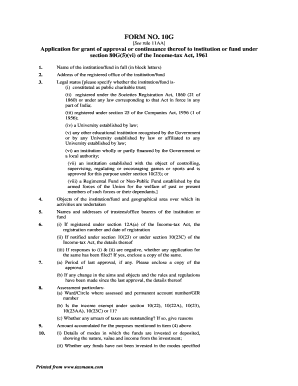

80g Renewal Application Form

What is the form 10g?

The form 10g is a specific document used primarily for income tax purposes in the United States. It serves as a means for individuals or entities to report income and claim deductions or credits. This form is essential for ensuring compliance with IRS regulations and accurately reflecting one's financial situation. Understanding the purpose and requirements of the form 10g is crucial for effective tax filing.

Steps to complete the form 10g

Completing the form 10g involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and receipts for deductions. Next, carefully fill out each section of the form, ensuring that all information is accurate and complete. Pay special attention to the income section, as this will determine your tax liability. After filling out the form, review it for any errors before submission. Finally, submit the form either electronically or by mail, depending on your preference and the requirements set by the IRS.

Legal use of the form 10g

The legal use of the form 10g is governed by IRS regulations, which stipulate that all information provided must be truthful and accurate. Misrepresentation or failure to report income can lead to penalties, including fines or audits. It is essential to understand the legal implications of filing this form, as it serves as a formal declaration of your financial status to the government. Utilizing a reliable eSignature solution can enhance the legal validity of your submission, ensuring compliance with eSignature laws.

Required documents for the form 10g

When preparing to complete the form 10g, certain documents are required to support the information reported. These may include:

- W-2 forms from employers

- 1099 forms for freelance or contract work

- Receipts for deductible expenses

- Bank statements and investment income statements

- Previous year's tax return for reference

Having these documents on hand will facilitate a smoother and more accurate filing process.

Form submission methods for the form 10g

The form 10g can be submitted through various methods, allowing flexibility based on individual preferences. The primary submission methods include:

- Online Submission: Many taxpayers opt to file electronically through IRS-approved software, which can streamline the process and reduce errors.

- Mail Submission: Alternatively, the form can be printed and mailed to the appropriate IRS address. Ensure that you use the correct postage and keep a copy for your records.

Choosing the right submission method can impact the speed of processing and the overall experience of filing your taxes.

Eligibility criteria for the form 10g

Eligibility for using the form 10g typically depends on your income level and filing status. Individuals or entities that earn income within certain thresholds are required to file this form. Additionally, specific criteria may apply based on whether you are filing as a self-employed individual, a corporation, or another business entity. Understanding these eligibility requirements is crucial for ensuring compliance and avoiding potential penalties.

IRS guidelines for the form 10g

The IRS provides comprehensive guidelines for completing and submitting the form 10g. These guidelines outline the necessary information to include, the deadlines for submission, and any specific instructions related to different income types. Familiarizing yourself with these guidelines can help prevent errors and ensure that your filing is accepted without issue. It is advisable to consult the latest IRS publications or resources for the most current information regarding the form 10g.

Quick guide on how to complete 80g renewal application form

Complete 80g Renewal Application Form effortlessly on any device

Online document administration has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to locate the needed form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly and without delays. Manage 80g Renewal Application Form on any platform using airSlate SignNow's Android or iOS applications and streamline any document-focused task today.

The easiest way to modify and eSign 80g Renewal Application Form without any hassle

- Obtain 80g Renewal Application Form and then click Get Form to begin.

- Make use of the tools we provide to complete your document.

- Emphasize important sections of your documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal significance as an ink signature.

- Review the details and then click the Done button to save your modifications.

- Select how you wish to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and eSign 80g Renewal Application Form and ensure outstanding communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 80g renewal application form

How to generate an electronic signature for your PDF file online

How to generate an electronic signature for your PDF file in Google Chrome

The way to make an e-signature for signing PDFs in Gmail

How to generate an electronic signature from your mobile device

How to make an electronic signature for a PDF file on iOS

How to generate an electronic signature for a PDF file on Android devices

People also ask

-

What is a 10g interactive form?

A 10g interactive form is a user-friendly digital document designed to facilitate electronic signing and data collection. By integrating advanced features, it provides businesses with streamlined processes for managing documents efficiently.

-

How can my business benefit from using a 10g interactive form?

Using a 10g interactive form allows businesses to enhance their workflow by reducing manual document handling. This solution not only saves time but also improves accuracy and compliance, ensuring that your processes are both efficient and legally sound.

-

What are the pricing options for the 10g interactive form?

airSlate SignNow offers flexible pricing plans for the 10g interactive form tailored to the needs of different businesses. Customers can choose from monthly or annual subscriptions based on their usage requirements, ensuring cost-effectiveness.

-

Does the 10g interactive form integrate with other software?

Yes, the 10g interactive form seamlessly integrates with various applications to enhance your existing workflows. This allows businesses to connect their CRM, ERP, and other tools, fostering a cohesive digital experience.

-

Is the 10g interactive form secure for sensitive documents?

Absolutely! The 10g interactive form employs advanced encryption and security protocols to protect sensitive information. Your documents are safe during transmission and storage, ensuring your data remains confidential.

-

Can I customize my 10g interactive form?

Yes, customization is a key feature of the 10g interactive form. Users can modify fields, logos, and branding elements to match their company's identity, creating a personalized experience for clients and stakeholders.

-

How easy is it to use the 10g interactive form for eSigning?

The 10g interactive form is designed with user experience in mind, making eSigning straightforward for anyone. Users can quickly add their signatures, fill out fields, and submit documents with just a few clicks.

Get more for 80g Renewal Application Form

- Guardian of a minor do hereby form

- Recent developments in ny civil practice april 2018 41818 form

- New york city civil court name changes new york state form

- Notice to chairman regarding possibility of processing case on form

- Workers compensation board hearing site locationsopen form

- Ny paid up pooling form

- Ny rental pooling form

- On the day of before me personally came name to me known form

Find out other 80g Renewal Application Form

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now