RRF 1, Annual Registrarion Renewal Fee Report to Attorney General of California RRF 1, Annual Registrarion Renewal Fee Report to 2017

Understanding the RRF 1 Form

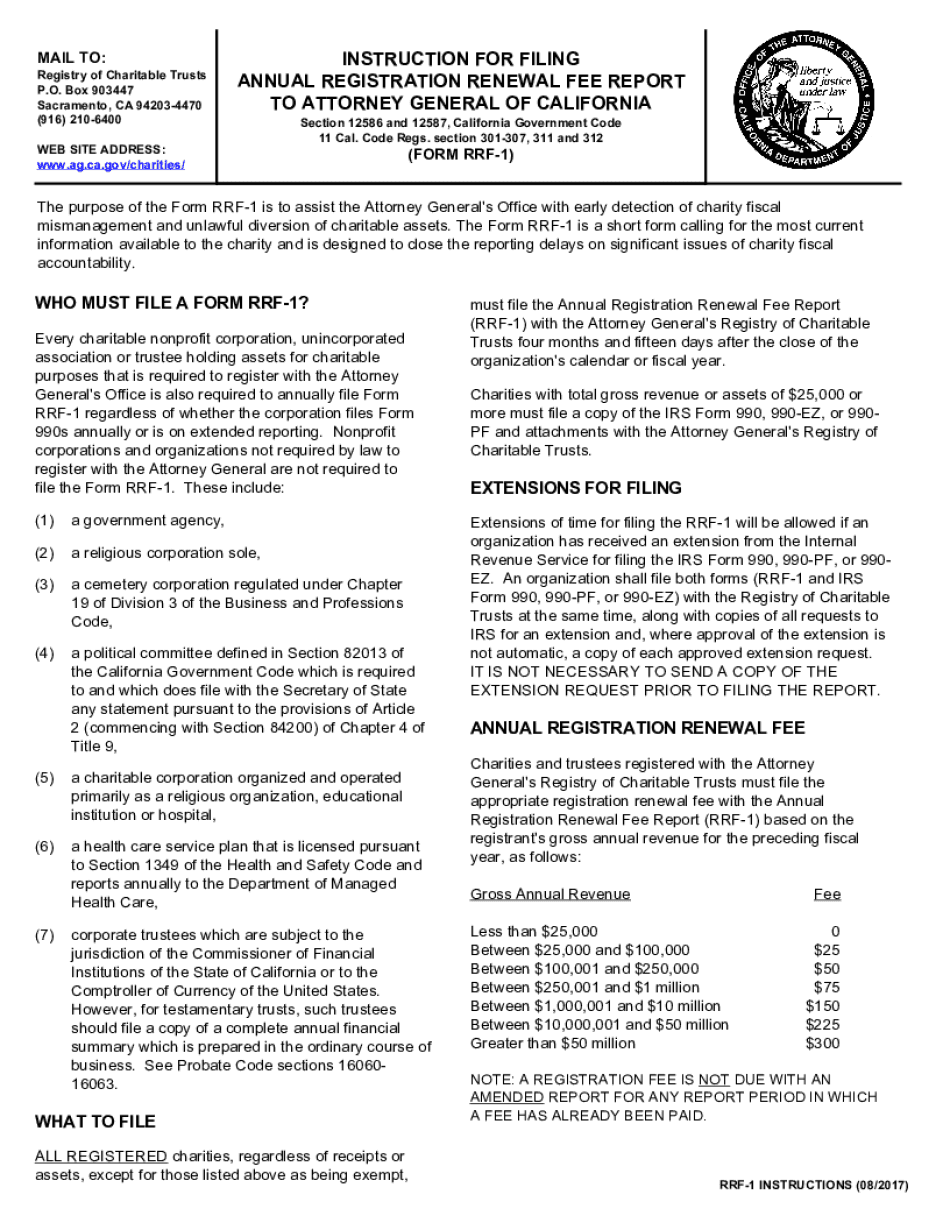

The RRF 1, or Annual Registration Renewal Fee Report to the Attorney General of California, is a mandatory form for charitable organizations operating in California. This form is essential for maintaining compliance with state regulations and ensuring that organizations can continue to solicit donations legally. It provides the Attorney General's office with updated information about the organization, including its activities, financial status, and governance. Non-compliance can lead to penalties, including fines or loss of charitable status.

Steps to Complete the RRF 1 Form

Completing the RRF 1 requires careful attention to detail. Here are the steps to ensure accurate submission:

- Gather necessary documents, including financial statements and a list of current board members.

- Fill out the RRF 1 form with accurate information regarding the organization’s activities and finances.

- Review the completed form for any errors or omissions.

- Submit the form electronically or by mail, depending on your preference and compliance with state regulations.

Legal Use of the RRF 1 Form

The RRF 1 form serves a critical legal function for charitable organizations in California. It is used to demonstrate compliance with the California Nonprofit Corporation Law and the California Government Code. By submitting this form, organizations affirm their commitment to transparency and accountability, which are vital for maintaining public trust and support.

Required Documents for RRF 1 Submission

When preparing to submit the RRF 1, organizations must include several key documents:

- Financial statements for the previous fiscal year.

- A list of current officers and directors.

- Any additional documentation that supports the organization’s activities and compliance efforts.

Filing Deadlines for the RRF 1

Timely submission of the RRF 1 is crucial. Organizations must file the form annually, typically by the 15th day of the fifth month after the end of their fiscal year. Missing this deadline can result in penalties, including late fees or additional scrutiny from the Attorney General's office.

Penalties for Non-Compliance

Failure to file the RRF 1 on time can lead to significant consequences for charitable organizations. Penalties may include:

- Monetary fines imposed by the Attorney General's office.

- Loss of eligibility to solicit donations.

- Potential legal action against the organization.

Form Submission Methods

Organizations can submit the RRF 1 form through various methods, ensuring flexibility and convenience:

- Online submission via the California Attorney General's website.

- Mailing a physical copy of the form to the designated office.

- In-person submission at local Attorney General offices, if applicable.

Quick guide on how to complete rrf 1 annual registrarion renewal fee report to attorney general of california rrf 1 annual registrarion renewal fee report to

Facilitate RRF 1, Annual Registrarion Renewal Fee Report To Attorney General Of California RRF 1, Annual Registrarion Renewal Fee Report To effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers a seamless eco-friendly alternative to traditional printed and signed paperwork, as you can obtain the necessary form and securely keep it online. airSlate SignNow provides you with all the tools you require to create, modify, and electronically sign your documents promptly without delays. Manage RRF 1, Annual Registrarion Renewal Fee Report To Attorney General Of California RRF 1, Annual Registrarion Renewal Fee Report To from any device using the airSlate SignNow Android or iOS applications and enhance any document-focused process today.

How to alter and eSign RRF 1, Annual Registrarion Renewal Fee Report To Attorney General Of California RRF 1, Annual Registrarion Renewal Fee Report To with ease

- Obtain RRF 1, Annual Registrarion Renewal Fee Report To Attorney General Of California RRF 1, Annual Registrarion Renewal Fee Report To and click on Get Form to commence.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or conceal sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to preserve your alterations.

- Choose how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, exhaustive form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from your preferred device. Modify and eSign RRF 1, Annual Registrarion Renewal Fee Report To Attorney General Of California RRF 1, Annual Registrarion Renewal Fee Report To and guarantee effective communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct rrf 1 annual registrarion renewal fee report to attorney general of california rrf 1 annual registrarion renewal fee report to

Create this form in 5 minutes!

How to create an eSignature for the rrf 1 annual registrarion renewal fee report to attorney general of california rrf 1 annual registrarion renewal fee report to

The best way to generate an electronic signature for a PDF in the online mode

The best way to generate an electronic signature for a PDF in Chrome

The way to create an eSignature for putting it on PDFs in Gmail

How to make an eSignature straight from your smart phone

The way to make an eSignature for a PDF on iOS devices

How to make an eSignature for a PDF document on Android OS

People also ask

-

What is the california attorney general rrf 1, and how does it relate to e-signatures?

The california attorney general rrf 1 is a compliance requirement that pertains to the secure handling of documents in California. Using airSlate SignNow can help businesses meet these compliance standards by providing a reliable platform for e-signatures that ensures document integrity.

-

How can airSlate SignNow assist me with the california attorney general rrf 1 requirements?

airSlate SignNow offers features tailored for legal compliance, including audit trails and secure storage, which are essential for fulfilling the california attorney general rrf 1 requirements. This guarantees that your documents are legally sound and tamper-proof.

-

What pricing plans does airSlate SignNow offer for those needing to comply with california attorney general rrf 1?

airSlate SignNow provides several pricing plans that cater to different business needs, including options for smaller businesses that require compliance with the california attorney general rrf 1. Each plan offers scalable features to ensure you only pay for what you need.

-

Does airSlate SignNow provide templates related to california attorney general rrf 1 compliance?

Yes, airSlate SignNow includes a variety of customizable templates specifically designed to help you comply with the california attorney general rrf 1. These templates streamline your document process while ensuring adherence to legal standards.

-

Can I integrate airSlate SignNow with other tools to help manage california attorney general rrf 1 documentation?

Absolutely! airSlate SignNow can be easily integrated with various third-party applications, enhancing your workflow for managing documents related to the california attorney general rrf 1. This integration helps maintain organized and compliant documentation processes.

-

What benefits does using airSlate SignNow provide for businesses dealing with the california attorney general rrf 1?

Using airSlate SignNow offers signNow benefits such as enhanced security, improved efficiency, and ease of use, all important for businesses navigating the california attorney general rrf 1. This can lead to faster document turnaround times and reduced operational costs.

-

Is airSlate SignNow user-friendly for businesses unfamiliar with california attorney general rrf 1 regulations?

Yes, airSlate SignNow is designed to be user-friendly, making it accessible for businesses that may be new to california attorney general rrf 1 regulations. With intuitive navigation and helpful features, users can quickly adapt to using the platform for their documentation needs.

Get more for RRF 1, Annual Registrarion Renewal Fee Report To Attorney General Of California RRF 1, Annual Registrarion Renewal Fee Report To

- Decedents estate inventory templatenet form

- Title of form

- Colorado rules of probate procedure part 1 form

- Designating clerk of court as agent for service of process form

- I object to the requested action set forth in the motion or petition entitled form

- Decree of final discharge pursuant to15 12 form

- Received from form

- Fillable online wildberry solar center fax email print form

Find out other RRF 1, Annual Registrarion Renewal Fee Report To Attorney General Of California RRF 1, Annual Registrarion Renewal Fee Report To

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT