STATE of FLORIDA Bay County Tax Collector Form

What is the Bay County Tax Collector?

The Bay County Tax Collector is an essential office responsible for managing various tax-related functions within Bay County, Florida. This office oversees the collection of property taxes, business taxes, and other revenue-generating activities for the county. It ensures that tax payments are processed efficiently, providing services to residents and businesses alike. The Tax Collector also plays a crucial role in maintaining accurate tax records and facilitating the distribution of tax revenues to local government entities.

How to Use the Bay County Tax Collector

Utilizing the services of the Bay County Tax Collector can be straightforward. Residents can access various forms and services online, allowing for convenient tax payments and inquiries. Users can visit the official website to find information on property tax assessments, payment options, and deadlines. Additionally, the office provides resources for understanding tax obligations and available exemptions, making it easier for taxpayers to comply with local regulations.

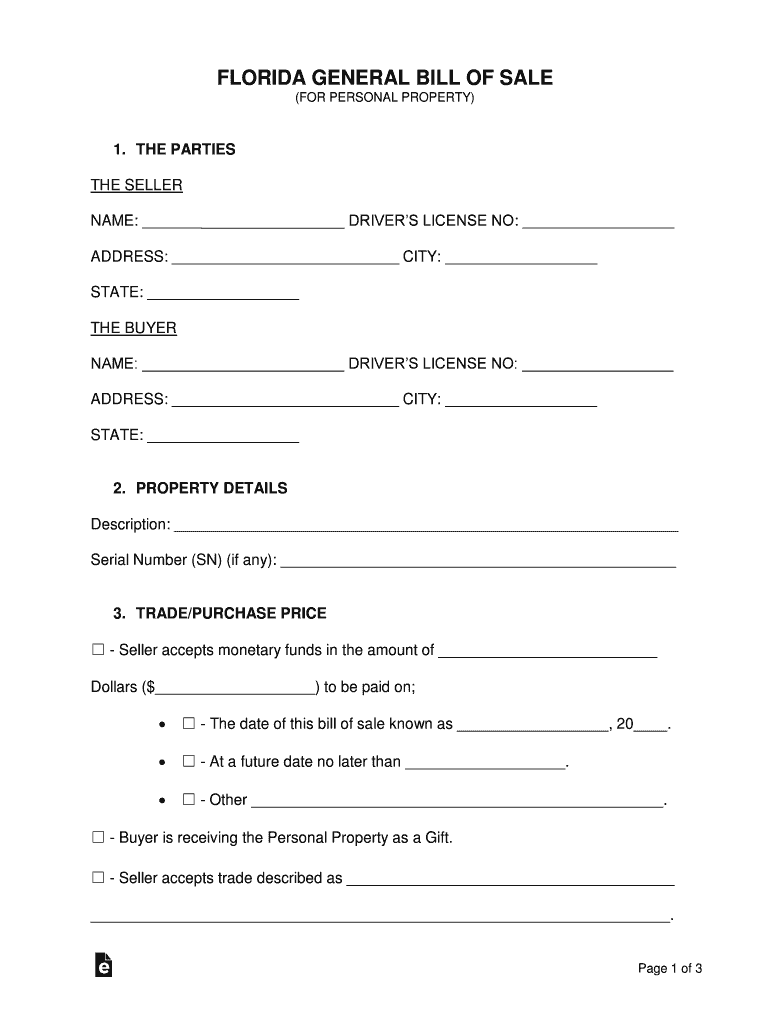

Steps to Complete the Bay County Tax Collector Form

Completing the Bay County Tax Collector form involves several key steps. First, gather all necessary documentation, including identification and any relevant financial records. Next, access the appropriate form on the Tax Collector's website. Carefully fill out the form, ensuring that all information is accurate and complete. After completing the form, review it for any errors before submitting it online or by mail. If submitting in person, visit the Tax Collector's office during business hours.

Required Documents for the Bay County Tax Collector

When dealing with the Bay County Tax Collector, certain documents may be required to ensure proper processing of tax-related forms. Commonly required documents include:

- Proof of identity, such as a driver's license or state ID

- Property ownership documentation, if applicable

- Previous tax records or receipts

- Any relevant financial statements for business taxes

Having these documents ready can facilitate a smoother interaction with the Tax Collector's office.

Legal Use of the Bay County Tax Collector

The legal use of the Bay County Tax Collector form is governed by state laws and regulations. It is crucial for taxpayers to ensure that all information provided is truthful and accurate to avoid penalties. Compliance with local tax laws not only helps in maintaining good standing with the county but also contributes to the overall functioning of local government services. Understanding the legal implications of tax filings can help taxpayers navigate their responsibilities effectively.

Form Submission Methods

Taxpayers have several options for submitting forms to the Bay County Tax Collector. These methods include:

- Online submission through the Tax Collector's official website

- Mailing the completed form to the designated office address

- In-person submission at the Tax Collector's office during regular business hours

Each method has its advantages, and taxpayers should choose the one that best fits their needs and circumstances.

Quick guide on how to complete state of florida bay county tax collector

Complete STATE OF FLORIDA Bay County Tax Collector effortlessly on any device

Digital document management has gained signNow traction among businesses and individuals. It serves as an ideal environmentally-friendly alternative to traditional printed and signed paperwork, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the tools needed to create, modify, and electronically sign your documents promptly without delays. Handle STATE OF FLORIDA Bay County Tax Collector on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign STATE OF FLORIDA Bay County Tax Collector without hassle

- Find STATE OF FLORIDA Bay County Tax Collector and click Get Form to begin.

- Use the tools we provide to complete your form.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow has designed specifically for this function.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and then click the Done button to save your changes.

- Select how you wish to send your form—via email, text message (SMS), or invite link—or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or errors that require reprinting new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign STATE OF FLORIDA Bay County Tax Collector and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the state of florida bay county tax collector

How to create an eSignature for your PDF document in the online mode

How to create an eSignature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

How to generate an eSignature from your mobile device

How to generate an electronic signature for a PDF document on iOS devices

How to generate an eSignature for a PDF file on Android devices

People also ask

-

What services does the Bay County Tax Collector provide?

The Bay County Tax Collector offers various services including property tax collection, vehicle registration, and issuance of licenses and permits. By utilizing airSlate SignNow, you can easily handle all necessary documentation related to these services electronically, streamlining the process for both the Tax Collector's office and the citizens.

-

How can airSlate SignNow benefit my interactions with the Bay County Tax Collector?

With airSlate SignNow, you can electronically sign documents needed for interactions with the Bay County Tax Collector, saving time and reducing paperwork. This platform ensures you can send and receive documents securely, making communication with the Tax Collector more efficient.

-

Is there a cost associated with using airSlate SignNow for Bay County Tax Collector transactions?

Using airSlate SignNow is a cost-effective solution. There are various pricing plans tailored to meet different needs, ensuring that you only pay for the features you use when interacting with the Bay County Tax Collector's office.

-

What features does airSlate SignNow offer to improve document management for the Bay County Tax Collector?

airSlate SignNow includes features such as customizable templates, real-time tracking, and secure document storage. These features enhance document management for users dealing with the Bay County Tax Collector, making it easier to track submissions and maintain records.

-

Can I integrate airSlate SignNow with other tools for my Bay County Tax Collector transactions?

Yes, airSlate SignNow offers robust integrations with various tools and applications, enabling you to streamline your workflow. Whether you're using CRM systems or project management software, integrating with airSlate SignNow can simplify processes associated with the Bay County Tax Collector.

-

How do I get started with airSlate SignNow for Bay County Tax Collector-related documents?

Getting started with airSlate SignNow is easy. Simply create an account, choose a pricing plan, and begin uploading documents to send for eSignature related to your interactions with the Bay County Tax Collector. The user-friendly interface ensures a smooth onboarding experience for new users.

-

What security measures does airSlate SignNow have for documents shared with the Bay County Tax Collector?

airSlate SignNow prioritizes security with features like encryption, secure cloud storage, and user authentication. When sending sensitive documents to the Bay County Tax Collector, you can trust that your information is protected against unauthorized access and bsignNowes.

Get more for STATE OF FLORIDA Bay County Tax Collector

- In the circuitcounty court of the thirteenth judicial form

- Control number fl 017 78 form

- Accordance with the applicable laws of the state of florida form

- Marital agreement form

- In thb county court of the thirteenth judicial circuit form

- Trustee to trustee form

- Affidavit supporting motion for summary judgmentby plaintiffgeneral form

- Control number fl 020 78 form

Find out other STATE OF FLORIDA Bay County Tax Collector

- Electronic signature Delaware Orthodontists Permission Slip Free

- How Do I Electronic signature Hawaii Orthodontists Lease Agreement Form

- Electronic signature North Dakota Life Sciences Business Plan Template Now

- Electronic signature Oklahoma Legal Bill Of Lading Fast

- Electronic signature Oklahoma Legal Promissory Note Template Safe

- Electronic signature Oregon Legal Last Will And Testament Online

- Electronic signature Life Sciences Document Pennsylvania Simple

- Electronic signature Legal Document Pennsylvania Online

- How Can I Electronic signature Pennsylvania Legal Last Will And Testament

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement

- How To Electronic signature South Carolina Legal Lease Agreement

- How Can I Electronic signature South Carolina Legal Quitclaim Deed

- Electronic signature South Carolina Legal Rental Lease Agreement Later

- Electronic signature South Carolina Legal Rental Lease Agreement Free

- How To Electronic signature South Dakota Legal Separation Agreement

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate