Homeowners Verification of Property Taxes for Use with Form

Understanding the homeowners verification of property taxes

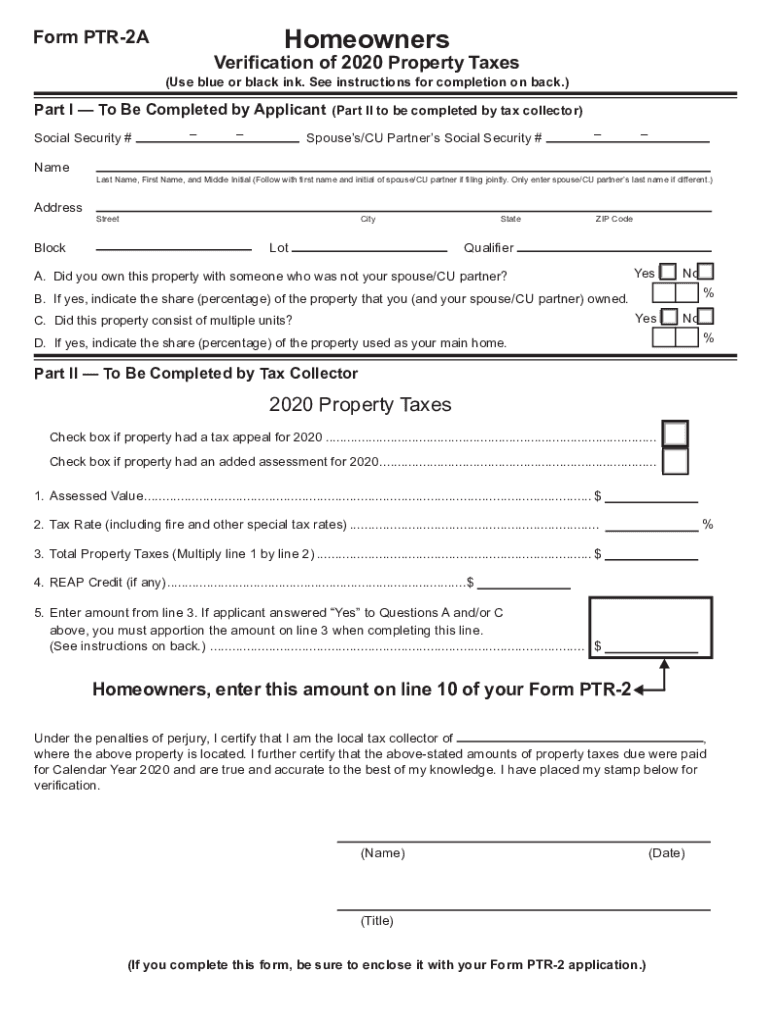

The homeowners verification of property taxes is a crucial document used to confirm the amount of property taxes owed by a homeowner. This form is often required when applying for certain benefits or exemptions, such as property tax relief programs. It provides official verification to local tax authorities, ensuring that the information provided is accurate and up-to-date.

Steps to complete the homeowners verification of property taxes

Completing the homeowners verification of property taxes involves several key steps:

- Gather necessary information, including your property details, tax identification number, and any relevant financial documents.

- Access the homeowners verification form, typically available through your local tax authority's website or office.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the information for accuracy before submission to avoid delays.

- Submit the form electronically or via mail, depending on the options provided by your local authority.

Legal use of the homeowners verification of property taxes

The homeowners verification of property taxes is legally recognized when it meets specific requirements. It must include accurate information about the property and be signed by the homeowner. Compliance with local regulations ensures that the document can be used in legal proceedings or when applying for tax exemptions. Understanding these legal aspects helps homeowners protect their rights and ensure their submissions are valid.

Required documents for the homeowners verification of property taxes

When completing the homeowners verification form, certain documents may be required to support your application. Commonly needed documents include:

- Proof of ownership, such as a deed or title.

- Previous tax statements or receipts.

- Identification documents, like a driver's license or Social Security number.

- Any additional documentation required by your local tax authority.

Who issues the homeowners verification of property taxes

The homeowners verification of property taxes is typically issued by local tax authorities or county assessors. These offices are responsible for maintaining property tax records and ensuring that all homeowners have access to the necessary forms. Homeowners should contact their local office for specific instructions on obtaining and submitting the verification form.

Examples of using the homeowners verification of property taxes

Homeowners may need to use the verification of property taxes in various scenarios, including:

- Applying for property tax exemptions or reductions.

- Submitting documents for mortgage applications.

- Providing proof of tax payments for financial audits.

- Ensuring compliance with local tax regulations during property transfers.

Quick guide on how to complete homeowners verification of 2020 property taxes for use with form

Handle Homeowners Verification Of Property Taxes For Use With Form effortlessly on any device

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly with no delays. Manage Homeowners Verification Of Property Taxes For Use With Form across any platform using airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign Homeowners Verification Of Property Taxes For Use With Form seamlessly

- Locate Homeowners Verification Of Property Taxes For Use With Form and click on Get Form to initiate.

- Utilize the provided tools to complete your form.

- Highlight important sections of your documents or redact sensitive information with the tools specifically offered by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to submit your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and eSign Homeowners Verification Of Property Taxes For Use With Form to ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the homeowners verification of 2020 property taxes for use with form

The way to make an electronic signature for your PDF file online

The way to make an electronic signature for your PDF file in Google Chrome

The best way to make an e-signature for signing PDFs in Gmail

The best way to make an e-signature right from your mobile device

The way to generate an electronic signature for a PDF file on iOS

The best way to make an e-signature for a PDF on Android devices

People also ask

-

What is ptr 2a verification?

PTR 2A verification is a process that ensures compliance with regulatory standards for electronic signatures. It verifies the authenticity and integrity of documents signed electronically, helping businesses maintain trust in their agreements and prevent fraud.

-

How does airSlate SignNow facilitate ptr 2a verification?

AirSlate SignNow incorporates robust security features to streamline the ptr 2a verification process. Our platform provides secure electronic signatures and authentication methods that meet regulatory requirements, ensuring your documents are legally binding.

-

What are the benefits of using airSlate SignNow for ptr 2a verification?

Using airSlate SignNow for ptr 2a verification offers several advantages, including enhanced security, streamlined workflows, and increased efficiency. Your business can save time and reduce errors associated with manual processes while ensuring compliance with legal standards.

-

Is there a cost associated with ptr 2a verification in airSlate SignNow?

AirSlate SignNow offers competitive pricing plans that include features for ptr 2a verification. Depending on your business needs, you can choose from various subscription options that ensure you get the best value for comprehensive electronic signature capabilities.

-

Can airSlate SignNow integrate with other applications for ptr 2a verification?

Yes, airSlate SignNow seamlessly integrates with various applications and platforms to enhance the ptr 2a verification process. By integrating with popular tools like CRM systems, you can establish efficient workflows that include document signing and verification.

-

How secure is ptr 2a verification with airSlate SignNow?

AirSlate SignNow prioritizes security in its ptr 2a verification process. We utilize encryption, secure servers, and multi-factor authentication to protect your documents and ensure that the integrity of the signing process is maintained.

-

What types of documents can I sign using ptr 2a verification on airSlate SignNow?

You can sign a variety of documents through airSlate SignNow with ptr 2a verification, including contracts, agreements, and legal papers. Our platform supports multiple document formats, allowing you to handle all your signing needs efficiently.

Get more for Homeowners Verification Of Property Taxes For Use With Form

- Warranty deed from husband to himself and wife arkansas form

- Quitclaim deed from husband to himself and wife arkansas form

- Quitclaim deed from husband and wife to husband and wife arkansas form

- Warranty deed from husband and wife to husband and wife arkansas form

- Ar revocation form

- Postnuptial property agreement arkansas arkansas form

- Ar amendment form

- Quitclaim deed from husband and wife to an individual arkansas form

Find out other Homeowners Verification Of Property Taxes For Use With Form

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT