Starter ChecklistStarter Checklist for PAYE GOV UKStarter Checklist for PAYE GOV UKStarter Checklist for PAYE GOV UK 2021

Understanding the Starter Checklist

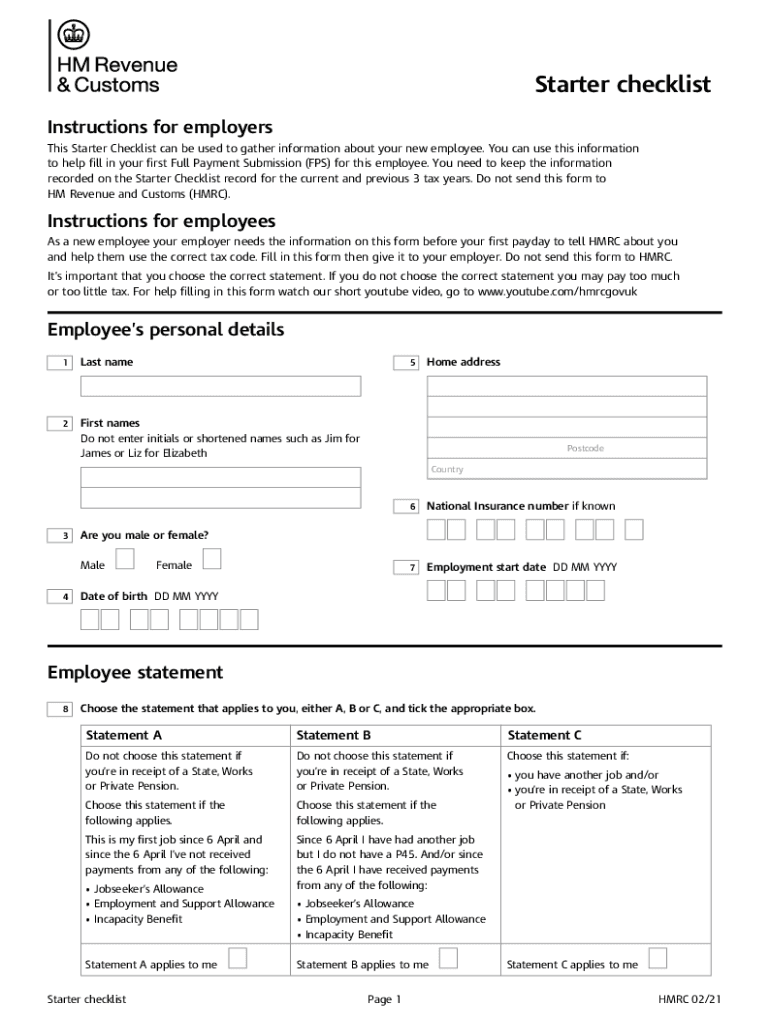

The HMRC starter checklist is a crucial document for employers in the United Kingdom, designed to collect essential information from new employees. This form helps ensure that the correct tax code is applied, allowing for the accurate calculation of PAYE (Pay As You Earn) deductions. It is particularly important for individuals starting a new job or returning to work after a break. The checklist serves as a means to establish a new employee's tax status and ensure compliance with HM Revenue and Customs regulations.

Steps to Complete the Starter Checklist

Completing the HMRC starter checklist involves several straightforward steps. First, the new employee should provide personal details, including their name, address, and National Insurance number. Next, they must indicate whether they have previously been employed or if this is their first job. It is also essential to confirm whether they have a P45 form from a previous employer. If a P45 is not available, the employee should select the appropriate option indicating this. Finally, the completed checklist should be submitted to the employer for processing.

Legal Use of the Starter Checklist

The legal validity of the HMRC starter checklist is upheld by ensuring that it is filled out accurately and submitted in a timely manner. Employers must retain the completed forms for their records, as they may be required to demonstrate compliance with tax regulations. The information provided on the checklist is used to determine the employee's tax code, which directly impacts their tax deductions. Therefore, both employers and employees should treat this document with care to avoid any potential legal issues.

Obtaining the Starter Checklist

The HMRC starter checklist can be easily obtained from the official HM Revenue and Customs website. Employers may also provide a printed version to new employees upon their hiring. It is important to ensure that the most current version of the checklist is used, as updates may occur that reflect changes in tax regulations or procedures.

Key Elements of the Starter Checklist

Several key elements are essential to the HMRC starter checklist. These include the employee's personal information, employment status, and tax code details. The form also requires the employee to declare whether they have received a P45 from a previous employer, which is critical for determining the correct tax deductions. Additionally, the checklist includes a section for the employer to sign, confirming that they have received the completed form.

Examples of Using the Starter Checklist

Employers can use the HMRC starter checklist in various scenarios. For instance, when hiring a new employee who has just graduated, the checklist helps establish their tax status and ensures that they are taxed correctly from the start. Similarly, if a worker returns to the job market after a period of unemployment, the checklist allows for the proper assessment of their tax obligations. Each situation emphasizes the importance of accurate completion and submission of this document.

Form Submission Methods

The HMRC starter checklist can be submitted through various methods, depending on the employer's preference. Employers may choose to collect the completed forms in person, allowing for immediate verification and clarification of any details. Alternatively, the checklist can be submitted electronically, particularly if the employer uses a payroll software system that integrates with HMRC. Regardless of the method chosen, it is essential to ensure that the form is submitted promptly to avoid any delays in processing the employee's tax information.

Quick guide on how to complete starter checkliststarter checklist for paye govukstarter checklist for paye govukstarter checklist for paye govuk

Complete Starter ChecklistStarter Checklist For PAYE GOV UKStarter Checklist For PAYE GOV UKStarter Checklist For PAYE GOV UK effortlessly on any device

Digital document management has gained signNow traction among companies and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, as you can access the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage Starter ChecklistStarter Checklist For PAYE GOV UKStarter Checklist For PAYE GOV UKStarter Checklist For PAYE GOV UK on any device with airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to edit and electronically sign Starter ChecklistStarter Checklist For PAYE GOV UKStarter Checklist For PAYE GOV UKStarter Checklist For PAYE GOV UK with ease

- Locate Starter ChecklistStarter Checklist For PAYE GOV UKStarter Checklist For PAYE GOV UKStarter Checklist For PAYE GOV UK and click Obtain Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature with the Sign feature, which takes seconds and holds the same legal validity as a traditional ink signature.

- Review the details and click on the Finish button to save your changes.

- Choose how you would like to share your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate worries about missing or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Starter ChecklistStarter Checklist For PAYE GOV UKStarter Checklist For PAYE GOV UKStarter Checklist For PAYE GOV UK to ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct starter checkliststarter checklist for paye govukstarter checklist for paye govukstarter checklist for paye govuk

Create this form in 5 minutes!

How to create an eSignature for the starter checkliststarter checklist for paye govukstarter checklist for paye govukstarter checklist for paye govuk

The way to create an electronic signature for your PDF document online

The way to create an electronic signature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

The best way to make an electronic signature right from your smart phone

The best way to create an electronic signature for a PDF document on iOS

The best way to make an electronic signature for a PDF on Android OS

People also ask

-

What is the HMRC starter checklist?

The HMRC starter checklist is a vital tool for new employees, helping them to provide necessary information to their employers for tax purposes. By following the checklist, businesses can ensure they comply with HMRC regulations, reducing the risk of errors in payroll processing.

-

How does airSlate SignNow assist with the HMRC starter checklist?

airSlate SignNow simplifies the process of collecting and managing the HMRC starter checklist by allowing businesses to send and eSign documents electronically. This ensures that all necessary information is securely collected, signed, and stored, making compliance easier and more efficient.

-

Is there a cost associated with using airSlate SignNow for the HMRC starter checklist?

Yes, airSlate SignNow offers various pricing plans to cater to different business needs. The cost-effectiveness of our solution emphasizes its value, especially when managing important documents like the HMRC starter checklist within a streamlined digital environment.

-

What features does airSlate SignNow offer for managing the HMRC starter checklist?

airSlate SignNow features an intuitive eSignature platform that allows businesses to create, send, and track documents such as the HMRC starter checklist quickly. Additionally, it provides templates and integrations that enhance productivity and ensure that the document workflow remains seamless.

-

Can airSlate SignNow integrate with other tools for handling the HMRC starter checklist?

Absolutely! airSlate SignNow integrates seamlessly with various applications, including HR and payroll systems. This connectivity ensures that the HMRC starter checklist data is easily transferred and managed within your existing workflows, enhancing overall efficiency.

-

What benefits does using airSlate SignNow for the HMRC starter checklist provide?

Using airSlate SignNow for the HMRC starter checklist enhances compliance by ensuring that all documentation is collected promptly and securely. Moreover, it streamlines the onboarding process for new employees, saving time and reducing administrative burdens for HR teams.

-

How secure is the information collected on the HMRC starter checklist with airSlate SignNow?

Security is a top priority at airSlate SignNow. When collecting information through the HMRC starter checklist, data is encrypted, and access controls are in place to protect sensitive information, ensuring compliance with data protection regulations.

Get more for Starter ChecklistStarter Checklist For PAYE GOV UKStarter Checklist For PAYE GOV UKStarter Checklist For PAYE GOV UK

Find out other Starter ChecklistStarter Checklist For PAYE GOV UKStarter Checklist For PAYE GOV UKStarter Checklist For PAYE GOV UK

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement