Income Tax Return Form Bd 21

What is the Income Tax Return Form Bd 21

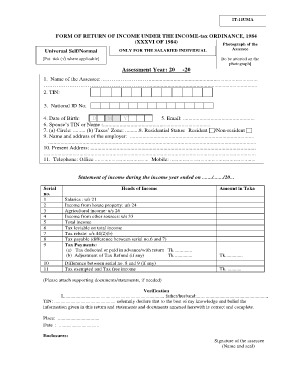

The Income Tax Return Form Bd 21 is a critical document used by U.S. taxpayers to report their annual income to the Internal Revenue Service (IRS). This form captures essential information about an individual's earnings, deductions, and tax liabilities, ensuring compliance with federal tax laws. It is designed for various taxpayer categories, including individuals, self-employed persons, and businesses. Understanding the purpose and structure of this form is vital for accurate tax reporting and minimizing potential errors.

Steps to complete the Income Tax Return Form Bd 21

Completing the Income Tax Return Form Bd 21 involves several systematic steps to ensure all necessary information is accurately reported. Here are the key steps:

- Gather all relevant financial documents, including W-2s, 1099s, and any records of deductions.

- Begin filling out the form by entering personal information, such as name, address, and Social Security number.

- Report all sources of income, including wages, dividends, and interest.

- Calculate and enter deductions and credits to determine your taxable income.

- Compute the total tax owed or refund due.

- Review the completed form for accuracy and completeness.

- Sign and date the form before submission.

How to obtain the Income Tax Return Form Bd 21

Obtaining the Income Tax Return Form Bd 21 is straightforward. Taxpayers can access the form through several channels:

- Visit the official IRS website to download a digital copy of the form.

- Request a paper form through the mail by contacting the IRS directly.

- Access the form at local IRS offices or participating libraries and community centers.

Legal use of the Income Tax Return Form Bd 21

The Income Tax Return Form Bd 21 is legally binding when completed and submitted correctly. It must comply with IRS regulations, which dictate how the form should be filled out and submitted. Taxpayers are responsible for ensuring the accuracy of the information provided. Failure to comply with tax laws can result in penalties, including fines and interest on unpaid taxes. It is essential to understand your obligations under the law to avoid legal complications.

Filing Deadlines / Important Dates

Filing deadlines for the Income Tax Return Form Bd 21 are crucial for taxpayers to observe. Typically, the deadline for filing individual income tax returns is April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any extensions they may apply for and the implications of late filing, including potential penalties and interest on owed taxes.

Required Documents

To complete the Income Tax Return Form Bd 21 accurately, several documents are required. These include:

- W-2 forms from employers

- 1099 forms for freelance or contract work

- Records of other income, such as rental income or dividends

- Documentation for deductions, including receipts for medical expenses, mortgage interest statements, and charitable contributions

Having these documents readily available will streamline the process of filling out the form and ensure compliance with tax regulations.

Quick guide on how to complete income tax return form bd 2020 21

Complete Income Tax Return Form Bd 21 easily on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to access the necessary form and securely save it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly without delays. Handle Income Tax Return Form Bd 21 on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and electronically sign Income Tax Return Form Bd 21 effortlessly

- Locate Income Tax Return Form Bd 21 and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes only seconds and holds the same legal force as a traditional handwritten signature.

- Review the details and press the Done button to save your changes.

- Select your preferred method for sending your form: via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate reprinting new copies. airSlate SignNow fulfills your document management needs in just a few clicks from your chosen device. Edit and electronically sign Income Tax Return Form Bd 21 and maintain effective communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the income tax return form bd 2020 21

The way to create an electronic signature for a PDF document online

The way to create an electronic signature for a PDF document in Google Chrome

How to generate an e-signature for signing PDFs in Gmail

The way to make an e-signature from your smart phone

The best way to create an e-signature for a PDF document on iOS

The way to make an e-signature for a PDF file on Android OS

People also ask

-

What is an income tax return sample?

An income tax return sample is a formatted document that illustrates how to report income and expenses to the IRS. It can serve as a useful guide for understanding the information required when filing your taxes. AirSlate SignNow provides options to digitally sign such samples, streamlining the tax filing process.

-

How can airSlate SignNow help with my income tax return documentation?

AirSlate SignNow simplifies the process of sending and eSigning income tax return documents. With its user-friendly interface, you can quickly upload, sign, and send an income tax return sample, ensuring that your important documents are handled efficiently. This saves you time and reduces the stress of tax season.

-

What are the pricing options for airSlate SignNow?

AirSlate SignNow offers competitive pricing plans suitable for businesses of all sizes. Each plan includes access to features that allow for easier management of documents, including income tax return samples. You can choose a plan based on your specific document handling needs.

-

Is there a free trial available for airSlate SignNow?

Yes, airSlate SignNow offers a free trial for new users to explore its features and benefits. This includes creating, sending, and signing income tax return samples without any cost. It’s a great way to determine if it's the right tool for your business needs.

-

What features does airSlate SignNow offer for managing income tax return samples?

AirSlate SignNow provides a suite of features including eSignature, templates, and document tracking that make managing income tax return samples straightforward. You can create templates for recurring tax documents and track their status in real time, enhancing your productivity.

-

Can airSlate SignNow integrate with other software for tax preparation?

Absolutely! AirSlate SignNow offers seamless integrations with popular accounting and tax preparation software. This allows you to easily import and export your income tax return samples, ensuring smooth workflow between your eSigning needs and tax management systems.

-

How secure is airSlate SignNow when handling income tax return samples?

Security is a top priority for airSlate SignNow. Our platform includes industry-standard encryption and compliance with regulations to protect sensitive data, including income tax return samples. You can have peace of mind knowing that your important documents are stored securely.

Get more for Income Tax Return Form Bd 21

- Fair debt collection act demand form

- Timesheet instructions templatenet form

- Directive issue directive to adjust territories or structures form

- Issue directive to establish change or reaffirm policies form

- What attorneys should know about the fair debt collection form

- Directive notify employees of a new policy or a change in an existing one form

- Disagreement disagree with a bill rent payment or other financial issue form

- Glacial morains rentals tenerife 0802 98 pronex property ridgid form

Find out other Income Tax Return Form Bd 21

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement