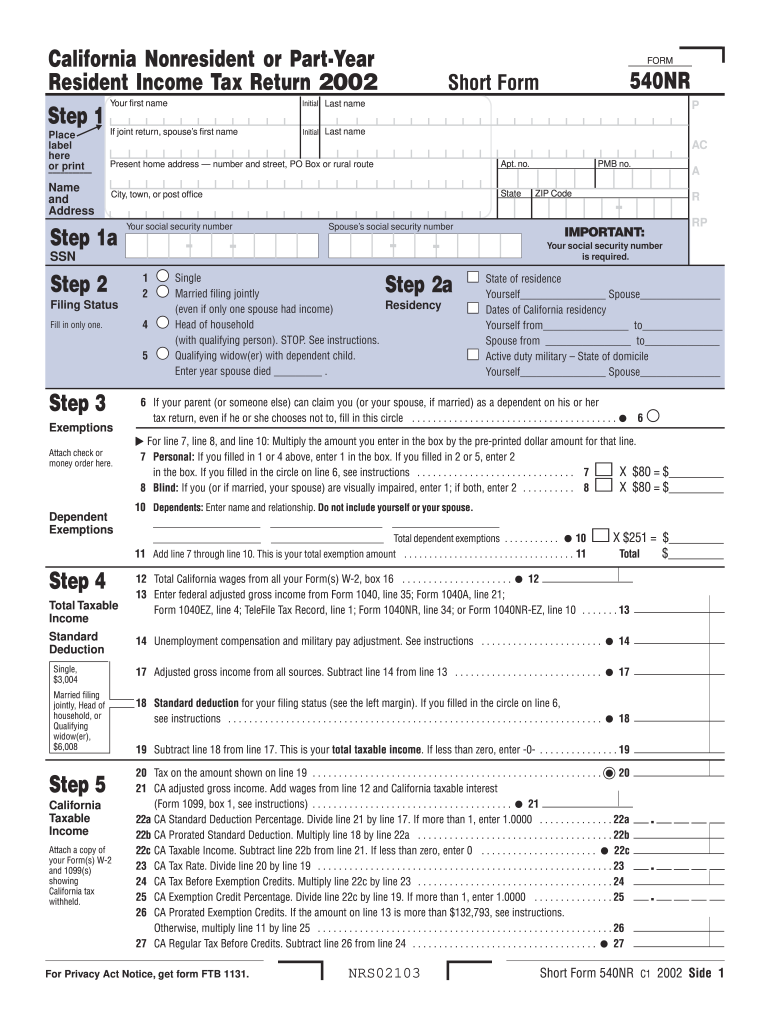

Form 540NR, California Nonresident or Part Year Resident Income Tax Return Short Form 540NR 2002

What is the Form 540NR, California Nonresident Or Part Year Resident Income Tax Return Short Form 540NR

The Form 540NR, California Nonresident Or Part Year Resident Income Tax Return Short Form 540NR, is a tax form used by individuals who are nonresidents or part-year residents of California. This form allows taxpayers to report their income earned within the state and calculate their tax liability accordingly. It is specifically designed for those who do not meet the requirements for filing the standard Form 540, making it a streamlined option for eligible individuals. The form collects essential information about the taxpayer's income sources, deductions, and credits applicable to their situation.

Steps to complete the Form 540NR, California Nonresident Or Part Year Resident Income Tax Return Short Form 540NR

Completing the Form 540NR involves several key steps to ensure accuracy and compliance with California tax laws. First, gather all necessary documents, including W-2s, 1099s, and any other income statements. Next, fill out personal information such as your name, address, and Social Security number. Then, report your income from California sources, including wages, interest, and rental income. After that, calculate your deductions and applicable credits. Finally, review the completed form for accuracy, sign it, and prepare it for submission.

How to obtain the Form 540NR, California Nonresident Or Part Year Resident Income Tax Return Short Form 540NR

The Form 540NR can be obtained through various methods. Individuals can download the form directly from the California Franchise Tax Board's website. Alternatively, taxpayers may request a physical copy by contacting the Franchise Tax Board or visiting local tax offices. Many tax preparation software programs also include the Form 540NR, allowing users to complete and file their returns electronically.

Legal use of the Form 540NR, California Nonresident Or Part Year Resident Income Tax Return Short Form 540NR

The Form 540NR is legally recognized for the purpose of reporting income and calculating taxes owed by nonresidents and part-year residents of California. It must be completed accurately, as any discrepancies may lead to penalties or audits. The form complies with state tax regulations, and it is essential for individuals to use the correct version for the tax year they are filing. Proper use of the form ensures that taxpayers fulfill their legal obligations while taking advantage of any applicable deductions and credits.

Filing Deadlines / Important Dates

Taxpayers should be aware of the important deadlines associated with the Form 540NR. Typically, the filing deadline for the form aligns with the federal tax deadline, which is usually April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. It is crucial for individuals to submit their forms on time to avoid penalties and interest on unpaid taxes. Additionally, taxpayers may qualify for extensions under certain circumstances, but they must still pay any taxes owed by the original deadline.

Required Documents

To complete the Form 540NR accurately, several documents are necessary. Taxpayers should gather income statements such as W-2s and 1099s, which report wages and other income. Additionally, documentation for any deductions, such as mortgage interest statements or property tax receipts, should be collected. If applicable, records of credits claimed must also be included. Having these documents ready will facilitate a smoother and more efficient filing process.

Quick guide on how to complete 2002 form 540nr california nonresident or part year resident income tax return short form 540nr

Your assistance manual on how to prepare your Form 540NR, California Nonresident Or Part Year Resident Income Tax Return Short Form 540NR

If you’re curious about how to generate and submit your Form 540NR, California Nonresident Or Part Year Resident Income Tax Return Short Form 540NR, here are a few concise instructions on how to simplify tax submission.

To begin, simply register your airSlate SignNow account to revolutionize how you manage documents online. airSlate SignNow is an extremely user-friendly and powerful document solution that enables you to modify, create, and complete your income tax documents effortlessly. With its editor, you can toggle between text, check boxes, and eSignatures, and return to edit details as necessary. Enhance your tax handling with advanced PDF editing, eSigning, and seamless sharing.

Follow the steps below to complete your Form 540NR, California Nonresident Or Part Year Resident Income Tax Return Short Form 540NR in moments:

- Establish your account and commence working on PDFs in a matter of minutes.

- Utilize our directory to access any IRS tax form; explore various versions and schedules.

- Click Obtain form to open your Form 540NR, California Nonresident Or Part Year Resident Income Tax Return Short Form 540NR in our editor.

- Populate the mandatory fillable fields with your details (text, numbers, check marks).

- Employ the Sign Tool to add your legally-recognized eSignature (if necessary).

- Examine your document and correct any inaccuracies.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Be aware that submitting in paper format may lead to return mistakes and delay refunds. Unsurprisingly, prior to e-filing your taxes, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct 2002 form 540nr california nonresident or part year resident income tax return short form 540nr

Create this form in 5 minutes!

How to create an eSignature for the 2002 form 540nr california nonresident or part year resident income tax return short form 540nr

How to create an electronic signature for the 2002 Form 540nr California Nonresident Or Part Year Resident Income Tax Return Short Form 540nr online

How to generate an electronic signature for your 2002 Form 540nr California Nonresident Or Part Year Resident Income Tax Return Short Form 540nr in Chrome

How to make an eSignature for signing the 2002 Form 540nr California Nonresident Or Part Year Resident Income Tax Return Short Form 540nr in Gmail

How to make an eSignature for the 2002 Form 540nr California Nonresident Or Part Year Resident Income Tax Return Short Form 540nr straight from your mobile device

How to create an eSignature for the 2002 Form 540nr California Nonresident Or Part Year Resident Income Tax Return Short Form 540nr on iOS devices

How to make an eSignature for the 2002 Form 540nr California Nonresident Or Part Year Resident Income Tax Return Short Form 540nr on Android OS

People also ask

-

What is the Form 540NR, California Nonresident Or Part Year Resident Income Tax Return Short Form 540NR?

Form 540NR, California Nonresident Or Part Year Resident Income Tax Return Short Form 540NR, is a tax return specifically designed for individuals who are not residents of California for the entire year. This form helps calculate the California income tax due based on their California-source income. It is essential for accurately reporting income and claiming any deductions or credits allowed for nonresidents.

-

How can airSlate SignNow help me with filing the Form 540NR?

airSlate SignNow simplifies the process of filing the Form 540NR, California Nonresident Or Part Year Resident Income Tax Return Short Form 540NR, by offering secure eSigning capabilities. You can easily fill out and sign your tax documents online, ensuring that they are submitted on time and with the correct information. This reduces the risk of errors and helps you stay organized during tax season.

-

Is airSlate SignNow cost-effective for individuals filing the Form 540NR?

Yes, airSlate SignNow offers a cost-effective solution for individuals needing to file the Form 540NR, California Nonresident Or Part Year Resident Income Tax Return Short Form 540NR. With flexible pricing plans, you can choose an option that fits your budget. This allows you to access professional-grade eSigning tools without overspending during tax time.

-

Are there any specific features for tax document management in airSlate SignNow?

airSlate SignNow includes features specifically designed for managing tax documents like the Form 540NR, California Nonresident Or Part Year Resident Income Tax Return Short Form 540NR. You can easily create, edit, and store your documents in one secure place. Additionally, the platform enables collaboration with tax professionals and keeps your documents organized for easy access.

-

What benefits can I expect from using airSlate SignNow to file Form 540NR?

Using airSlate SignNow to file your Form 540NR, California Nonresident Or Part Year Resident Income Tax Return Short Form 540NR, provides several benefits, including increased efficiency and reduced stress. The eSigning feature speeds up document approval processes, while secure storage helps you keep track of all your tax documents. Moreover, you can quickly access templates tailored for tax returns.

-

Can I integrate airSlate SignNow with other tax software for filing Form 540NR?

Absolutely! airSlate SignNow seamlessly integrates with various tax software platforms, making it easier to file your Form 540NR, California Nonresident Or Part Year Resident Income Tax Return Short Form 540NR. This integration allows for efficient data transfer and document management, ensuring that all necessary information is readily available when filing your taxes.

-

Is there customer support available for using airSlate SignNow for Form 540NR?

Yes, airSlate SignNow offers robust customer support to assist users in completing their Form 540NR, California Nonresident Or Part Year Resident Income Tax Return Short Form 540NR. You can signNow out via chat, email, or phone for assistance with any questions or issues. Our support team is knowledgeable about tax documents and can guide you through using the platform effectively.

Get more for Form 540NR, California Nonresident Or Part Year Resident Income Tax Return Short Form 540NR

- Rental application vermont form

- Residential rental lease application vermont form

- Salary verification form for potential lease vermont

- Landlord agreement to allow tenant alterations to premises vermont form

- Notice of default on residential lease vermont form

- Landlord tenant lease co signer agreement vermont form

- Application for sublease vermont form

- Inventory and condition of leased premises for pre lease and post lease vermont form

Find out other Form 540NR, California Nonresident Or Part Year Resident Income Tax Return Short Form 540NR

- How Can I Electronic signature Iowa Car Dealer Promissory Note Template

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Myself

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Fast

- How Do I Electronic signature Iowa Car Dealer Limited Power Of Attorney

- Electronic signature Kentucky Car Dealer LLC Operating Agreement Safe

- Electronic signature Louisiana Car Dealer Lease Template Now

- Electronic signature Maine Car Dealer Promissory Note Template Later

- Electronic signature Maryland Car Dealer POA Now

- Electronic signature Oklahoma Banking Affidavit Of Heirship Mobile

- Electronic signature Oklahoma Banking Separation Agreement Myself

- Electronic signature Hawaii Business Operations Permission Slip Free

- How Do I Electronic signature Hawaii Business Operations Forbearance Agreement

- Electronic signature Massachusetts Car Dealer Operating Agreement Free

- How To Electronic signature Minnesota Car Dealer Credit Memo

- Electronic signature Mississippi Car Dealer IOU Now

- Electronic signature New Hampshire Car Dealer NDA Now

- Help Me With Electronic signature New Hampshire Car Dealer Warranty Deed

- Electronic signature New Hampshire Car Dealer IOU Simple

- Electronic signature Indiana Business Operations Limited Power Of Attorney Online

- Electronic signature Iowa Business Operations Resignation Letter Online