Maintaining Your Retirement Plan Records IRS Tax Forms 2021-2026

What is the Maintaining Your Retirement Plan Records IRS Tax Forms

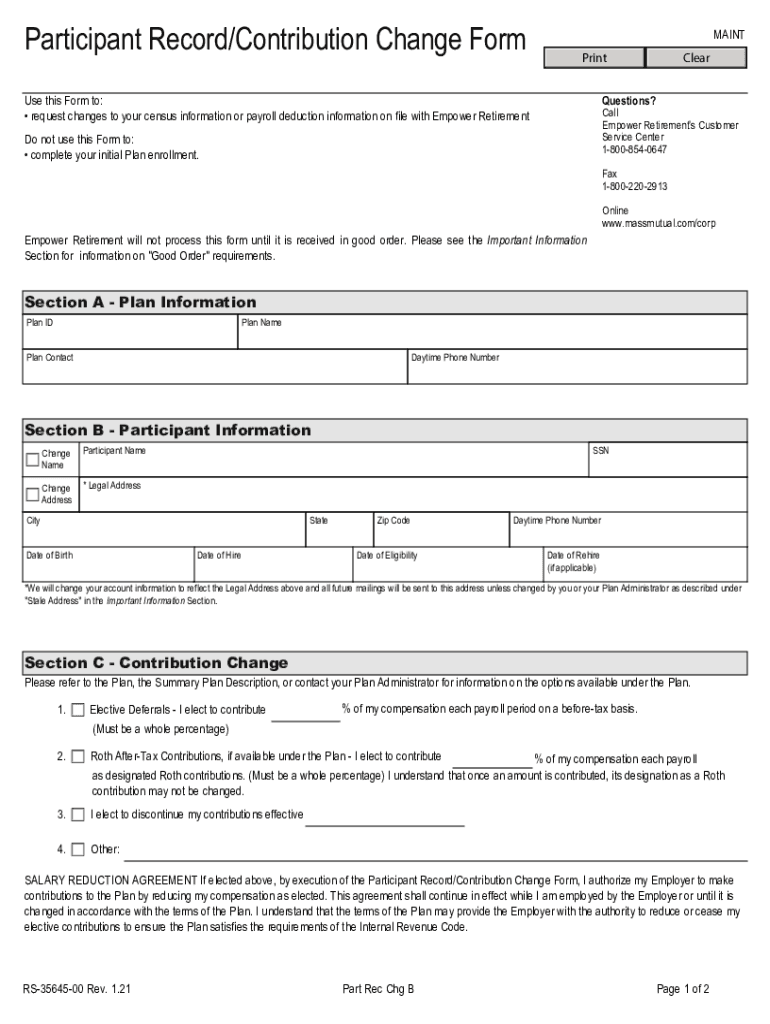

The Maintaining Your Retirement Plan Records IRS Tax Forms are essential documents that help individuals and businesses keep track of their retirement plan contributions and distributions. These forms ensure compliance with IRS regulations and provide a clear record for tax reporting purposes. They typically include information about contributions made to retirement accounts, distributions taken, and any loans against the plan. Proper maintenance of these records is crucial for avoiding penalties and ensuring that retirement funds are managed effectively.

Steps to complete the Maintaining Your Retirement Plan Records IRS Tax Forms

Completing the Maintaining Your Retirement Plan Records IRS Tax Forms involves several key steps:

- Gather all relevant documents, including past tax returns, contribution records, and statements from your retirement plan provider.

- Fill out the required sections of the form accurately, ensuring that all personal and financial information is correct.

- Review the completed form for any errors or omissions before submission.

- Sign and date the form to validate it, ensuring that you comply with eSignature laws if submitting electronically.

- Submit the form according to IRS guidelines, whether online, by mail, or in person, depending on the specific requirements.

Legal use of the Maintaining Your Retirement Plan Records IRS Tax Forms

The legal use of the Maintaining Your Retirement Plan Records IRS Tax Forms is governed by several regulations. These forms must be filled out accurately and submitted on time to avoid penalties. When using digital signatures, it is important to select a compliant eSignature solution that adheres to the ESIGN and UETA acts. This ensures that your electronically signed documents are legally binding and recognized by the IRS. Keeping these records secure and accessible is also vital for legal protection and compliance.

IRS Guidelines

The IRS provides specific guidelines regarding the Maintaining Your Retirement Plan Records IRS Tax Forms. These guidelines outline the necessary information to include, the deadlines for submission, and the consequences of non-compliance. It is important to stay informed about any updates to these guidelines, as they can change annually. Following the IRS guidelines helps ensure that your retirement plan records are accurate and that you remain in good standing with tax regulations.

Filing Deadlines / Important Dates

Filing deadlines for the Maintaining Your Retirement Plan Records IRS Tax Forms are crucial for compliance. Typically, these forms must be submitted by specific dates each year, coinciding with the tax filing deadline for individuals and businesses. It is important to mark these dates on your calendar to avoid late submissions, which can result in penalties. Additionally, keep an eye on any announcements from the IRS regarding changes to these deadlines, especially during tax season.

Required Documents

When completing the Maintaining Your Retirement Plan Records IRS Tax Forms, several required documents must be gathered. These may include:

- Previous years' tax returns

- Statements from your retirement accounts

- Records of contributions made to the retirement plan

- Documentation of any distributions or loans taken

Having these documents on hand will streamline the process and ensure that all necessary information is accurately reported.

Quick guide on how to complete maintaining your retirement plan records irs tax forms

Effortlessly Prepare Maintaining Your Retirement Plan Records IRS Tax Forms on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the appropriate forms and securely store them online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and efficiently. Manage Maintaining Your Retirement Plan Records IRS Tax Forms on any platform with airSlate SignNow's Android or iOS applications and simplify your document-related processes today.

Easily Modify and eSign Maintaining Your Retirement Plan Records IRS Tax Forms Without Stress

- Find Maintaining Your Retirement Plan Records IRS Tax Forms and click on Get Form to begin.

- Utilize the tools available to fill out your form.

- Highlight important sections of your documents or redact sensitive information using tools specifically designed by airSlate SignNow for this purpose.

- Create your signature with the Sign tool, which takes only seconds and holds the same legal validity as a traditional ink signature.

- Review all information carefully and click on the Done button to save your changes.

- Select your preferred delivery method for your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs with just a few clicks from your chosen device. Modify and eSign Maintaining Your Retirement Plan Records IRS Tax Forms while ensuring excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct maintaining your retirement plan records irs tax forms

Create this form in 5 minutes!

How to create an eSignature for the maintaining your retirement plan records irs tax forms

The best way to make an e-signature for your PDF file online

The best way to make an e-signature for your PDF file in Google Chrome

The way to make an e-signature for signing PDFs in Gmail

How to generate an electronic signature from your mobile device

How to make an electronic signature for a PDF file on iOS

How to generate an electronic signature for a PDF file on Android devices

People also ask

-

What are the best practices for Maintaining Your Retirement Plan Records IRS Tax Forms?

To effectively manage your retirement plan records for IRS tax forms, start by keeping all relevant documents organized in one secure location. Utilize a digital solution like airSlate SignNow for eSigning and archiving important forms, ensuring compliance with IRS requirements while simplifying access to your records.

-

How can airSlate SignNow help with Maintaining Your Retirement Plan Records IRS Tax Forms?

airSlate SignNow provides an intuitive platform for sending and signing documents, making it easy to manage your retirement plan records. By utilizing its features, you can efficiently gather signatures on IRS tax forms and store them securely, which is crucial for accurate record-keeping.

-

What features does airSlate SignNow offer for Managing IRS Tax Forms related to retirement plans?

airSlate SignNow includes electronic signatures, document templates, and secure cloud storage, all of which are essential for Maintaining Your Retirement Plan Records IRS Tax Forms. These features help streamline the signing process and ensure your tax documents are organized and easily retrievable.

-

Is airSlate SignNow cost-effective for maintaining IRS Tax Forms?

Yes, airSlate SignNow is designed to be a cost-effective solution, allowing businesses to manage their documents without excessive expenses. Investing in this platform can lead to long-term savings by reducing printing and storage costs associated with Maintaining Your Retirement Plan Records IRS Tax Forms.

-

Can airSlate SignNow integrate with other software for tracking retirement plan documents?

Absolutely! airSlate SignNow offers integrations with popular accounting and project management tools that can enhance your ability to manage IRS tax forms. This capability helps streamline the process of Maintaining Your Retirement Plan Records IRS Tax Forms across multiple platforms.

-

How secure is airSlate SignNow for handling IRS Tax Forms related to retirement plans?

Security is a top priority for airSlate SignNow, which employs advanced encryption and compliance features to protect your documents. When Maintaining Your Retirement Plan Records IRS Tax Forms, you can trust that your sensitive information is safeguarded against unauthorized access.

-

What support resources are available for using airSlate SignNow for tax form management?

airSlate SignNow offers extensive support resources, including tutorials, customer service, and an extensive knowledge base. These resources ensure you have the guidance needed for Maintaining Your Retirement Plan Records IRS Tax Forms effectively.

Get more for Maintaining Your Retirement Plan Records IRS Tax Forms

- Mc 311 claim on seized property and objection to forfeiture form

- Mc 98 statement of grievance and response regarding e filing access plan form

- Title 12civil procedure 2006 oklahoma code oklahoma code form

- Procedures for filing a petition to close a safe deposit box form

- Physicians affidavit note this affidavit will be used in a legal form

- Emergency denied form

- Misdemeanor convictions form

- Unmade template for pinellas county clerk form

Find out other Maintaining Your Retirement Plan Records IRS Tax Forms

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document