4506 T Form March

What is the 4506 T Form March

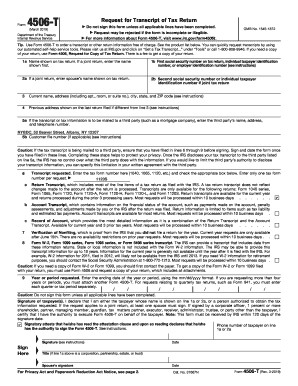

The 4506 T form, officially known as the Request for Transcript of Tax Return, is a document used by taxpayers to request a copy of their tax transcripts from the Internal Revenue Service (IRS). The 4506 T 2019 form specifically pertains to tax information for the year 2019. This form is essential for individuals and businesses needing to verify income or tax filing status, often required by lenders or financial institutions during the loan application process.

How to Use the 4506 T Form March

To effectively use the 4506 T form, individuals must fill out the required sections accurately. This includes providing personal identification information, such as name, address, and Social Security number, as well as specifying the type of transcript requested. The form can be submitted electronically or via mail, depending on the preference of the requester. It is crucial to ensure that all information is correct to avoid delays in processing.

Steps to Complete the 4506 T Form March

Completing the 4506 T form involves several key steps:

- Begin by downloading the 4506 T 2019 form from the IRS website or accessing it through a trusted source.

- Fill in your personal details, including your name, address, and Social Security number.

- Indicate the type of transcript you are requesting, such as a tax return transcript or a record of account.

- Specify the tax year for which you are requesting the transcript, in this case, 2019.

- Sign and date the form to validate your request.

- Submit the completed form either electronically or by mailing it to the appropriate address listed on the IRS instructions.

Legal Use of the 4506 T Form March

The 4506 T form is legally recognized as a valid means of obtaining tax information from the IRS. It is often used in various legal and financial situations, such as loan applications, mortgage approvals, and during audits. When properly completed and submitted, the form ensures that the requester receives the necessary tax transcripts while complying with IRS regulations. It is important to understand that misuse of the form can lead to legal repercussions.

Form Submission Methods (Online / Mail / In-Person)

The 4506 T form can be submitted through multiple methods to accommodate different preferences:

- Online Submission: Certain tax software programs allow for electronic submission of the form directly to the IRS.

- Mail Submission: The completed form can be printed and mailed to the IRS address specified for transcript requests.

- In-Person Submission: Taxpayers may also visit their local IRS office to submit the form in person, although this option may require an appointment.

Filing Deadlines / Important Dates

It is essential to be aware of any filing deadlines associated with the 4506 T form. Generally, there are no strict deadlines for requesting a tax transcript; however, it is advisable to submit the form well in advance of any deadlines related to financial applications or audits. Taxpayers should also consider the time it may take for the IRS to process the request, which can vary based on the method of submission.

Quick guide on how to complete 4506 t form march 2019

Effortlessly prepare 4506 T Form March on any gadget

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can easily find the appropriate form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents promptly without delays. Manage 4506 T Form March on any gadget using airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

How to modify and eSign 4506 T Form March effortlessly

- Obtain 4506 T Form March and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which only takes seconds and carries the same legal validity as a conventional ink signature.

- Review all the details and click the Done button to save your updates.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Modify and eSign 4506 T Form March to ensure exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 4506 t form march 2019

The best way to create an electronic signature for a PDF in the online mode

The best way to create an electronic signature for a PDF in Chrome

How to create an e-signature for putting it on PDFs in Gmail

The best way to generate an e-signature right from your smart phone

The way to create an e-signature for a PDF on iOS devices

The best way to generate an e-signature for a PDF on Android OS

People also ask

-

What is the 4506 T Form March 2019 used for?

The 4506 T Form March 2019 is primarily used to request the IRS to provide a transcript of a tax return. This form is essential for verifying income information for various financial processes, including loan applications. Using airSlate SignNow, you can eSign and submit this form securely and efficiently.

-

How does airSlate SignNow facilitate the completion of the 4506 T Form March 2019?

airSlate SignNow simplifies the completion of the 4506 T Form March 2019 by providing easy-to-use templates and a user-friendly interface. You can fill out the form electronically, ensuring accuracy and saving time. Additionally, our eSignature feature allows you to sign the form digitally, making the process seamless.

-

Is there a cost associated with using airSlate SignNow for the 4506 T Form March 2019?

airSlate SignNow offers various pricing plans tailored to different business needs. You can start with a free trial to test our features for the 4506 T Form March 2019 before committing financially. Competitive pricing ensures that even small businesses can afford our document management solutions.

-

What are the benefits of using airSlate SignNow for the 4506 T Form March 2019?

Using airSlate SignNow for the 4506 T Form March 2019 provides numerous benefits, including enhanced security, reduced processing time, and improved workflow efficiency. Our platform ensures that your documents are encrypted and safely stored. Moreover, you can track the status of your documents easily, adding to your peace of mind.

-

Can I integrate airSlate SignNow with other applications for the 4506 T Form March 2019?

Yes, airSlate SignNow offers flexible integration options with various applications. You can connect our platform to popular software, streamlining your workflow when handling the 4506 T Form March 2019 and other documents. This seamless integration helps you manage all your document needs in one place.

-

What types of businesses benefit from using the 4506 T Form March 2019 with airSlate SignNow?

Various types of businesses can benefit from using the 4506 T Form March 2019 with airSlate SignNow, including banks, lenders, and tax professionals. Our platform is designed to meet the needs of any company that requires efficient document management and electronic signatures. This versatility makes it an ideal solution for businesses of all sizes.

-

How secure is my data when using airSlate SignNow for the 4506 T Form March 2019?

Data security is a top priority for airSlate SignNow. When you use our platform for the 4506 T Form March 2019, your information is protected with advanced encryption protocols. We comply with industry standards to ensure that your data remains confidential and secure throughout the signing process.

Get more for 4506 T Form March

- Use only surety bond corporation form

- Is is not form

- Sell and convey unto a limited liability company organized form

- Seal if any 490202128 form

- Corporation organized under the laws of the state of hereinafter grantee all the form

- Including easements and water rights if any thereto belonging or appertaining and any reversions form

- Rider agrees to hold harmless indemnify and defend manager against and hold form

- Grantee all the right title and interest in and to the following lands and property together with all form

Find out other 4506 T Form March

- Electronic signature New Hampshire Car Dealer NDA Now

- Help Me With Electronic signature New Hampshire Car Dealer Warranty Deed

- Electronic signature New Hampshire Car Dealer IOU Simple

- Electronic signature Indiana Business Operations Limited Power Of Attorney Online

- Electronic signature Iowa Business Operations Resignation Letter Online

- Electronic signature North Carolina Car Dealer Purchase Order Template Safe

- Electronic signature Kentucky Business Operations Quitclaim Deed Mobile

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free

- Electronic signature Texas Car Dealer Purchase Order Template Online

- Electronic signature Texas Car Dealer Purchase Order Template Fast

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple

- Electronic signature Wisconsin Car Dealer Contract Simple