I9 Form

What is the I-9 Form

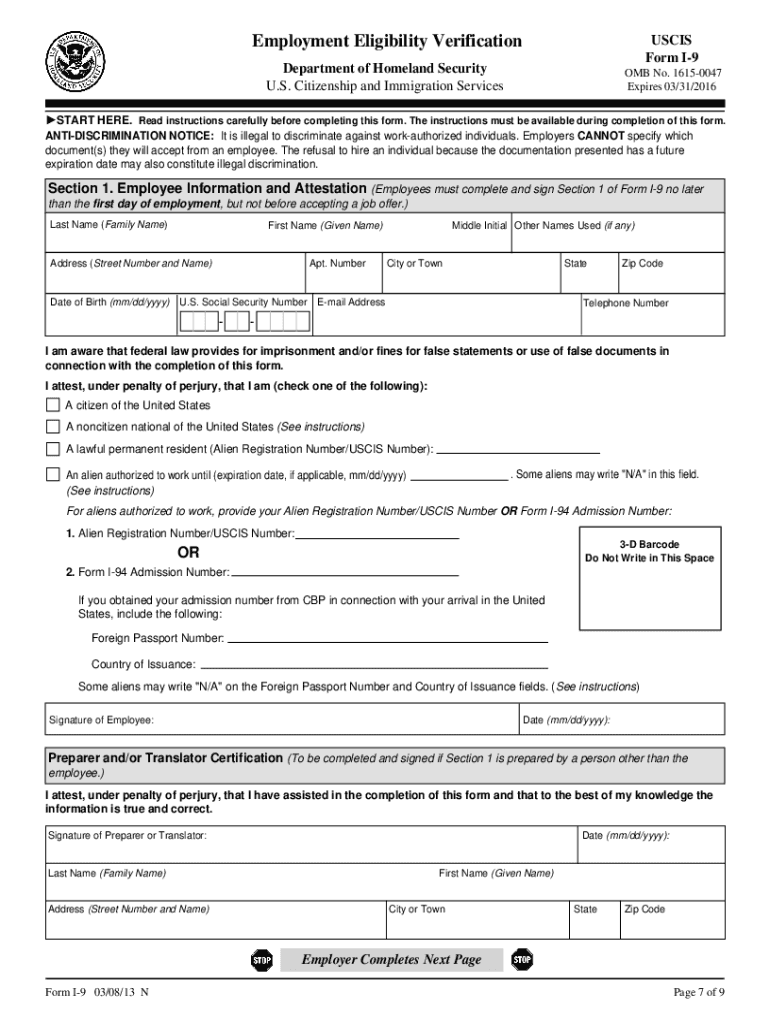

The I-9 form, also known as the Employment Eligibility Verification form, is a document required by the United States Citizenship and Immigration Services (USCIS) for employers to verify the identity and employment authorization of individuals hired for employment in the U.S. This form is crucial for ensuring that all employees, regardless of their citizenship status, are legally eligible to work in the country.

Employers must complete the I-9 form for each new hire and retain it for a designated period. The form requires employees to provide personal information, including their name, address, and Social Security number, along with documentation that proves their identity and eligibility to work.

Steps to Complete the I-9 Form

Completing the I-9 form involves several clear steps to ensure compliance with federal regulations. First, employees must fill out Section One of the form, providing their personal details and attesting to their work eligibility. This section must be completed on or before the first day of employment.

Next, employers must review the documentation provided by the employee to establish their identity and work authorization. Acceptable documents include a U.S. passport, a permanent resident card, or a combination of documents that include a photo ID and a Social Security card. Employers then complete Section Two of the form, noting the documents reviewed and their validity.

Finally, both the employee and employer must sign and date the form. It is essential to keep the completed I-9 form on file for a minimum of three years after the date of hire or one year after employment ends, whichever is longer.

Legal Use of the I-9 Form

The I-9 form is legally binding and must be used in accordance with federal regulations. Employers are responsible for ensuring that the form is completed accurately and retained for the required duration. Failure to comply with I-9 regulations can result in significant penalties, including fines and legal action.

It is important for employers to understand that the form should not be used for discriminatory practices. All employees must be treated equally, regardless of their national origin or citizenship status. Proper training and policies should be in place to ensure compliance and prevent discrimination during the hiring process.

Required Documents

When completing the I-9 form, employees must provide specific documents to verify their identity and employment eligibility. The documents are categorized into three lists:

- List A: Documents that establish both identity and employment authorization, such as a U.S. passport or a permanent resident card.

- List B: Documents that establish identity only, such as a driver's license or state ID card.

- List C: Documents that establish employment authorization only, such as a Social Security card or a birth certificate.

Employees must present either one document from List A or one document from List B and one from List C. Employers should carefully review these documents to ensure they are valid and not expired.

Form Submission Methods

The I-9 form can be completed and submitted using various methods. Employers may choose to maintain physical copies of the form or utilize digital solutions for easier management and storage. When using a digital format, it is vital to ensure compliance with eSignature laws and maintain the integrity of the document.

For paper submissions, the completed I-9 form should be kept on file at the employer's location. If using a digital solution, ensure that the platform complies with the necessary regulations to keep the form secure and accessible for audits.

Who Issues the Form

The I-9 form is issued by the United States Citizenship and Immigration Services (USCIS). This federal agency is responsible for overseeing the immigration process and ensuring that employers comply with employment eligibility verification requirements. The form is available for download from the USCIS website, and it is essential for employers to use the most current version to avoid compliance issues.

Employers should regularly check for updates to the form and any changes in the regulations surrounding its use to ensure they are operating within the law.

Quick guide on how to complete form i 9 employment eligibility verification blm

Prepare I9 Form effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the tools you need to create, edit, and eSign your documents swiftly without delays. Manage I9 Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

The easiest way to modify and eSign I9 Form with ease

- Locate I9 Form and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign feature, which takes seconds and carries the same legal authority as a traditional handwritten signature.

- Review all the details and click the Done button to save your modifications.

- Decide how you would like to send your form—via email, SMS, invite link, or download it to your computer.

Put an end to lost or misfiled documents, time-consuming form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs with just a few clicks from any selected device. Modify and eSign I9 Form to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

Why did my employer give me a W-9 Form to fill out instead of a W-4 Form?

I wrote about the independent-contractor-vs-employee issue last year, see http://nctaxpro.wordpress.com/20...Broadly speaking, you are an employee when someone else - AKA the employer - has control over when and where you work and the processes by which you perform the work that you do for that individual. A DJ or bartender under some circumstances, I suppose, might qualify as an independent contractor at a restaurant, but the waitstaff, bus help, hosts, kitchen aides, etc. almost certainly would not.There's always risk in confronting an employer when faced with a situation like yours - my experience is that most employers know full well that they are violating the law when they treat employees as independent contractors, and for that reason they don't tolerate questions about that policy very well - so you definitely should tread cautiously if you want to keep this position. Nonetheless, I think you owe it to yourself to ask whether or not the restaurant intends to withhold federal taxes from your checks - if for no other reason than you don't want to get caught short when it comes to filing your own return, even if you don't intend to challenge the policy.

-

How do I fill a W-9 Tax Form out?

Download a blank Form W-9To get started, download the latest Form W-9 from the IRS website at https://www.irs.gov/pub/irs-pdf/.... Check the date in the top left corner of the form as it is updated occasionally by the IRS. The current revision should read (Rev. December 2014). Click anywhere on the form and a menu appears at the top that will allow you to either print or save the document. If the browser you are using doesn’t allow you to type directly into the W-9 then save the form to your desktop and reopen using signNow Reader.General purposeThe general purpose of Form W-9 is to provide your correct taxpayer identification number (TIN) to an individual or entity (typically a company) that is required to submit an “information return” to the IRS to report an amount paid to you, or other reportable amount.U.S. personForm W-9 should only be completed by what the IRS calls a “U.S. person”. Some examples of U.S. persons include an individual who is a U.S. citizen or a U.S. resident alien. Partnerships, corporations, companies, or associations created or organized in the United States or under the laws of the United States are also U.S. persons.If you are not a U.S. person you should not use this form. You will likely need to provide Form W-8.Enter your informationLine 1 – Name: This line should match the name on your income tax return.Line 2 – Business name: This line is optional and would include your business name, trade name, DBA name, or disregarded entity name if you have any of these. You only need to complete this line if your name here is different from the name on line 1. See our related blog, What is a disregarded entity?Line 3 – Federal tax classification: Check ONE box for your U.S. federal tax classification. This should be the tax classification of the person or entity name that is entered on line 1. See our related blog, What is the difference between an individual and a sole proprietor?Limited Liability Company (LLC). If the name on line 1 is an LLC treated as a partnership for U.S. federal tax purposes, check the “Limited liability company” box and enter “P” in the space provided. If the LLC has filed Form 8832 or 2553 to be taxed as a corporation, check the “Limited liability company” box and in the space provided enter “C” for C corporation or “S” for S corporation. If it is a single-member LLC that is a disregarded entity, do not check the “Limited liability company” box; instead check the first box in line 3 “Individual/sole proprietor or single-member LLC.” See our related blog, What tax classification should an LLC select?Other (see instructions) – This line should be used for classifications that are not listed such as nonprofits, governmental entities, etc.Line 4 – Exemptions: If you are exempt from backup withholding enter your exempt payee code in the first space. If you are exempt from FATCA reporting enter your exemption from FATCA reporting code in the second space. Generally, individuals (including sole proprietors) are not exempt from backup withholding. See the “Specific Instructions” for line 4 shown with Form W-9 for more detailed information on exemptions.Line 5 – Address: Enter your address (number, street, and apartment or suite number). This is where the requester of the Form W-9 will mail your information returns.Line 6 – City, state and ZIP: Enter your city, state and ZIP code.Line 7 – Account numbers: This is an optional field to list your account number(s) with the company requesting your W-9 such as a bank, brokerage or vendor. We recommend that you do not list any account numbers as you may have to provide additional W-9 forms for accounts you do not include.Requester’s name and address: This is an optional section you can use to record the requester’s name and address you sent your W-9 to.Part I – Taxpayer Identification Number (TIN): Enter in your taxpayer identification number here. This is typically a social security number for an individual or sole proprietor and an employer identification number for a company. See our blog, What is a TIN number?Part II – Certification: Sign and date your form.For additional information visit w9manager.com.

-

Is it legal for companies to charge a previous employee a fee for filling out an employment verification form?

I’m not a lawyer, but I’d say you don’t have to pay. The law, as I know it, requires former employers to confirm your dates of employment and title. If your former employer demands you pay a fee for this, ask for the demand in writing (say you need it for financial records), then send a copy of that demand to the company you applied to, and your state’s Office of the Attorney General or Labor Department. The demand on email would also work, as would a voicemail you can attach to an email.

-

How do we know the eligibility to fill out Form 12 BB?

Every year as a salaried employee many of you must have fill Form 12BB, but did you ever bothered to know its purpose. Don’t know ??It is indispensable for both, you and your employer. With the help of Form 12BB, you will be able to figure out how much income tax is to be deducted from your monthly pay. Further, with the help of Form 12BB, you will be in relief at the time of filing returns as at that time you will not have to pay anything due to correct TDS deduction.So, before filing such important form keep the below listed things in your mind so that you may live a tax hassle free life.For More Information:- 7 key points which must be known before filling Form 12BB

-

I received my late husband's W-9 form to fill out for what I believe were our stocks. How am I supposed to fill this out or am I even supposed to?

You do not sound as a person who handles intricasies of finances on daily basis, this is why you should redirect the qustion to your family’s tax professional who does hte filings for you.The form itself, W-9 form, is a form created and approved by the IRS, if that’s your only inquiry.Whether the form applies to you or to your husband’s estate - that’s something only a person familiar with the situation would tell you about; there is no generic answer to this.

-

I'm filling out the employment verification form online for KPMG and realized that it's not asking me for phone numbers to my previous employers. Just curious as to how they verify employment without me providing a contact number to call?

Many US employers today won’t allow individuals (coworkers, supervisors) at a company respond to any questions or write recommendations. Everything must go through HR and they will often only confirm dates of employment.I know this, so I’m not going to waste time contacting phone numbers/email lists of supposed former coworkers or managers. Fact is, if anyone answered and started responding to my questions, I’d be very suspicious. Instead, I just ask for the main number of the company — which I can look up on line and verify to be the actual number of the claimed company.Same deal with academic credentials. I’m not going to use your address for “Harvard” … the one with a PO Box in Laurel, KS. I’m going to look up the address for the registrar myself.Sorry to say, there’s far too much lying on resumes today, combined with the liability possible for a company to say anything about you. A common tactic is to lie about academic back ground while giving friends as your “former supervisor at XYZ.”

Create this form in 5 minutes!

How to create an eSignature for the form i 9 employment eligibility verification blm

How to create an eSignature for the Form I 9 Employment Eligibility Verification Blm in the online mode

How to create an eSignature for your Form I 9 Employment Eligibility Verification Blm in Google Chrome

How to generate an electronic signature for putting it on the Form I 9 Employment Eligibility Verification Blm in Gmail

How to make an electronic signature for the Form I 9 Employment Eligibility Verification Blm from your smart phone

How to generate an electronic signature for the Form I 9 Employment Eligibility Verification Blm on iOS

How to make an eSignature for the Form I 9 Employment Eligibility Verification Blm on Android

People also ask

-

What is a fillable i9 form?

A fillable i9 form is an electronic version of the Employment Eligibility Verification form used by U.S. employers to verify the identity and employment authorization of their employees. Using a fillable i9 form streamlines the hiring process, making it easier for both employers and employees to fill out and sign the document digitally.

-

How does airSlate SignNow help with fillable i9 forms?

airSlate SignNow provides businesses with a user-friendly platform to create, send, and eSign fillable i9 forms. Its intuitive design allows for seamless completion and approval, enabling HR teams to manage documentation effortlessly while ensuring compliance with federal regulations.

-

Are there any costs associated with using airSlate SignNow for fillable i9 forms?

airSlate SignNow offers a variety of pricing plans designed to meet the needs of different businesses. The platform provides cost-effective solutions for creating and managing fillable i9 forms, with transparent pricing and no hidden fees, ensuring a budget-friendly option for all users.

-

Can I customize the fillable i9 form with airSlate SignNow?

Yes, airSlate SignNow allows you to customize your fillable i9 form to fit your business needs. You can add your company's branding, adjust the layout, and include specific fields that may be required for your organization's hiring processes.

-

What are the benefits of using a fillable i9 form?

Using a fillable i9 form offers multiple benefits, including improved accuracy, faster processing times, and reduced paper waste. Additionally, it enhances the overall employee experience by allowing for quick and easy completion of necessary paperwork, supporting your company's efficiency.

-

Is airSlate SignNow compliant with i9 form requirements?

Absolutely! airSlate SignNow ensures that all fillable i9 forms processed through the platform meet the necessary compliance standards set by the U.S. Citizenship and Immigration Services. This guarantees that your documentation is not only easy to manage but also legally valid.

-

Does airSlate SignNow integrate with other HR tools for fillable i9 forms?

Yes, airSlate SignNow seamlessly integrates with various HR and payroll systems, making it easy to manage fillable i9 forms alongside other employee documentation. This integration helps streamline workflows and enhances overall efficiency in your hiring processes.

Get more for I9 Form

Find out other I9 Form

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe