Fiduciary Allocation it 205 a Department of Taxation and Form

Understanding the Fiduciary Allocation IT 205 A

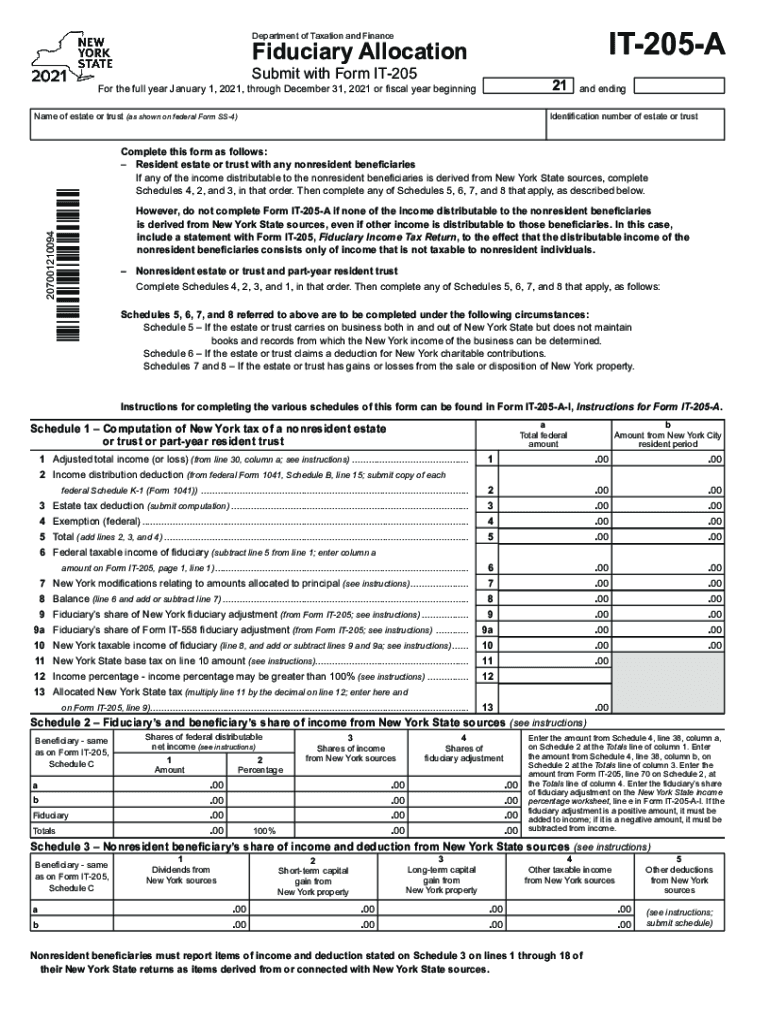

The Fiduciary Allocation IT 205 A is a form issued by the New York State Department of Taxation and Finance. It is designed for fiduciaries to report income, deductions, and credits for estates and trusts. This form is essential for ensuring that the income generated by the estate or trust is appropriately allocated to beneficiaries, which is crucial for tax purposes. Understanding its structure and requirements can help fiduciaries navigate their responsibilities effectively.

Steps to Complete the Fiduciary Allocation IT 205 A

Completing the Fiduciary Allocation IT 205 A involves several key steps:

- Gather necessary documentation, including financial statements and tax records related to the estate or trust.

- Fill out the form with accurate information regarding income, deductions, and credits.

- Ensure that all beneficiary information is correctly entered, reflecting their respective shares of income.

- Review the completed form for accuracy and completeness before submission.

Legal Use of the Fiduciary Allocation IT 205 A

The Fiduciary Allocation IT 205 A holds legal significance as it serves as an official document for reporting tax obligations. It must be completed in compliance with New York State tax laws to ensure that the income is taxed appropriately. Proper use of this form helps prevent legal issues related to misreporting income or failing to allocate funds correctly among beneficiaries.

Filing Deadlines and Important Dates

Filing the Fiduciary Allocation IT 205 A is subject to specific deadlines. Typically, the form must be submitted by the 15th day of the fourth month following the close of the estate's or trust's tax year. It is essential to be aware of these dates to avoid penalties and ensure compliance with tax regulations.

Required Documents for the Fiduciary Allocation IT 205 A

To complete the Fiduciary Allocation IT 205 A, certain documents are required:

- Financial statements detailing income and expenses of the estate or trust.

- Tax records from previous years, if applicable.

- Information regarding beneficiaries, including their tax identification numbers.

Who Issues the Fiduciary Allocation IT 205 A

The Fiduciary Allocation IT 205 A is issued by the New York State Department of Taxation and Finance. This agency is responsible for administering tax laws and ensuring compliance among fiduciaries managing estates and trusts. Understanding the issuing authority helps fiduciaries know where to direct any inquiries or concerns regarding the form.

Quick guide on how to complete fiduciary allocation it 205 a department of taxation and 577839398

Complete Fiduciary Allocation IT 205 A Department Of Taxation And effortlessly on any gadget

Digital document management has surged in popularity among businesses and individuals. It offers a perfect eco-conscious alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources you need to create, modify, and eSign your documents swiftly without delays. Manage Fiduciary Allocation IT 205 A Department Of Taxation And on any platform with airSlate SignNow for Android or iOS applications and enhance any document-centric operation today.

How to alter and eSign Fiduciary Allocation IT 205 A Department Of Taxation And with ease

- Locate Fiduciary Allocation IT 205 A Department Of Taxation And and click on Get Form to commence.

- Utilize the tools we provide to complete your form.

- Highlight essential sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from a device of your choosing. Edit and eSign Fiduciary Allocation IT 205 A Department Of Taxation And and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fiduciary allocation it 205 a department of taxation and 577839398

How to generate an electronic signature for a PDF document online

How to generate an electronic signature for a PDF document in Google Chrome

The way to generate an e-signature for signing PDFs in Gmail

How to generate an electronic signature right from your smart phone

How to make an e-signature for a PDF document on iOS

How to generate an electronic signature for a PDF on Android OS

People also ask

-

What is a 205a form print and why is it important?

The 205a form print is a crucial document used for various business processes, specifically for submitting information related to certain transactions. Ensuring you have an accurate and readily available 205a form print can streamline operations and reduce potential errors during submission.

-

How can I create a 205a form print using airSlate SignNow?

Creating a 205a form print with airSlate SignNow is simple and efficient. You can easily upload your document, customize it within our platform, and prepare it for electronic signatures, ensuring quick turnaround times for your workflow.

-

Is there a cost associated with obtaining a 205a form print from airSlate SignNow?

airSlate SignNow offers competitive pricing plans that include access to features for creating and managing a 205a form print. You can choose a plan that fits your business needs and budget, often available with a free trial for new users.

-

What features does airSlate SignNow offer for managing a 205a form print?

AirSlate SignNow comes equipped with various features to enhance the management of your 205a form print, such as templates, collaborative editing, and secure eSignatures. These functionalities help ensure that your document processes are efficient and compliant.

-

Can I integrate airSlate SignNow with other applications for my 205a form print?

Yes, airSlate SignNow offers robust integrations with various applications to facilitate the handling of your 205a form print. This integration capability allows you to seamlessly connect with CRM, cloud storage, and more, streamlining your workflow.

-

What are the benefits of using airSlate SignNow for my 205a form print needs?

Utilizing airSlate SignNow for your 205a form print provides numerous benefits, such as enhanced security, ease of use, and cost-effectiveness. By automating your document processes, you can save time and prevent errors, ensuring a smoother experience.

-

How secure is the 205a form print submission process with airSlate SignNow?

The security of your 205a form print submission is a priority at airSlate SignNow. We implement industry-standard encryption protocols and secure authentication processes to protect your data and ensure your documents are safe throughout the signing process.

Get more for Fiduciary Allocation IT 205 A Department Of Taxation And

Find out other Fiduciary Allocation IT 205 A Department Of Taxation And

- Sign Mississippi Insurance POA Fast

- How Do I Sign South Carolina Lawers Limited Power Of Attorney

- Sign South Dakota Lawers Quitclaim Deed Fast

- Sign South Dakota Lawers Memorandum Of Understanding Free

- Sign South Dakota Lawers Limited Power Of Attorney Now

- Sign Texas Lawers Limited Power Of Attorney Safe

- Sign Tennessee Lawers Affidavit Of Heirship Free

- Sign Vermont Lawers Quitclaim Deed Simple

- Sign Vermont Lawers Cease And Desist Letter Free

- Sign Nevada Insurance Lease Agreement Mobile

- Can I Sign Washington Lawers Quitclaim Deed

- Sign West Virginia Lawers Arbitration Agreement Secure

- Sign Wyoming Lawers Lease Agreement Now

- How To Sign Alabama Legal LLC Operating Agreement

- Sign Alabama Legal Cease And Desist Letter Now

- Sign Alabama Legal Cease And Desist Letter Later

- Sign California Legal Living Will Online

- How Do I Sign Colorado Legal LLC Operating Agreement

- How Can I Sign California Legal Promissory Note Template

- How Do I Sign North Dakota Insurance Quitclaim Deed