Ethiopian Revenue and Customs Authority Forms

What are the Ethiopian Revenue and Customs Authority Forms?

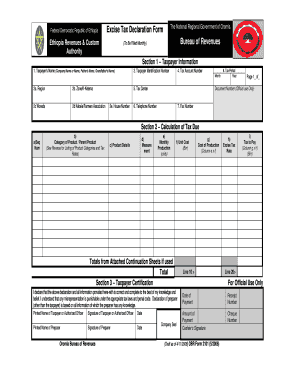

The Ethiopian Revenue and Customs Authority forms are official documents required for various tax and customs-related processes in Ethiopia. These forms facilitate the collection of taxes, customs duties, and other financial obligations mandated by the government. They are essential for individuals and businesses to comply with Ethiopian tax laws and regulations. The forms may include tax declaration forms, customs declaration forms, and other related documents that ensure proper reporting and payment of taxes.

How to Use the Ethiopian Revenue and Customs Authority Forms

Using the Ethiopian Revenue and Customs Authority forms involves several steps to ensure compliance and accuracy. First, identify the specific form required for your situation, such as a tax declaration or customs declaration. Next, download the appropriate form, often available in Amharic PDF format. Carefully fill out the form with accurate information, ensuring all required fields are completed. Once completed, submit the form according to the guidelines provided, which may include online submission or mailing it to the relevant authority.

Steps to Complete the Ethiopian Revenue and Customs Authority Forms

Completing the Ethiopian Revenue and Customs Authority forms requires attention to detail. Follow these steps:

- Identify the correct form needed for your specific tax or customs requirement.

- Download the form in Amharic PDF format from the Ethiopian Revenue and Customs Authority website.

- Read the instructions carefully to understand the information required.

- Fill out the form accurately, providing all necessary information.

- Review the completed form for any errors or omissions.

- Submit the form as directed, either online or by mail.

Legal Use of the Ethiopian Revenue and Customs Authority Forms

The legal use of the Ethiopian Revenue and Customs Authority forms is crucial for ensuring compliance with tax laws. These forms serve as official documentation of your tax obligations and customs declarations. When properly completed and submitted, they can be used as evidence in case of audits or disputes. It is important to adhere to all legal requirements associated with these forms to avoid penalties or legal issues.

Required Documents for Ethiopian Revenue and Customs Authority Forms

When filling out the Ethiopian Revenue and Customs Authority forms, certain documents may be required to support your submissions. Commonly required documents include:

- Identification documents, such as a national ID or passport.

- Proof of income or business revenue, such as pay stubs or financial statements.

- Previous tax returns or customs declarations, if applicable.

- Any additional documentation specified in the form instructions.

Form Submission Methods

There are various methods for submitting the Ethiopian Revenue and Customs Authority forms. These methods may include:

- Online submission through the Ethiopian Revenue and Customs Authority website.

- Mailing the completed forms to the designated office.

- In-person submission at local tax offices or customs agencies.

Quick guide on how to complete ethiopian revenue and customs authority forms

Easily prepare Ethiopian Revenue And Customs Authority Forms on any device

The management of documents online has gained popularity among businesses and individuals alike. It serves as an excellent environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents promptly without complications. Administer Ethiopian Revenue And Customs Authority Forms on any platform using the airSlate SignNow apps for Android or iOS and simplify any document-related tasks today.

The easiest way to modify and electronically sign Ethiopian Revenue And Customs Authority Forms effortlessly

- Locate Ethiopian Revenue And Customs Authority Forms and click on Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize important sections of the documents or redact sensitive information using the tools specifically provided by airSlate SignNow for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to store your modifications.

- Select your preferred method for sending your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Ethiopian Revenue And Customs Authority Forms to ensure excellent communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ethiopian revenue and customs authority forms

How to make an e-signature for your PDF file in the online mode

How to make an e-signature for your PDF file in Chrome

The way to make an e-signature for putting it on PDFs in Gmail

How to create an electronic signature straight from your smartphone

The best way to make an electronic signature for a PDF file on iOS devices

How to create an electronic signature for a PDF document on Android

People also ask

-

What is the Ethiopian revenue and customs authority in Amharic PDF?

The Ethiopian revenue and customs authority in Amharic PDF provides essential information and guidelines on tax regulations and customs procedures in Ethiopia. This PDF serves as a vital resource for individuals and businesses looking to understand their obligations and rights regarding taxation and customs.

-

How can the Ethiopian revenue and customs authority in Amharic PDF help my business?

Utilizing the Ethiopian revenue and customs authority in Amharic PDF can help your business navigate the complexities of tax compliance and customs regulations. By understanding these guidelines, you can ensure that your operations are lawful, potentially saving your business from costly penalties or disruptions.

-

Is there a cost associated with obtaining the Ethiopian revenue and customs authority in Amharic PDF?

The Ethiopian revenue and customs authority in Amharic PDF is generally available for free download on the official government website. However, businesses may incur costs if they choose to use services that assist in interpreting the document or applying its guidance.

-

What features are included in the Ethiopian revenue and customs authority in Amharic PDF?

The Ethiopian revenue and customs authority in Amharic PDF typically includes key regulations, tax rates, and forms required for compliance. It also provides contact information for relevant offices, deadlines for submissions, and instructions on how to properly complete necessary documents.

-

How often is the Ethiopian revenue and customs authority in Amharic PDF updated?

The Ethiopian revenue and customs authority in Amharic PDF is updated regularly to reflect changes in tax laws and customs regulations. It’s advisable to check for updates frequently, especially before submitting any documents or making filings.

-

Can I integrate the Ethiopian revenue and customs authority in Amharic PDF with other digital tools?

Yes, businesses can integrate the Ethiopian revenue and customs authority in Amharic PDF with various digital tools for better document management and compliance tracking. Using an electronic signature solution like airSlate SignNow can streamline the process of eSigning your compliance documents based on the guidelines set forth in the PDF.

-

What are the benefits of using the Ethiopian revenue and customs authority in Amharic PDF for eSigning documents?

Using the Ethiopian revenue and customs authority in Amharic PDF in conjunction with eSigning solutions can simplify the signing process while ensuring compliance with local regulations. It allows for quick access to necessary guidelines and facilitates a seamless workflow for getting documents properly signed and filed.

Get more for Ethiopian Revenue And Customs Authority Forms

- Could you please review this document for any major form

- Leasehold deed of trust security agreement form

- Title 68 real and personal property form

- What compensation do electric companies pay for an easement form

- Property owner rights ampampamp electric power easements form

- Nonexclusive permanent use of grantors private road form

- Deed of conservation easement south florida water form

- Electric ampampamp gas lines right of way comal county texas form

Find out other Ethiopian Revenue And Customs Authority Forms

- How To Electronic signature West Virginia Bill of Sale Immovable Property

- Electronic signature Delaware Equipment Sales Agreement Fast

- Help Me With Electronic signature Louisiana Assignment of Mortgage

- Can I Electronic signature Minnesota Assignment of Mortgage

- Electronic signature West Virginia Sales Receipt Template Free

- Electronic signature Colorado Sales Invoice Template Computer

- Electronic signature New Hampshire Sales Invoice Template Computer

- Electronic signature Tennessee Introduction Letter Free

- How To eSignature Michigan Disclosure Notice

- How To Electronic signature Ohio Product Defect Notice

- Electronic signature California Customer Complaint Form Online

- Electronic signature Alaska Refund Request Form Later

- How Can I Electronic signature Texas Customer Return Report

- How Do I Electronic signature Florida Reseller Agreement

- Electronic signature Indiana Sponsorship Agreement Free

- Can I Electronic signature Vermont Bulk Sale Agreement

- Electronic signature Alaska Medical Records Release Mobile

- Electronic signature California Medical Records Release Myself

- Can I Electronic signature Massachusetts Medical Records Release

- How Do I Electronic signature Michigan Medical Records Release