February S 103 Application for Wisconsin Sales and Use Tax Certificate of Exempt Status CES and Instructions Fillable Form

Understanding the S-103 Application for Wisconsin Sales and Use Tax Certificate of Exempt Status

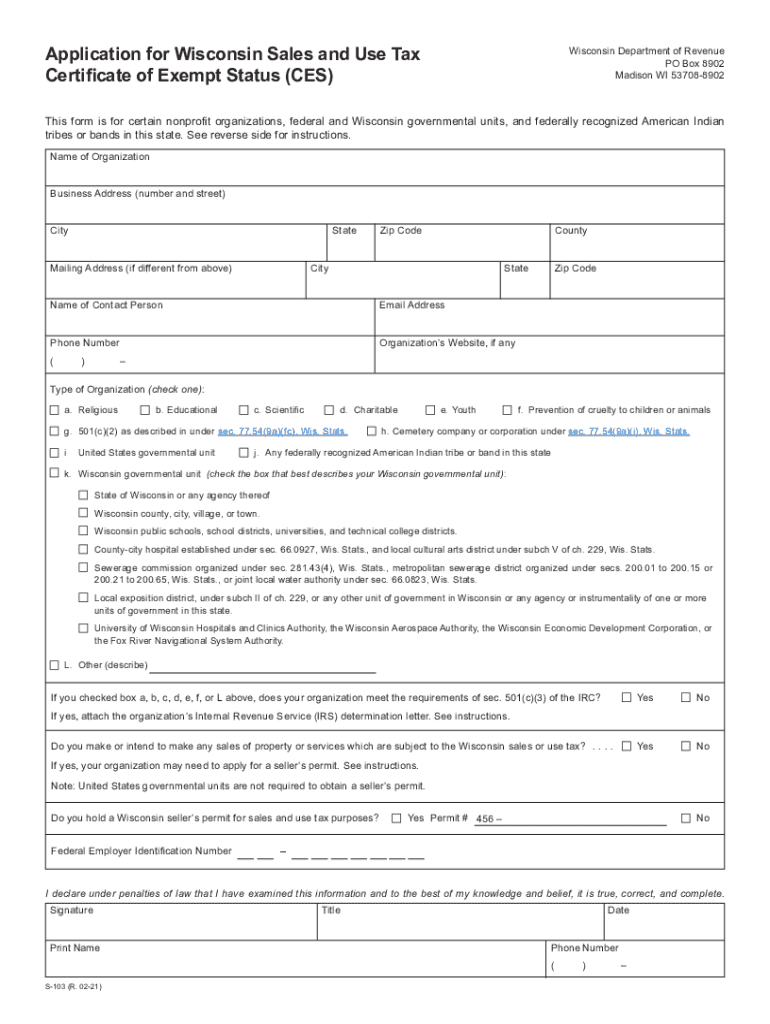

The S-103 form is a crucial document for businesses in Wisconsin seeking a Sales and Use Tax Certificate of Exempt Status. This certificate allows eligible entities to make tax-exempt purchases for specific purposes. Understanding the purpose and requirements of the S-103 form is essential for compliance with state tax regulations.

This application is primarily used by organizations that qualify as exempt under Wisconsin law, such as certain non-profit entities, government agencies, and specific educational institutions. The form must be accurately completed and submitted to ensure the exemption is recognized by the Wisconsin Department of Revenue.

Steps to Complete the S-103 Application

Filling out the S-103 form requires attention to detail. Here are the essential steps to ensure proper completion:

- Gather necessary documentation, including proof of your organization’s exempt status.

- Fill out the application with accurate information, including the name, address, and type of organization.

- Provide details about the intended use of the purchases that will be made tax-exempt.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the Wisconsin Department of Revenue through the appropriate method.

Eligibility Criteria for the S-103 Application

To qualify for the S-103 form, applicants must meet specific eligibility criteria set by the Wisconsin Department of Revenue. Generally, the following types of organizations may apply:

- Non-profit organizations that operate for charitable, educational, or religious purposes.

- Government entities at the federal, state, or local level.

- Certain educational institutions that meet the requirements outlined by the state.

It is important to review the detailed eligibility guidelines to ensure compliance and avoid potential issues during the application process.

Legal Use of the S-103 Application

The S-103 form serves a legal purpose in the context of Wisconsin sales and use tax law. By obtaining the exemption certificate, eligible organizations can legally purchase goods and services without incurring sales tax. This legal framework is designed to support non-profit activities and government functions, ensuring that these entities can operate effectively without the burden of additional tax costs.

Failure to comply with the regulations surrounding the use of the S-103 form may result in penalties or the loss of exempt status, making it vital for organizations to adhere strictly to the guidelines provided by the Wisconsin Department of Revenue.

Form Submission Methods for the S-103 Application

Submitting the S-103 application can be done through various methods, depending on the preferences of the applicant and the requirements of the Wisconsin Department of Revenue:

- Online Submission: Many organizations prefer to submit their applications electronically through the department's online portal.

- Mail Submission: Completed forms can also be mailed directly to the Wisconsin Department of Revenue.

- In-Person Submission: Applicants may choose to deliver their forms in person at designated department offices.

It is advisable to check the latest submission guidelines to ensure compliance with any changes in the process.

Quick guide on how to complete february 2021 s 103 application for wisconsin sales and use tax certificate of exempt status ces and instructions fillable

Effortlessly prepare February S 103 Application For Wisconsin Sales And Use Tax Certificate Of Exempt Status CES And Instructions Fillable on any device

The management of online documents has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly solution to traditional printed and signed paperwork, allowing you to locate the appropriate form and securely store it in the cloud. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and eSign your documents without interruption. Manage February S 103 Application For Wisconsin Sales And Use Tax Certificate Of Exempt Status CES And Instructions Fillable on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to edit and eSign February S 103 Application For Wisconsin Sales And Use Tax Certificate Of Exempt Status CES And Instructions Fillable with ease

- Locate February S 103 Application For Wisconsin Sales And Use Tax Certificate Of Exempt Status CES And Instructions Fillable and click Get Form to initiate.

- Utilize the tools available to complete your document.

- Emphasize important sections of the documents or obscure sensitive details using features specifically offered by airSlate SignNow for that purpose.

- Generate your signature with the Sign tool, which requires mere seconds and possesses the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to finalize your edits.

- Select your preferred method of sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, frustrating form searches, and mistakes that necessitate reprinting new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign February S 103 Application For Wisconsin Sales And Use Tax Certificate Of Exempt Status CES And Instructions Fillable to ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the february 2021 s 103 application for wisconsin sales and use tax certificate of exempt status ces and instructions fillable

The best way to create an electronic signature for your PDF document online

The best way to create an electronic signature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

How to generate an electronic signature right from your smart phone

The way to create an electronic signature for a PDF document on iOS

How to generate an electronic signature for a PDF on Android OS

People also ask

-

What is the s103 feature in airSlate SignNow?

The s103 feature in airSlate SignNow streamlines the process of electronic signatures and document management. It offers a user-friendly interface that allows businesses to send and eSign documents quickly and securely. With s103, you can automate workflows and ensure compliance with eSignature laws.

-

How much does airSlate SignNow's s103 feature cost?

Pricing for the airSlate SignNow s103 feature varies based on the selected plan. It is designed to be cost-effective, offering various tiers to fit different business needs. Prospective customers can visit our pricing page to explore the options and find the right plan that incorporates the s103 capabilities.

-

What are the key benefits of using the s103 feature?

The s103 feature in airSlate SignNow enhances productivity by simplifying document workflows and reducing turnaround time. It empowers users to eSign documents from anywhere, streamlining approval processes. Additionally, the feature ensures document security and compliance, making it a reliable choice for businesses.

-

Can I integrate s103 with other software tools?

Yes, the s103 feature in airSlate SignNow integrates seamlessly with various software applications, including CRMs and document management systems. This interoperability allows businesses to incorporate eSignature capabilities without disrupting their existing workflows. Take advantage of our API for custom integrations to enhance your efficiency.

-

How does the s103 feature ensure document security?

The s103 feature in airSlate SignNow employs industry-leading security measures to protect sensitive documents. This includes data encryption, secure cloud storage, and comprehensive user authentication processes. By prioritizing security, airSlate SignNow ensures that your documents remain confidential and tamper-proof.

-

Is the s103 feature user-friendly for non-technical users?

Absolutely! The s103 feature in airSlate SignNow is designed with usability in mind, making it accessible for users of all technical backgrounds. Its intuitive interface and straightforward navigation allow anyone to send and eSign documents without extensive training or experience.

-

Does the s103 feature offer mobile access?

Yes, the s103 feature in airSlate SignNow is accessible on mobile devices, allowing users to manage documents and eSign on the go. This flexibility ensures that you can conduct business anytime and anywhere, enhancing productivity and responsiveness. Download our mobile app to experience the full functionality of s103 on your device.

Get more for February S 103 Application For Wisconsin Sales And Use Tax Certificate Of Exempt Status CES And Instructions Fillable

- Letter from tenant to landlord containing notice to landlord to withdraw improper rent increase during lease arizona form

- Letter from landlord to tenant about intent to increase rent and effective date of rental increase arizona form

- Letter from landlord to tenant as notice to tenant to repair damage caused by tenant arizona form

- Arizona claim benefits form

- Letter tenant increase form

- Letter from tenant to landlord containing notice to landlord to cease retaliatory decrease in services arizona form

- Temporary lease agreement to prospective buyer of residence prior to closing arizona form

- Letter from tenant to landlord containing notice to landlord to cease retaliatory threats to evict or retaliatory eviction 497297132 form

Find out other February S 103 Application For Wisconsin Sales And Use Tax Certificate Of Exempt Status CES And Instructions Fillable

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document