Form TP 584 I Instructions for Form TP 584 Combined Real Estate Transfer Tax Return, Credit Line Mortgage Certificate, and Certi 2021-2026

Understanding the TP 584 Instructions

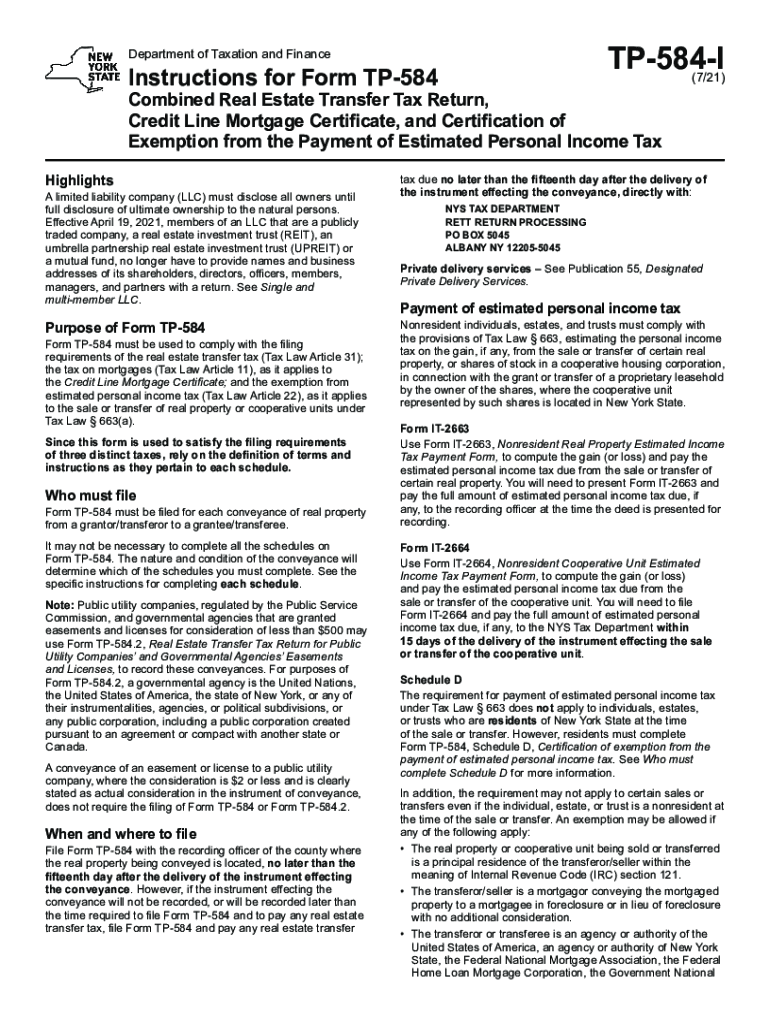

The TP 584 instructions guide users through the process of completing the Combined Real Estate Transfer Tax Return, Credit Line Mortgage Certificate, and Certification of Exemption from the Payment of Estimated Personal Income Tax. This form is essential for individuals and entities involved in real estate transactions in New York State. It ensures compliance with local tax regulations while facilitating the transfer of property ownership.

Steps to Complete the TP 584 Instructions

Completing the TP 584 requires careful attention to detail. Follow these steps to ensure accurate submission:

- Gather necessary information, including property details, buyer and seller information, and tax identification numbers.

- Fill out each section of the form accurately, ensuring that all required fields are completed.

- Review the form for errors or omissions before submission.

- Sign and date the form where indicated.

- Submit the completed form to the appropriate local tax authority.

Legal Use of the TP 584 Instructions

The TP 584 instructions are legally binding when completed correctly. They provide a framework for reporting real estate transactions and ensuring compliance with New York State tax laws. Proper execution of this form can prevent legal complications and financial penalties associated with non-compliance.

Key Elements of the TP 584 Instructions

Understanding the key elements of the TP 584 instructions is crucial for successful completion. Important components include:

- Property Information: Details about the property being transferred, including address and tax identification number.

- Buyer and Seller Information: Names, addresses, and tax identification numbers of all parties involved in the transaction.

- Tax Exemptions: Information regarding any exemptions that may apply to the transaction.

- Signature Requirements: Necessary signatures from all parties to validate the form.

Obtaining the TP 584 Instructions

The TP 584 instructions can be obtained through various channels. They are available on the New York State Department of Taxation and Finance website, where users can download the latest version. Additionally, local tax offices may provide printed copies upon request, ensuring that users have access to the most current information.

Filing Deadlines for the TP 584 Instructions

Timely submission of the TP 584 is essential to avoid penalties. The filing deadline typically aligns with the date of the real estate transaction. It is advisable to check with local tax authorities for specific deadlines, as they may vary based on the type of transaction or jurisdiction.

Quick guide on how to complete form tp 584 i instructions for form tp 584 combined real estate transfer tax return credit line mortgage certificate and

Complete Form TP 584 I Instructions For Form TP 584 Combined Real Estate Transfer Tax Return, Credit Line Mortgage Certificate, And Certi effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed documents and signatures, allowing you to access the required form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Form TP 584 I Instructions For Form TP 584 Combined Real Estate Transfer Tax Return, Credit Line Mortgage Certificate, And Certi on any platform with the airSlate SignNow Android or iOS applications and streamline any document-related tasks today.

The most efficient way to adjust and eSign Form TP 584 I Instructions For Form TP 584 Combined Real Estate Transfer Tax Return, Credit Line Mortgage Certificate, And Certi with ease

- Obtain Form TP 584 I Instructions For Form TP 584 Combined Real Estate Transfer Tax Return, Credit Line Mortgage Certificate, And Certi and click on Get Form to begin.

- Utilize the available tools to fill out your form.

- Select relevant sections of the documents or redact sensitive information using features specifically offered by airSlate SignNow for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all details and click the Done button to finalize your modifications.

- Choose how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow caters to all your document management needs in just a few clicks from your chosen device. Modify and eSign Form TP 584 I Instructions For Form TP 584 Combined Real Estate Transfer Tax Return, Credit Line Mortgage Certificate, And Certi and ensure effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form tp 584 i instructions for form tp 584 combined real estate transfer tax return credit line mortgage certificate and

Create this form in 5 minutes!

How to create an eSignature for the form tp 584 i instructions for form tp 584 combined real estate transfer tax return credit line mortgage certificate and

The way to generate an e-signature for a PDF in the online mode

The way to generate an e-signature for a PDF in Chrome

How to create an e-signature for putting it on PDFs in Gmail

The best way to generate an e-signature right from your smart phone

The way to create an e-signature for a PDF on iOS devices

The best way to generate an e-signature for a PDF on Android OS

People also ask

-

What are tp 584 instructions?

The tp 584 instructions detail the process required for completing the TP-584 form, which is essential for recording real estate documents in New York. Understanding these instructions is crucial for ensuring compliance and preventing delays in the property transaction process.

-

How can airSlate SignNow help with tp 584 instructions?

airSlate SignNow simplifies the completion and signing of documents, including those requiring tp 584 instructions. By using our platform, you can easily upload, fill out, and eSign the necessary forms, reducing the time and hassle associated with manual processes.

-

What features does airSlate SignNow offer for handling tp 584 instructions?

Our platform offers features such as document templates, automated workflows, and secure eSigning to streamline the process tied to tp 584 instructions. These tools help ensure accuracy and efficiency, ultimately leading to smoother transactions.

-

Is there a free trial available for airSlate SignNow when working with tp 584 instructions?

Yes, airSlate SignNow provides a free trial that allows users to explore all features, including those related to tp 584 instructions. This trial period is an excellent opportunity to assess how our solution can improve your document management processes.

-

What are the pricing plans for airSlate SignNow?

airSlate SignNow offers competitive pricing plans tailored to various business needs. Whether you’re a solo entrepreneur or a large organization managing multiple transactions involving tp 584 instructions, we have a plan that suits you.

-

Can I integrate airSlate SignNow with other applications when dealing with tp 584 instructions?

Absolutely! airSlate SignNow seamlessly integrates with various applications, making it easy to manage your documents while following tp 584 instructions. This integration enhances functionality, allowing users to work more efficiently across platforms.

-

What are the benefits of using airSlate SignNow for tp 584 instructions?

Using airSlate SignNow for tp 584 instructions offers numerous benefits, such as increased efficiency, reduced errors, and enhanced security. Our platform helps streamline the document signing process, saving you time and ensuring compliance with legal requirements.

Get more for Form TP 584 I Instructions For Form TP 584 Combined Real Estate Transfer Tax Return, Credit Line Mortgage Certificate, And Certi

Find out other Form TP 584 I Instructions For Form TP 584 Combined Real Estate Transfer Tax Return, Credit Line Mortgage Certificate, And Certi

- How Can I Sign North Dakota Share Transfer Agreement Template

- Sign Oklahoma Debt Settlement Agreement Template Online

- Can I Sign Oklahoma Debt Settlement Agreement Template

- Sign Pennsylvania Share Transfer Agreement Template Now

- Sign Nevada Stock Purchase Agreement Template Later

- Sign Arkansas Indemnity Agreement Template Easy

- Sign Oklahoma Stock Purchase Agreement Template Simple

- Sign South Carolina Stock Purchase Agreement Template Fast

- Sign California Stock Transfer Form Template Online

- How Do I Sign California Stock Transfer Form Template

- How Can I Sign North Carolina Indemnity Agreement Template

- How Do I Sign Delaware Stock Transfer Form Template

- Help Me With Sign Texas Stock Purchase Agreement Template

- Help Me With Sign Nevada Stock Transfer Form Template

- Can I Sign South Carolina Stock Transfer Form Template

- How Can I Sign Michigan Promissory Note Template

- Sign New Mexico Promissory Note Template Now

- Sign Indiana Basketball Registration Form Now

- Sign Iowa Gym Membership Agreement Later

- Can I Sign Michigan Gym Membership Agreement