Form CT 400 Department of Taxation and Finance NY Gov

What is the Form CT 400 Department Of Taxation And Finance NY Gov

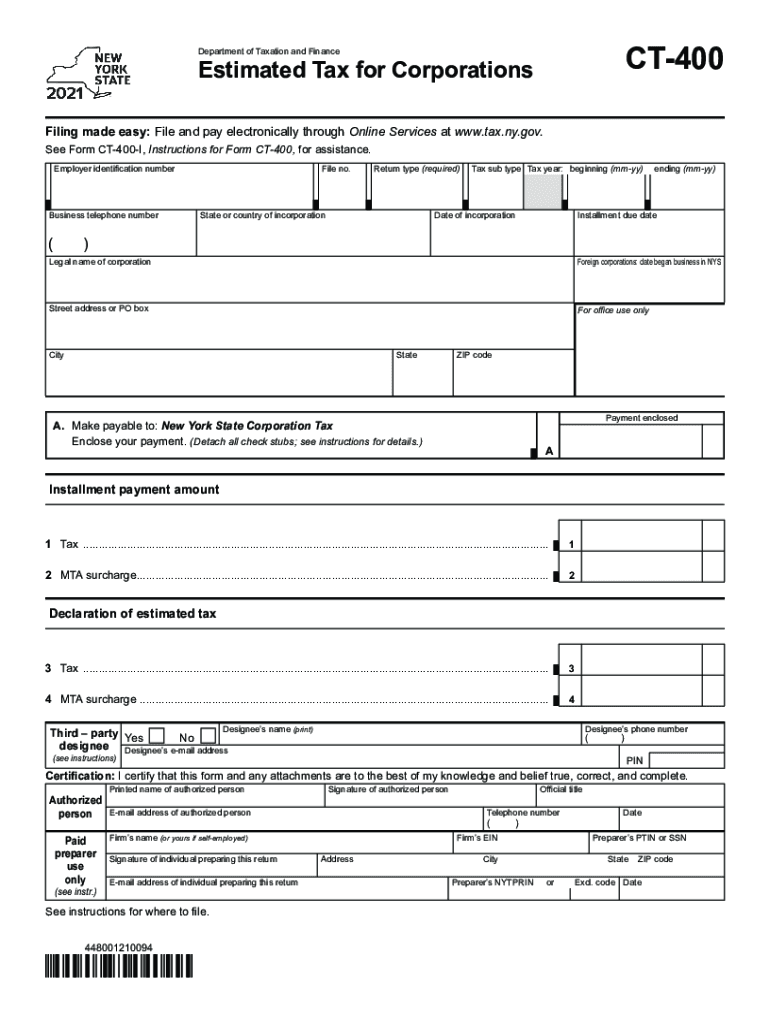

The Form CT 400 is a critical document used by businesses in New York for filing their corporate tax returns. This form is specifically designed for corporations that are subject to the New York State franchise tax. It provides a comprehensive overview of the corporation's income, deductions, and tax liability. By accurately completing this form, businesses ensure compliance with state tax regulations and contribute to the state's revenue system.

Steps to complete the Form CT 400 Department Of Taxation And Finance NY Gov

Completing the Form CT 400 requires careful attention to detail to ensure accuracy and compliance. Here are the essential steps:

- Gather necessary financial documents, including income statements and balance sheets.

- Fill out the identification section with the corporation's name, address, and employer identification number (EIN).

- Report total income, including gross receipts and any other income sources.

- List allowable deductions, such as business expenses and losses.

- Calculate the tax due based on the provided tax rates and any applicable credits.

- Review the completed form for accuracy before submission.

How to obtain the Form CT 400 Department Of Taxation And Finance NY Gov

The Form CT 400 can be easily obtained through the New York State Department of Taxation and Finance website. It is available for download in a printable format, allowing businesses to fill it out manually. Additionally, many accounting software programs offer integration with this form, enabling electronic completion and submission. Businesses should ensure they are using the most current version of the form to comply with any recent tax law changes.

Legal use of the Form CT 400 Department Of Taxation And Finance NY Gov

The Form CT 400 is legally binding when completed and submitted according to New York State tax laws. It must be signed by an authorized representative of the corporation, affirming that the information provided is accurate and complete. Failure to comply with the legal requirements associated with this form can result in penalties, including fines and interest on unpaid taxes. It is essential for businesses to understand their obligations under the law when using this form.

Filing Deadlines / Important Dates

Timely filing of the Form CT 400 is crucial for compliance with New York State tax regulations. Typically, the form is due on the fifteenth day of the fourth month following the end of the corporation's fiscal year. For corporations operating on a calendar year, this means the form is due by April fifteenth. Failure to file by the deadline can lead to penalties and interest charges, making it essential for businesses to stay informed about these important dates.

Form Submission Methods (Online / Mail / In-Person)

Businesses have multiple options for submitting the Form CT 400. The form can be filed electronically through the New York State Department of Taxation and Finance's online services, which is often the most efficient method. Alternatively, businesses may choose to mail the completed form to the appropriate address provided in the instructions. In-person submissions are also accepted at designated tax offices. Each method has its own processing times, so businesses should consider their needs when choosing how to submit.

Quick guide on how to complete form ct 400 department of taxation and finance ny gov

Effortlessly Prepare Form CT 400 Department Of Taxation And Finance NY Gov on Any Device

Managing documents online has gained popularity among businesses and individuals. It offers a perfect environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the right template and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Handle Form CT 400 Department Of Taxation And Finance NY Gov on any platform with airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

The Easiest Way to Modify and eSign Form CT 400 Department Of Taxation And Finance NY Gov with Ease

- Locate Form CT 400 Department Of Taxation And Finance NY Gov and click on Get Form to commence.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive data with tools specifically available from airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and has the same legal validity as a conventional pen-and-ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you choose. Edit and eSign Form CT 400 Department Of Taxation And Finance NY Gov and ensure excellent communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form ct 400 department of taxation and finance ny gov

How to create an electronic signature for a PDF in the online mode

How to create an electronic signature for a PDF in Chrome

How to create an e-signature for putting it on PDFs in Gmail

The way to create an e-signature right from your smart phone

How to create an e-signature for a PDF on iOS devices

The way to create an e-signature for a PDF on Android OS

People also ask

-

What are the CT 400 instructions for using airSlate SignNow?

The CT 400 instructions for airSlate SignNow guide users through the process of eSigning documents securely and efficiently. This includes step-by-step directions on uploading files, adding signatures, and sending them for approval. By following the CT 400 instructions, users can ensure compliance and streamlined workflows.

-

How much does airSlate SignNow cost?

Pricing for airSlate SignNow varies based on the specific plan and features you choose. The basic plan offers essential eSigning capabilities, while advanced features may be found in higher-tier options. For detailed CT 400 instructions on pricing, visit our pricing page or contact our sales team.

-

What features are included in airSlate SignNow?

airSlate SignNow includes a range of features such as document templates, in-person signing, and real-time tracking. The CT 400 instructions utilize these features to enhance user experience, making it easy to manage and sign documents online. Our platform is designed to simplify document workflows for individuals and businesses alike.

-

How can airSlate SignNow benefit my business?

By implementing airSlate SignNow, businesses can streamline their document processes and reduce time spent on paperwork. The CT 400 instructions are designed to help users maximize these benefits, enabling quicker turnaround times and improved collaboration among team members. This leads to increased efficiency and productivity in business operations.

-

Does airSlate SignNow integrate with other software?

Yes, airSlate SignNow offers seamless integration with various software applications, enhancing its functionality within your existing workflow. The CT 400 instructions provide insights on how to connect with popular platforms like Salesforce and Google Drive. This integration capability allows for a more cohesive document management experience.

-

Can I try airSlate SignNow for free?

Absolutely! We offer a free trial of airSlate SignNow, allowing you to explore all the features before committing. The CT 400 instructions will guide you through the signup process to ensure you can start using the platform without any hassles. Experience the benefits of eSigning risk-free during your trial period.

-

What support resources are available for airSlate SignNow users?

airSlate SignNow provides various support resources, including a comprehensive knowledge base, tutorials, and customer service. The CT 400 instructions serve as an essential resource for users seeking quick guidance on common tasks. Our dedicated support team is also available to assist with any specific queries or issues.

Get more for Form CT 400 Department Of Taxation And Finance NY Gov

- Notice of default in payment of rent as warning prior to demand to pay or terminate for nonresidential or commercial property 497296457 form

- Notice of intent to vacate at end of specified lease term from tenant to landlord for residential property arkansas form

- Notice of intent to vacate at end of specified lease term from tenant to landlord nonresidential arkansas form

- Notice of intent not to renew at end of specified term from landlord to tenant for residential property arkansas form

- Notice of intent not to renew at end of specified term from landlord to tenant for nonresidential or commercial property form

- Ar landlord 497296463 form

- Notice of breach of written lease for violating specific provisions of lease with right to cure for residential property from 497296465 form

- Notice of breach of written lease for violating specific provisions of lease with right to cure for nonresidential property 497296466 form

Find out other Form CT 400 Department Of Taxation And Finance NY Gov

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online