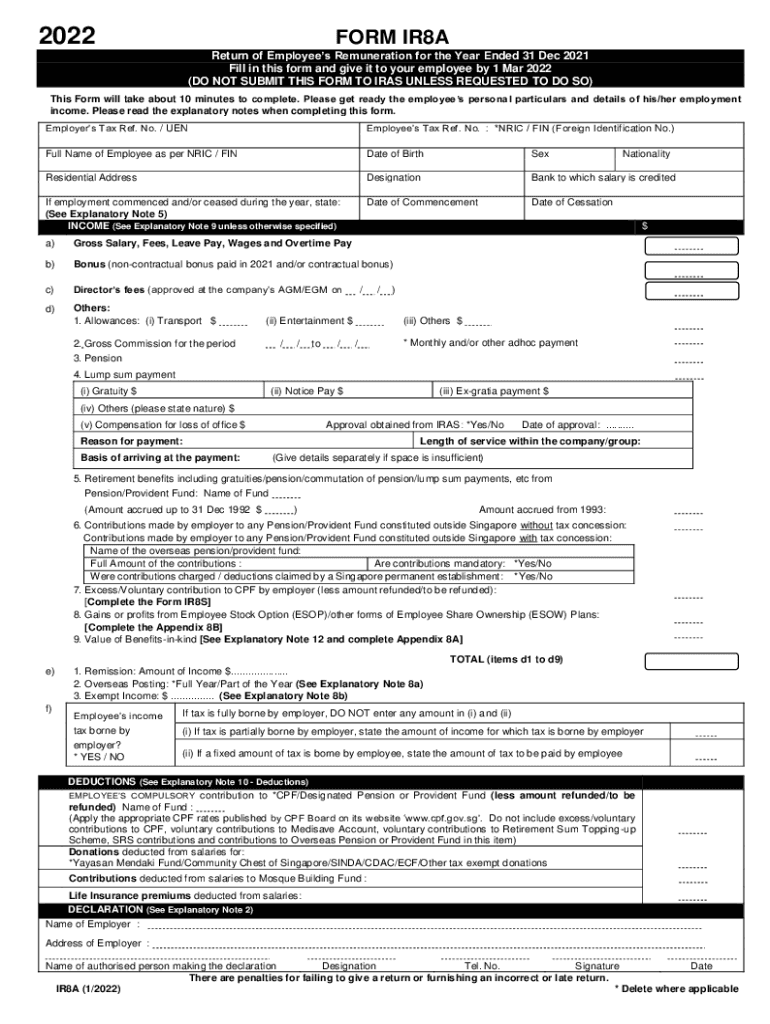

The IRAS Income Tax Form for Employers, commonly referred to as the IR8A form, is a crucial document used in Singapore for reporting employee income to the Inland Revenue Authority of Singapore (IRAS). This form is essential for employers to accurately declare the salaries, bonuses, and other compensation paid to their employees during the financial year. The IR8A form ensures compliance with tax regulations and helps employees fulfill their tax obligations. It serves as a record for both employers and employees, detailing the income earned and any deductions made throughout the year.

Steps to Complete the IR8A Form

Completing the IR8A form involves several key steps to ensure accuracy and compliance:

- Gather Employee Information: Collect necessary details such as employee names, identification numbers, and income details.

- Report Income: Accurately fill in the income earned by each employee, including salary, bonuses, and allowances.

- Include Deductions: Document any applicable deductions, such as contributions to the Central Provident Fund (CPF).

- Review and Verify: Double-check all entries for accuracy to avoid errors that could lead to penalties.

- Submit the Form: Once completed, submit the IR8A form to IRAS by the specified deadline.

Legal Use of the IR8A Form

The IR8A form is legally binding and must be completed in accordance with the regulations set forth by IRAS. Employers are obligated to provide accurate and truthful information on this form, as it is used to assess employees' tax liabilities. Failure to comply with the legal requirements can result in penalties for both employers and employees. It is essential to maintain records and documentation supporting the information reported on the IR8A form to ensure compliance and facilitate any potential audits by tax authorities.

Filing Deadlines / Important Dates

Employers must adhere to specific deadlines for submitting the IR8A form to IRAS. The deadline for filing the form is typically set for March 1st of the following year. It is crucial for employers to be aware of these dates to avoid late submission penalties. Additionally, employers should keep track of any changes in deadlines announced by IRAS, especially in light of any adjustments made due to extraordinary circumstances.

Required Documents

To complete the IR8A form, employers need to gather several key documents:

- Employee Payroll Records: Documentation of salaries, bonuses, and deductions for each employee.

- CPF Contribution Statements: Records of contributions made to the Central Provident Fund.

- Tax Identification Numbers: Employees' identification numbers for accurate reporting.

- Previous Year’s IR8A Forms: Reference documents to ensure consistency and accuracy in reporting.

Who Issues the Form

The IR8A form is issued by the Inland Revenue Authority of Singapore (IRAS). This government agency is responsible for tax collection and enforcement in Singapore. Employers must ensure they are using the most current version of the form provided by IRAS to comply with the latest tax regulations. The form can typically be obtained from the official IRAS website or through authorized tax professionals.

Quick guide on how to complete irasincome tax forms for employers

Complete IRASIncome Tax Forms For Employers with ease on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly substitute to traditional printed and signed paperwork, allowing you to find the correct form and securely keep it online. airSlate SignNow equips you with all the tools you need to create, edit, and eSign your documents quickly and without delays. Handle IRASIncome Tax Forms For Employers on any device using airSlate SignNow’s Android or iOS applications and simplify any document-based task today.

How to edit and eSign IRASIncome Tax Forms For Employers effortlessly

- Find IRASIncome Tax Forms For Employers and click on Get Form to begin.

- Use the tools we provide to fill out your document.

- Highlight important sections of the documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes moments and carries the same legal significance as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you prefer. Edit and eSign IRASIncome Tax Forms For Employers and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the ir8s form 2022 and why is it important?

The ir8s form 2022 is a tax document that summarizes an individual's income and tax deductions for the year. It's important for ensuring compliance with tax regulations and accurately reporting income to the tax authorities. Utilizing an efficient solution like airSlate SignNow helps streamline the signing process for such forms.

-

How can airSlate SignNow assist with the ir8s form 2022?

airSlate SignNow provides a secure and user-friendly platform for sending and eSigning documents, including the ir8s form 2022. Users can easily upload the form, send it for signatures, and manage their documents all in one place, ensuring a smooth and compliant process.

-

What features does airSlate SignNow offer for handling the ir8s form 2022?

Key features of airSlate SignNow include customizable templates, audit trails, and secure cloud storage. These features make it easy to create, manage, and electronically sign the ir8s form 2022, enhancing both convenience and security.

-

Is airSlate SignNow affordable for small businesses needing the ir8s form 2022?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes. With flexible pricing plans, small businesses can use the platform to manage the ir8s form 2022 without compromising on quality or functionality.

-

Can I integrate airSlate SignNow with other tools for managing the ir8s form 2022?

Absolutely! airSlate SignNow offers robust integrations with various tools and software such as CRMs, project management, and accounting software. This capability makes it easier to handle the ir8s form 2022 within your existing workflow.

-

What are the benefits of using airSlate SignNow for the ir8s form 2022?

Using airSlate SignNow for the ir8s form 2022 simplifies the document signing process, reduces paperwork, and saves time. Additionally, the platform ensures that all your communications and documents are secure and compliant with legal standards.

-

How does airSlate SignNow ensure the security of the ir8s form 2022?

airSlate SignNow employs advanced security measures, including encryption and secure data storage, to protect your ir8s form 2022 and other sensitive documents. You can trust that your information is safeguarded throughout the signing process.

Get more for IRASIncome Tax Forms For Employers

- Petition for probate of lost will form

- Ex parte frontier corp 1998 supreme court of alabama form

- Us district court for the southern district of alabama justia form

- The ethical dark side of requests for admission digital form

- Accident insurance company form

- I will comply with a proper form

- Pursuant to rule 26c7 of the alabama rules of civil procedure it is hereby form

- Landlords letters sample chapter lawpackcouk form

Find out other IRASIncome Tax Forms For Employers

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure