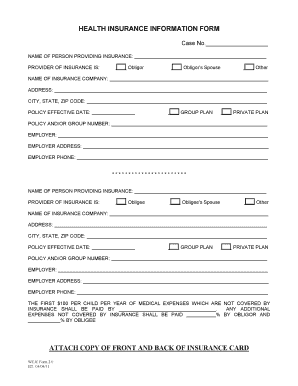

The FIRST $100 PER CHILD PER YEAR of MEDICAL EXPENSES WHICH ARE NOT COVERED by Form

What is the first $100 per child per year of medical expenses which are not covered by

The first $100 per child per year of medical expenses which are not covered by is a provision that allows families to claim a specific amount for medical expenses incurred for their children. This provision is particularly relevant for parents seeking to manage out-of-pocket healthcare costs. Understanding this provision is essential for parents who want to maximize their tax benefits and ensure they are compliant with federal regulations.

How to use the first $100 per child per year of medical expenses which are not covered by

To effectively use the first $100 per child per year of medical expenses which are not covered by, parents should keep detailed records of all medical expenses that exceed this threshold. This includes receipts and invoices for services not covered by insurance. When filing taxes, these expenses can be reported to potentially reduce taxable income, depending on eligibility and specific tax situations.

Steps to complete the first $100 per child per year of medical expenses which are not covered by

Completing the first $100 per child per year of medical expenses which are not covered by involves several steps:

- Gather all relevant medical expenses for your child that are not covered by insurance.

- Ensure that the total amount exceeds $100 for the year.

- Document each expense with receipts and notes on the services provided.

- Report these expenses when filing your tax return, using the appropriate forms.

Legal use of the first $100 per child per year of medical expenses which are not covered by

The legal use of the first $100 per child per year of medical expenses which are not covered by requires adherence to IRS guidelines. It is important to ensure that all claimed expenses are legitimate and properly documented. Misreporting can lead to penalties, so understanding the legal framework surrounding this provision is crucial for compliance.

Key elements of the first $100 per child per year of medical expenses which are not covered by

Key elements of this provision include:

- The amount of $100, which serves as a threshold for claiming expenses.

- Eligibility criteria, which typically require the child to be a dependent.

- Documentation requirements to substantiate claims.

Eligibility Criteria

Eligibility for the first $100 per child per year of medical expenses which are not covered by generally includes the following conditions:

- The child must be a dependent on the taxpayer's return.

- Medical expenses must be incurred during the tax year in question.

- Expenses must not be reimbursed by insurance or other sources.

Quick guide on how to complete the first 100 per child per year of medical expenses which are not covered by

Effortlessly Prepare THE FIRST $100 PER CHILD PER YEAR OF MEDICAL EXPENSES WHICH ARE NOT COVERED BY on Any Device

Digital document management has gained traction among companies and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can easily locate the appropriate form and securely archive it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents promptly without delays. Manage THE FIRST $100 PER CHILD PER YEAR OF MEDICAL EXPENSES WHICH ARE NOT COVERED BY on any device using the airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

How to Alter and Electronically Sign THE FIRST $100 PER CHILD PER YEAR OF MEDICAL EXPENSES WHICH ARE NOT COVERED BY with Ease

- Obtain THE FIRST $100 PER CHILD PER YEAR OF MEDICAL EXPENSES WHICH ARE NOT COVERED BY and click on Get Form to begin.

- Utilize the tools we offer to finalize your form.

- Emphasize pertinent sections of the documents or conceal sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Create your electronic signature with the Sign tool, which only takes seconds and carries the same legal validity as a conventional ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to share your form—via email, SMS, or invite link—or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form searches, or mistakes requiring new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Alter and electronically sign THE FIRST $100 PER CHILD PER YEAR OF MEDICAL EXPENSES WHICH ARE NOT COVERED BY to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the the first 100 per child per year of medical expenses which are not covered by

How to generate an e-signature for a PDF file online

How to generate an e-signature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

The way to make an e-signature right from your mobile device

The best way to create an e-signature for a PDF file on iOS

The way to make an e-signature for a PDF on Android devices

People also ask

-

What is the purpose of THE FIRST $100 PER CHILD PER YEAR OF MEDICAL EXPENSES WHICH ARE NOT COVERED BY?

THE FIRST $100 PER CHILD PER YEAR OF MEDICAL EXPENSES WHICH ARE NOT COVERED BY is designed to assist families in managing unexpected medical costs for their children. This initiative ensures that parents can access essential financial support, easing the burden of healthcare expenses that may arise throughout the year. By understanding its benefits, families can better prepare for unforeseen medical needs.

-

How does airSlate SignNow facilitate documentation for THE FIRST $100 PER CHILD PER YEAR OF MEDICAL EXPENSES WHICH ARE NOT COVERED BY?

With airSlate SignNow, you can easily create, send, and sign documents related to THE FIRST $100 PER CHILD PER YEAR OF MEDICAL EXPENSES WHICH ARE NOT COVERED BY. Our intuitive platform simplifies the process, ensuring that all necessary forms are correctly completed and submitted in a timely manner. This enhances the overall experience for families navigating these medical costs.

-

Are there any costs associated with accessing support for THE FIRST $100 PER CHILD PER YEAR OF MEDICAL EXPENSES WHICH ARE NOT COVERED BY?

Accessing support for THE FIRST $100 PER CHILD PER YEAR OF MEDICAL EXPENSES WHICH ARE NOT COVERED BY is generally cost-effective, especially when utilizing airSlate SignNow’s services. We offer affordable plans that enhance document management and support for families. This means that you can efficiently handle medical documentation without incurring additional costs.

-

What benefits does airSlate SignNow provide for families dealing with THE FIRST $100 PER CHILD PER YEAR OF MEDICAL EXPENSES WHICH ARE NOT COVERED BY?

AirSlate SignNow offers numerous benefits for families coping with THE FIRST $100 PER CHILD PER YEAR OF MEDICAL EXPENSES WHICH ARE NOT COVERED BY. Our platform streamlines the document signing process, saves time, and reduces the complexities involved in managing medical expenses. This allows families to focus more on their children’s health rather than cumbersome paperwork.

-

How does airSlate SignNow maintain the security of documents related to THE FIRST $100 PER CHILD PER YEAR OF MEDICAL EXPENSES WHICH ARE NOT COVERED BY?

Security is a top priority at airSlate SignNow. We utilize advanced encryption methods and stringent data protection measures to ensure that all documents pertaining to THE FIRST $100 PER CHILD PER YEAR OF MEDICAL EXPENSES WHICH ARE NOT COVERED BY are safeguarded. Families can share sensitive information confidently without worrying about data bsignNowes.

-

Can airSlate SignNow integrate with other tools to streamline the process regarding THE FIRST $100 PER CHILD PER YEAR OF MEDICAL EXPENSES WHICH ARE NOT COVERED BY?

Absolutely! airSlate SignNow seamlessly integrates with various tools and platforms that can further streamline the experience surrounding THE FIRST $100 PER CHILD PER YEAR OF MEDICAL EXPENSES WHICH ARE NOT COVERED BY. This allows families to connect their preferred applications, enhancing workflow efficiency and simplifying document management throughout the healthcare process.

-

What types of documents will I need to submit for THE FIRST $100 PER CHILD PER YEAR OF MEDICAL EXPENSES WHICH ARE NOT COVERED BY?

To qualify for THE FIRST $100 PER CHILD PER YEAR OF MEDICAL EXPENSES WHICH ARE NOT COVERED BY, you typically need to submit medical bills, receipts, and any supporting documentation that verifies the expenses incurred. AirSlate SignNow simplifies this effort by allowing you to upload and manage these documents all in one place. This ensures that you maintain an organized record of necessary paperwork.

Get more for THE FIRST $100 PER CHILD PER YEAR OF MEDICAL EXPENSES WHICH ARE NOT COVERED BY

- Electronic mail email policy empire state college form

- Philosophy has a sexual harassment problemsaloncom form

- Addendum to agreement dated august 12 2003 by and between form

- Notice of termination due to work rules violation legal form

- Design services agreement this agreement is entered into form

- Cancellation of leave of absence form

- Enclosed herewith please find a letter which i received from form

- Foodborne disease outbreaks world health organization form

Find out other THE FIRST $100 PER CHILD PER YEAR OF MEDICAL EXPENSES WHICH ARE NOT COVERED BY

- How Can I eSign Iowa House rental lease agreement

- eSign Florida Land lease agreement Fast

- eSign Louisiana Land lease agreement Secure

- How Do I eSign Mississippi Land lease agreement

- eSign Connecticut Landlord tenant lease agreement Now

- eSign Georgia Landlord tenant lease agreement Safe

- Can I eSign Utah Landlord lease agreement

- How Do I eSign Kansas Landlord tenant lease agreement

- How Can I eSign Massachusetts Landlord tenant lease agreement

- eSign Missouri Landlord tenant lease agreement Secure

- eSign Rhode Island Landlord tenant lease agreement Later

- How Can I eSign North Carolina lease agreement

- eSign Montana Lease agreement form Computer

- Can I eSign New Hampshire Lease agreement form

- How To eSign West Virginia Lease agreement contract

- Help Me With eSign New Mexico Lease agreement form

- Can I eSign Utah Lease agreement form

- Can I eSign Washington lease agreement

- Can I eSign Alabama Non disclosure agreement sample

- eSign California Non disclosure agreement sample Now