Arkansas Tax Forms and Instructions for Income Tax Pro

Understanding the Arkansas Tax AR3 Form

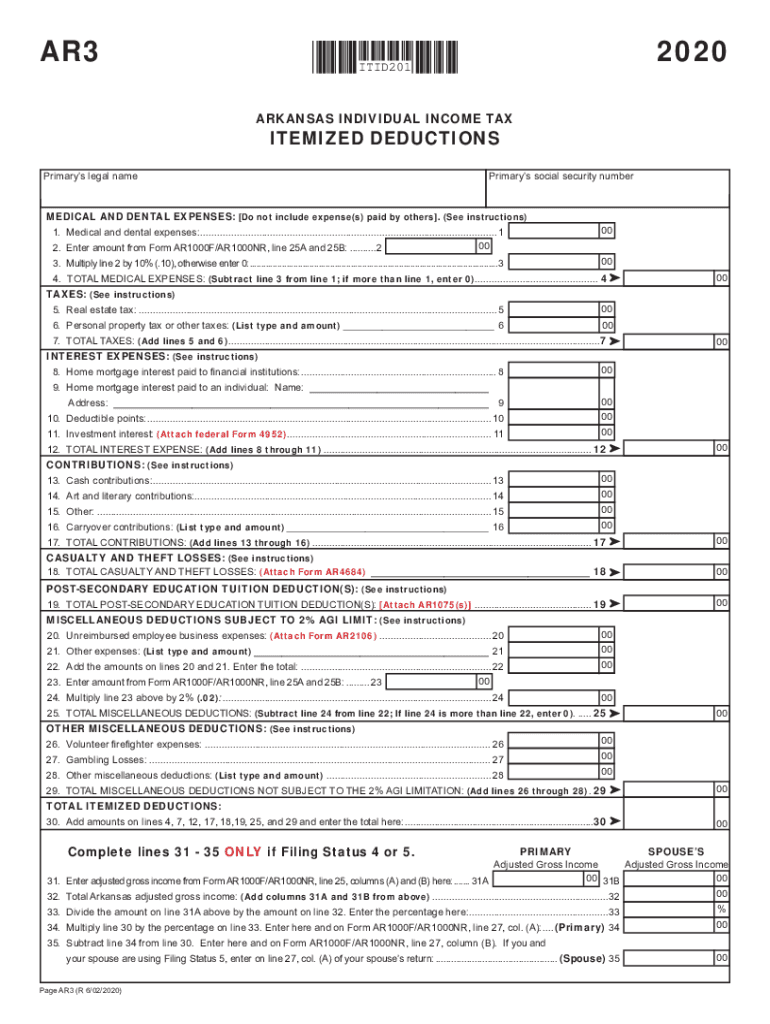

The Arkansas Tax AR3 form is essential for individuals who wish to claim itemized deductions on their state income tax returns. This form allows taxpayers to report various deductible expenses, which can significantly reduce their taxable income. Understanding the specifics of the AR3 form is crucial for ensuring accurate and compliant tax filings.

Key components of the AR3 form include personal information, a breakdown of itemized deductions such as medical expenses, state and local taxes, mortgage interest, and charitable contributions. Each section must be filled out carefully to reflect the taxpayer's financial situation accurately.

Steps to Complete the Arkansas Tax AR3 Form

Completing the Arkansas Tax AR3 form involves several detailed steps. First, gather all necessary documentation, including receipts and statements related to deductible expenses. This preparation is vital for ensuring that all entries on the form are accurate and substantiated.

Next, begin filling out the form by entering personal information, including your name, address, and Social Security number. Follow this by detailing each deductible expense in the appropriate sections. It is important to double-check all figures and ensure that they align with the supporting documents.

After completing the form, review it thoroughly for any errors or omissions. Finally, sign and date the form before submission, either electronically or by mail, depending on your preference.

Legal Use of the Arkansas Tax AR3 Form

The Arkansas Tax AR3 form holds legal significance as it is used to claim itemized deductions for state income tax purposes. To ensure that the form is legally binding, it must be completed accurately and submitted in accordance with state regulations.

Using a reliable electronic signature solution, such as signNow, can enhance the legitimacy of your submission. Compliance with eSignature laws, including ESIGN and UETA, ensures that your electronically signed document is recognized as valid by state authorities.

Filing Deadlines for the Arkansas Tax AR3 Form

Timely filing of the Arkansas Tax AR3 form is crucial to avoid penalties and interest on unpaid taxes. Typically, the deadline for submitting this form aligns with the federal income tax filing deadline, which is usually April 15. However, taxpayers should verify specific dates each year, as they may vary based on weekends or holidays.

If additional time is needed, taxpayers can file for an extension, which allows for an extended deadline. It is important to note that an extension to file does not extend the time to pay any taxes owed.

Required Documents for the Arkansas Tax AR3 Form

When preparing to complete the Arkansas Tax AR3 form, several documents are necessary to substantiate the itemized deductions claimed. These documents typically include:

- Receipts for medical expenses

- Statements for state and local taxes paid

- Mortgage interest statements (Form 1098)

- Charitable contribution receipts

- Any other relevant financial documentation

Having these documents organized and readily available will facilitate a smoother filing process and help ensure that all deductions are accurately reported.

Form Submission Methods for the Arkansas Tax AR3

The Arkansas Tax AR3 form can be submitted through various methods, providing flexibility for taxpayers. The primary submission options include:

- Online submission through the Arkansas Department of Finance and Administration's website

- Mailing a physical copy of the completed form to the appropriate state address

- In-person submission at designated state tax offices

Choosing the right submission method depends on individual preferences and circumstances, including the need for immediate confirmation of receipt.

Quick guide on how to complete arkansas tax forms and instructions for income tax pro

Complete Arkansas Tax Forms And Instructions For Income Tax Pro effortlessly on any gadget

Web-based document administration has become increasingly favored by companies and individuals alike. It offers an ideal environmentally-friendly substitute for traditional printed and signed papers, as you can obtain the right format and securely save it online. airSlate SignNow provides you with all the resources necessary to generate, modify, and eSign your documents rapidly without any holdups. Manage Arkansas Tax Forms And Instructions For Income Tax Pro on any device using airSlate SignNow Android or iOS applications and enhance any document-focused process today.

The simplest method to alter and eSign Arkansas Tax Forms And Instructions For Income Tax Pro with ease

- Find Arkansas Tax Forms And Instructions For Income Tax Pro and click on Get Form to begin.

- Make use of the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Generate your eSignature with the Sign feature, which takes moments and carries the same legal standing as a conventional wet ink signature.

- Review all the details and click on the Done button to preserve your modifications.

- Choose how you prefer to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document versions. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Alter and eSign Arkansas Tax Forms And Instructions For Income Tax Pro to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the arkansas tax forms and instructions for income tax pro

The best way to generate an e-signature for a PDF file in the online mode

The best way to generate an e-signature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

How to create an e-signature from your smartphone

How to create an e-signature for a PDF file on iOS devices

How to create an e-signature for a PDF file on Android

People also ask

-

What is the Arkansas tax AR3 form?

The Arkansas tax AR3 form is a required document for businesses in Arkansas to report their income tax liabilities. Properly filling out this form helps ensure compliance with state tax regulations. By using airSlate SignNow, you can easily complete and eSign the Arkansas tax AR3 to streamline your tax filing process.

-

How does airSlate SignNow simplify the Arkansas tax AR3 process?

airSlate SignNow provides an easy-to-use platform for electronically signing and submitting the Arkansas tax AR3 form. With features that allow real-time collaboration and document tracking, businesses can ensure their tax documents are complete and submitted on time. This makes managing your Arkansas tax AR3 much more efficient.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers a variety of pricing plans to cater to the needs of different businesses. You can choose from monthly or annual subscriptions that provide access to essential features, including those necessary for handling the Arkansas tax AR3. This affordable solution ensures you get value while managing your tax responsibilities.

-

Can I integrate airSlate SignNow with my accounting software for Arkansas tax AR3?

Yes, airSlate SignNow seamlessly integrates with various accounting software applications. This allows you to import necessary tax data directly into your Arkansas tax AR3 form, reducing the likelihood of errors and saving time on manual entries. The integrations enhance your overall tax management workflow.

-

What benefits does airSlate SignNow offer for filing the Arkansas tax AR3?

AirSlate SignNow offers numerous benefits for filing the Arkansas tax AR3, including time-saving electronic signatures and easy document sharing. Its user-friendly interface simplifies the process, while built-in security features protect your sensitive tax information. This comprehensive solution helps you manage your compliance efficiently.

-

Is airSlate SignNow secure for handling tax documents like the Arkansas tax AR3?

Absolutely! airSlate SignNow prioritizes the security of your documents, including the Arkansas tax AR3. With encryption, secure access controls, and audit trails, you can trust that your sensitive tax information is protected throughout the signing and submission process.

-

How can I ensure my Arkansas tax AR3 is filed accurately?

To ensure accuracy when filing the Arkansas tax AR3, use airSlate SignNow’s pre-built templates and guided workflows. These features help you complete the necessary fields correctly while providing prompts for essential information. Additionally, always double-check your calculations or consult with a tax professional.

Get more for Arkansas Tax Forms And Instructions For Income Tax Pro

- Ak will form

- Legal last will and testament form for divorced person not remarried with adult and minor children alaska

- Mutual wills package with last wills and testaments for married couple with adult children alaska form

- Mutual wills package with last wills and testaments for married couple with no children alaska form

- Mutual wills package with last wills and testaments for married couple with minor children alaska form

- Legal last will and testament form for married person with adult and minor children from prior marriage alaska

- Legal last will and testament form for married person with adult and minor children alaska

- Mutual wills package with last wills and testaments for married couple with adult and minor children alaska form

Find out other Arkansas Tax Forms And Instructions For Income Tax Pro

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF