Get the Virginia Form ST 9, Retail Sales and Use Tax

Understanding the Virginia Form ST-9, Retail Sales and Use Tax

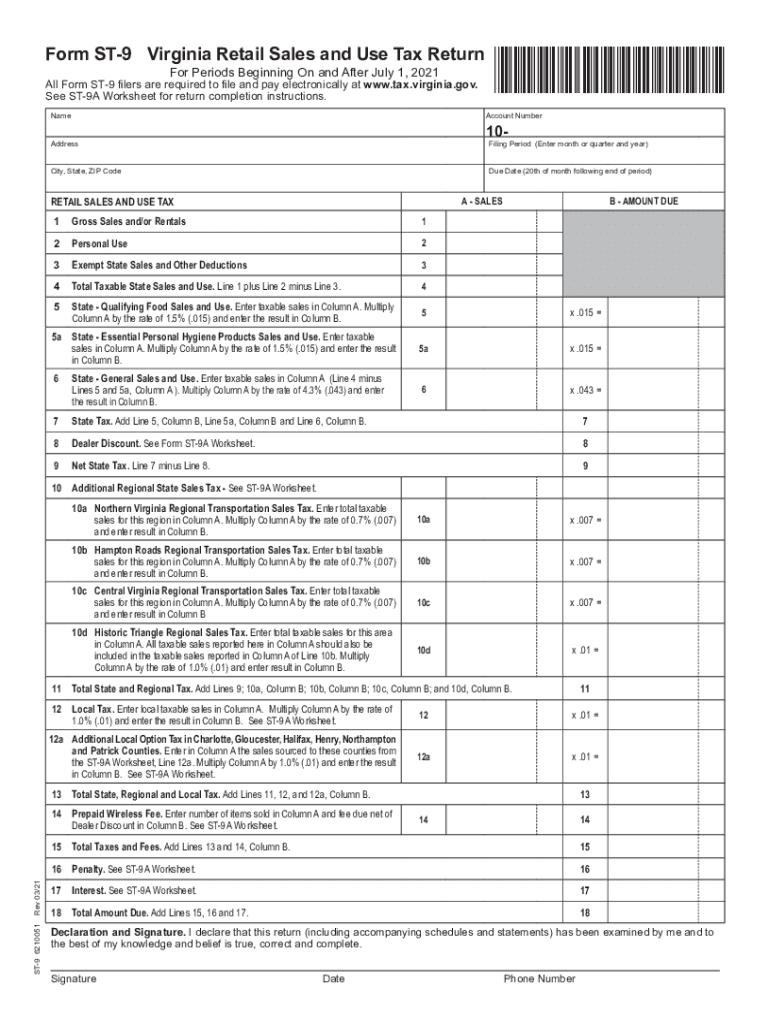

The Virginia Form ST-9 is a crucial document for businesses and individuals engaged in retail sales and use tax transactions within the state. This form serves as an exemption certificate, allowing eligible purchasers to claim exemptions from sales tax on specific purchases. It is essential for ensuring compliance with Virginia tax laws while facilitating smooth transactions for exempt items.

Steps to Complete the Virginia Form ST-9

Completing the Virginia Form ST-9 involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including the purchaser's name, address, and tax identification number. Next, clearly specify the type of exemption being claimed, such as resale or government use. Ensure that the form is signed and dated by an authorized representative of the purchaser. Finally, retain a copy of the completed form for your records and provide the original to the seller.

Legal Use of the Virginia Form ST-9

The legal use of the Virginia Form ST-9 is governed by state tax regulations. This form is valid only when properly completed and signed, confirming the purchaser's eligibility for the claimed exemption. Using this form improperly or without justification can lead to penalties and interest charges. It is crucial to understand the specific exemptions available under Virginia law and to use the form accordingly to avoid compliance issues.

Obtaining the Virginia Form ST-9

The Virginia Form ST-9 can be obtained through the Virginia Department of Taxation's official website or directly from authorized tax professionals. The form is available in PDF format, allowing for easy printing and completion. It is advisable to ensure that you are using the most current version of the form to comply with the latest tax regulations.

Filing Deadlines and Important Dates

Filing deadlines for the Virginia Form ST-9 vary depending on the nature of the transaction and the specific exemption being claimed. It is important to be aware of these deadlines to ensure timely submission. Generally, businesses should maintain records of all exempt sales and ensure that the ST-9 forms are completed and submitted as required by state law to avoid any potential penalties.

Examples of Using the Virginia Form ST-9

The Virginia Form ST-9 is commonly used in various scenarios, such as when a retailer purchases goods for resale or when a government entity acquires items exempt from sales tax. For instance, a clothing retailer may present the ST-9 to a supplier to purchase inventory without incurring sales tax. Understanding these examples can help businesses identify when to utilize the form effectively.

Quick guide on how to complete get the free virginia form st 9 retail sales and use tax

Effortlessly Prepare Get The Virginia Form ST 9, Retail Sales And Use Tax on Any Device

Digital document management has become increasingly popular among businesses and individuals. It serves as an excellent environmentally-friendly alternative to traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the essential tools to create, modify, and electronically sign your documents swiftly without any delays. Manage Get The Virginia Form ST 9, Retail Sales And Use Tax on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to Modify and eSign Get The Virginia Form ST 9, Retail Sales And Use Tax with Ease

- Locate Get The Virginia Form ST 9, Retail Sales And Use Tax and click on Get Form to begin.

- Employ the tools available to fill out your document.

- Highlight pertinent sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or scattered documents, tedious form searches, and mistakes that require reprinting new copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Edit and eSign Get The Virginia Form ST 9, Retail Sales And Use Tax to ensure excellent communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the get the free virginia form st 9 retail sales and use tax

How to make an electronic signature for a PDF file online

How to make an electronic signature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

The way to make an electronic signature from your mobile device

The best way to generate an e-signature for a PDF file on iOS

The way to make an electronic signature for a PDF file on Android devices

People also ask

-

What is a virginia st 9 pdf?

The virginia st 9 pdf is a specific document format used for filing various forms related to business operations in Virginia. It serves as an essential tool for businesses needing to submit required paperwork efficiently and accurately. Utilizing a virginia st 9 pdf ensures that your documents are correctly formatted for state compliance.

-

How can airSlate SignNow facilitate the signing of virginia st 9 pdf documents?

airSlate SignNow allows users to upload and sign virginia st 9 pdf documents quickly and securely. With its user-friendly interface, you can easily send the document to multiple signers while tracking the signing progress in real-time. This streamlines the signing process and helps businesses stay compliant with state regulations.

-

What are the pricing options for using airSlate SignNow to manage virginia st 9 pdfs?

airSlate SignNow offers a range of pricing plans tailored to different business needs, making it cost-effective for managing virginia st 9 pdf documents. Each plan provides access to essential features for eSigning and document management, allowing you to choose one that fits your budget. Additionally, you can take advantage of a free trial to assess if it suits your requirements.

-

What features does airSlate SignNow provide for working with virginia st 9 pdf documents?

airSlate SignNow includes features like document security, templates, and a robust audit trail for virginia st 9 pdf documents. These features ensure that your documents remain confidential and provide a clear record of signers and alterations made. Plus, you can easily integrate custom workflows to fit your business processes.

-

Can I integrate airSlate SignNow with other tools for managing virginia st 9 pdfs?

Yes, airSlate SignNow offers integrations with multiple platforms, enhancing your ability to manage virginia st 9 pdf documents seamlessly. This includes CRM systems, cloud storage solutions, and project management tools. By utilizing these integrations, you can streamline your workflow and enhance overall productivity.

-

What are the benefits of using airSlate SignNow for virginia st 9 pdf documents?

Using airSlate SignNow for virginia st 9 pdf documents enhances efficiency by simplifying the signing process and reducing turnaround times. Businesses can save money and reduce paper usage while ensuring compliance with local regulations. Moreover, the platform’s intuitive design allows users of all skill levels to navigate its features easily.

-

Is there customer support available for issues with virginia st 9 pdfs on airSlate SignNow?

Absolutely, airSlate SignNow provides dedicated customer support to assist users with any issues regarding virginia st 9 pdf documents. You can access help through various channels, including live chat, email, and a comprehensive knowledge base. This ensures you receive timely support for a smooth experience.

Get more for Get The Virginia Form ST 9, Retail Sales And Use Tax

- Notice of assignment of contract for deed arizona form

- Arizona contract residential purchase form

- Home checklist form printable

- Sellers information for appraiser provided to buyer arizona

- Legallife multistate guide and handbook for selling or buying real estate arizona form

- Subcontractors agreement arizona form

- Option to purchase addendum to residential lease lease or rent to own arizona form

- Arizona prenuptial premarital agreement with financial statements arizona form

Find out other Get The Virginia Form ST 9, Retail Sales And Use Tax

- Can I Electronic signature Vermont Bulk Sale Agreement

- Electronic signature Alaska Medical Records Release Mobile

- Electronic signature California Medical Records Release Myself

- Can I Electronic signature Massachusetts Medical Records Release

- How Do I Electronic signature Michigan Medical Records Release

- Electronic signature Indiana Membership Agreement Easy

- How Can I Electronic signature New Jersey Medical Records Release

- Electronic signature New Mexico Medical Records Release Easy

- How Can I Electronic signature Alabama Advance Healthcare Directive

- How Do I Electronic signature South Carolina Advance Healthcare Directive

- eSignature Kentucky Applicant Appraisal Form Evaluation Later

- Electronic signature Colorado Client and Developer Agreement Later

- Electronic signature Nevada Affiliate Program Agreement Secure

- Can I Electronic signature Pennsylvania Co-Branding Agreement

- Can I Electronic signature South Dakota Engineering Proposal Template

- How Do I Electronic signature Arizona Proforma Invoice Template

- Electronic signature California Proforma Invoice Template Now

- Electronic signature New York Equipment Purchase Proposal Now

- How Do I Electronic signature New York Proforma Invoice Template

- How Can I Electronic signature Oklahoma Equipment Purchase Proposal