Tax Credit Compliance FAQs Washington State Housing Form

Key elements of the tenant household form

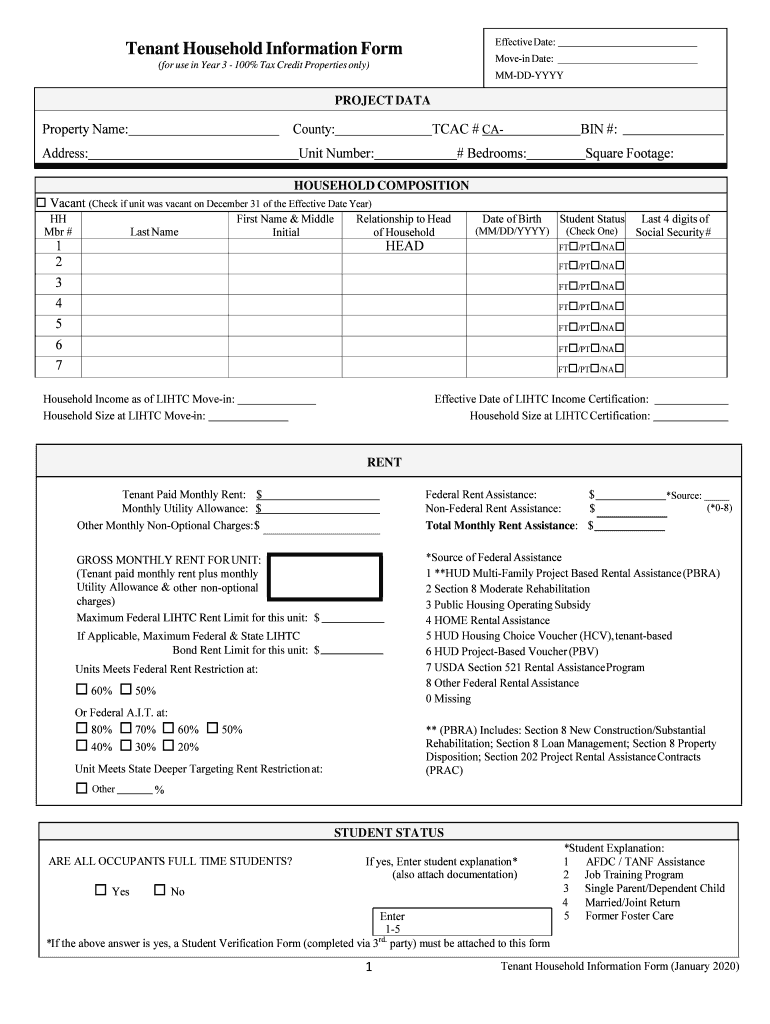

The tenant household form is essential for gathering information about the members of a household applying for housing assistance or tax credits. This form typically includes sections for personal details such as names, ages, and relationships of household members. Additionally, it may require information about income sources, employment status, and any other financial details relevant to the application process.

Understanding the key elements of this form helps ensure accurate completion and compliance with housing regulations. Common elements include:

- Household Composition: Listing all members, including dependents.

- Income Information: Documenting all income sources for each member.

- Housing History: Providing details on previous residences and rental history.

- Signature Section: Ensuring all adult members sign to verify the information provided.

Steps to complete the tenant household form

Completing the tenant household form accurately is crucial for a successful application. Follow these steps to ensure all necessary information is included:

- Gather Required Information: Collect personal details, income statements, and housing history for each household member.

- Fill Out the Form: Carefully enter the information in the designated fields, ensuring accuracy.

- Review the Form: Double-check all entries for completeness and correctness.

- Obtain Signatures: Ensure all adult household members sign the form to validate the information.

- Submit the Form: Follow the submission guidelines, whether online, by mail, or in person.

Eligibility Criteria for the tenant household form

Eligibility for completing the tenant household form often depends on specific criteria set by housing authorities or programs. Generally, applicants must meet the following requirements:

- Residency: Must reside in the state or locality where the application is submitted.

- Income Limits: Household income must fall within specified limits based on family size.

- Citizenship Status: Applicants may need to provide proof of citizenship or eligible immigration status.

- Age Requirements: Some programs may have age restrictions for applicants or household members.

Form Submission Methods for the tenant household form

Submitting the tenant household form can be done through various methods, depending on the specific requirements of the housing authority or program. Common submission methods include:

- Online Submission: Many programs allow electronic submission through secure portals, facilitating quicker processing.

- Mail: Completed forms can often be sent via postal service to the designated office.

- In-Person Submission: Applicants may also have the option to submit forms directly at local housing offices.

Legal use of the tenant household form

The tenant household form must be completed in accordance with applicable laws and regulations governing housing assistance and tax credits. Legal use involves:

- Compliance with Regulations: Ensuring that all information disclosed adheres to federal and state laws.

- Accurate Representation: Providing truthful and complete information to avoid legal repercussions.

- Retention of Records: Keeping copies of submitted forms for personal records and future reference.

Examples of using the tenant household form

The tenant household form is utilized in various scenarios, each highlighting its importance in the housing application process. Examples include:

- Low-Income Housing Applications: Families applying for subsidized housing often need to complete this form to determine eligibility.

- Tax Credit Programs: Households seeking tax credits related to housing may be required to submit this form to verify income and household composition.

- Rental Assistance Programs: Individuals applying for rental assistance may need to provide this information to qualify for support.

Quick guide on how to complete tax credit compliance faqs washington state housing

Prepare Tax Credit Compliance FAQs Washington State Housing effortlessly on any device

Online document management has gained popularity among companies and individuals. It offers a perfect environmentally-friendly substitute for traditional printed and signed paperwork, as you can locate the appropriate form and securely preserve it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle Tax Credit Compliance FAQs Washington State Housing on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Tax Credit Compliance FAQs Washington State Housing with ease

- Obtain Tax Credit Compliance FAQs Washington State Housing and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to deliver your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in several clicks from any device of your preference. Modify and eSign Tax Credit Compliance FAQs Washington State Housing and guarantee outstanding communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax credit compliance faqs washington state housing

How to create an e-signature for your PDF file online

How to create an e-signature for your PDF file in Google Chrome

The best way to make an e-signature for signing PDFs in Gmail

The way to generate an e-signature right from your mobile device

How to generate an electronic signature for a PDF file on iOS

The way to generate an e-signature for a PDF on Android devices

People also ask

-

What is a tenant household form?

A tenant household form is a document used to collect information about all members of a tenant's household. This form is essential for landlords and property managers to assess eligibility for tenancy and ensure compliance with housing regulations. With airSlate SignNow, you can easily create and manage tenant household forms online.

-

How can I create a tenant household form using airSlate SignNow?

Creating a tenant household form with airSlate SignNow is straightforward. Simply choose from our customizable templates or start from scratch. Once completed, you can share the form via email or link for eSigning, streamlining the entire application process.

-

Is there a cost associated with using the tenant household form feature?

airSlate SignNow offers a competitive pricing model that includes access to the tenant household form feature. You can choose a plan that fits your budget and offers the features you need. Additionally, our platform provides a free trial, allowing you to test this functionality before committing.

-

What are the benefits of using an electronic tenant household form?

Using an electronic tenant household form provides several benefits, including faster processing times and enhanced accuracy. It eliminates paperwork errors and allows tenants to complete the form from anywhere. Additionally, eSigning enhances the security of the documents while ensuring compliance with legal standards.

-

Can I customize the tenant household form to fit my specific needs?

Yes, airSlate SignNow allows you to fully customize your tenant household form. You can add or remove fields, change the layout, and incorporate your branding elements. This flexibility ensures that the form meets all of your specific requirements and those of your tenants.

-

Does airSlate SignNow integrate with other applications for tenant management?

Absolutely! airSlate SignNow integrates seamlessly with various property management and CRM applications. This allows you to sync data and manage your tenant household forms alongside other essential documents, improving workflow and efficiency.

-

How secure is the information collected on a tenant household form?

Security is a top priority for airSlate SignNow. All information collected through the tenant household form is encrypted and securely stored. We comply with industry regulations to protect sensitive data, ensuring that both landlords and tenants can trust our platform.

Get more for Tax Credit Compliance FAQs Washington State Housing

- Appellate division first department october 3 lawcom form

- 123 distribution inc form

- Hunterdon county lawyers compare top attorneys in form

- Hsbc bank usa plaintiff v john new york law journal form

- Esquire mens fashion cocktails politics interviews form

- New jersey lawyers compare top attorneys in new jersey form

- Unapproved opinions week of aug 10new jersey law journal form

- Abc day camps inc form

Find out other Tax Credit Compliance FAQs Washington State Housing

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word