Transferring Common Stock from One Broker to Another? 2021-2026

What is the Transferring Common Stock From One Broker To Another?

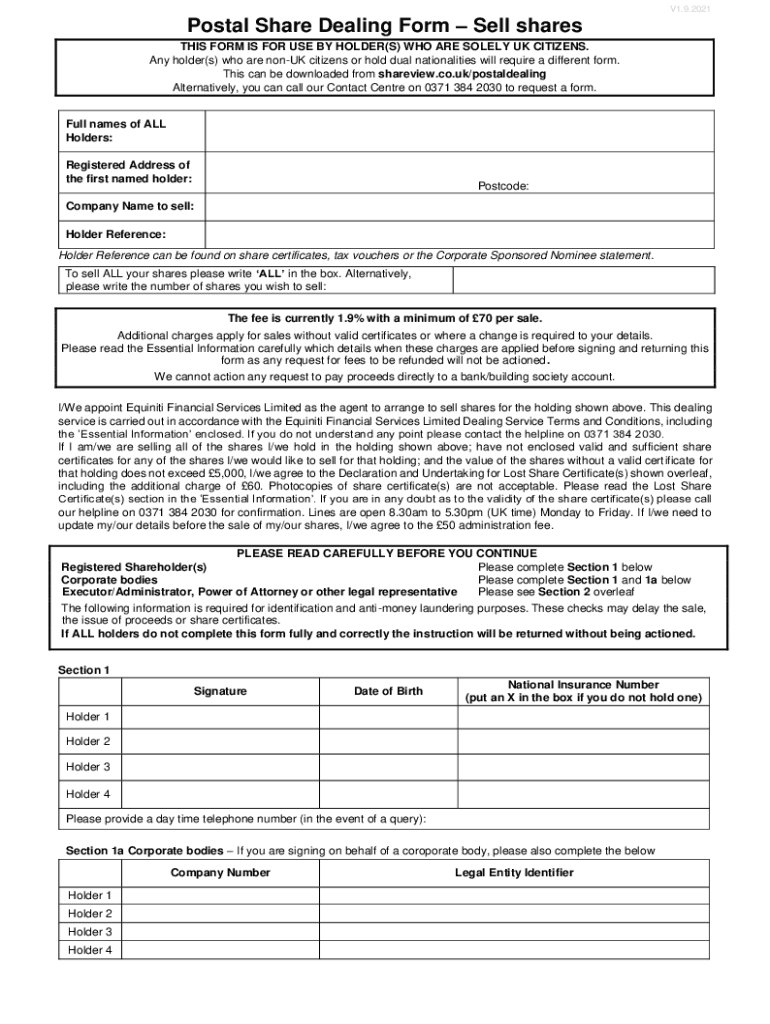

Transferring common stock from one broker to another involves moving your existing shares from one brokerage account to another. This process is often necessary when investors wish to consolidate their investments, seek better trading fees, or access superior trading tools. The transfer can include various types of securities, such as stocks, bonds, and mutual funds, and is typically executed through a formal process known as an Automated Customer Account Transfer Service (ACATS).

Steps to complete the Transferring Common Stock From One Broker To Another

To successfully transfer your common stock, follow these steps:

- Contact the new broker to initiate the transfer process and obtain the necessary forms.

- Complete the transfer form, providing details about your existing brokerage account and the securities you wish to transfer.

- Submit the completed form to your new broker, who will then coordinate with your current broker to facilitate the transfer.

- Monitor the transfer process, which typically takes between five to seven business days.

- Confirm that the stocks have been successfully transferred to your new account.

Required Documents

When transferring common stock, you may need to provide specific documentation, including:

- A completed transfer request form from your new brokerage.

- Your current brokerage account statement to verify your holdings.

- Identification documents, such as a government-issued ID, to confirm your identity.

Legal use of the Transferring Common Stock From One Broker To Another

The transfer of common stock is governed by regulations that ensure the process is secure and compliant with financial laws. Investors must adhere to the guidelines set forth by the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA). These regulations protect investors by ensuring that transfers are executed in a transparent manner, safeguarding against fraud and unauthorized transactions.

Digital vs. Paper Version

Investors can choose between digital and paper methods for transferring common stock. Digital transfers are typically faster and more efficient, allowing for real-time processing through online brokerage platforms. Paper transfers, while still an option, may involve longer processing times due to mailing and manual handling. Many brokers now encourage digital submissions to streamline the transfer process and enhance security.

Who Issues the Form

The transfer form is typically issued by the new brokerage firm where you intend to move your common stock. Each brokerage has its own specific form, which is designed to capture all necessary information for the transfer. It is important to ensure that the form is filled out accurately to avoid delays in processing your request.

Quick guide on how to complete transferring common stock from one broker to another

Effortlessly Prepare Transferring Common Stock From One Broker To Another? on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Handle Transferring Common Stock From One Broker To Another? on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Edit and eSign Transferring Common Stock From One Broker To Another? with Ease

- Find Transferring Common Stock From One Broker To Another? and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight essential sections of your documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and click the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or mistakes necessitating the printing of new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your preference. Modify and eSign Transferring Common Stock From One Broker To Another? and ensure outstanding communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct transferring common stock from one broker to another

Create this form in 5 minutes!

How to create an eSignature for the transferring common stock from one broker to another

The best way to generate an electronic signature for a PDF in the online mode

The best way to generate an electronic signature for a PDF in Chrome

The way to create an e-signature for putting it on PDFs in Gmail

How to make an e-signature straight from your smart phone

The way to make an e-signature for a PDF on iOS devices

How to make an e-signature for a PDF document on Android OS

People also ask

-

What is UK share dealing and how can airSlate SignNow assist in the process?

UK share dealing refers to buying and selling shares of companies listed on UK stock exchanges. airSlate SignNow streamlines the documentation process for share transactions, enabling businesses to send and eSign necessary documents quickly. This helps in ensuring that your share dealing activities are compliant and efficiently managed.

-

How does airSlate SignNow ensure the security of my UK share dealing transactions?

Security is a top priority for airSlate SignNow when it comes to UK share dealing. We use advanced encryption and secure data storage to protect your documents and sensitive information. Our compliant eSigning platform ensures that your transactions are safeguarded against unauthorized access.

-

What are the costs associated with using airSlate SignNow for UK share dealing?

Using airSlate SignNow for UK share dealing involves a competitive pricing model designed to suit different business needs. We offer various subscription plans that provide flexible pricing according to your usage. This makes our solution both cost-effective and scalable for different volumes of share transactions.

-

Can I integrate airSlate SignNow with other tools for UK share dealing?

Yes, airSlate SignNow offers seamless integrations with various platforms that can enhance your UK share dealing experience. By connecting with CRM systems, document management tools, and other financial applications, you can streamline your workflow and improve efficiency when managing share transactions.

-

What features does airSlate SignNow offer that are beneficial for UK share dealing?

airSlate SignNow comes with a range of features specifically useful for UK share dealing, including customizable templates, bulk sending options, and automated reminders for document signing. These tools simplify the management of share dealings, ensuring that all necessary documents are signed promptly and efficiently.

-

How does eSigning enhance the UK share dealing process?

eSigning with airSlate SignNow signNowly enhances the UK share dealing process by reducing turnaround times and eliminating the need for physical paperwork. This digital approach enables quicker execution of transactions, providing a more efficient and hassle-free experience for shareholders and investors.

-

Is airSlate SignNow compliant with UK regulations for share dealing?

Absolutely, airSlate SignNow is fully compliant with UK regulations regarding eSigning and document management in share dealing. Our platform adheres to the relevant legal standards, ensuring that your transactions are valid and recognized by regulatory authorities in the UK.

Get more for Transferring Common Stock From One Broker To Another?

- Control number ky p027 pkg form

- Control number ky p023 pkg form

- Control number ky p029 pkg form

- Control number ky p031 pkg form

- Kentucky lease agreement with option to purchase form

- Kentucky prenuptial agreement form downloadus legal

- Control number ky p037 pkg form

- Plumbing contractors forms packageus legal forms

Find out other Transferring Common Stock From One Broker To Another?

- Sign Illinois Drug Testing Consent Agreement Online

- Sign Louisiana Applicant Appraisal Form Evaluation Free

- Sign Maine Applicant Appraisal Form Questions Secure

- Sign Wisconsin Applicant Appraisal Form Questions Easy

- Sign Alabama Deed of Indemnity Template Later

- Sign Alabama Articles of Incorporation Template Secure

- Can I Sign Nevada Articles of Incorporation Template

- Sign New Mexico Articles of Incorporation Template Safe

- Sign Ohio Articles of Incorporation Template Simple

- Can I Sign New Jersey Retainer Agreement Template

- Sign West Virginia Retainer Agreement Template Myself

- Sign Montana Car Lease Agreement Template Fast

- Can I Sign Illinois Attorney Approval

- Sign Mississippi Limited Power of Attorney Later

- How Can I Sign Kansas Attorney Approval

- How Do I Sign New Mexico Limited Power of Attorney

- Sign Pennsylvania Car Lease Agreement Template Simple

- Sign Rhode Island Car Lease Agreement Template Fast

- Sign Indiana Unlimited Power of Attorney Online

- Can I Sign Idaho Affidavit of No Lien