ST-3 Resale Certificate 2021

What is the ST-3 Resale Certificate

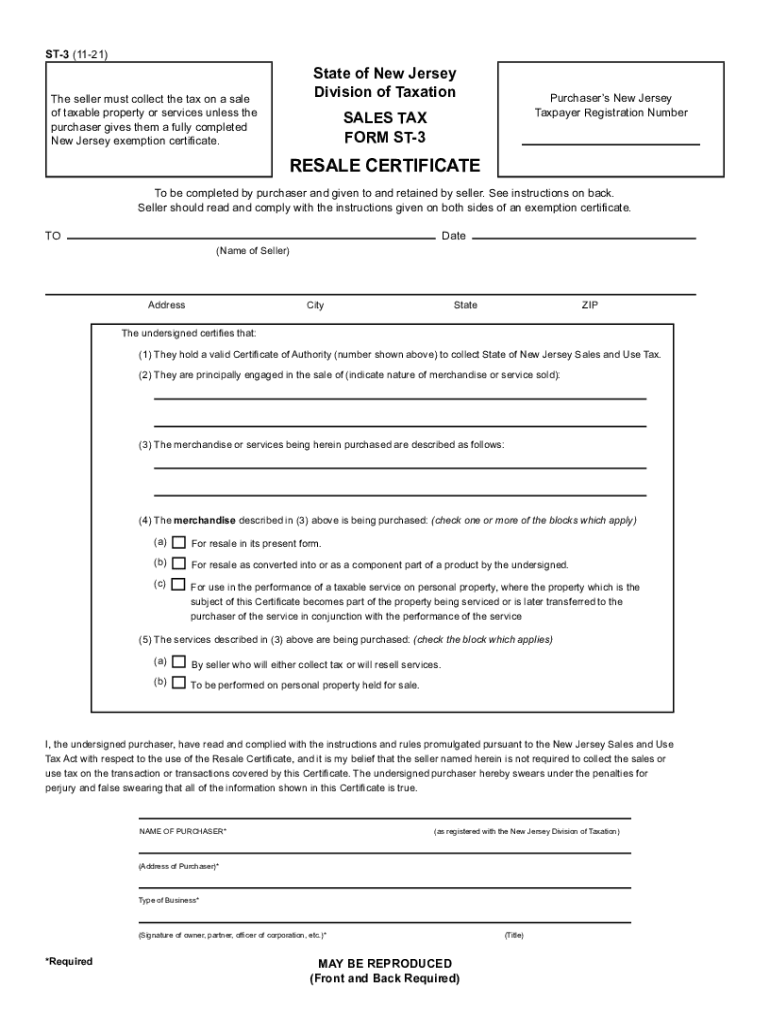

The ST-3 Resale Certificate is a crucial document used in New Jersey for tax purposes. It allows businesses to purchase goods without paying sales tax, provided those goods are intended for resale. This certificate is essential for retailers and wholesalers who wish to avoid the additional tax burden on inventory that will eventually be sold to consumers. By utilizing the ST-3, businesses can streamline their purchasing process and maintain compliance with state tax regulations.

How to use the ST-3 Resale Certificate

To effectively use the ST-3 Resale Certificate, businesses must present it to their suppliers at the time of purchase. The certificate should be filled out completely, including the seller's name, address, and the nature of the goods being purchased. It is important to ensure that the certificate is signed by an authorized representative of the purchasing entity. This process helps to establish that the items acquired are for resale and not for personal use, thereby exempting the transaction from sales tax.

Steps to complete the ST-3 Resale Certificate

Completing the ST-3 Resale Certificate involves several key steps:

- Obtain the ST-3 form from the New Jersey Division of Taxation or authorized sources.

- Fill in the purchaser's name, address, and sales tax identification number.

- Provide details about the seller, including their name and address.

- Describe the type of property being purchased for resale.

- Sign and date the certificate to validate it.

Once completed, the ST-3 should be presented to the seller during the transaction.

Key elements of the ST-3 Resale Certificate

The ST-3 Resale Certificate includes several key elements that ensure its validity and effectiveness:

- Purchaser Information: Name, address, and sales tax identification number of the buyer.

- Seller Information: Name and address of the seller providing the goods.

- Description of Goods: A clear description of the items being purchased for resale.

- Signature: An authorized signature from the purchaser, confirming the accuracy of the information provided.

Legal use of the ST-3 Resale Certificate

The legal use of the ST-3 Resale Certificate is governed by New Jersey state tax laws. To be valid, the certificate must be used solely for purchases intended for resale. Misuse of the certificate, such as using it for personal purchases, can lead to penalties and fines. It is essential for businesses to maintain accurate records of transactions involving the ST-3 to ensure compliance and avoid any legal issues.

Eligibility Criteria

Eligibility to use the ST-3 Resale Certificate typically requires the purchaser to be a registered business entity in New Jersey. This includes various business structures such as sole proprietorships, partnerships, LLCs, and corporations. Additionally, the goods purchased must be intended for resale in the regular course of business. It is vital for businesses to verify their eligibility before utilizing the ST-3 to ensure compliance with state regulations.

Quick guide on how to complete form st 3nr resale certificate for non new jersey sellersstate of nj government of new jerseystate of nj government of new

Effortlessly Prepare ST-3 Resale Certificate on Any Device

The management of online documents has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents quickly without delays. Manage ST-3 Resale Certificate on any device with the airSlate SignNow apps for Android or iOS and enhance any document-centric process today.

Easily Modify and Electronically Sign ST-3 Resale Certificate

- Find ST-3 Resale Certificate and click Get Form to begin.

- Use the tools available to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with the tools provided by airSlate SignNow specifically for this purpose.

- Create your signature with the Sign tool, which takes just seconds and carries the same legal significance as a traditional hand-written signature.

- Review the information carefully and click the Done button to save your modifications.

- Choose how you would like to send your form, via email, SMS, invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new copies of documents. airSlate SignNow addresses your needs in document management in just a few clicks from your chosen device. Modify and electronically sign ST-3 Resale Certificate and ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form st 3nr resale certificate for non new jersey sellersstate of nj government of new jerseystate of nj government of new

Create this form in 5 minutes!

How to create an eSignature for the form st 3nr resale certificate for non new jersey sellersstate of nj government of new jerseystate of nj government of new

The way to generate an electronic signature for your PDF file online

The way to generate an electronic signature for your PDF file in Google Chrome

The way to make an e-signature for signing PDFs in Gmail

The best way to create an electronic signature from your mobile device

The best way to make an electronic signature for a PDF file on iOS

The best way to create an electronic signature for a PDF file on Android devices

People also ask

-

What is the st3 form nj and why is it important?

The st3 form nj is a Sales Tax Exempt Certificate used in New Jersey. It is important for businesses that are purchasing goods without sales tax, allowing them to save money on eligible products. Understanding how to properly fill out and submit the st3 form nj is crucial for compliance and efficiency in financial transactions.

-

How can airSlate SignNow assist with the st3 form nj?

airSlate SignNow can streamline the process of completing and eSigning the st3 form nj by providing easy-to-use digital tools. You can quickly fill out the form, ensure accuracy, and securely sign it electronically, helping your business save time and reduce paperwork. This simplifies the management of essential documents like the st3 form nj.

-

Is airSlate SignNow cost-effective for managing the st3 form nj?

Yes, airSlate SignNow offers cost-effective solutions for managing the st3 form nj and other documents. With various pricing plans, businesses can choose one that fits their budget while benefiting from features that expedite document processing. This makes managing forms like the st3 form nj affordable and efficient.

-

What features does airSlate SignNow provide for handling the st3 form nj?

airSlate SignNow provides a range of features, including customizable templates, secure eSigning, and automated workflows that enhance the handling of the st3 form nj. You can track the status of the form in real-time and access it from anywhere, ensuring seamless completion and compliance. These features help streamline your document management process.

-

Are there any integrations available for the st3 form nj with airSlate SignNow?

Yes, airSlate SignNow integrates with various applications to enhance the process of managing the st3 form nj. Whether you use CRM systems, accounting software, or cloud storage solutions, these integrations allow for a cohesive document management experience. By connecting your tools, you can make the paperwork related to the st3 form nj even more efficient.

-

How does eSigning the st3 form nj improve business efficiency?

eSigning the st3 form nj with airSlate SignNow accelerates the approval process, allowing businesses to finalize purchases without delays. This electronic method eliminates the need for physical signatures, reducing the time spent on manual paperwork. With quicker access and processing, businesses can operate more efficiently while ensuring compliance.

-

What benefits can businesses expect from using airSlate SignNow for the st3 form nj?

Businesses using airSlate SignNow for the st3 form nj can expect enhanced efficiency, reduced costs, and improved compliance. The platform's simplified digital processes help eliminate errors and expedite the completion of necessary forms. These benefits contribute to smoother business operations and better financial management.

Get more for ST-3 Resale Certificate

- Excavation contractor package alabama form

- Renovation contractor package alabama form

- Concrete mason contractor package alabama form

- Demolition contractor package alabama form

- Security contractor package alabama form

- Insulation contractor package alabama form

- Paving contractor package alabama form

- Site work contractor package alabama form

Find out other ST-3 Resale Certificate

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation