Form ST 100 ATT New York State and Local Quarterly Sales and Use Tax Credit Worksheet Revised 921

What is the Form ST-100 ATT New York State and Local Quarterly Sales and Use Tax Credit Worksheet?

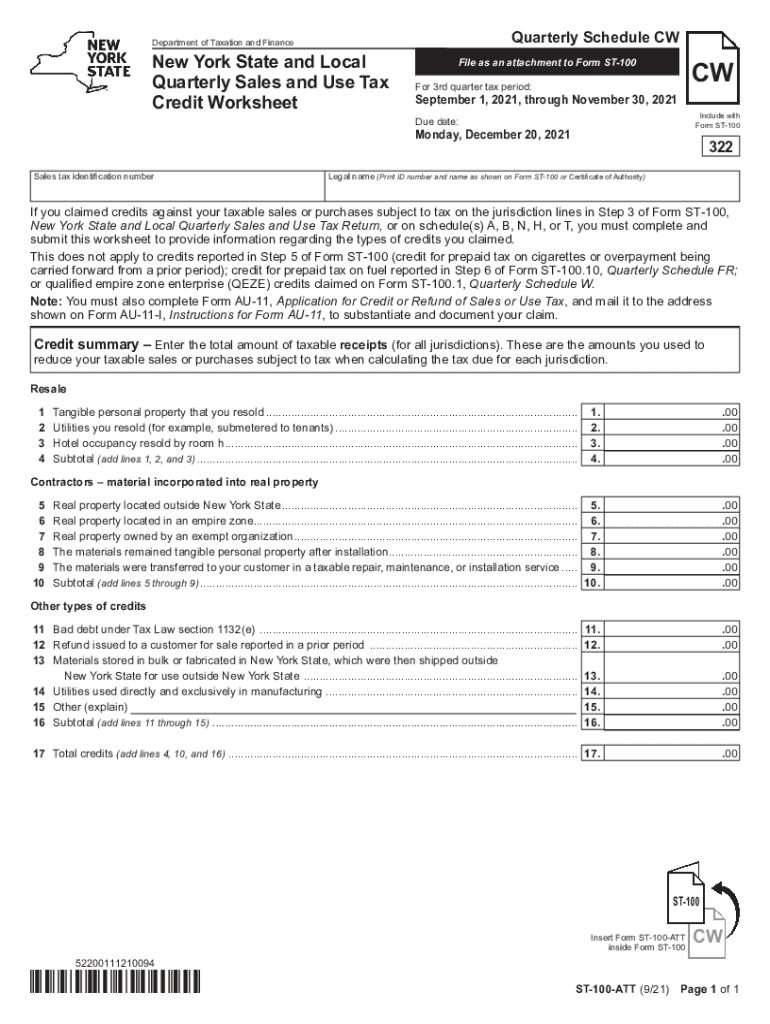

The Form ST-100 ATT is a worksheet used by businesses in New York State to calculate and claim the sales and use tax credit for the quarterly reporting period. This form is essential for businesses that have made purchases subject to sales tax and are eligible for credits against their sales tax liability. The ST-100 ATT helps ensure that businesses accurately report their tax obligations while taking advantage of available credits to reduce their overall tax burden.

Steps to Complete the Form ST-100 ATT

Completing the Form ST-100 ATT involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including sales receipts and previous tax filings. Next, enter your business information, including your name, address, and identification number. Then, calculate your total sales and use tax liability for the quarter. After determining the eligible credits, fill in the appropriate sections of the form, ensuring all calculations are correct. Finally, review the completed form for accuracy before submission.

Legal Use of the Form ST-100 ATT

The Form ST-100 ATT is legally binding when filled out correctly and submitted in accordance with New York State tax regulations. It is crucial for businesses to ensure that all information provided is accurate and complete to avoid penalties or audits. The form must be submitted within the designated filing periods to maintain compliance with state tax laws. Utilizing a reliable eSignature platform can enhance the legal validity of the submitted form, ensuring that all signatures and data are securely captured and stored.

Filing Deadlines and Important Dates

Filing deadlines for the Form ST-100 ATT are typically aligned with the quarterly tax periods. Businesses must submit their forms by the last day of the month following the end of the quarter. For example, the deadlines for the first quarter (January to March) are due by April 30. It is essential for businesses to stay informed about any changes to these deadlines to avoid late fees or penalties. Consulting the New York State Department of Taxation and Finance website can provide up-to-date information on important dates.

Eligibility Criteria for the Form ST-100 ATT

To be eligible to use the Form ST-100 ATT, businesses must meet specific criteria established by New York State. Primarily, the business must be registered for sales tax collection and have made taxable purchases during the reporting period. Additionally, the business must have documentation to support the claims made on the form, including receipts and invoices. Understanding these eligibility criteria is crucial for ensuring that the business can successfully claim the appropriate credits and minimize tax liabilities.

Examples of Using the Form ST-100 ATT

Businesses may encounter various scenarios in which the Form ST-100 ATT is applicable. For instance, a retail store that purchases inventory for resale can use the form to claim credits for sales tax paid on those purchases. Similarly, a service provider that acquires equipment necessary for operations may also qualify for credits. By accurately completing the ST-100 ATT, these businesses can effectively reduce their tax liabilities and improve their cash flow.

Quick guide on how to complete form st 100 att new york state and local quarterly sales and use tax credit worksheet revised 921

Effortlessly Prepare Form ST 100 ATT New York State And Local Quarterly Sales And Use Tax Credit Worksheet Revised 921 on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to obtain the appropriate format and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Form ST 100 ATT New York State And Local Quarterly Sales And Use Tax Credit Worksheet Revised 921 on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to Modify and eSign Form ST 100 ATT New York State And Local Quarterly Sales And Use Tax Credit Worksheet Revised 921 with Ease

- Acquire Form ST 100 ATT New York State And Local Quarterly Sales And Use Tax Credit Worksheet Revised 921 and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of your documents or redact sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you want to send your form—via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device. Edit and eSign Form ST 100 ATT New York State And Local Quarterly Sales And Use Tax Credit Worksheet Revised 921 and ensure effective communication throughout the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form st 100 att new york state and local quarterly sales and use tax credit worksheet revised 921

The way to make an e-signature for a PDF document online

The way to make an e-signature for a PDF document in Google Chrome

The way to generate an e-signature for signing PDFs in Gmail

The best way to make an electronic signature right from your smart phone

The way to make an e-signature for a PDF document on iOS

The best way to make an electronic signature for a PDF on Android OS

People also ask

-

What is the airSlate SignNow solution for 100 st100att nys?

The airSlate SignNow platform offers a comprehensive eSignature solution tailored for businesses dealing with 100 st100att nys. It allows users to send, sign, and manage documents efficiently in a secure digital environment. By using airSlate SignNow, businesses can streamline their operations while ensuring compliance with electronic signature regulations.

-

How much does airSlate SignNow cost for 100 st100att nys?

Pricing for airSlate SignNow varies based on the number of users and features selected. For businesses handling 100 st100att nys, our plans start at competitive rates, allowing you to choose a package that fits your needs. We also offer a free trial, giving prospective customers an opportunity to experience the benefits before committing.

-

What features does airSlate SignNow provide for 100 st100att nys?

airSlate SignNow includes several powerful features for effective document management relevant to 100 st100att nys. Key offerings include customizable templates, secure mobile signatures, and real-time tracking of document status. These features enable businesses to enhance their workflow and improve productivity.

-

Can airSlate SignNow integrate with other tools for 100 st100att nys?

Yes, airSlate SignNow offers various integrations that support workflows associated with 100 st100att nys. It can seamlessly connect with popular applications such as CRM systems, cloud storage services, and productivity tools. This flexibility ensures that users can easily incorporate airSlate SignNow into their existing processes.

-

What are the benefits of using airSlate SignNow for 100 st100att nys?

By utilizing airSlate SignNow for 100 st100att nys, businesses can greatly improve their efficiency and reduce document turnaround time. The platform is designed to be user-friendly, allowing team members to adopt it quickly with minimal training. Additionally, the security features protect sensitive information, giving users peace of mind.

-

Is airSlate SignNow legally compliant for 100 st100att nys?

Yes, airSlate SignNow is legally compliant with electronic signature laws, making it suitable for businesses operating under 100 st100att nys regulations. Our platform adheres to the U.S. ESIGN Act and the Uniform Electronic Transactions Act (UETA). This compliance ensures that all documents signed through airSlate SignNow hold the same legal weight as traditional handwritten signatures.

-

How does airSlate SignNow enhance user experience for 100 st100att nys?

airSlate SignNow enhances user experience for 100 st100att nys businesses with its intuitive interface and streamline process. Users can easily design, send, and track documents with just a few clicks, minimizing disruptions to their workflow. The platform also offers customizable notifications, keeping users informed about their document status.

Get more for Form ST 100 ATT New York State And Local Quarterly Sales And Use Tax Credit Worksheet Revised 921

- Quitclaim deed from individual to llc arkansas form

- Warranty deed from individual to llc arkansas form

- Account and affidavit of accounts claiming materialman or labor lien for architect by corporation or llc arkansas form

- Questioning of sufficiency of bond individual arkansas form

- Quitclaim deed from husband and wife to corporation arkansas form

- Warranty deed from husband and wife to corporation arkansas form

- Divorce worksheet and law summary for contested or uncontested case of over 25 pages ideal client interview form arkansas

- Ar bond form

Find out other Form ST 100 ATT New York State And Local Quarterly Sales And Use Tax Credit Worksheet Revised 921

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip

- Electronic signature Legal PDF North Dakota Online

- Electronic signature North Carolina Life Sciences Stock Certificate Fast

- Help Me With Electronic signature North Dakota Legal Warranty Deed

- Electronic signature North Dakota Legal Cease And Desist Letter Online

- Electronic signature North Dakota Legal Cease And Desist Letter Free

- Electronic signature Delaware Orthodontists Permission Slip Free

- How Do I Electronic signature Hawaii Orthodontists Lease Agreement Form

- Electronic signature North Dakota Life Sciences Business Plan Template Now

- Electronic signature Oklahoma Legal Bill Of Lading Fast

- Electronic signature Oklahoma Legal Promissory Note Template Safe

- Electronic signature Oregon Legal Last Will And Testament Online

- Electronic signature Life Sciences Document Pennsylvania Simple

- Electronic signature Legal Document Pennsylvania Online

- How Can I Electronic signature Pennsylvania Legal Last Will And Testament

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement

- How To Electronic signature South Carolina Legal Lease Agreement

- How Can I Electronic signature South Carolina Legal Quitclaim Deed