NOTICE of CORRECTION from MUNICIPAL TAX ASSESSORS STATE of 2018-2026

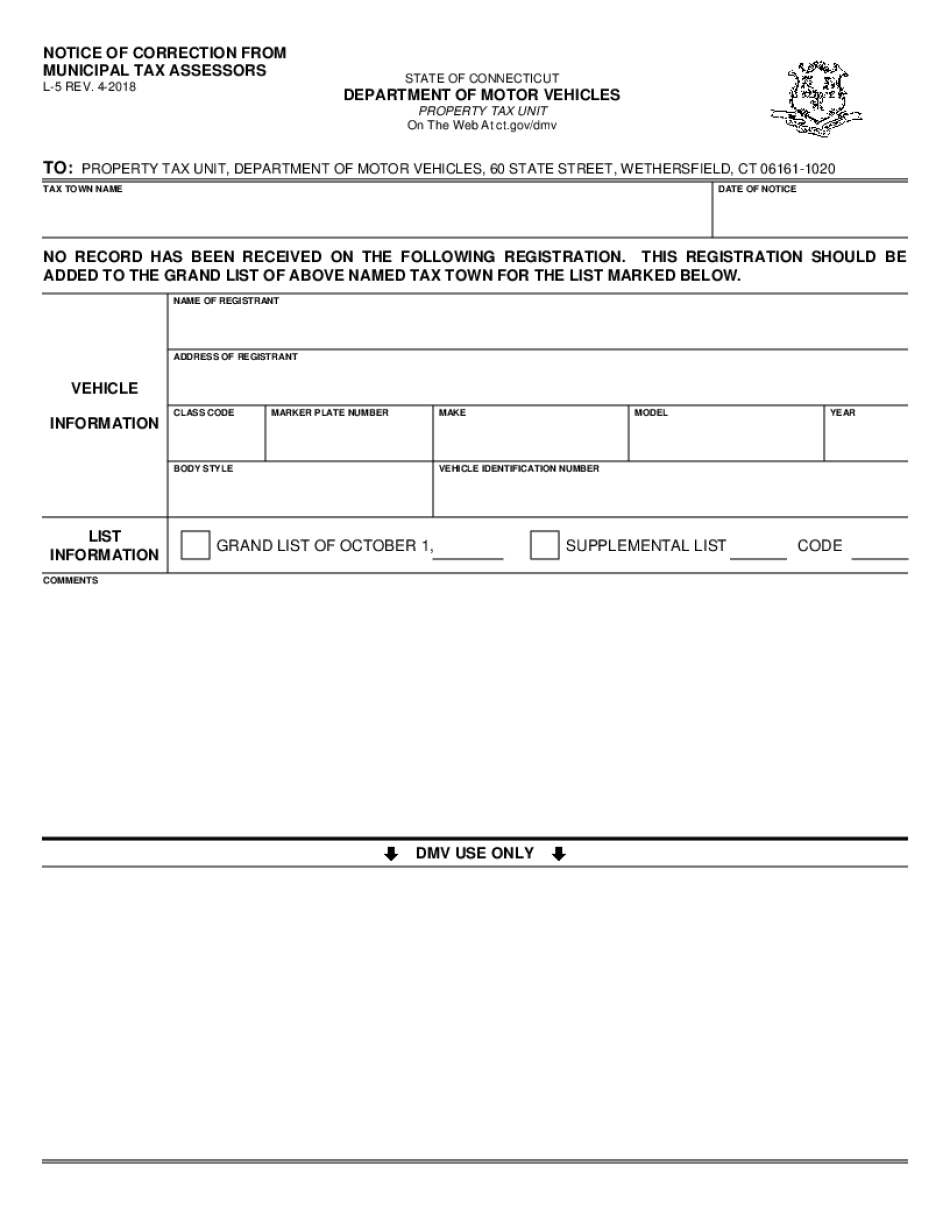

What is the notice of correction from municipal tax assessors?

The notice of correction from municipal tax assessors is a formal document used to amend or rectify inaccuracies in property tax assessments. This notice is essential for property owners who believe their property has been overvalued or incorrectly classified, impacting their tax obligations. By submitting this notice, individuals can ensure their property assessments reflect accurate values, which can lead to fairer tax rates.

Steps to complete the notice of correction from municipal tax assessors

Completing the notice of correction involves several key steps to ensure accuracy and compliance. First, gather all relevant property information, including the tax identification number and current assessment details. Then, clearly outline the reasons for the correction, providing supporting documentation where necessary. Next, fill out the notice form carefully, ensuring all fields are completed accurately. Once the form is complete, review it for any errors before submitting it to the appropriate municipal tax office.

Legal use of the notice of correction from municipal tax assessors

The legal use of the notice of correction is governed by state and local laws regarding property tax assessments. This document must be filed within specific timeframes to be considered valid. It serves as a formal request for review and adjustment of property values, and if properly executed, it can lead to a legally binding reassessment. Understanding the legal implications and requirements is crucial for property owners to ensure their submissions are accepted.

Key elements of the notice of correction from municipal tax assessors

Several key elements must be included in the notice of correction to ensure its validity. These include:

- Property Identification: Clearly state the property address and tax identification number.

- Reason for Correction: Provide a detailed explanation of the inaccuracies being addressed.

- Supporting Documentation: Attach any relevant documents that substantiate the claim, such as appraisals or photographs.

- Signature: Ensure the form is signed by the property owner or an authorized representative.

How to obtain the notice of correction from municipal tax assessors

To obtain the notice of correction, property owners can typically visit their local municipal tax assessor's office or access the form online through the official municipal website. Many municipalities provide downloadable forms that can be filled out electronically or printed for manual completion. It is advisable to check for any specific instructions or requirements that may vary by location.

Filing deadlines / Important dates

Filing deadlines for the notice of correction can vary by state and municipality. Generally, property owners must submit their notices within a specified period after receiving their assessment notice. It is important to be aware of these deadlines to ensure that the correction is considered for the current tax year. Checking with the local tax assessor's office for precise dates is recommended to avoid missing any critical deadlines.

Quick guide on how to complete notice of correction from municipal tax assessors state of

Effortlessly Prepare NOTICE OF CORRECTION FROM MUNICIPAL TAX ASSESSORS STATE OF on Any Device

The management of documents online has become increasingly popular among businesses and individuals alike. It offers a great eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct format and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your paperwork quickly without any delays. Handle NOTICE OF CORRECTION FROM MUNICIPAL TAX ASSESSORS STATE OF on any platform using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

The Easiest Way to Edit and eSign NOTICE OF CORRECTION FROM MUNICIPAL TAX ASSESSORS STATE OF Seamlessly

- Find NOTICE OF CORRECTION FROM MUNICIPAL TAX ASSESSORS STATE OF and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize key sections of the documents or hide sensitive data using tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign feature, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose your preferred method to send your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Edit and eSign NOTICE OF CORRECTION FROM MUNICIPAL TAX ASSESSORS STATE OF and ensure outstanding communication throughout every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct notice of correction from municipal tax assessors state of

Create this form in 5 minutes!

How to create an eSignature for the notice of correction from municipal tax assessors state of

The best way to create an e-signature for a PDF file in the online mode

The best way to create an e-signature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

The way to generate an electronic signature straight from your smartphone

The way to generate an e-signature for a PDF file on iOS devices

The way to generate an electronic signature for a PDF document on Android

People also ask

-

What are correction assessors and how do they benefit businesses?

Correction assessors are professionals who review and validate document corrections to ensure accuracy. By integrating correction assessors into your workflow, businesses can enhance document quality, reduce errors, and streamline the review process. This leads to increased efficiency and higher customer satisfaction.

-

How does airSlate SignNow support correction assessors?

airSlate SignNow provides a seamless platform for correction assessors to easily review and sign documents electronically. With user-friendly features and real-time collaboration, correction assessors can expedite the assessment process and provide timely feedback. This ensures that documents are error-free and meet compliance standards.

-

What pricing plans are available for businesses using correction assessors?

airSlate SignNow offers flexible pricing plans tailored to various business needs, including options that specifically accommodate correction assessors. Depending on the plan, businesses can take advantage of features such as document tracking and enhanced security measures. For detailed pricing information, visit our website or contact our sales team.

-

What features does airSlate SignNow offer for correction assessors?

Key features for correction assessors in airSlate SignNow include document templates, electronic signatures, and integration with popular cloud storage solutions. These features simplify the document review process, allowing correction assessors to focus on critical tasks. Advanced analytics also help in tracking performance and improving efficiency.

-

Are there integration options available for correction assessors?

Yes, airSlate SignNow offers various integration options that are beneficial for correction assessors. You can connect with tools like Google Drive, Salesforce, and Microsoft Office, enhancing the functionality and ease of use for correction assessors. These integrations streamline document management and improve collaboration across your team.

-

How can correction assessors improve compliance and security?

By utilizing airSlate SignNow, correction assessors can ensure that document workflows adhere to legal and regulatory standards. The platform incorporates robust security features such as encryption and secure storage to protect sensitive information. This enhances compliance and reassures clients about the safety of their documents.

-

What customer support options are available for correction assessors?

airSlate SignNow provides comprehensive customer support tailored for correction assessors. Access to detailed documentation, live chat, and email support ensures that correction assessors can get timely assistance. Our dedicated support team is equipped to help with any inquiries related to document workflows or feature usage.

Get more for NOTICE OF CORRECTION FROM MUNICIPAL TAX ASSESSORS STATE OF

- Application packet ampamp checklist for consolidation boundary form

- Azlawhelporghousinglandlord and tenant rights and form

- Pipeline right of way option agreement day of 20 form

- Pipeline right of way easement form

- Precedent agreement for firm natural gas storage service form

- Nrs chapter 100 special relations of debtor and form

- Priority of proposed operations form

- Custom farming an ag decision maker alternative to leasing d form

Find out other NOTICE OF CORRECTION FROM MUNICIPAL TAX ASSESSORS STATE OF

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple