CALIFORNIA 540 Forms & Instructions Personal Income Tax Booklet CALIFORNIA 540 Forms & Instructions Personal Inc 2020

Understanding the 2020 540 Tax Form

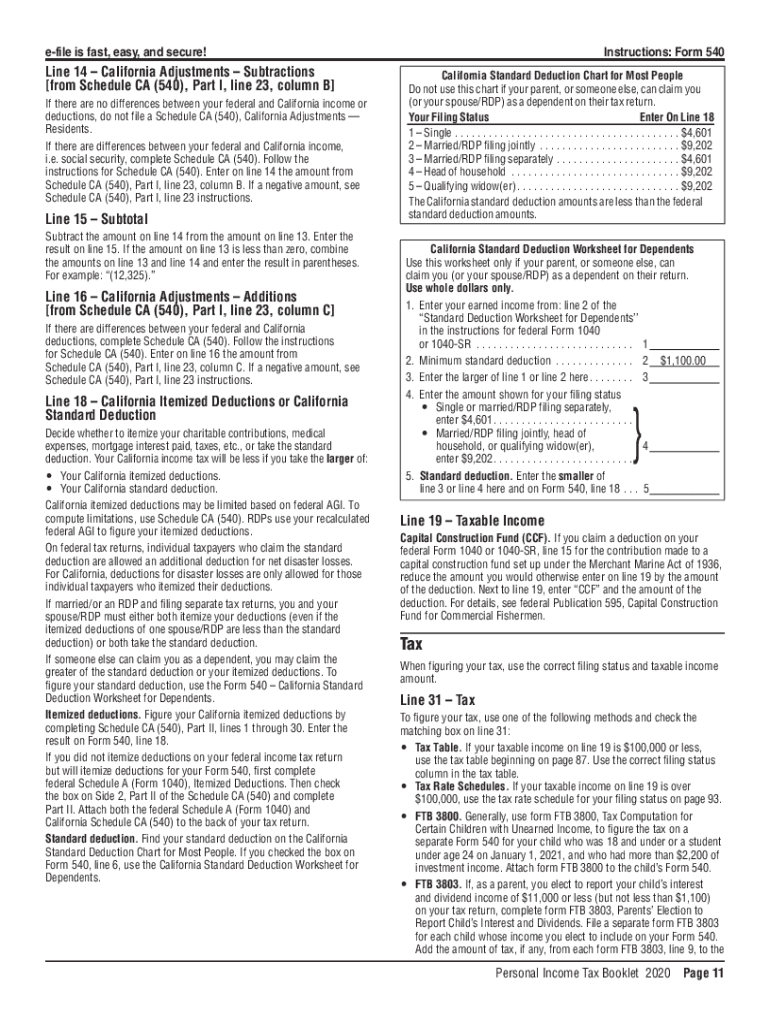

The 2020 540 tax form is California's personal income tax return for residents. This form is used to report income, calculate tax liability, and claim any applicable credits or deductions. It is essential for individuals who earned income in California during the tax year 2020. The form includes sections for reporting wages, interest, dividends, and other sources of income, as well as deductions for expenses such as mortgage interest and property taxes.

Steps to Complete the 2020 540 Tax Form

Completing the 2020 540 tax form involves several key steps:

- Gather all necessary documents, including W-2s, 1099s, and records of other income.

- Fill out personal information, including your name, address, and Social Security number.

- Report your total income in the appropriate sections of the form.

- Calculate your deductions and credits, ensuring to follow the instructions provided.

- Review the completed form for accuracy before submitting it.

Legal Use of the 2020 540 Tax Form

The 2020 540 tax form is legally binding once it is signed and submitted. E-signatures are accepted, provided they comply with federal and state eSignature laws. It is crucial to ensure that all information is accurate and complete to avoid penalties or legal issues. Using a reliable eSignature solution can enhance the security and validity of your submission.

Filing Deadlines for the 2020 540 Tax Form

The deadline for filing the 2020 540 tax form is typically April 15 of the following year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is important to file on time to avoid late fees and penalties. Taxpayers may also request an extension, but this does not extend the time to pay any taxes owed.

Required Documents for the 2020 540 Tax Form

To complete the 2020 540 tax form, you will need several documents, including:

- W-2 forms from employers

- 1099 forms for other income sources

- Records of deductible expenses, such as mortgage interest and property taxes

- Any relevant documentation for tax credits you plan to claim

Form Submission Methods for the 2020 540 Tax Form

The 2020 540 tax form can be submitted in several ways:

- Online through the California Franchise Tax Board's website

- By mail, sending the completed form to the appropriate address

- In-person at designated tax offices

Choosing the right submission method can streamline the filing process and ensure timely delivery.

Quick guide on how to complete california 540 forms ampamp instructions 2020 personal income tax booklet california 540 forms ampamp instructions 2020

Effortlessly prepare CALIFORNIA 540 Forms & Instructions Personal Income Tax Booklet CALIFORNIA 540 Forms & Instructions Personal Inc on any device

Digital document management has become increasingly popular among enterprises and individuals. It offers an excellent environmentally friendly substitute for conventional printed and signed paperwork, as you can easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents promptly without delays. Handle CALIFORNIA 540 Forms & Instructions Personal Income Tax Booklet CALIFORNIA 540 Forms & Instructions Personal Inc on any device with airSlate SignNow's Android or iOS applications and simplify any document-oriented task today.

The simplest method to modify and eSign CALIFORNIA 540 Forms & Instructions Personal Income Tax Booklet CALIFORNIA 540 Forms & Instructions Personal Inc effortlessly

- Obtain CALIFORNIA 540 Forms & Instructions Personal Income Tax Booklet CALIFORNIA 540 Forms & Instructions Personal Inc and then click Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with the tools airSlate SignNow specifically provides for this purpose.

- Create your eSignature using the Sign feature, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choosing. Modify and eSign CALIFORNIA 540 Forms & Instructions Personal Income Tax Booklet CALIFORNIA 540 Forms & Instructions Personal Inc and ensure effective communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct california 540 forms ampamp instructions 2020 personal income tax booklet california 540 forms ampamp instructions 2020

Create this form in 5 minutes!

People also ask

-

What is the significance of the 2020 540 tax form?

The 2020 540 tax form is crucial for California residents who need to report their income and calculate their state tax obligations. It helps you determine any tax owed or refund due based on your earnings for that year. Understanding its importance can aid in ensuring compliance with state tax regulations.

-

How can airSlate SignNow simplify the process of filing the 2020 540 tax?

airSlate SignNow can streamline the process of completing your 2020 540 tax forms by allowing you to eSign documents electronically. Its user-friendly interface helps in reducing the time needed to gather signatures and send completed forms. As a cost-effective solution, it minimizes paper usage and enhances efficiency.

-

Are there any additional features that help with the 2020 540 tax filing?

Yes, airSlate SignNow offers features that can enhance your 2020 540 tax filing process, such as document templates, automated reminders, and secure cloud storage. These tools ensure that you have everything you need at your fingertips, making the filing process seamless and stress-free.

-

What is the pricing model for airSlate SignNow in relation to the 2020 540 tax?

airSlate SignNow offers a variety of pricing plans that are budget-friendly while catering to those needing to file the 2020 540 tax form. Whether you are an individual or a business, you can choose a plan that fits your requirements for eSigning and managing tax documents. All plans come with a free trial so you can evaluate the service.

-

Can I integrate airSlate SignNow with other accounting software for the 2020 540 tax?

Absolutely! airSlate SignNow can be seamlessly integrated with many popular accounting software solutions. This integration allows for automatic import and export of your tax data, making it easier to manage your finances and file your 2020 540 tax form accurately.

-

What are the benefits of using airSlate SignNow for the 2020 540 tax filing?

Using airSlate SignNow for your 2020 540 tax filing means you can eSign documents securely and quickly, reducing paperwork and saving time. Its cost-effective solution enables easy document management and collaboration, ensuring that all stakeholders can contribute to your tax filing efficiently.

-

Is eSigning the 2020 540 tax form legally valid?

Yes, eSigning your 2020 540 tax form with airSlate SignNow is legally valid and compliant with state and federal regulations. Electronic signatures have the same legal standing as traditional signatures, helping you file your tax documents with confidence while adhering to legal standards.

Get more for CALIFORNIA 540 Forms & Instructions Personal Income Tax Booklet CALIFORNIA 540 Forms & Instructions Personal Inc

- Fillable online ssa oasdi beneficiaries by state and zip form

- While you were out template pdf ampampgt dobraemeryturaorg form

- Defendantrespondentminor name address and telephone no form

- Justia order for publication or posting and notice of form

- Affidavit and order suspension of feecosts form wayne

- Dear prospective juror your name has been drawn by random selection for jury service from secretary of state records form

- Juror personal history questionnaire michigan courts state form

- Case evaluator application mc 34pdf fpdf doc docxmichigan form

Find out other CALIFORNIA 540 Forms & Instructions Personal Income Tax Booklet CALIFORNIA 540 Forms & Instructions Personal Inc

- Sign Louisiana Applicant Appraisal Form Evaluation Free

- Sign Maine Applicant Appraisal Form Questions Secure

- Sign Wisconsin Applicant Appraisal Form Questions Easy

- Sign Alabama Deed of Indemnity Template Later

- Sign Alabama Articles of Incorporation Template Secure

- Can I Sign Nevada Articles of Incorporation Template

- Sign New Mexico Articles of Incorporation Template Safe

- Sign Ohio Articles of Incorporation Template Simple

- Can I Sign New Jersey Retainer Agreement Template

- Sign West Virginia Retainer Agreement Template Myself

- Sign Montana Car Lease Agreement Template Fast

- Can I Sign Illinois Attorney Approval

- Sign Mississippi Limited Power of Attorney Later

- How Can I Sign Kansas Attorney Approval

- How Do I Sign New Mexico Limited Power of Attorney

- Sign Pennsylvania Car Lease Agreement Template Simple

- Sign Rhode Island Car Lease Agreement Template Fast

- Sign Indiana Unlimited Power of Attorney Online

- Can I Sign Idaho Affidavit of No Lien

- Sign New York Affidavit of No Lien Online