Draft Form PTE Virginia Pass through Credit Allocation 2021-2026

What is the Draft Form PTE Virginia Pass Through Credit Allocation

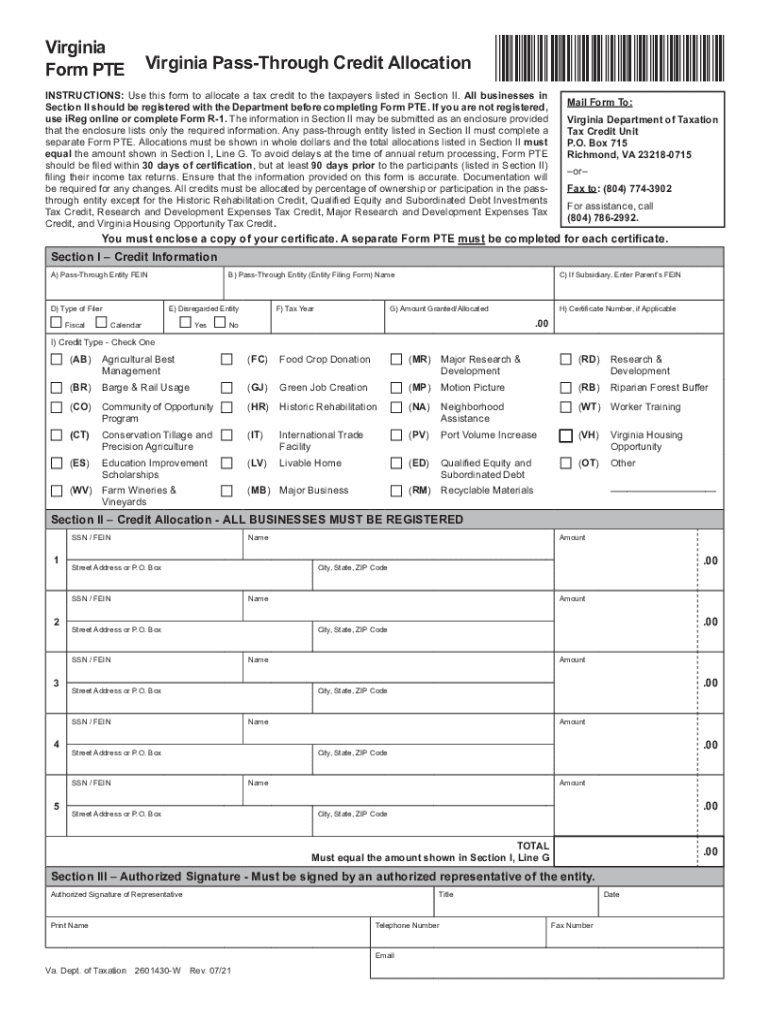

The Draft Form PTE Virginia Pass Through Credit Allocation is a tax document used by pass-through entities in Virginia, such as partnerships and S corporations, to allocate tax credits to their owners or members. This form is essential for ensuring that the tax credits earned by the entity are properly distributed among its stakeholders. The credits can include various state-specific incentives that benefit both the entity and its individual members.

How to use the Draft Form PTE Virginia Pass Through Credit Allocation

To use the Draft Form PTE, entities must first complete the form accurately, detailing the amount of credit to be allocated to each member. Each member should receive a copy of the completed form, which they will use when filing their personal tax returns. It is important to ensure that all information is correct and that the allocations comply with Virginia tax laws to avoid any issues during the filing process.

Steps to complete the Draft Form PTE Virginia Pass Through Credit Allocation

Completing the Draft Form PTE involves several key steps:

- Gather necessary information about the entity and its members.

- Determine the total amount of credits available for allocation.

- Allocate the credits among members based on their ownership percentages or other agreed-upon methods.

- Fill out the form completely, ensuring all details are accurate.

- Distribute copies of the completed form to all members for their records.

Legal use of the Draft Form PTE Virginia Pass Through Credit Allocation

The legal use of the Draft Form PTE is governed by Virginia tax laws. The form must be completed and submitted in accordance with these regulations to ensure that the credits are valid and can be claimed by the members. Proper documentation is crucial, as it serves as proof of the allocation and may be required in the event of an audit.

Eligibility Criteria

Eligibility to use the Draft Form PTE is generally limited to pass-through entities operating within Virginia. These include partnerships and S corporations that have earned tax credits eligible for allocation. Each member of the entity must also meet specific criteria, such as being a resident or having taxable income in Virginia, to claim the allocated credits on their personal tax returns.

Filing Deadlines / Important Dates

Filing deadlines for the Draft Form PTE typically align with the standard tax filing dates in Virginia. Entities must ensure that they complete and distribute the form to their members by the required deadlines to allow for proper reporting on individual tax returns. It is advisable to check the Virginia Department of Taxation's official calendar for any updates or changes to the filing schedule.

Examples of using the Draft Form PTE Virginia Pass Through Credit Allocation

Examples of using the Draft Form PTE include a partnership that has earned a renewable energy tax credit and wishes to allocate this credit to its partners based on their ownership stakes. Another example could be an S corporation that has received a job creation credit and needs to distribute this benefit among its shareholders. In both cases, accurate completion of the Draft Form PTE ensures that all eligible members can claim their respective credits when filing their tax returns.

Quick guide on how to complete draft form pte virginia pass through credit allocation

Complete Draft Form PTE Virginia Pass Through Credit Allocation effortlessly on any gadget

Digital document management has become favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to acquire the correct form and securely keep it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle Draft Form PTE Virginia Pass Through Credit Allocation on any gadget using the airSlate SignNow Android or iOS applications and enhance any document-oriented workflow today.

How to modify and eSign Draft Form PTE Virginia Pass Through Credit Allocation with ease

- Find Draft Form PTE Virginia Pass Through Credit Allocation and then click Get Form to begin.

- Make use of the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that intent.

- Generate your eSignature with the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Verify the details and then click on the Done button to save your changes.

- Choose how you wish to submit your form, via email, SMS, or invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your requirements in document management in just a few clicks from any device of your choosing. Modify and eSign Draft Form PTE Virginia Pass Through Credit Allocation to ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct draft form pte virginia pass through credit allocation

Create this form in 5 minutes!

How to create an eSignature for the draft form pte virginia pass through credit allocation

How to generate an e-signature for your PDF online

How to generate an e-signature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

The way to make an e-signature straight from your smartphone

The best way to create an electronic signature for a PDF on iOS

The way to make an e-signature for a PDF document on Android

People also ask

-

What is vaireg and how does it benefit my business?

Vaireg is a powerful electronic signature solution that streamlines document management for businesses. By using vaireg, you can reduce processing time, enhance team collaboration, and ensure secure transactions, making it a perfect fit for modern businesses looking to optimize their workflow.

-

How much does vaireg cost?

Vaireg offers a variety of pricing plans tailored to different business needs, ensuring that you only pay for what you use. The cost-effective nature of vaireg makes it an attractive choice for companies of all sizes, allowing you to manage your budget efficiently while enjoying robust features.

-

What features does vaireg offer?

Vaireg includes several essential features such as customizable templates, real-time tracking, and multi-party signing capabilities. These features help simplify the signing process and improve document management, making vaireg an invaluable tool for businesses aiming to enhance their operations.

-

Is vaireg easy to integrate with my existing systems?

Yes, vaireg is designed for seamless integration with a variety of popular software and applications. This flexibility allows businesses to incorporate vaireg into their existing workflows without disruption, ensuring a smooth transition to electronic document management.

-

Can I use vaireg for international transactions?

Absolutely! Vaireg supports electronic signatures that comply with international laws, making it suitable for cross-border transactions. This capability ensures that your documents are valid and legally binding, regardless of where your business operates.

-

What security measures does vaireg have in place?

Vaireg prioritizes the security of your documents with advanced encryption and authentication measures. This ensures that your sensitive data remains protected throughout the signing process, giving you peace of mind while using the vaireg platform.

-

How can vaireg improve my document workflow?

Vaireg streamlines the document workflow by automating signing processes and reducing turnaround times. This increased efficiency not only saves time but also enhances productivity, allowing your team to focus on more important tasks.

Get more for Draft Form PTE Virginia Pass Through Credit Allocation

- Assignment of lease and rent from borrower to lender arkansas form

- Assignment of lease from lessor with notice of assignment arkansas form

- Letter from landlord to tenant as notice of abandoned personal property arkansas form

- Guaranty or guarantee of payment of rent arkansas form

- Letter from landlord to tenant as notice of default on commercial lease arkansas form

- Residential or rental lease extension agreement arkansas form

- Arkansas rental form

- Apartment lease rental application questionnaire arkansas form

Find out other Draft Form PTE Virginia Pass Through Credit Allocation

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online