Kaiser Permanente DC Enrollment Employer Form

What is the Kaiser Permanente DC Enrollment Employer

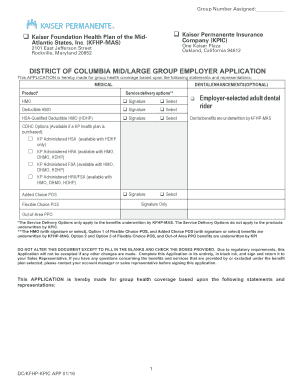

The Kaiser Permanente DC Enrollment Employer form is a crucial document that allows employers in Washington, D.C., to enroll their employees in Kaiser Permanente health plans. This form captures essential information about the employer and the employees who will be covered under the health plan. It ensures that both the employer and employees understand their rights and responsibilities regarding health insurance coverage. The form is designed to facilitate the enrollment process while adhering to the regulations set forth by health care authorities.

Steps to complete the Kaiser Permanente DC Enrollment Employer

Completing the Kaiser Permanente DC Enrollment Employer form involves several key steps to ensure accuracy and compliance. First, gather all necessary employee information, including names, addresses, dates of birth, and Social Security numbers. Next, fill out the employer section, providing details such as the business name, address, and contact information. Once the form is filled out, review it carefully for any errors or omissions. After ensuring all information is correct, submit the form as instructed, either electronically or via mail, according to the guidelines provided by Kaiser Permanente.

Legal use of the Kaiser Permanente DC Enrollment Employer

The legal use of the Kaiser Permanente DC Enrollment Employer form is governed by various regulations that ensure its validity and compliance. For the form to be legally binding, it must be completed accurately and signed by authorized representatives. Electronic signatures are accepted, provided they meet the requirements of the ESIGN Act and UETA. This means that the form must be executed using a secure platform that provides verification of identity and consent. Adhering to these legal standards helps protect both employers and employees in their health coverage arrangements.

Key elements of the Kaiser Permanente DC Enrollment Employer

Key elements of the Kaiser Permanente DC Enrollment Employer form include essential sections that capture both employer and employee information. The form typically requires the employer's identification details, such as the business name and tax identification number. Additionally, it includes sections for listing employees who will be enrolled, along with their personal information. Important terms and conditions related to the health plan coverage, including eligibility criteria and premium payment responsibilities, are also outlined in the form. Understanding these elements is vital for ensuring compliance and smooth enrollment.

Eligibility Criteria

Eligibility criteria for the Kaiser Permanente DC Enrollment Employer form vary based on the specific health plan offerings. Generally, employees must meet certain conditions, such as being full-time or part-time, to qualify for enrollment. Employers are responsible for informing their employees about these criteria and ensuring that all enrolled individuals meet the necessary requirements. Additionally, eligibility may depend on factors such as length of employment and the type of employment contract, making it essential for employers to review these criteria before submitting the enrollment form.

Form Submission Methods

The Kaiser Permanente DC Enrollment Employer form can be submitted through various methods, providing flexibility for employers. Typically, the form can be completed and submitted online through a secure portal, ensuring a quick and efficient process. Alternatively, employers may choose to print the form and send it via mail to the designated address provided by Kaiser Permanente. In some cases, in-person submissions may also be accepted, allowing for direct communication with Kaiser Permanente representatives. Understanding these submission options helps streamline the enrollment process for employers.

Required Documents

When completing the Kaiser Permanente DC Enrollment Employer form, several required documents must be gathered to ensure a smooth enrollment process. Employers typically need to provide proof of business registration, such as a business license or tax identification number. Additionally, employee documentation, including Social Security numbers and proof of eligibility, may be required. Having these documents ready helps facilitate the completion of the form and ensures that all necessary information is accurately reported, reducing the likelihood of delays in enrollment.

Quick guide on how to complete kaiser permanente dc enrollment employer

Effortlessly prepare Kaiser Permanente DC Enrollment Employer on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary forms and securely save them online. airSlate SignNow equips you with all the tools required to quickly create, modify, and eSign your documents without delays. Manage Kaiser Permanente DC Enrollment Employer on any platform using airSlate SignNow's Android or iOS applications and streamline your document-related processes today.

The easiest way to modify and eSign Kaiser Permanente DC Enrollment Employer with minimal effort

- Obtain Kaiser Permanente DC Enrollment Employer and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of your documents or redact sensitive information with the tools that airSlate SignNow specifically offers for this purpose.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal standing as a conventional wet ink signature.

- Review the information and then click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, the hassle of searching for forms, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in a few clicks from any device of your choice. Edit and eSign Kaiser Permanente DC Enrollment Employer to ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the kaiser permanente dc enrollment employer

The way to make an electronic signature for a PDF online

The way to make an electronic signature for a PDF in Google Chrome

The best way to create an e-signature for signing PDFs in Gmail

How to generate an electronic signature from your smartphone

The way to generate an e-signature for a PDF on iOS

How to generate an electronic signature for a PDF file on Android

People also ask

-

What is Kaiser Permanente DC Enrollment Employer?

Kaiser Permanente DC Enrollment Employer refers to the enrollment process for employers in the D.C. area to provide health insurance benefits through Kaiser Permanente. This program simplifies the health benefits application, ensuring that employees receive the necessary coverage efficiently.

-

How does airSlate SignNow facilitate Kaiser Permanente DC Enrollment Employer?

airSlate SignNow streamlines the Kaiser Permanente DC Enrollment Employer process by allowing businesses to send and electronically sign enrollment documents in a matter of minutes. Our platform is designed to enhance productivity by providing an easy-to-use solution for document management.

-

What features does airSlate SignNow offer for Kaiser Permanente DC Enrollment Employer?

Key features of airSlate SignNow for Kaiser Permanente DC Enrollment Employer include customizable templates, automated workflows, and secure cloud storage. These features help businesses manage their enrollment paperwork easily while ensuring compliance and security.

-

Is there a cost associated with using airSlate SignNow for Kaiser Permanente DC Enrollment Employer?

Yes, while airSlate SignNow offers various pricing plans, the cost for utilizing our services to facilitate Kaiser Permanente DC Enrollment Employer is competitive. We provide tiered pricing options that cater to different business sizes, ensuring affordability.

-

What benefits does airSlate SignNow provide for Kaiser Permanente DC Enrollment Employer?

Using airSlate SignNow for Kaiser Permanente DC Enrollment Employer can signNowly reduce paperwork processing time and enhance employee satisfaction with a hassle-free enrollment experience. Employers benefit from streamlined operations and more effective communication.

-

Can airSlate SignNow integrate with other software for Kaiser Permanente DC Enrollment Employer?

Absolutely! airSlate SignNow easily integrates with various HR systems and software to enhance the Kaiser Permanente DC Enrollment Employer process. This integration ensures seamless data transfer, improving overall workflow efficiency for employers.

-

How secure is the airSlate SignNow platform for Kaiser Permanente DC Enrollment Employer?

airSlate SignNow prioritizes the security of sensitive information during the Kaiser Permanente DC Enrollment Employer process. We implement top-notch encryption and security protocols, ensuring that all electronic signatures and documents are safe and compliant.

Get more for Kaiser Permanente DC Enrollment Employer

- You are according to law hereby notified that a check or instrument numbered form

- Pay for print the university of rhode island form

- Rhode island next generation science riderigov form

- With links to web based paternity statutes and resources for rhode island form

- Fillable online courts ri family court forms all documents

- State of rhode island and providence plantations family court form

- Leased property including but not limited to landscaping roof exterior doors and walls form

- Complaint for separate maintenance without form

Find out other Kaiser Permanente DC Enrollment Employer

- Electronic signature Maine Contract for work Secure

- Electronic signature Utah Contract Myself

- How Can I Electronic signature Texas Electronic Contract

- How Do I Electronic signature Michigan General contract template

- Electronic signature Maine Email Contracts Later

- Electronic signature New Mexico General contract template Free

- Can I Electronic signature Rhode Island Email Contracts

- How Do I Electronic signature California Personal loan contract template

- Electronic signature Hawaii Personal loan contract template Free

- How To Electronic signature Hawaii Personal loan contract template

- Electronic signature New Hampshire Managed services contract template Computer

- Electronic signature Alabama Real estate sales contract template Easy

- Electronic signature Georgia Real estate purchase contract template Secure

- Electronic signature South Carolina Real estate sales contract template Mobile

- Can I Electronic signature Kentucky Residential lease contract

- Can I Electronic signature Nebraska Residential lease contract

- Electronic signature Utah New hire forms Now

- Electronic signature Texas Tenant contract Now

- How Do I Electronic signature Florida Home rental application

- Electronic signature Illinois Rental application Myself