VA DMV RDT 121 Fill and Sign Printable Form

Understanding the IFTA Virginia Quarterly Tax Return Form

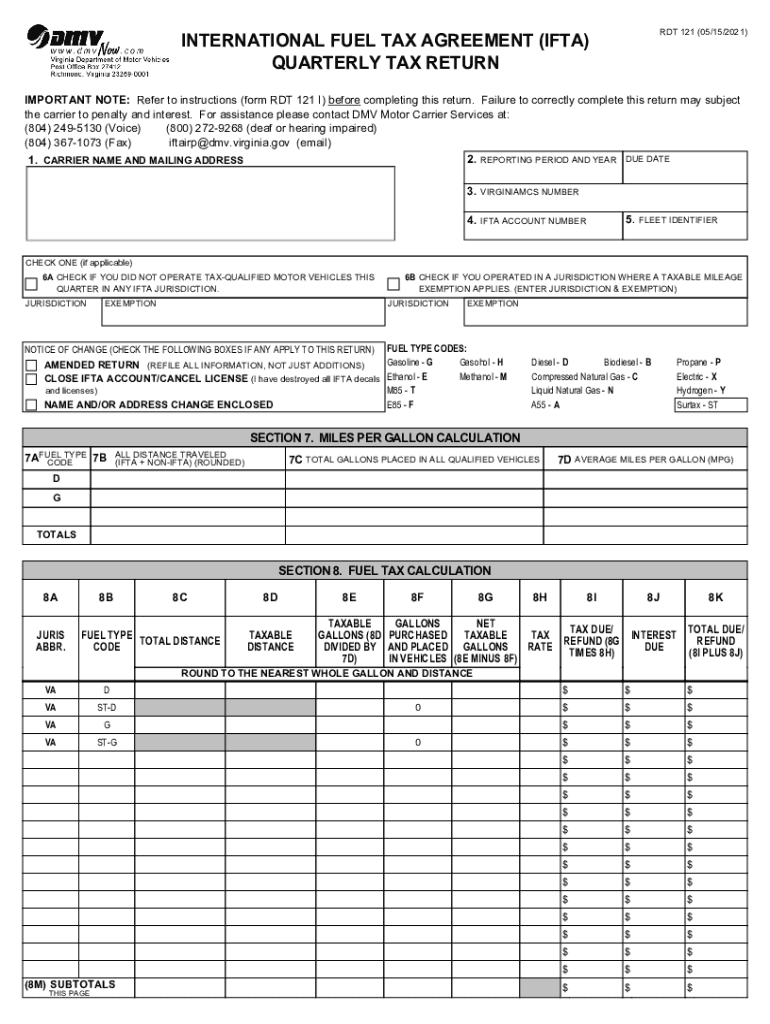

The IFTA Virginia quarterly tax return form is essential for businesses that operate commercial vehicles across state lines. This form allows carriers to report and pay fuel taxes based on the miles driven in each jurisdiction. Accurate completion of this form ensures compliance with state regulations and helps avoid penalties. It is crucial for fleet operators to understand the specific requirements and details involved in this process.

Steps to Complete the IFTA Virginia Quarterly Tax Return Form

Completing the IFTA Virginia quarterly tax return form involves several key steps:

- Gather necessary data, including total miles driven and fuel purchased in each state.

- Calculate the total miles and fuel consumption for the reporting period.

- Complete the form by entering the calculated figures in the designated sections.

- Review the information for accuracy to ensure compliance with state regulations.

- Submit the form by the deadline, either electronically or by mail.

Filing Deadlines for IFTA Virginia

Filing deadlines for the IFTA Virginia quarterly tax return are critical to maintain compliance. The form must be submitted by the last day of the month following the end of each quarter. This means that the deadlines are:

- First quarter: April 30

- Second quarter: July 31

- Third quarter: October 31

- Fourth quarter: January 31

Late submissions may result in penalties, so timely filing is essential.

Required Documents for IFTA Virginia Filing

To complete the IFTA Virginia quarterly tax return form, specific documents are necessary. These include:

- Records of total miles driven in each jurisdiction.

- Receipts or invoices for fuel purchases.

- Previous IFTA returns for reference.

Having these documents ready will facilitate a smoother filing process.

Penalties for Non-Compliance with IFTA Virginia

Failure to comply with IFTA Virginia regulations can lead to significant penalties. These may include:

- Fines for late filing or underreporting fuel usage.

- Interest on unpaid taxes.

- Potential audits by state authorities.

Understanding these penalties emphasizes the importance of accurate and timely filing.

Legal Use of the IFTA Virginia Quarterly Tax Return Form

The IFTA Virginia quarterly tax return form is legally binding when completed accurately and submitted on time. Compliance with the regulations set forth by the International Fuel Tax Agreement ensures that businesses maintain their operational licenses and avoid legal repercussions. It is crucial for carriers to understand the legal implications of their submissions.

Quick guide on how to complete va dmv rdt 121 2020 2021 fill and sign printable

Prepare VA DMV RDT 121 Fill And Sign Printable effortlessly on any device

Managing documents online has gained traction among organizations and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Handle VA DMV RDT 121 Fill And Sign Printable on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

How to modify and eSign VA DMV RDT 121 Fill And Sign Printable effortlessly

- Obtain VA DMV RDT 121 Fill And Sign Printable and then click Get Form to initiate.

- Use the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that task.

- Create your signature with the Sign tool, which takes moments and has the same legal validity as a conventional wet ink signature.

- Review the information carefully and then click on the Done button to store your modifications.

- Select your preferred method of sending your form, whether via email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in a few clicks from your chosen device. Modify and eSign VA DMV RDT 121 Fill And Sign Printable to ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is IFTA Virginia and why is it important for trucking businesses?

IFTA Virginia is the International Fuel Tax Agreement that simplifies the reporting of fuel use among states and provinces for interstate carriers. It is important for trucking businesses as it ensures compliance with tax regulations and helps avoid penalties. By understanding IFTA Virginia, businesses can efficiently manage their fuel tax reporting.

-

How does airSlate SignNow support IFTA Virginia compliance?

airSlate SignNow offers document management solutions that streamline the process of creating, sending, and signing IFTA Virginia documentation. By utilizing our eSignature capabilities, you can ensure all necessary forms are completed accurately and stored securely. This efficiency helps you maintain compliance with IFTA Virginia regulations.

-

What features of airSlate SignNow are beneficial for managing IFTA Virginia documents?

AirSlate SignNow provides features such as templates, secure storage, and automated workflows that make managing IFTA Virginia documents effortless. These tools help you save time by automating repetitive tasks, ensuring your IFTA submissions are timely and organized. Additionally, our mobile access allows you to manage documents on the go.

-

Can I integrate airSlate SignNow with other software for IFTA Virginia reporting?

Yes, airSlate SignNow can integrate with various software solutions essential for IFTA Virginia reporting, such as accounting programs and fleet management tools. This integration allows you to streamline your workflows and ensure all data is consistent across platforms. By connecting your tools, you make IFTA Virginia compliance much less cumbersome.

-

What is the pricing structure for airSlate SignNow, especially for managing IFTA Virginia?

AirSlate SignNow offers various pricing plans tailored to meet the needs of different businesses handling IFTA Virginia documents. Our plans are cost-effective, allowing for scalability as your business grows. By choosing a plan that suits your needs, you can effectively manage your IFTA Virginia documentation without unnecessary expenses.

-

How can airSlate SignNow enhance the efficiency of my IFTA Virginia document workflow?

With airSlate SignNow, you can enhance the efficiency of your IFTA Virginia document workflow by automating approvals and utilizing templates for recurring documents. This reduces the time spent on manual processes and minimizes errors, ensuring smoother compliance. Our platform allows you to focus on your business while we handle the logistics.

-

Is airSlate SignNow secure for handling sensitive IFTA Virginia documents?

Absolutely, airSlate SignNow prioritizes security and uses encryption protocols to protect sensitive IFTA Virginia documents. With features like two-factor authentication and secure cloud storage, your data remains safe against unauthorized access. You can confidently manage your IFTA Virginia compliance with our reliable security measures.

Get more for VA DMV RDT 121 Fill And Sign Printable

- Motion to dismiss complaint and request for hearing form

- A letter to a parole board for an individual coming up to form

- 2016 form wwwrevenuealabamagov ala bam a 40

- Nonprofit formation documents articles of incorporation

- Incorporators and directors of form

- Pdf coping with demographic change in job markets how form

- United states v bondslawcom form

- Use electronic records express to send records related to form

Find out other VA DMV RDT 121 Fill And Sign Printable

- How Do I Electronic signature Utah Gift Affidavit

- Electronic signature Kentucky Mechanic's Lien Free

- Electronic signature Maine Mechanic's Lien Fast

- Can I Electronic signature North Carolina Mechanic's Lien

- How To Electronic signature Oklahoma Mechanic's Lien

- Electronic signature Oregon Mechanic's Lien Computer

- Electronic signature Vermont Mechanic's Lien Simple

- How Can I Electronic signature Virginia Mechanic's Lien

- Electronic signature Washington Mechanic's Lien Myself

- Electronic signature Louisiana Demand for Extension of Payment Date Simple

- Can I Electronic signature Louisiana Notice of Rescission

- Electronic signature Oregon Demand for Extension of Payment Date Online

- Can I Electronic signature Ohio Consumer Credit Application

- eSignature Georgia Junior Employment Offer Letter Later

- Electronic signature Utah Outsourcing Services Contract Online

- How To Electronic signature Wisconsin Debit Memo

- Electronic signature Delaware Junior Employment Offer Letter Later

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online