Fillable Online 14 0404FDOT D6Traffic EngineeringLOR Form 2020-2026

Understanding Delaware Income Tax

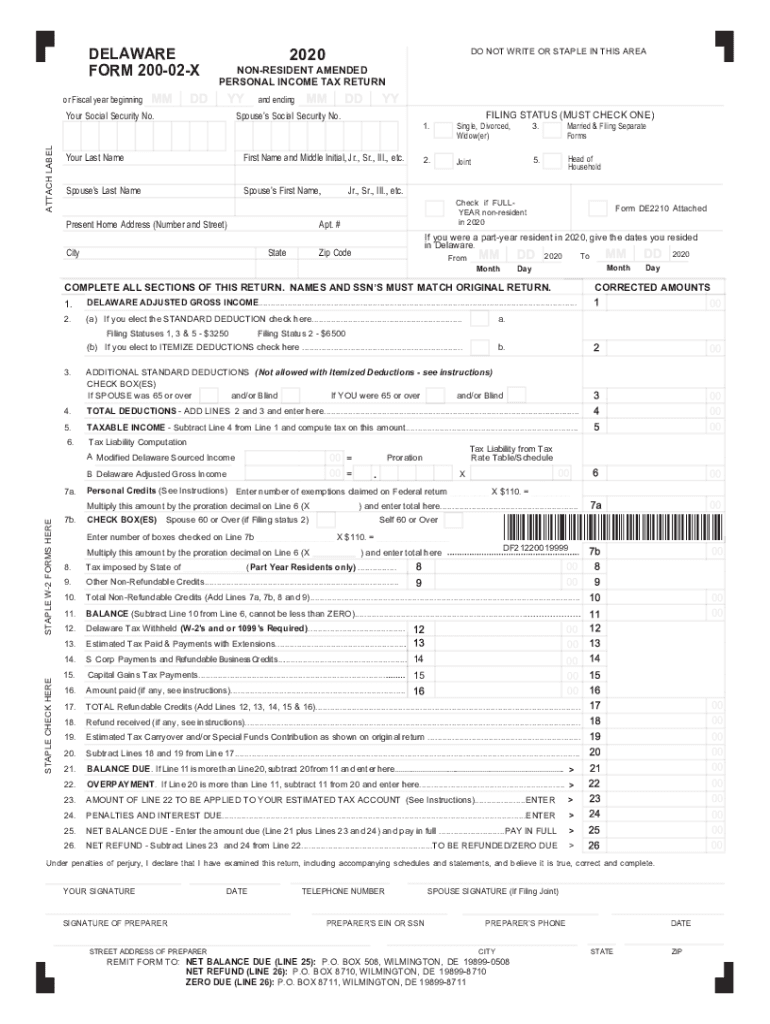

Delaware income tax is a state tax imposed on the income earned by residents and non-residents working or doing business in Delaware. The tax rates vary based on income levels, with a progressive tax structure that ranges from two point two percent to six point six percent. Residents are taxed on all income, while non-residents are taxed only on income sourced from Delaware. Understanding these nuances is essential for accurate tax filing and compliance.

Filing Deadlines for Delaware Income Tax

Delaware has specific deadlines for filing income tax returns. Generally, individual income tax returns are due on April fifteenth of each year. If this date falls on a weekend or holiday, the deadline is extended to the next business day. Taxpayers may also request an extension, which allows additional time to file but does not extend the deadline for payment of any taxes owed.

Required Documents for Filing

To file Delaware income tax, taxpayers need several documents, including:

- W-2 forms from employers

- 1099 forms for other income sources

- Records of any deductions or credits claimed

- Previous year’s tax return for reference

Having these documents ready ensures a smooth and accurate filing process.

Form Submission Methods

Delaware offers various methods for submitting income tax returns. Taxpayers can file online through the Delaware Division of Revenue website, which provides a user-friendly platform for electronic filing. Alternatively, paper forms can be mailed to the appropriate address provided by the state. In-person submissions are also accepted at designated state offices, allowing for direct interaction with tax officials.

Penalties for Non-Compliance

Failure to comply with Delaware income tax regulations can result in penalties, including fines and interest on unpaid taxes. The state may impose a penalty of five percent of the unpaid tax for each month the tax remains unpaid, up to a maximum of twenty-five percent. Additionally, interest accrues on overdue amounts, compounding the total liability over time.

Eligibility Criteria for Tax Deductions

To qualify for certain deductions on Delaware income tax, taxpayers must meet specific eligibility criteria. Common deductions include those for education expenses, medical costs, and contributions to retirement accounts. Each deduction has its own set of rules, and taxpayers should consult the Delaware Division of Revenue guidelines to ensure compliance and maximize their tax benefits.

Taxpayer Scenarios

Different taxpayer scenarios can affect how Delaware income tax is calculated. For instance, self-employed individuals may have different filing requirements compared to salaried employees. Retirees may qualify for specific exemptions, while students working part-time may have lower tax obligations. Understanding these scenarios can help taxpayers navigate their responsibilities more effectively.

Quick guide on how to complete fillable online 14 0404fdot d6traffic engineeringlor form

Effortlessly Prepare Fillable Online 14 0404FDOT D6Traffic EngineeringLOR Form on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed materials, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents promptly and without hassle. Handle Fillable Online 14 0404FDOT D6Traffic EngineeringLOR Form on any device with the airSlate SignNow applications for Android or iOS and enhance any document-related process today.

How to Edit and Electronically Sign Fillable Online 14 0404FDOT D6Traffic EngineeringLOR Form with Ease

- Obtain Fillable Online 14 0404FDOT D6Traffic EngineeringLOR Form and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Select important sections of the documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature with the Sign feature, which takes mere seconds and holds the same legal standing as a traditional handwritten signature.

- Verify the details and then click on the Done button to save your changes.

- Choose how you wish to share your document: via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, cumbersome document searching, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your preferred device. Edit and electronically sign Fillable Online 14 0404FDOT D6Traffic EngineeringLOR Form and ensure outstanding communication at every step of your document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fillable online 14 0404fdot d6traffic engineeringlor form

Create this form in 5 minutes!

How to create an eSignature for the fillable online 14 0404fdot d6traffic engineeringlor form

How to create an e-signature for a PDF document online

How to create an e-signature for a PDF document in Google Chrome

The best way to generate an e-signature for signing PDFs in Gmail

The way to create an electronic signature straight from your smart phone

How to generate an e-signature for a PDF document on iOS

The way to create an electronic signature for a PDF document on Android OS

People also ask

-

What is Delaware income tax, and how does it affect businesses?

Delaware income tax is a state tax levied on the income earned by businesses and individuals in Delaware. For businesses using airSlate SignNow, understanding Delaware income tax regulations is essential for compliance and financial planning. Utilizing our eSignature solutions can streamline document processes involved in tax filing, making it easier to meet your tax obligations.

-

How can airSlate SignNow help me with Delaware income tax documentation?

AirSlate SignNow provides a seamless way to create, send, and eSign important documents related to Delaware income tax. Our platform allows you to securely gather signatures on tax-related forms, ensuring all documentation is completed accurately and promptly. This reduces the hassle of paper-based processes, freeing your time to focus on your business.

-

What are the pricing options for airSlate SignNow, especially for tax-related needs?

Our pricing for airSlate SignNow varies based on the features you need, but we offer flexible plans to accommodate various business sizes and requirements. Whether you are handling Delaware income tax documents or other contracts, you'll find an affordable solution that fits your budget. Check our pricing page for detailed information and find the best fit for your tax documentation needs.

-

Can I integrate airSlate SignNow with other software to manage Delaware income tax?

Yes, airSlate SignNow integrates with various accounting and tax software systems, facilitating better management of Delaware income tax documents. By streamlining integration, you can automatically sync your tax documents and signatures, ensuring everything is organized. This helps in not only maintaining compliance but also simplifying your overall workflow.

-

Are there any special features in airSlate SignNow that assist with tax filing in Delaware?

AirSlate SignNow includes features that enhance your ability to manage Delaware income tax filings, such as document templates and reminders for deadlines. By utilizing our platform, businesses can create templates for frequently used tax forms, reducing the time spent on repetitive tasks. Additionally, the automated reminders will help ensure you never miss a critical filing date.

-

How secure is airSlate SignNow for handling sensitive documents like Delaware income tax forms?

Security is a top priority at airSlate SignNow, especially when handling sensitive documents such as Delaware income tax forms. We use advanced encryption and secure data storage measures to protect your information. You can confidently sign and send your tax documents, knowing that your data is safe and compliant with industry standards.

-

Can airSlate SignNow assist with electronic signatures for Delaware income tax documents?

Absolutely! AirSlate SignNow provides a user-friendly platform for obtaining electronic signatures on Delaware income tax documents. Our eSignature solution is legally binding and compliant with all applicable laws, making it a reliable choice for your tax-related paperwork. This not only speeds up the signing process but also keeps everything organized and easily accessible.

Get more for Fillable Online 14 0404FDOT D6Traffic EngineeringLOR Form

Find out other Fillable Online 14 0404FDOT D6Traffic EngineeringLOR Form

- eSignature California Renter's contract Safe

- eSignature Florida Renter's contract Myself

- eSignature Florida Renter's contract Free

- eSignature Florida Renter's contract Fast

- eSignature Vermont Real estate sales contract template Later

- Can I eSignature Texas New hire forms

- How Can I eSignature California New hire packet

- How To eSignature South Carolina Real estate document

- eSignature Florida Real estate investment proposal template Free

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure

- eSignature California Distributor Agreement Template Later

- eSignature Vermont General Power of Attorney Template Easy

- eSignature Michigan Startup Cost Estimate Simple

- eSignature New Hampshire Invoice for Services (Standard Format) Computer