NOTIFICATION by an EMPLOYER of an EMPLOYEE WHO is ABOUT to CEASE to BE EMPLOYED IR56F NOTIFICATION by an EMPLOYER of an EMPLOYEE Form

Understanding the IR56F Form

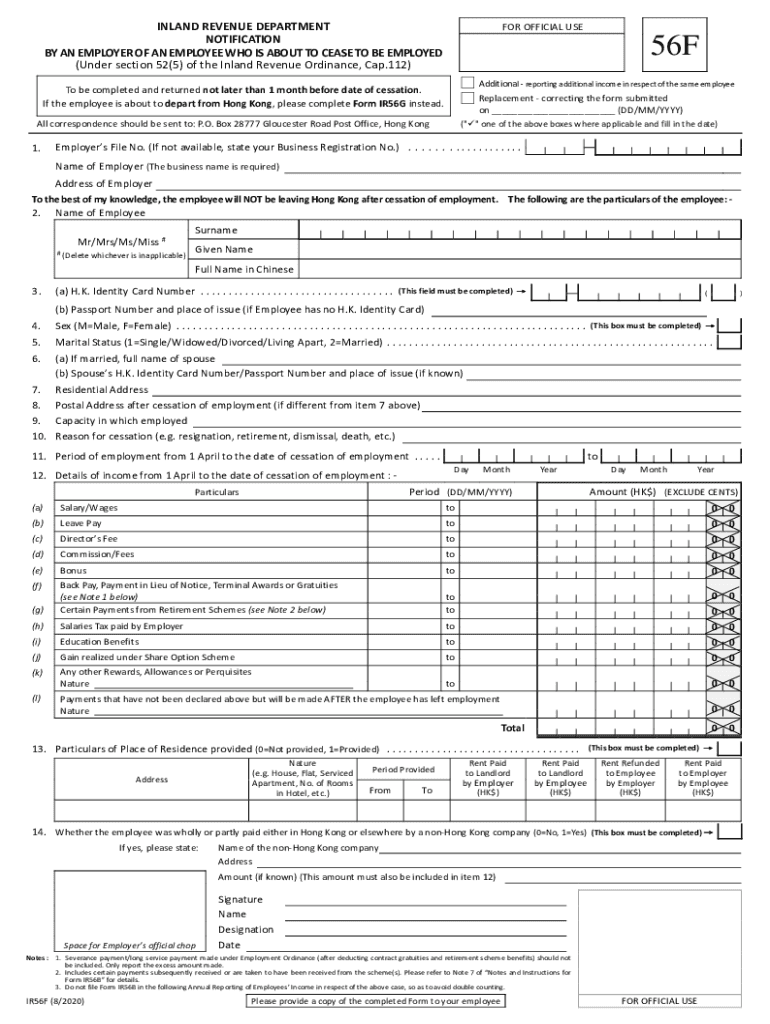

The IR56F form, officially known as the Notification by an Employer of an Employee Who Is About to Cease to Be Employed, is a crucial document for employers in Hong Kong. This form serves to inform the Inland Revenue Department (IRD) about an employee's termination of employment. It is essential for ensuring that tax obligations are met and that the employee's tax affairs are properly managed. Employers must complete this form accurately to avoid penalties and ensure compliance with local tax regulations.

Steps to Complete the IR56F Form

Completing the IR56F form requires careful attention to detail. Here are the key steps involved:

- Gather necessary information, including the employee's personal details, employment period, and reasons for termination.

- Fill in the form accurately, ensuring all sections are completed as per the guidelines provided by the IRD.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the IRD within the specified timeframe to avoid penalties.

Legal Use of the IR56F Form

The IR56F form is legally binding and must be used in accordance with the laws governing employment and taxation in Hong Kong. Employers are responsible for ensuring that the information provided is truthful and complete. Failure to comply with the legal requirements can result in penalties for both the employer and the employee. Understanding the legal implications of the IR56F form is essential for maintaining compliance with the Inland Revenue Ordinance.

Obtaining the IR56F Form

The IR56F form can be obtained directly from the Inland Revenue Department's website or through authorized channels. Employers should ensure they have the most current version of the form to avoid issues with outdated information. It is advisable to download the form in advance of any employee termination to streamline the process when needed.

Filing Deadlines for the IR56F Form

Timely submission of the IR56F form is critical. Employers must be aware of the filing deadlines set by the IRD to avoid penalties. Generally, the form should be submitted within one month of the employee's termination date. Keeping track of these deadlines helps ensure compliance and prevents unnecessary complications.

Key Elements of the IR56F Form

Several key elements must be included in the IR56F form to ensure it is valid:

- Employee's full name and identification details.

- Employment start and end dates.

- Reason for termination.

- Any outstanding tax obligations or deductions.

Each of these elements plays a vital role in the processing of the form by the IRD and impacts the employee's tax status.

Quick guide on how to complete notification by an employer of an employee who is about to cease to be employed ir56f notification by an employer of an

Effortlessly Prepare NOTIFICATION BY AN EMPLOYER OF AN EMPLOYEE WHO IS ABOUT TO CEASE TO BE EMPLOYED IR56F NOTIFICATION BY AN EMPLOYER OF AN EMPLOYEE on Any Device

The management of documents online has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides all the resources you require to create, modify, and electronically sign your documents quickly and without delays. Manage NOTIFICATION BY AN EMPLOYER OF AN EMPLOYEE WHO IS ABOUT TO CEASE TO BE EMPLOYED IR56F NOTIFICATION BY AN EMPLOYER OF AN EMPLOYEE on any device using the airSlate SignNow apps for Android or iOS, and simplify any document-related process today.

Effortless Ways to Modify and eSign NOTIFICATION BY AN EMPLOYER OF AN EMPLOYEE WHO IS ABOUT TO CEASE TO BE EMPLOYED IR56F NOTIFICATION BY AN EMPLOYER OF AN EMPLOYEE

- Obtain NOTIFICATION BY AN EMPLOYER OF AN EMPLOYEE WHO IS ABOUT TO CEASE TO BE EMPLOYED IR56F NOTIFICATION BY AN EMPLOYER OF AN EMPLOYEE and click on Get Form to begin.

- Use the tools we offer to fill in your form.

- Highlight important sections of your documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes only a few seconds and carries the same legal significance as a traditional ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management needs with just a few clicks from any device of your choice. Modify and eSign NOTIFICATION BY AN EMPLOYER OF AN EMPLOYEE WHO IS ABOUT TO CEASE TO BE EMPLOYED IR56F NOTIFICATION BY AN EMPLOYER OF AN EMPLOYEE and ensure exceptional communication at every step of the document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the notification by an employer of an employee who is about to cease to be employed ir56f notification by an employer of an

How to create an electronic signature for a PDF file in the online mode

How to create an electronic signature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

The way to create an eSignature from your smartphone

How to create an eSignature for a PDF file on iOS devices

The way to create an eSignature for a PDF file on Android

People also ask

-

What is the ir56f Chinese form and why do I need it?

The ir56f Chinese form is a crucial tax document required for reporting certain income in China. It ensures compliance with local tax regulations. Using airSlate SignNow, you can easily fill and eSign this document, streamlining your tax filing process.

-

How does airSlate SignNow simplify the process of filling out the ir56f Chinese form?

airSlate SignNow offers an intuitive interface that guides users through the completion of the ir56f Chinese form. You can upload your documents, fill in required fields, and eSign them seamlessly. This eliminates the hassle of paperwork and reduces error rates.

-

Is there a cost associated with using airSlate SignNow for the ir56f Chinese form?

Yes, while airSlate SignNow is a cost-effective solution, there are subscription plans available that fit various budgets. These plans provide access to all features for managing documents, including the ir56f Chinese form. You can choose a plan that meets your business needs.

-

Can I integrate airSlate SignNow with other business tools for managing the ir56f Chinese form?

Absolutely! airSlate SignNow integrates seamlessly with various platforms like Google Drive, Salesforce, and more. This allows you to manage your workflow efficiently while keeping all documents related to the ir56f Chinese form organized.

-

What features does airSlate SignNow offer for the electronic signing of the ir56f Chinese form?

airSlate SignNow provides features like secure electronic signatures, document tracking, and template management specifically for forms like the ir56f Chinese. These features enhance the security and reliability of your document workflows, making eSigning effortless.

-

How secure is airSlate SignNow when dealing with sensitive documents like the ir56f Chinese form?

Security is a top priority at airSlate SignNow. It uses advanced encryption and complies with regulations to protect sensitive information, including the ir56f Chinese form. You can trust that your documents are safe and secure throughout the signing process.

-

Can I access airSlate SignNow from any device to work on the ir56f Chinese form?

Yes, airSlate SignNow is designed to be accessible from any device with internet access. Whether you’re on a computer, tablet, or smartphone, you can easily work on the ir56f Chinese form, making it convenient for users on the go.

Get more for NOTIFICATION BY AN EMPLOYER OF AN EMPLOYEE WHO IS ABOUT TO CEASE TO BE EMPLOYED IR56F NOTIFICATION BY AN EMPLOYER OF AN EMPLOYEE

Find out other NOTIFICATION BY AN EMPLOYER OF AN EMPLOYEE WHO IS ABOUT TO CEASE TO BE EMPLOYED IR56F NOTIFICATION BY AN EMPLOYER OF AN EMPLOYEE

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer