Fair Debt Collection Act Demand Form

What is the Fair Debt Collection Act Demand

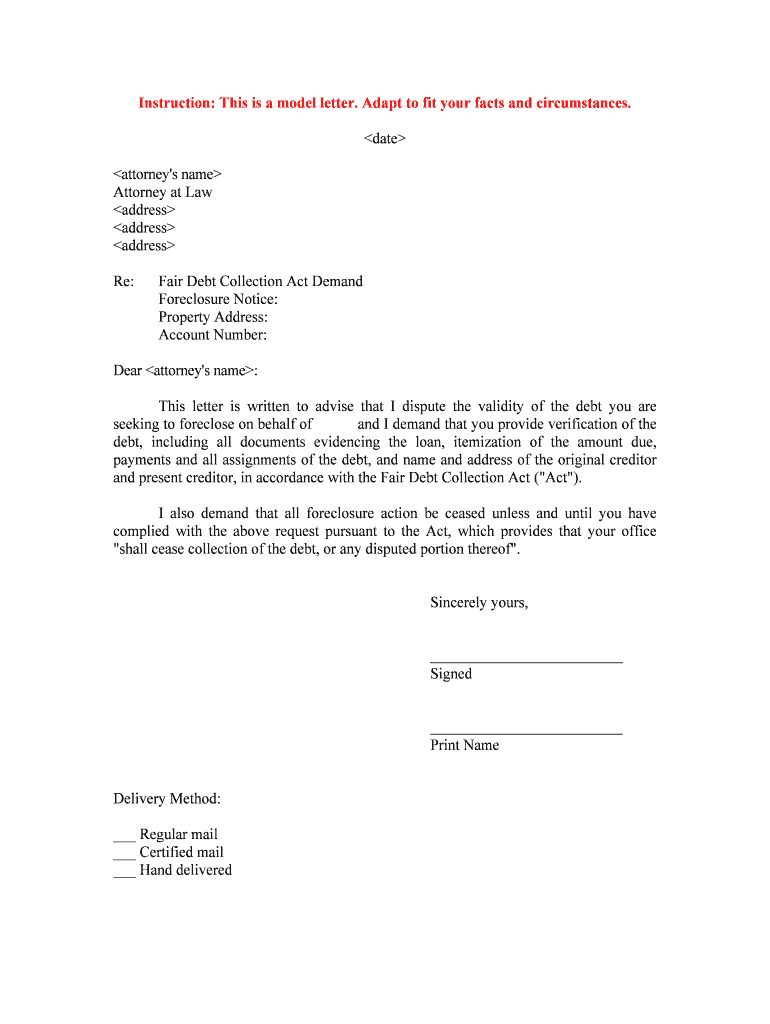

The Fair Debt Collection Act Demand is a formal request made by consumers to debt collectors, asserting their rights under the Fair Debt Collection Practices Act (FDCPA). This federal law aims to eliminate abusive practices in the collection of consumer debts. The demand typically includes the consumer's request for validation of the debt, details about the original creditor, and any other pertinent information that the consumer believes is necessary to resolve the debt issue. Understanding this demand is essential for consumers who wish to ensure their rights are protected during the debt collection process.

How to use the Fair Debt Collection Act Demand

Using the Fair Debt Collection Act Demand involves several steps to ensure that your rights are upheld. First, gather all relevant information about the debt, including account numbers and creditor details. Next, draft a formal demand letter that outlines your request for debt validation and any other inquiries you may have. It is important to send this letter via certified mail to ensure you have proof of delivery. Retain a copy of the letter for your records. Following this process helps establish a clear communication line with the debt collector and protects your rights under the FDCPA.

Steps to complete the Fair Debt Collection Act Demand

Completing the Fair Debt Collection Act Demand requires careful attention to detail. Begin by identifying the debt collector and the specific debt in question. Next, write a clear and concise demand letter that includes your name, address, and the date. Specify that you are requesting validation of the debt and include any relevant account information. After drafting the letter, review it for accuracy and clarity. Finally, send the letter using certified mail to ensure it is received, and keep a copy for your records. This structured approach helps ensure that your demand is taken seriously and adheres to legal standards.

Key elements of the Fair Debt Collection Act Demand

Several key elements must be included in the Fair Debt Collection Act Demand to ensure its effectiveness. These include:

- Your contact information: Include your full name, address, and phone number.

- Debt collector's information: Clearly state the name and address of the debt collector.

- Debt details: Provide specific information about the debt, including the amount owed and the original creditor.

- Request for validation: Explicitly request that the debt collector validate the debt and provide documentation supporting their claim.

- Date of the letter: Always include the date to establish a timeline for your request.

Including these elements helps ensure that your demand is comprehensive and legally sound.

Legal use of the Fair Debt Collection Act Demand

The legal use of the Fair Debt Collection Act Demand is crucial for protecting consumer rights. Under the FDCPA, consumers have the right to request validation of debts, and debt collectors are legally obligated to respond. This demand serves as a formal notification to the collector that you are aware of your rights and expect compliance with the law. It is important to ensure that your demand is respectful and factual, as aggressive or misleading language could undermine your position. By adhering to legal standards, you enhance your ability to resolve debt-related issues effectively.

Examples of using the Fair Debt Collection Act Demand

Examples of using the Fair Debt Collection Act Demand can provide clarity on its application. For instance, if a consumer receives a call from a debt collector regarding an unpaid credit card bill, they may choose to send a demand letter requesting validation of the debt. Another example could involve a consumer disputing a debt that they believe is inaccurate or has been paid. In both cases, the demand serves as a formal mechanism to assert rights and seek clarification. These examples illustrate the practical use of the demand in various debt situations.

Quick guide on how to complete fair debt collection act demand

Complete Fair Debt Collection Act Demand effortlessly on any device

Online document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to easily locate the right form and securely store it online. airSlate SignNow provides all the necessary tools to swiftly create, edit, and electronically sign your documents without any delays. Handle Fair Debt Collection Act Demand across any platform using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The easiest method to modify and eSign Fair Debt Collection Act Demand with minimal effort

- Locate Fair Debt Collection Act Demand and select Get Form to begin.

- Utilize the tools available to complete your document.

- Highlight pertinent sections of the documents or redact sensitive information using the tools that airSlate SignNow offers specifically for this purpose.

- Create your signature with the Sign feature, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and eSign Fair Debt Collection Act Demand and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Fair Debt Collection Act Demand and how can it help my business?

The Fair Debt Collection Act Demand (FDCA) is a legal requirement that governs how debt collectors must conduct their business. Understanding this act helps businesses ensure compliance and protect consumer rights. airSlate SignNow allows you to create, send, and eSign FDCA compliant documents, streamlining your collection process and maintaining professionalism.

-

How does airSlate SignNow ensure compliance with the Fair Debt Collection Act?

airSlate SignNow provides templates and customizable options designed to meet the Fair Debt Collection Act Demand. Our platform incorporates all necessary legal verbiage and allows you to easily edit documents to reflect compliance. This means your communications remain professional and legally sound.

-

What features does airSlate SignNow offer for managing Fair Debt Collection Act demands?

airSlate SignNow features robust document management, eSignature capabilities, and secure sharing options tailored for Fair Debt Collection Act demands. With automated workflows and status tracking, you can efficiently handle collections while keeping your clients informed. These features enable faster resolutions and customer satisfaction.

-

Is there a free trial available for airSlate SignNow for Fair Debt Collection?

Yes, airSlate SignNow offers a free trial that lets you explore our features, specifically for managing Fair Debt Collection Act demands. You can test the platform risk-free and discover how our eSigning solutions can simplify your debt collection processes. Sign up today to experience the benefits firsthand.

-

What are the pricing options for airSlate SignNow and how do they fit into my budget for Fair Debt Collection needs?

airSlate SignNow provides competitive pricing plans that accommodate various business sizes and budgets, especially for handling Fair Debt Collection Act demands. Our flexible subscription options allow you to choose a plan that fits your specific needs. You'll find that investing in our platform can save you time and improve efficiency in your debt collection efforts.

-

Can I integrate airSlate SignNow with any existing systems for Fair Debt Collection Act demands?

Absolutely! airSlate SignNow seamlessly integrates with various CRM, accounting, and productivity tools, making it easy to manage Fair Debt Collection Act demands alongside your existing systems. This integration ensures a cohesive workflow and enhances productivity without disrupting your current processes.

-

What are the benefits of using airSlate SignNow for Fair Debt Collection Act Demands?

Using airSlate SignNow for Fair Debt Collection Act demands offers numerous benefits, including increased efficiency, enhanced compliance, and improved customer relations. Our platform allows for quick document turnaround through eSigning, decreasing the time to collect payments. Additionally, maintaining legal compliance strengthens your business reputation.

Get more for Fair Debt Collection Act Demand

- Front range brain and spine fort collins form

- Usa wrestling claim form

- Medical consultation request form medical consultation form by berkeley lake dentists in norcross ga

- Patient information release form henry ford health system

- Fitness certificate by doctor form

- Yoga intake form

- Obstetric template form

- Aim specialty prior authorization form

Find out other Fair Debt Collection Act Demand

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document

- Can I Electronic signature Georgia Car Dealer Form

- Can I Electronic signature Idaho Car Dealer Document

- How Can I Electronic signature Illinois Car Dealer Document

- How Can I Electronic signature North Carolina Banking PPT

- Can I Electronic signature Kentucky Car Dealer Document