How to Get Sdsu Working Students W2 Form

How to obtain the SDSU W-2 for working students

To obtain the SDSU W-2 form as a working student, you need to follow a few essential steps. First, ensure that you have completed your employment with San Diego State University. The W-2 form is typically issued to employees by the end of January each year, reflecting the previous year’s earnings and tax withholdings.

Students can access their W-2 forms through the SDSU employee portal. Log in using your university credentials to view and download your W-2 form. If you encounter difficulties accessing the portal, consider reaching out to the SDSU payroll department for assistance.

Steps to complete the SDSU W-2 request

Completing the SDSU W-2 request involves several straightforward steps:

- Visit the SDSU employee portal.

- Log in with your university credentials.

- Navigate to the payroll section to locate your W-2 form.

- Select the appropriate tax year and download your W-2.

- If needed, print the form for your records.

By following these steps, you can easily obtain your W-2 form, ensuring that you have the necessary documentation for tax filing purposes.

Legal use of the SDSU W-2 form

The SDSU W-2 form is a critical document for tax purposes, as it provides a summary of your earnings and the taxes withheld during the year. This form is legally binding and must be used when filing your federal and state income tax returns. Ensure that you keep a copy of your W-2 for your records, as it may be required for future reference or audits.

It is essential to verify that all information on the W-2 is accurate. If you notice any discrepancies, contact the SDSU payroll department promptly to correct the information.

Filing deadlines for the SDSU W-2 form

Filing deadlines for tax returns are crucial for compliance. Typically, the IRS requires individuals to file their federal income tax returns by April 15 each year. Ensure that you have received your SDSU W-2 form by the end of January to allow adequate time for filing your taxes. If you do not receive your W-2 by mid-February, reach out to the payroll department to request a duplicate.

Who issues the SDSU W-2 form

The SDSU W-2 form is issued by the university's payroll department. They are responsible for generating and distributing W-2 forms to all employees, including student workers. The payroll department ensures that the information on the W-2 is accurate and complies with IRS regulations.

If you have any questions regarding your W-2 form or its contents, the payroll department is your primary point of contact for assistance.

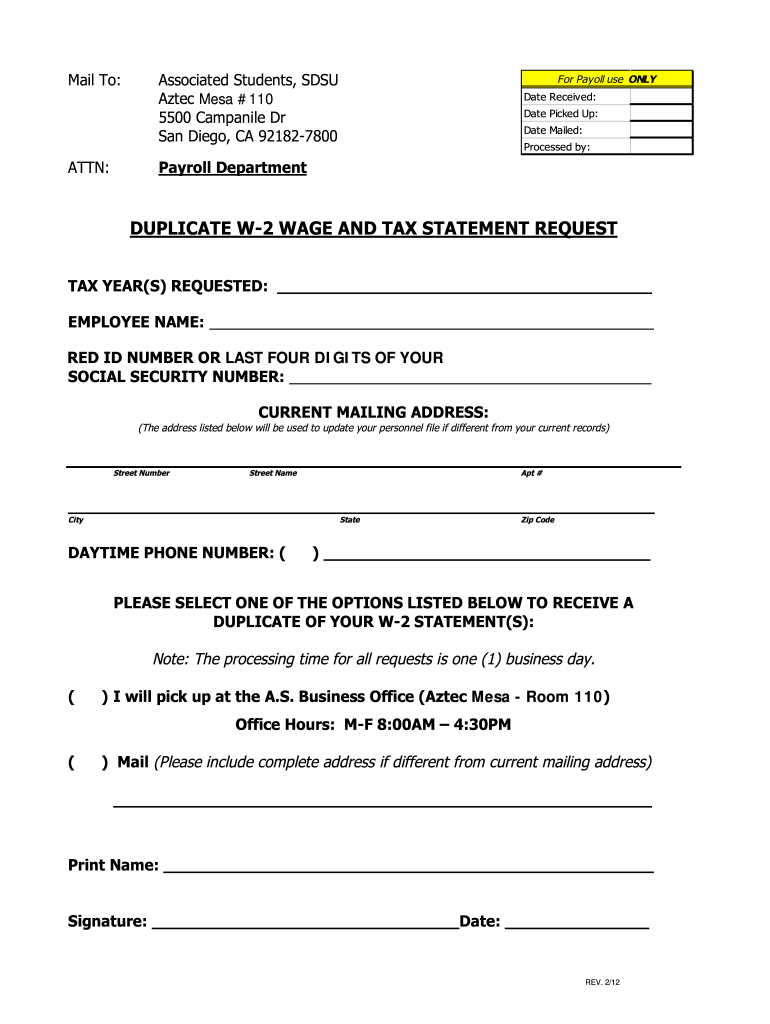

Required documents for the SDSU W-2 request

When requesting your SDSU W-2 form, you typically do not need to provide additional documents. However, it is essential to have your university identification and login credentials handy to access the employee portal. If you need to request a duplicate W-2, you may be asked to verify your identity, so having personal information such as your Social Security number may be helpful.

Examples of using the SDSU W-2 form

The SDSU W-2 form is used primarily for tax filing purposes. For instance, when preparing your federal and state tax returns, you will need to input the earnings and tax withholdings reported on your W-2. Additionally, if you apply for financial aid or loans, you may be required to submit your W-2 as proof of income. Keeping this document organized and accessible is vital for various financial processes.

Quick guide on how to complete request w 2 form associated students sdsu

Uncover the way to smoothly navigate the How To Obtain Sdsu Working Students W2 completion with this straightforward guide

Electronic filing and certification of forms are becoming more popular and the preferred choice for many clients. It presents a variety of advantages over conventional printed documents, such as ease of use, time savings, improved accuracy, and enhanced security.

With tools like airSlate SignNow, you can discover, edit, signNow, and send your How To Get Sdsu Working Students W2 without the hassle of continuous printing and scanning. Follow this concise guide to get started and finalize your document.

Follow these steps to obtain and complete How To Get Sdsu Working Students W2

- Begin by clicking on the Get Form button to access your document in our editor.

- Observe the green label on the left that indicates required fields to ensure you don't overlook them.

- Utilize our professional features to annotate, edit, sign, secure, and enhance your document.

- Protect your file or convert it into a fillable form using the appropriate tab options.

- Review the document and verify it for any mistakes or inconsistencies.

- Click on DONE to complete the editing process.

- Rename your document or keep it unchanged.

- Select the storage service where you wish to save your document, send it via USPS, or click the Download Now button to obtain your document.

If How To Get Sdsu Working Students W2 doesn't align with what you were looking for, explore our wide range of pre-loaded templates that can be filled out with minimal effort. Discover our solution today!

Create this form in 5 minutes or less

FAQs

-

When do I have to learn how to fill out a W-2 form?

Form W-2 is an obligatory form to be completed by every employer. Form W-2 doesn’t have to be filled out by the employee. It is given to inform the employee about the amount of his annual income and taxes withheld from it.You can find a lot of information here: http://bit.ly/2NjjlJi

-

How do I respond to a request for a restraining order? Do I need to fill out a form?

As asked of me specifically;The others are right, you will likely need a lawyer. But to answer your question, there is a response form to respond to a restraining order or order of protection. Worst case the form is available at the courthouse where your hearing is set to be heard in, typically at the appropriate clerk's window, which may vary, so ask any of the clerk's when you get there.You only have so many days to respond, and it will specify in the paperwork.You will also have to appear in court on the date your hearing is scheduled.Most courts have a department that will help you respond to forms at no cost. I figure you are asking because you can't afford an attorney which is completely understandable.The problem is that if you aren't represented and the other person is successful in getting a temporary restraining order made permanent in the hearing you will not be allowed at any of the places the petitioner goes, without risking arrest.I hope this helps.Not given as legal advice-

-

How do you fill out a W-2 form?

In general, the W-2 form is divided into two parts each with numerous fields to be completed carefully by an employer. The section on the left contains both the employer's and employee`s names and contact information as well social security number and identification number.You can find a lot of information here: http://bit.ly/2NjjlJi

-

How should I fill out my w-2 or w-4 form?

To calculate how much you should withhold you need to calculate two things. Step 1 - Estimate your TaxFirst go to Intuit's TaxCaster (Link -> TurboTax® TaxCaster, Free Tax Calculator, Free Tax Refund Estimator) and put in your family's information and income (estimate what you'll make in 2016 before taxes and put zero for federal and state taxes withheld, don't worry that the TaxCaster is for 2015, you're just trying to get a general number). Once you enter in your correct information it will tell you what you would owe to the federal government.Step 2 - Estimate your Tax Withholding Based on Allowances ClaimedSecond go to Paycheck City (Link -> Salary Paycheck Calculator | Payroll Calculator | Paycheck City) select the correct state, enter in your pay information. Select married filing jointly then try putting in 3 or 4 for withholdings. Once you calculate it will tell you how much taxes are being withheld. Set the pay frequency to annual instead of bi-monthly or bi-weekly since you need a total number for the year. Try changing the Federal withholding allowance until you have enough Federal taxes withheld to cover the amount calculated in the TaxCaster. The Federal withholding allowance number that covers all taxes owed should be the number claimed on your W-4.Don't worry too much about your state. If you claim the same as Federal what will usually happen is you might get a small refund for Federal and owe a small amount for State. I usually end up getting a Federal refund for ~$100 and owing state for just over $100. In the end I net owing state $20-40.Remember, the more details you can put into the TaxCaster and Paycheck City the more accurate your tax estimate will be.

Create this form in 5 minutes!

How to create an eSignature for the request w 2 form associated students sdsu

How to make an electronic signature for your Request W 2 Form Associated Students Sdsu online

How to create an eSignature for the Request W 2 Form Associated Students Sdsu in Chrome

How to create an eSignature for signing the Request W 2 Form Associated Students Sdsu in Gmail

How to make an electronic signature for the Request W 2 Form Associated Students Sdsu right from your smart phone

How to generate an eSignature for the Request W 2 Form Associated Students Sdsu on iOS devices

How to make an eSignature for the Request W 2 Form Associated Students Sdsu on Android devices

People also ask

-

What is airSlate SignNow and how can it help me with my SDSU Working Students W2?

airSlate SignNow is a powerful e-signature solution that simplifies the process of sending and signing documents, including tax forms like the SDSU Working Students W2. With its user-friendly interface, you can easily manage your documents, ensuring you receive your W2 on time and without hassle.

-

How do I use airSlate SignNow to get my SDSU Working Students W2?

To get your SDSU Working Students W2 using airSlate SignNow, simply upload your form, add the necessary signatures, and send it to the relevant parties. The platform allows for seamless collaboration and ensures that your W2 is processed quickly and efficiently.

-

What features does airSlate SignNow offer for managing my SDSU Working Students W2?

airSlate SignNow offers features such as document templates, automated workflows, and secure cloud storage, all designed to help you manage your SDSU Working Students W2 effectively. These tools enhance productivity and reduce the risk of errors when handling important tax documents.

-

Is airSlate SignNow a cost-effective solution for obtaining my SDSU Working Students W2?

Yes, airSlate SignNow is a cost-effective solution for managing documents like your SDSU Working Students W2. With flexible pricing plans, you can choose an option that fits your budget while still benefiting from a comprehensive suite of e-signature features.

-

Can I integrate airSlate SignNow with other tools to help manage my SDSU Working Students W2?

Absolutely! airSlate SignNow integrates with various applications like Google Drive, Salesforce, and Dropbox, allowing you to streamline your workflow when obtaining your SDSU Working Students W2. These integrations make it easier to access and manage your documents from one central location.

-

What are the benefits of using airSlate SignNow for my SDSU Working Students W2?

Using airSlate SignNow for your SDSU Working Students W2 offers numerous benefits, including enhanced security, faster document turnaround times, and improved collaboration. It simplifies the signing process, ensuring that you can focus on your studies while efficiently managing your tax documents.

-

How can airSlate SignNow ensure the security of my SDSU Working Students W2?

airSlate SignNow prioritizes security, employing advanced encryption and compliance with industry standards to protect your SDSU Working Students W2. You can trust that your sensitive tax information remains confidential and secure throughout the signing process.

Get more for How To Get Sdsu Working Students W2

Find out other How To Get Sdsu Working Students W2

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast