Schedule 3K 1 Partner's Share of Income, Deductions, Credits, Etc Form

Understanding the Schedule 3K-1 Partner's Share of Income, Deductions, Credits, Etc.

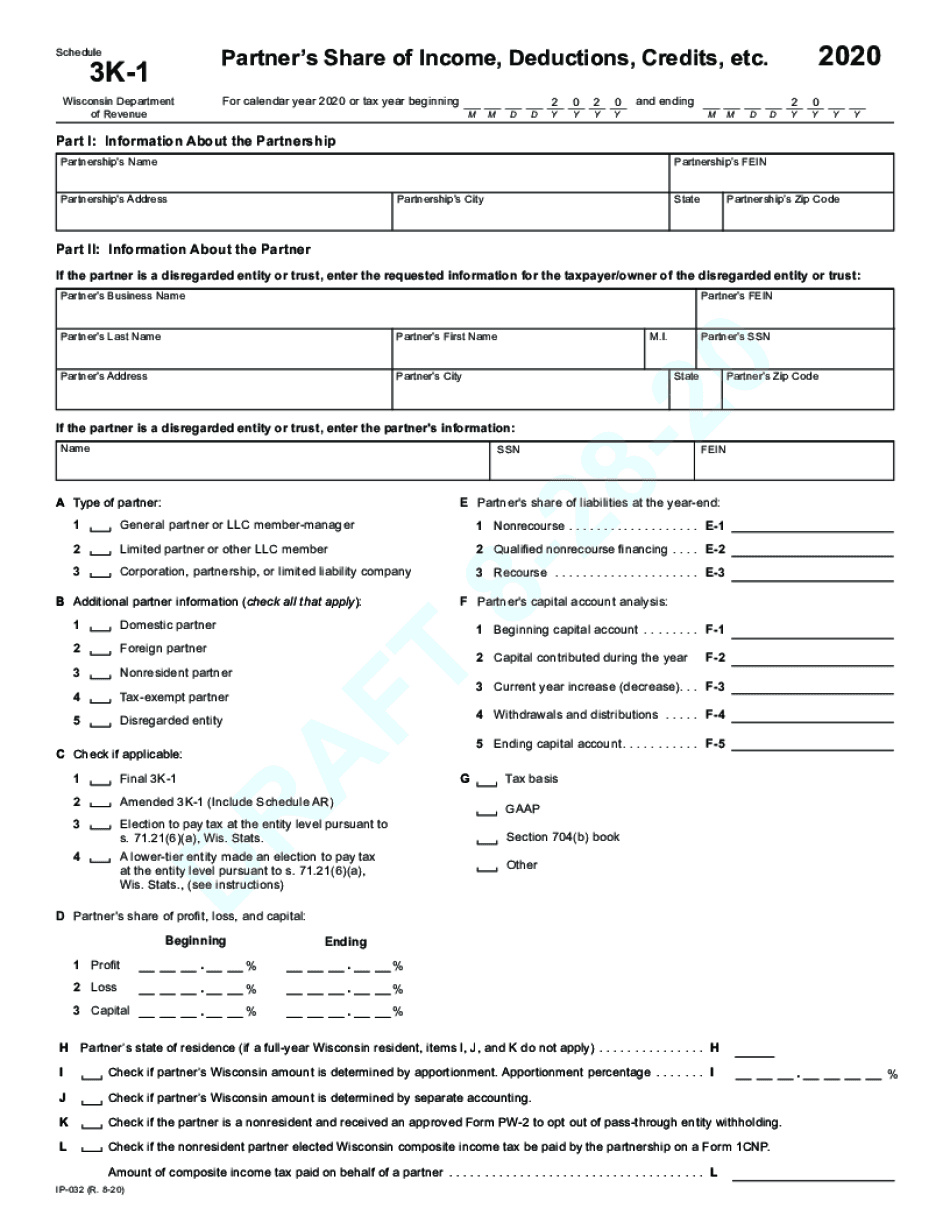

The Schedule 3K-1 is a crucial tax document used by partnerships to report each partner's share of income, deductions, credits, and other relevant tax information. This form is essential for partners to accurately report their income on their individual tax returns. The information on the Schedule 3K-1 is derived from the partnership's overall financial activities and is allocated to each partner based on their ownership percentage or partnership agreement.

Steps to Complete the Schedule 3K-1

Completing the Schedule 3K-1 involves several steps to ensure accuracy and compliance with tax regulations. First, gather all necessary financial documents related to the partnership's income and expenses. Next, accurately report each partner's share of income, deductions, and credits as outlined in the partnership agreement. Ensure that all figures are correctly calculated and that any applicable tax credits are included. Finally, review the completed form for any errors before submitting it to the appropriate tax authorities.

Legal Use of the Schedule 3K-1

The Schedule 3K-1 is legally binding and must be filled out in accordance with IRS guidelines. It serves as an official record of each partner's share of the partnership's financial activities. To ensure its legal standing, the form must be completed accurately and filed on time. Partners should retain a copy of the Schedule 3K-1 for their records, as it may be required for future tax filings or audits.

Filing Deadlines for the Schedule 3K-1

Filing deadlines for the Schedule 3K-1 are crucial for compliance. The partnership must provide the completed Schedule 3K-1 to each partner by the due date of the partnership's tax return. Typically, this is the fifteenth day of the third month following the end of the partnership's tax year. Partners must ensure they receive their Schedule 3K-1 in time to accurately report their income on their individual tax returns, which are generally due on April fifteenth.

Required Documents for Completing the Schedule 3K-1

To complete the Schedule 3K-1, partners need several documents, including the partnership's financial statements, prior year tax returns, and any relevant agreements that outline the distribution of income and expenses among partners. These documents provide the necessary information to accurately report each partner's share and ensure compliance with IRS regulations.

Examples of Using the Schedule 3K-1

Partners can utilize the Schedule 3K-1 in various scenarios. For instance, if a partner is involved in a real estate partnership, the Schedule 3K-1 will detail their share of rental income, depreciation, and other deductions. Similarly, partners in a professional services firm will report their share of income and any applicable business expenses. Each example highlights the importance of accurately reporting this information for tax purposes.

Quick guide on how to complete 2020 schedule 3k 1 partners share of income deductions credits etc

Complete Schedule 3K 1 Partner's Share Of Income, Deductions, Credits, Etc effortlessly on any device

Managing documents online has increasingly gained traction among businesses and individuals. It serves as an excellent eco-friendly substitute for traditional printed and signed papers, allowing you to access the right format and securely save it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and electronically sign your documents without any holdups. Manage Schedule 3K 1 Partner's Share Of Income, Deductions, Credits, Etc on any device through airSlate SignNow Android or iOS applications and streamline any document-driven process today.

How to modify and electronically sign Schedule 3K 1 Partner's Share Of Income, Deductions, Credits, Etc with ease

- Find Schedule 3K 1 Partner's Share Of Income, Deductions, Credits, Etc and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or obscure sensitive data with tools specifically designed for that purpose, available through airSlate SignNow.

- Create your signature with the Sign tool, which only takes seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing additional copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Modify and electronically sign Schedule 3K 1 Partner's Share Of Income, Deductions, Credits, Etc to guarantee outstanding communication throughout every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2020 schedule 3k 1 partners share of income deductions credits etc

The way to create an e-signature for a PDF document in the online mode

The way to create an e-signature for a PDF document in Chrome

The best way to generate an e-signature for putting it on PDFs in Gmail

The best way to make an electronic signature straight from your mobile device

The best way to generate an e-signature for a PDF document on iOS devices

The best way to make an electronic signature for a PDF document on Android devices

People also ask

-

What is the form 3k wisconsin online and how can I use it?

The form 3k wisconsin online is an essential document used in Wisconsin for various business and personal transactions. You can easily fill out and eSign this form using airSlate SignNow's intuitive platform, making the process faster and more efficient.

-

How much does it cost to use airSlate SignNow for the form 3k wisconsin online?

airSlate SignNow offers flexible pricing plans that cater to different needs, starting at a competitive rate for basic usage. By choosing SignNow, you can efficiently manage your form 3k wisconsin online without breaking the bank.

-

What are the key features of airSlate SignNow for handling form 3k wisconsin online?

AirSlate SignNow provides features such as customizable templates, secure eSignature capabilities, and document tracking specifically designed for forms like the 3k wisconsin online. These features streamline your workflow and enhance productivity.

-

Can I integrate airSlate SignNow with other software for handling the form 3k wisconsin online?

Yes, airSlate SignNow seamlessly integrates with popular applications such as Google Workspace, Microsoft Office, and CRMs. This integration allows you to efficiently work with your form 3k wisconsin online alongside your other essential tools.

-

Is airSlate SignNow compliant with regulations for the form 3k wisconsin online?

Absolutely! airSlate SignNow complies with all necessary legal standards and regulations for electronic signatures, ensuring that your form 3k wisconsin online is processed securely and legally.

-

How can I get started with filling out my form 3k wisconsin online on airSlate SignNow?

Getting started is simple! Just sign up for an account on airSlate SignNow, choose our form 3k wisconsin online template, and start filling it out. Our user-friendly interface guides you through the process.

-

What benefits does airSlate SignNow offer for the form 3k wisconsin online?

Using airSlate SignNow for the form 3k wisconsin online provides signNow benefits such as reduced processing time, enhanced efficiency, and secure storage for all your documents. This not only saves time but also minimizes errors.

Get more for Schedule 3K 1 Partner's Share Of Income, Deductions, Credits, Etc

- Conservatorship murphy ca form

- Quitclaim deed three individuals to two individuals california form

- Grant deed from two individuals as grantors to two individuals as grantees california form

- California husband wife 497298327 form

- Grant deed trust 497298328 form

- Quitclaim deed individual to six individuals california form

- Mineral rights form

- Gift deed form 497298331

Find out other Schedule 3K 1 Partner's Share Of Income, Deductions, Credits, Etc

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form