Starter Hmrc Fill Out and Sign Printable PDF Template 2020

What is the HM Revenue Starter Checklist?

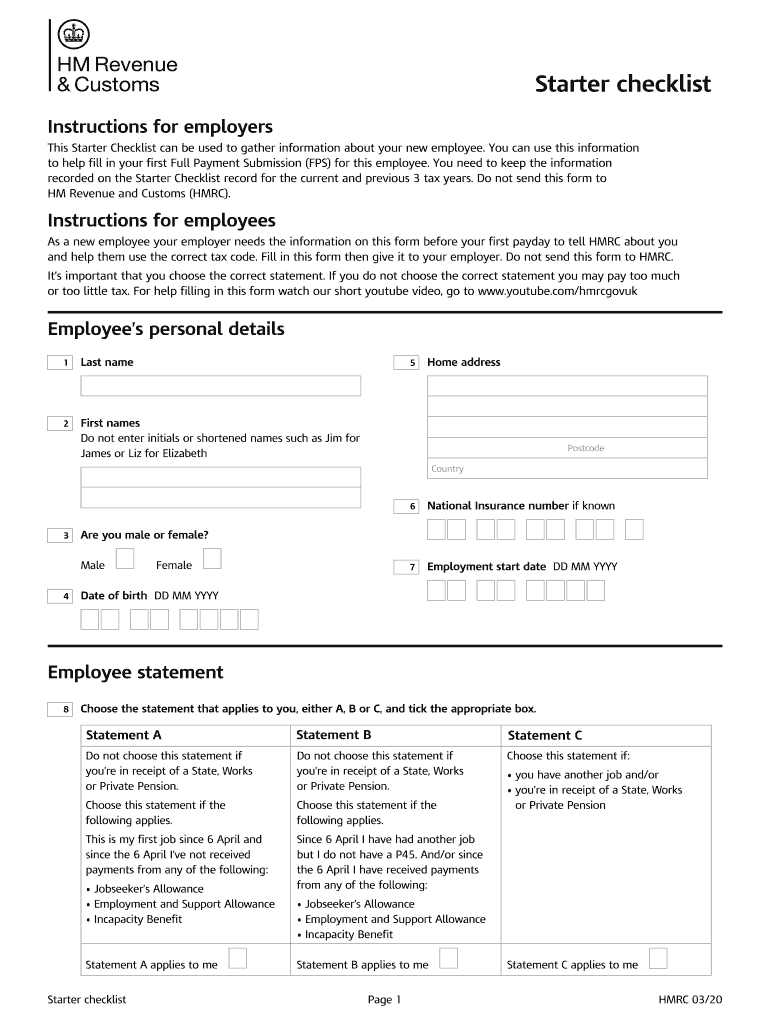

The HM Revenue Starter Checklist is a document used by employers in the United Kingdom to gather essential information from new employees. This form is crucial for ensuring that the correct tax code is applied and that employees are registered correctly with HM Revenue and Customs (HMRC). The checklist includes details such as the employee's name, address, National Insurance number, and previous employment information, which helps to determine the correct tax deductions and contributions. It serves as a vital tool for compliance with PAYE (Pay As You Earn) regulations.

Steps to Complete the HM Revenue Starter Checklist

Completing the HM Revenue Starter Checklist involves several straightforward steps:

- Gather necessary personal information, including the employee's full name, address, and National Insurance number.

- Fill out the sections regarding previous employment and tax codes if applicable.

- Ensure that all information is accurate and up to date to avoid any issues with tax deductions.

- Review the completed checklist for any errors before submission.

- Submit the checklist to HMRC as part of the new employee onboarding process.

Legal Use of the HM Revenue Starter Checklist

The HM Revenue Starter Checklist is legally recognized as a valid document for tax purposes. It must be completed accurately to ensure compliance with tax laws in the UK. Employers are required to keep this information on file and submit it to HMRC as part of their payroll responsibilities. Failure to use the checklist correctly can result in penalties for both the employer and the employee, making it essential to adhere to legal guidelines.

Key Elements of the HM Revenue Starter Checklist

Several key elements must be included in the HM Revenue Starter Checklist to ensure its effectiveness:

- Employee Information: Full name, address, and National Insurance number.

- Previous Employment: Information about any previous jobs and tax codes used.

- Tax Code: The correct tax code must be noted to ensure proper deductions.

- Signature: The employee's signature is required to validate the information provided.

Form Submission Methods

The HM Revenue Starter Checklist can be submitted to HMRC through various methods. Employers may choose to submit it online via the HMRC portal or send a physical copy through the mail. It is essential to ensure that the submission method complies with HMRC guidelines to avoid delays in processing. Keeping a copy of the submitted checklist is advisable for record-keeping purposes.

Examples of Using the HM Revenue Starter Checklist

Employers often use the HM Revenue Starter Checklist during the onboarding process of new employees. For instance, a small business hiring its first employee would utilize the checklist to collect necessary information for tax registration. Similarly, larger organizations may implement the checklist for each new hire to ensure compliance with tax regulations. These examples highlight the checklist's role in facilitating accurate payroll processing and tax compliance.

Quick guide on how to complete starter hmrc fill out and sign printable pdf template

Effortlessly Prepare Starter Hmrc Fill Out And Sign Printable PDF Template on Any Device

The management of online documents has become increasingly popular among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed paperwork, as you can access the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Manage Starter Hmrc Fill Out And Sign Printable PDF Template on any platform with airSlate SignNow's Android or iOS applications and streamline any document-driven process today.

The easiest way to modify and electronically sign Starter Hmrc Fill Out And Sign Printable PDF Template effortlessly

- Obtain Starter Hmrc Fill Out And Sign Printable PDF Template and click Retrieve Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or obscure sensitive data with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Signature tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click the Complete button to save your changes.

- Select your preferred method to deliver your form via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Starter Hmrc Fill Out And Sign Printable PDF Template and maintain excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct starter hmrc fill out and sign printable pdf template

Create this form in 5 minutes!

How to create an eSignature for the starter hmrc fill out and sign printable pdf template

The way to generate an electronic signature for a PDF file in the online mode

The way to generate an electronic signature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

The best way to create an electronic signature right from your smartphone

The best way to make an eSignature for a PDF file on iOS devices

The best way to create an electronic signature for a PDF on Android

People also ask

-

What is the HM Revenue Starter Checklist?

The HM Revenue Starter Checklist is a vital tool designed to help businesses understand their tax obligations. By using the airSlate SignNow platform, you can easily prepare and sign necessary documents, ensuring compliance with HM Revenue requirements.

-

How can airSlate SignNow help with the HM Revenue Starter Checklist?

airSlate SignNow streamlines the process of completing the HM Revenue Starter Checklist by allowing users to digitally sign and send required documents. This not only saves time but also enhances accuracy and accountability in document management.

-

Is there a cost associated with using the HM Revenue Starter Checklist on airSlate SignNow?

Using the HM Revenue Starter Checklist within airSlate SignNow is part of our affordable pricing plans. We offer different subscription tiers that cater to various business sizes and needs, ensuring you get the best value for your investment.

-

What features does airSlate SignNow offer for handling the HM Revenue Starter Checklist?

airSlate SignNow offers features such as customizable templates, secure eSigning, and automated workflows which simplify the management of the HM Revenue Starter Checklist. These tools enhance efficiency and help you keep track of important deadlines.

-

Can I integrate airSlate SignNow with other applications while managing the HM Revenue Starter Checklist?

Yes, airSlate SignNow offers seamless integrations with various applications, enabling you to manage the HM Revenue Starter Checklist alongside your existing tools. This integration ensures a smooth workflow and improved productivity for your business.

-

What are the benefits of using airSlate SignNow for the HM Revenue Starter Checklist?

By using airSlate SignNow for the HM Revenue Starter Checklist, you benefit from reduced paper usage, faster processing times, and enhanced security for your documents. These advantages help streamline your business processes while maintaining compliance.

-

Is airSlate SignNow secure for handling sensitive documents related to the HM Revenue Starter Checklist?

Absolutely! airSlate SignNow prioritizes security, utilizing advanced encryption and secure cloud storage for all documents, including those related to the HM Revenue Starter Checklist. Your sensitive information is protected, giving you peace of mind.

Get more for Starter Hmrc Fill Out And Sign Printable PDF Template

- Security contractor package wisconsin form

- Insulation contractor package wisconsin form

- Paving contractor package wisconsin form

- Site work contractor package wisconsin form

- Siding contractor package wisconsin form

- Refrigeration contractor package wisconsin form

- Drainage contractor package wisconsin form

- Tax free exchange package wisconsin form

Find out other Starter Hmrc Fill Out And Sign Printable PDF Template

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document