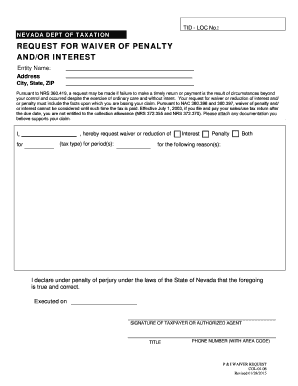

Nevada Request for Waiver of Penalty Andor Interest Form

What is the sample letter requesting waiver of penalty and interest?

The sample letter requesting waiver of penalty and interest is a formal document used by individuals or businesses to appeal for the removal of penalties and interest charges that may have been applied due to late payments or other financial issues. This letter outlines the reasons for the request and provides supporting information to justify the waiver. It is often utilized in tax situations, where taxpayers seek relief from additional charges imposed by the IRS or state tax authorities.

How to use the sample letter requesting waiver of penalty and interest

To effectively use the sample letter requesting waiver of penalty and interest, begin by personalizing the template to fit your specific circumstances. Clearly state your case, including the reasons for the delay in payment and any extenuating circumstances that may have contributed to the situation. Ensure that you provide all necessary details, such as your taxpayer identification number and relevant dates. It is also important to express your willingness to comply with future obligations and to maintain open communication with the tax authority.

Steps to complete the sample letter requesting waiver of penalty and interest

Completing the sample letter requesting waiver of penalty and interest involves several key steps:

- Gather all relevant information, including your tax identification number, account details, and any documentation supporting your case.

- Use a clear and professional format for the letter, including your contact information and the date at the top.

- Begin with a formal greeting, addressing the appropriate tax authority or official.

- Clearly state the purpose of the letter in the opening paragraph.

- Provide a detailed explanation of the circumstances that led to the penalties and interest.

- Include any supporting documents that can strengthen your request.

- Conclude with a polite closing, expressing gratitude for their consideration.

Eligibility criteria for requesting a waiver of penalty and interest

Eligibility criteria for requesting a waiver of penalty and interest can vary based on the specific tax authority and the nature of the penalties. Generally, taxpayers may qualify if they can demonstrate reasonable cause for their failure to meet tax obligations. This may include situations such as serious illness, natural disasters, or other unforeseen circumstances that hindered timely payment. It is advisable to review the specific guidelines provided by the IRS or state tax agencies to ensure compliance with their requirements.

Required documents to accompany the waiver request

When submitting a sample letter requesting waiver of penalty and interest, it is important to include any required documents that support your case. Commonly required documents may include:

- Copies of tax returns for the relevant years.

- Documentation of any extenuating circumstances, such as medical records or letters from employers.

- Payment records that show attempts to comply with tax obligations.

- Any correspondence with the tax authority regarding the penalties.

Form submission methods for the waiver request

The submission methods for the sample letter requesting waiver of penalty and interest can vary depending on the tax authority. Typically, taxpayers may submit their requests through the following methods:

- Online submission via the tax authority's official website, if available.

- Mailing the letter to the appropriate address provided by the tax authority.

- In-person submission at local tax offices, where applicable.

Quick guide on how to complete nevada request for waiver of penalty andor interest form

Effortlessly Prepare Nevada Request For Waiver Of Penalty Andor Interest Form on Any Device

Managing documents online has gained traction among organizations and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed paperwork, as you can easily locate the correct form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents promptly without delays. Handle Nevada Request For Waiver Of Penalty Andor Interest Form on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The Easiest Way to Edit and eSign Nevada Request For Waiver Of Penalty Andor Interest Form Seamlessly

- Locate Nevada Request For Waiver Of Penalty Andor Interest Form and click on Get Form to begin.

- Utilize the features we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, invite link, or download it to your computer.

Eliminate concerns over lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Nevada Request For Waiver Of Penalty Andor Interest Form and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nevada request for waiver of penalty andor interest form

How to make an electronic signature for your PDF file online

How to make an electronic signature for your PDF file in Google Chrome

The best way to make an e-signature for signing PDFs in Gmail

How to create an e-signature right from your mobile device

The best way to generate an electronic signature for a PDF file on iOS

How to create an e-signature for a PDF on Android devices

People also ask

-

What is the application for waiver of penalty?

The application for waiver of penalty is a document that businesses can submit to request the removal of penalties associated with late compliance or other regulatory issues. Using airSlate SignNow, you can easily create, send, and track your application for waiver of penalty, ensuring you meet deadlines without hassle.

-

How can airSlate SignNow help with the application for waiver of penalty?

airSlate SignNow streamlines the process of completing and submitting your application for waiver of penalty. With features such as eSigning and document tracking, you can ensure your application is processed quickly and efficiently, saving you time and reducing stress.

-

Is there a cost associated with using airSlate SignNow for the application for waiver of penalty?

Yes, airSlate SignNow offers competitive pricing plans that fit a variety of business needs. The cost of using our platform for the application for waiver of penalty will depend on your chosen plan, which provides features tailored to help manage documents effectively.

-

What features does airSlate SignNow offer for handling the application for waiver of penalty?

airSlate SignNow includes advanced features such as customizable templates, secure eSigning, automated reminders, and integration capabilities, all of which facilitate the application for waiver of penalty. These features ensure that you can efficiently manage your documents and reduce turnaround time.

-

Can I integrate airSlate SignNow with other software for my application for waiver of penalty?

Absolutely! airSlate SignNow supports integration with various platforms, including CRM systems and cloud storage services. This allows for seamless management of your application for waiver of penalty alongside your existing tools, enhancing workflow efficiency.

-

What are the benefits of using airSlate SignNow for my application for waiver of penalty?

Using airSlate SignNow for your application for waiver of penalty provides several benefits, including faster processing times, reduced paperwork, and improved tracking capabilities. These advantages help ensure that you have a smooth experience from submission to approval.

-

Is airSlate SignNow secure for submitting my application for waiver of penalty?

Yes, airSlate SignNow prioritizes security by utilizing advanced encryption and authentication measures. When submitting your application for waiver of penalty, you can trust that your data is secure and protected against unauthorized access.

Get more for Nevada Request For Waiver Of Penalty Andor Interest Form

- Advertising agency agreement legal form

- Above styled and numbered cause by and through his attorneys and files this his complaint form

- Exhibit 101 sale agreement secgov form

- Retainer agreement for virtual assistant services form

- Endorsement agreement between apparel company and licensor of professional form

- Promotional letter boat shop form

- Client agreement template form

- Quitclaim bill of sale of personal property form

Find out other Nevada Request For Waiver Of Penalty Andor Interest Form

- Help Me With Sign Colorado Mutual non-disclosure agreement

- Sign Arizona Non disclosure agreement sample Online

- Sign New Mexico Mutual non-disclosure agreement Simple

- Sign Oklahoma Mutual non-disclosure agreement Simple

- Sign Utah Mutual non-disclosure agreement Free

- Sign Michigan Non disclosure agreement sample Later

- Sign Michigan Non-disclosure agreement PDF Safe

- Can I Sign Ohio Non-disclosure agreement PDF

- Help Me With Sign Oklahoma Non-disclosure agreement PDF

- How Do I Sign Oregon Non-disclosure agreement PDF

- Sign Oregon Non disclosure agreement sample Mobile

- How Do I Sign Montana Rental agreement contract

- Sign Alaska Rental lease agreement Mobile

- Sign Connecticut Rental lease agreement Easy

- Sign Hawaii Rental lease agreement Mobile

- Sign Hawaii Rental lease agreement Simple

- Sign Kansas Rental lease agreement Later

- How Can I Sign California Rental house lease agreement

- How To Sign Nebraska Rental house lease agreement

- How To Sign North Dakota Rental house lease agreement