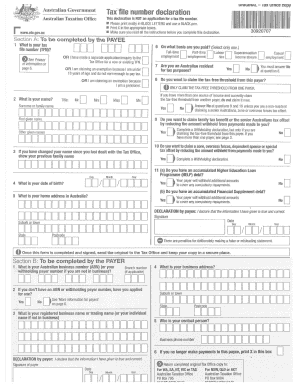

Tax Declaration Form

What is the Tax Declaration Form

The tax declaration form is a crucial document used by individuals and businesses to report their income, expenses, and other relevant financial information to the Internal Revenue Service (IRS). This form serves as a formal declaration of a taxpayer's financial situation for a specific period, typically a calendar year. It is essential for determining tax liability and ensuring compliance with federal tax laws.

In the United States, various forms may be used for tax declarations, including the 1040 for individuals and the 1065 for partnerships. Each form has its specific requirements and purposes, tailored to different taxpayer scenarios.

Steps to Complete the Tax Declaration Form

Completing the tax declaration form involves several key steps to ensure accuracy and compliance. Here’s a streamlined process:

- Gather necessary documents, such as W-2s, 1099s, and receipts for deductible expenses.

- Choose the appropriate tax declaration form based on your filing status and income type.

- Fill out personal information, including your name, address, and Social Security number.

- Report all sources of income, including wages, interest, and dividends.

- Claim deductions and credits for which you qualify, ensuring you have supporting documentation.

- Review the completed form for accuracy before submission.

- Submit the form electronically or by mail, ensuring you meet the filing deadline.

Legal Use of the Tax Declaration Form

The legal use of the tax declaration form is governed by federal tax laws, which require accurate reporting of income and expenses. To ensure the form is legally binding, it must be completed truthfully and submitted within the designated time frame. Falsifying information on a tax declaration can lead to severe penalties, including fines and potential criminal charges.

Utilizing a reliable electronic signature solution, like signNow, can enhance the legal validity of your tax declaration by providing a secure and verifiable method of signing documents digitally. Compliance with eSignature laws, such as the ESIGN Act and UETA, further solidifies the document's legal standing.

Examples of Using the Tax Declaration Form

Understanding how to use the tax declaration form can be enhanced by examining specific examples:

- A self-employed individual may use a Schedule C attached to their 1040 to report business income and expenses.

- A married couple filing jointly will complete a single 1040 form, combining their incomes and deductions.

- Students may use the 1098-T form to report tuition payments and potentially qualify for education-related tax credits.

Filing Deadlines / Important Dates

Filing deadlines for tax declarations are critical to avoid penalties. Typically, individual tax returns are due on April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers can file for an extension, which usually grants an additional six months, but any taxes owed must still be paid by the original deadline to avoid interest and penalties.

Required Documents

To complete a tax declaration form accurately, several documents are necessary:

- W-2 forms from employers, detailing annual wages and taxes withheld.

- 1099 forms for other income sources, such as freelance work or interest income.

- Receipts for deductible expenses, including medical costs, mortgage interest, and charitable contributions.

- Previous year’s tax return for reference and consistency.

Quick guide on how to complete tax declaration form 243830547

Effortlessly Prepare Tax Declaration Form on Any Device

Managing documents online has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed paperwork, allowing you to acquire the necessary form and securely save it online. airSlate SignNow equips you with all the tools needed to create, customize, and eSign your documents quickly and without delays. Handle Tax Declaration Form on any device using airSlate SignNow apps for Android or iOS and streamline any document-related procedure today.

Edit and eSign Tax Declaration Form with Ease

- Locate Tax Declaration Form and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to apply your changes.

- Select your preferred method to share your form: via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form retrieval, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Modify and eSign Tax Declaration Form to ensure smooth communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax declaration form 243830547

The best way to create an e-signature for your PDF file in the online mode

The best way to create an e-signature for your PDF file in Chrome

The best way to make an e-signature for putting it on PDFs in Gmail

How to make an e-signature from your smartphone

The way to generate an electronic signature for a PDF file on iOS devices

How to make an e-signature for a PDF file on Android

People also ask

-

What is airSlate SignNow's role in managing tax declarations?

airSlate SignNow simplifies the process of managing tax declarations by allowing users to send, sign, and store essential documents securely. With our platform, you can ensure that all necessary tax declaration paperwork is completed efficiently without the hassle of manual processes. This helps businesses comply with tax regulations while saving time.

-

How does airSlate SignNow ensure security for my tax declaration documents?

Security is a top priority for airSlate SignNow, especially when handling sensitive tax declaration documents. Our platform employs advanced encryption and secure data storage to protect your information. Additionally, eSignatures are legally binding, providing peace of mind that your tax declarations are secure and compliant.

-

What are the pricing options for using airSlate SignNow for tax declarations?

airSlate SignNow offers competitive pricing plans tailored to fit the needs of businesses handling tax declarations. Our pricing is transparent with no hidden fees, ensuring that you get a cost-effective solution for eSigning and managing documents. Explore our various plans to find one that suits your business size and document volume.

-

Can I integrate airSlate SignNow with other software for tax declarations?

Yes, airSlate SignNow seamlessly integrates with a wide variety of software applications to enhance your workflow for tax declarations. Whether you use accounting software or document management systems, our integrations ensure that you can stay organized and efficient. This capability allows for a streamlined process in managing all tax declaration documents.

-

What features does airSlate SignNow offer for tax declaration management?

airSlate SignNow offers numerous features specifically designed to facilitate tax declaration management. These include customizable templates, automated workflows, and advanced tracking options for documents. Such features make it easier to gather necessary signatures and organize important tax documents efficiently.

-

How can airSlate SignNow benefit small businesses with tax declarations?

For small businesses, airSlate SignNow provides an affordable and user-friendly solution for handling tax declarations. Our platform minimizes administrative burdens, allowing small business owners to focus on their core operations. By streamlining the document signing process, you can ensure timely submission of tax declarations and reduce the risk of non-compliance.

-

What support does airSlate SignNow offer for users with tax declaration queries?

airSlate SignNow offers robust customer support for users with questions regarding tax declarations. Our team is available to assist you through multiple channels, ensuring you can get help when needed. Additionally, our comprehensive knowledge base includes guides and FAQs to help you navigate any challenges you may encounter.

Get more for Tax Declaration Form

- Fillable online complaint for relief from abuse fax email form

- An order for relief from abuse was entered in the above case on form

- Litigants address for notification form

- The johnson city community concert band donor doc template form

- Form 818

- Form 814

- Notice of appearance and intent to represent form

- Form 803

Find out other Tax Declaration Form

- eSign Delaware Healthcare / Medical Living Will Now

- eSign Healthcare / Medical Form Florida Secure

- eSign Florida Healthcare / Medical Contract Safe

- Help Me With eSign Hawaii Healthcare / Medical Lease Termination Letter

- eSign Alaska High Tech Warranty Deed Computer

- eSign Alaska High Tech Lease Template Myself

- eSign Colorado High Tech Claim Computer

- eSign Idaho Healthcare / Medical Residential Lease Agreement Simple

- eSign Idaho Healthcare / Medical Arbitration Agreement Later

- How To eSign Colorado High Tech Forbearance Agreement

- eSign Illinois Healthcare / Medical Resignation Letter Mobile

- eSign Illinois Healthcare / Medical Job Offer Easy

- eSign Hawaii High Tech Claim Later

- How To eSign Hawaii High Tech Confidentiality Agreement

- How Do I eSign Hawaii High Tech Business Letter Template

- Can I eSign Hawaii High Tech Memorandum Of Understanding

- Help Me With eSign Kentucky Government Job Offer

- eSign Kentucky Healthcare / Medical Living Will Secure

- eSign Maine Government LLC Operating Agreement Fast

- eSign Kentucky Healthcare / Medical Last Will And Testament Free