International Fuel Tax Agreement and Motive Fuel User Permits Form

Understanding the International Fuel Tax Agreement and Motive Fuel User Permits

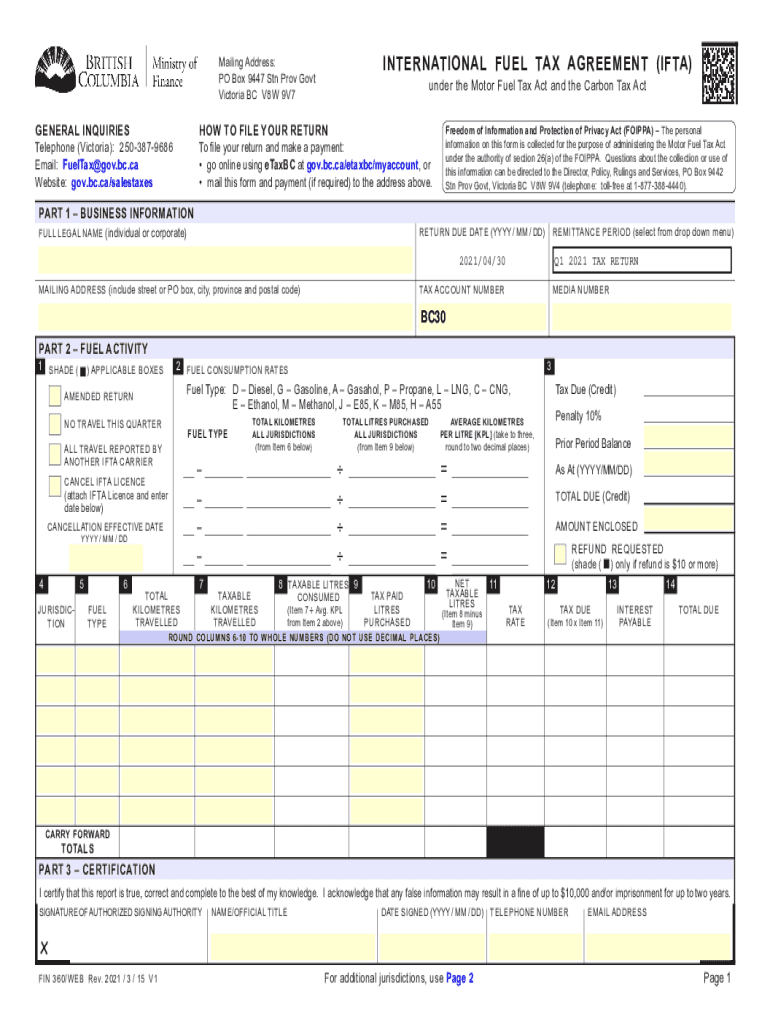

The International Fuel Tax Agreement (IFTA) is a cooperative agreement among U.S. states and Canadian provinces that simplifies the reporting of fuel use by motor carriers operating in multiple jurisdictions. The primary aim of IFTA is to ensure that fuel taxes are paid to the appropriate jurisdictions based on the miles driven in each area. Motive Fuel User Permits are necessary for operators of vehicles that travel across state lines and use fuel, ensuring compliance with tax regulations.

Steps to Complete the International Fuel Tax Agreement and Motive Fuel User Permits

Completing the ca bc ifta form requires careful attention to detail. Here are the steps to follow:

- Gather necessary information, including your business name, address, and vehicle details.

- Calculate the total miles driven in each jurisdiction and the gallons of fuel purchased.

- Fill out the IFTA application form, ensuring all sections are completed accurately.

- Submit the form to your base jurisdiction along with any required fees.

- Keep copies of all submitted documents for your records.

Legal Use of the International Fuel Tax Agreement and Motive Fuel User Permits

To ensure the legal use of the IFTA and motive fuel user permits, it is essential to comply with all applicable regulations. This includes maintaining accurate records of fuel purchases and mileage, submitting timely reports, and paying any owed taxes. Non-compliance can lead to penalties, including fines and potential legal action.

Required Documents for the International Fuel Tax Agreement and Motive Fuel User Permits

When applying for the ca bc ifta form, several documents are typically required:

- Proof of business registration.

- Vehicle identification information, including VINs.

- Records of fuel purchases and mileage logs.

- Previous IFTA returns, if applicable.

Filing Deadlines and Important Dates

Filing deadlines for the ca bc ifta form can vary by jurisdiction. Generally, quarterly reports are due on the last day of the month following the end of each quarter. It is crucial to be aware of these dates to avoid late fees and penalties.

Penalties for Non-Compliance with the International Fuel Tax Agreement

Failure to comply with IFTA regulations can result in significant penalties. These may include fines, interest on unpaid taxes, and potential revocation of operating authority. It is essential for businesses to stay informed and adhere to all requirements to avoid these consequences.

Quick guide on how to complete international fuel tax agreement and motive fuel user permits

Effortlessly prepare International Fuel Tax Agreement And Motive Fuel User Permits on any device

The management of online documents has become increasingly popular among companies and individuals. It offers a superb eco-friendly substitute for traditional printed and signed paperwork, as you can access the appropriate forms and securely store them online. airSlate SignNow equips you with all the tools necessary to create, revise, and eSign your documents quickly and without delays. Manage International Fuel Tax Agreement And Motive Fuel User Permits on any platform using airSlate SignNow applications for Android or iOS and enhance any document-related process today.

Easily edit and eSign International Fuel Tax Agreement And Motive Fuel User Permits without hassle

- Locate International Fuel Tax Agreement And Motive Fuel User Permits and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the information and then click the Done button to save your modifications.

- Choose how you want to share your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form navigation, or mistakes that necessitate the printing of new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and eSign International Fuel Tax Agreement And Motive Fuel User Permits to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the international fuel tax agreement and motive fuel user permits

How to create an electronic signature for a PDF in the online mode

How to create an electronic signature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

The way to create an eSignature right from your smart phone

How to create an eSignature for a PDF on iOS devices

The way to create an eSignature for a PDF on Android OS

People also ask

-

What is the CA BC IFTA form and who needs it?

The CA BC IFTA form is a crucial document for commercial vehicle operators who travel in multiple jurisdictions, specifically in California and British Columbia. It simplifies the reporting of fuel use and distance traveled in various states and provinces. Businesses involved in interstate transport should ensure they file this form to remain compliant with IFTA regulations.

-

How can airSlate SignNow help with filing the CA BC IFTA form?

airSlate SignNow streamlines the process of completing and submitting the CA BC IFTA form, allowing users to fill it out quickly and efficiently. Our user-friendly platform not only enables document signing but also ensures you stay organized with the necessary paperwork. With airSlate SignNow, you can save time and reduce the hassle of managing these forms.

-

What are the pricing options for using airSlate SignNow to manage the CA BC IFTA form?

airSlate SignNow offers various pricing plans tailored to different business needs, enabling cost-effective management of the CA BC IFTA form. Each plan includes access to essential features like e-signature, document tracking, and templates. You can choose the plan that fits your budget and effectively handle your IFTA documentation.

-

Are there any special features for handling the CA BC IFTA form with airSlate SignNow?

Yes, airSlate SignNow includes features specifically designed for managing the CA BC IFTA form efficiently. These features include customizable templates, automated reminders, and secure storage for easy access to your documents. This helps ensure that your submissions are timely and accurate.

-

Can I integrate airSlate SignNow with other tools to manage the CA BC IFTA form?

Absolutely! airSlate SignNow offers integrations with popular apps and tools like Google Drive, Dropbox, and CRM systems, making it easier to manage the CA BC IFTA form. These integrations enable seamless workflow management, allowing you to connect all your necessary documentation in one place.

-

What benefits do I gain by using airSlate SignNow for the CA BC IFTA form?

Using airSlate SignNow to file the CA BC IFTA form offers many benefits, including enhanced accuracy, reduced processing time, and improved compliance. Our platform ensures that your forms are completed correctly and submitted on time, helping you avoid potential penalties. Additionally, you gain access to expert support whenever you need assistance.

-

How secure is my information when using airSlate SignNow for the CA BC IFTA form?

airSlate SignNow prioritizes the security of your sensitive information, especially when completing the CA BC IFTA form. Our platform employs advanced encryption and security protocols to safeguard your data. You can trust that your personal and business information remains confidential throughout the process.

Get more for International Fuel Tax Agreement And Motive Fuel User Permits

- Form nc 230 download printable pdf decree changing name and

- Rfp template maryland department of health form

- Nc 400 info information sheet for name change proceedings

- In name change proceeding under form

- The application was duly considered form

- Nc 500 petition for recognition of minors change of gender and issuance of new birth certificate and change of name judicial form

- Nc 330 order recognizing change of gender california courts form

- Rights warning procedurewaiver certificate form

Find out other International Fuel Tax Agreement And Motive Fuel User Permits

- Can I eSignature Nebraska Student Data Sheet

- How To eSignature Michigan Application for University

- eSignature North Carolina Weekly Class Evaluation Now

- eSignature Colorado Medical Power of Attorney Template Fast

- Help Me With eSignature Florida Medical Power of Attorney Template

- eSignature Iowa Medical Power of Attorney Template Safe

- eSignature Nevada Medical Power of Attorney Template Secure

- eSignature Arkansas Nanny Contract Template Secure

- eSignature Wyoming New Patient Registration Mobile

- eSignature Hawaii Memorandum of Agreement Template Online

- eSignature Hawaii Memorandum of Agreement Template Mobile

- eSignature New Jersey Memorandum of Agreement Template Safe

- eSignature Georgia Shareholder Agreement Template Mobile

- Help Me With eSignature Arkansas Cooperative Agreement Template

- eSignature Maryland Cooperative Agreement Template Simple

- eSignature Massachusetts Redemption Agreement Simple

- eSignature North Carolina Redemption Agreement Mobile

- eSignature Utah Equipment Rental Agreement Template Now

- Help Me With eSignature Texas Construction Contract Template

- eSignature Illinois Architectural Proposal Template Simple