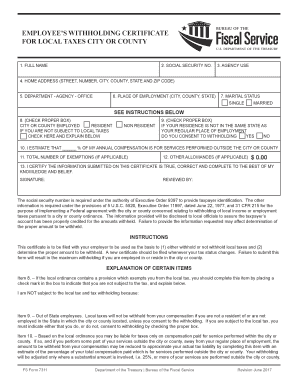

Withholding Certificate City 2017-2026

What is the withholding certificate local?

The withholding certificate local is a crucial document used by individuals and businesses to manage local tax withholding obligations. This form allows taxpayers to certify their eligibility for reduced withholding rates or exemptions based on specific criteria, such as residency status or income level. By completing this certificate, taxpayers can ensure that the correct amount of local taxes is withheld from their earnings, helping them avoid underpayment or overpayment issues.

Steps to complete the withholding certificate local

Completing the withholding certificate local involves several straightforward steps:

- Obtain the form: The withholding certificate local can typically be downloaded from your local tax authority's website or obtained directly from their office.

- Provide personal information: Fill in your name, address, and Social Security number to identify yourself accurately.

- Specify withholding exemptions: Indicate any exemptions you qualify for, such as being a full-time student or having low income.

- Sign and date the form: Ensure that you sign and date the certificate to validate it legally.

- Submit the form: Send the completed certificate to your employer or the relevant tax authority as instructed.

Legal use of the withholding certificate local

The withholding certificate local is legally binding when completed correctly. It must adhere to the specific requirements set forth by local tax laws. This document serves as proof of your tax status and any claims for exemptions or reductions in withholding. To ensure its legal validity, it is essential to provide accurate information and maintain compliance with local regulations. Failure to do so may result in penalties or additional tax liabilities.

Who issues the withholding certificate local?

The withholding certificate local is typically issued by local tax authorities or municipalities. Each jurisdiction may have its own version of the form, designed to meet specific local tax requirements. Taxpayers should consult their local tax office or website to obtain the correct form and ensure compliance with local regulations. This ensures that the withholding certificate local is valid and accepted by employers and tax authorities.

Examples of using the withholding certificate local

There are various scenarios where the withholding certificate local is applicable:

- A full-time student working part-time may use the certificate to claim exemption from local taxes due to low income.

- A resident moving to a new city may need to complete the form to adjust their withholding based on the new local tax rates.

- Employees who qualify for specific exemptions, such as military personnel, can use the certificate to reduce their local tax withholding.

Filing deadlines / Important dates

When dealing with the withholding certificate local, it is vital to be aware of filing deadlines to avoid penalties. Generally, the certificate should be submitted to your employer before the start of a new tax year or when your employment status changes. Local tax authorities may also set specific deadlines for submitting the form, especially if there are changes in local tax laws. Keeping track of these dates ensures compliance and helps in managing tax obligations effectively.

Quick guide on how to complete withholding certificate city

Complete Withholding Certificate City effortlessly on any device

Online document management has gained traction among companies and individuals. It offers an excellent environmentally friendly alternative to traditional printed and signed paperwork, as you can access the correct form and securely store it online. airSlate SignNow provides all the tools required to create, alter, and eSign your documents swiftly without delays. Manage Withholding Certificate City on any device with the airSlate SignNow Android or iOS applications and enhance any document-related task today.

The easiest way to modify and eSign Withholding Certificate City without hassle

- Obtain Withholding Certificate City and click on Get Form to begin.

- Use the tools we offer to fill out your document.

- Emphasize relevant sections of the documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign feature, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to submit your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Alter and eSign Withholding Certificate City and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct withholding certificate city

Create this form in 5 minutes!

How to create an eSignature for the withholding certificate city

How to make an electronic signature for your PDF file in the online mode

How to make an electronic signature for your PDF file in Chrome

The best way to make an eSignature for putting it on PDFs in Gmail

The best way to create an eSignature from your smartphone

The best way to generate an electronic signature for a PDF file on iOS devices

The best way to create an eSignature for a PDF file on Android

People also ask

-

What is a withholding certificate local and how does it work?

A withholding certificate local is a document that certifies local taxation status for payments made to foreign entities. It ensures that the correct amount of tax is withheld from payments according to local regulations. This certificate can be filed with tax authorities to reduce or eliminate withholding tax obligations.

-

How can airSlate SignNow assist with managing withholding certificate local submissions?

airSlate SignNow simplifies the process of submitting withholding certificate locals by allowing users to upload, fill out, and eSign documents seamlessly. Our platform ensures that all parties have access to the necessary documents in real-time, reducing delays and compliance issues. You can manage all your documents in one secure place, streamlining your workflow.

-

What features does airSlate SignNow offer for handling withholding certificate locals?

airSlate SignNow provides features like custom templates, collaborative editing, and secure eSigning, which are essential for managing withholding certificate local documents. Additionally, you can automate reminders for document completion, ensuring timely submissions. Our platform is designed to enhance efficiency for all your document-related tasks.

-

Is there a cost associated with using airSlate SignNow for withholding certificate locals?

Yes, there is a subscription cost for using airSlate SignNow, which varies based on the features you choose. Our pricing plans are designed to be cost-effective for businesses of all sizes. You can select a plan that meets your specific needs while efficiently managing your withholding certificate local processes.

-

Does airSlate SignNow integrate with other software to manage withholding certificate local?

Absolutely! airSlate SignNow integrates seamlessly with numerous popular software applications, enhancing your ability to manage your withholding certificate local documents. Whether you need to connect with CRM systems, cloud storage, or accounting tools, our API ensures smooth data flow and improved operational efficiency.

-

What are the benefits of using airSlate SignNow for withholding certificate locals?

Using airSlate SignNow for your withholding certificate local documents improves turnaround time and ensures compliance with local tax laws. The platform is user-friendly, enabling quick document preparation and signature collection. Additionally, improved organization and accessibility reduce the risk of errors and optimize your workflow.

-

How secure is airSlate SignNow when dealing with withholding certificate locals?

airSlate SignNow prioritizes security, employing industry-standard encryption to protect sensitive information related to your withholding certificate local documents. Our platform is compliant with various regulations, ensuring that your data is both secure and confidential. Trust us to safeguard your documents through added layers of security.

Get more for Withholding Certificate City

Find out other Withholding Certificate City

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation