Income Withholding Order for Spousal Support Only Vs Form 2012-2026

Understanding the Income Withholding Order for Spousal Support

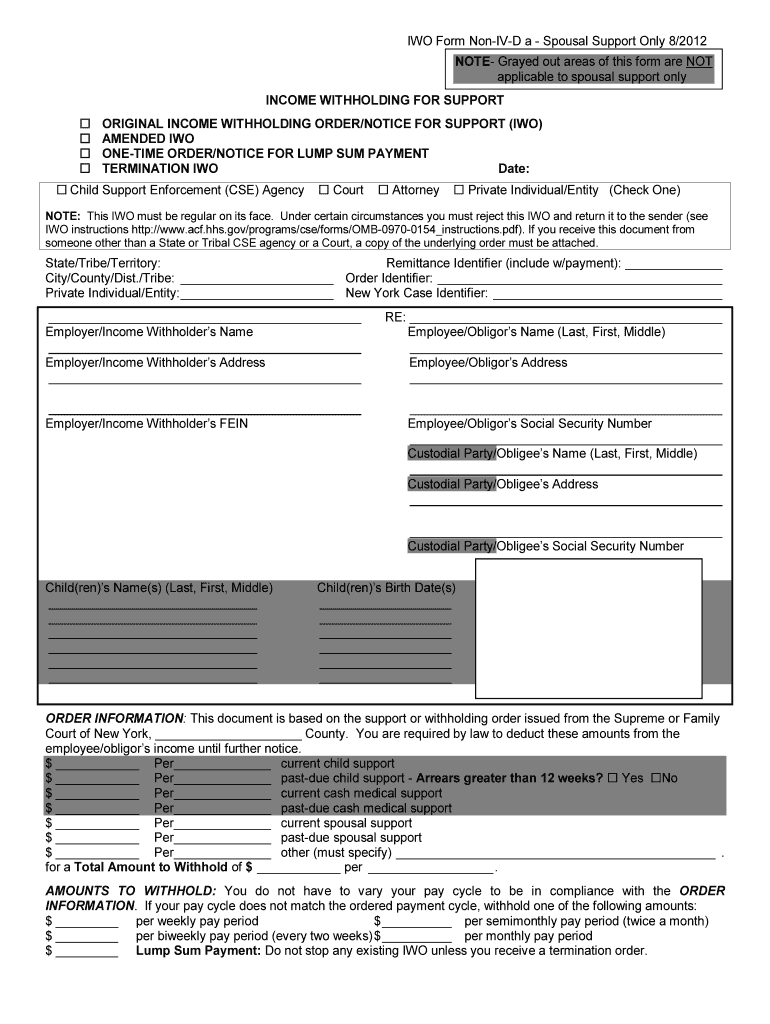

The Income Withholding Order for Spousal Support is a legal document used to facilitate the collection of spousal support payments directly from the income of the paying spouse. This form is essential for ensuring that payments are made consistently and on time. It typically outlines the amount to be withheld from the payor's wages and is issued by a court or authorized agency. Understanding the purpose and function of this form can help both parties navigate their financial obligations effectively.

Steps to Complete the Income Withholding Order for Spousal Support

Completing the Income Withholding Order for Spousal Support involves several key steps:

- Gather necessary information, including the names and addresses of both spouses, the court case number, and the amount of spousal support to be withheld.

- Fill out the form accurately, ensuring all required fields are completed. This includes details about the employer of the paying spouse.

- Review the form for any errors or omissions before submission. Accurate information is crucial to avoid delays.

- Sign and date the form, as required, to validate it legally.

- Submit the completed form to the appropriate court or agency, ensuring it reaches the correct office for processing.

Legal Use of the Income Withholding Order for Spousal Support

The legal use of the Income Withholding Order for Spousal Support is governed by state laws, which outline how the form should be utilized and enforced. This document serves as a court order, compelling the employer of the paying spouse to withhold the specified amount from their paycheck. It is crucial that the order is issued by a court to ensure its legality and enforceability. Failure to comply with the order can result in legal penalties for the paying spouse.

Key Elements of the Income Withholding Order for Spousal Support

Several key elements must be included in the Income Withholding Order for Spousal Support to ensure its effectiveness:

- Identifying Information: Names, addresses, and case numbers for both spouses.

- Payment Details: The specific amount to be withheld and the frequency of payments.

- Employer Information: The name and address of the employer responsible for withholding payments.

- Signature: The signature of the issuing authority, typically a judge or court official.

Obtaining the Income Withholding Order for Spousal Support

To obtain the Income Withholding Order for Spousal Support, individuals typically need to request it through the court that issued the original spousal support order. This may involve submitting a formal request or petition, along with any required documentation. It is advisable to consult with a legal professional to ensure that all necessary steps are followed and that the order is issued correctly.

State-Specific Rules for the Income Withholding Order for Spousal Support

Each state has its own regulations governing the Income Withholding Order for Spousal Support. These rules can dictate the process for issuing the order, the required information, and how payments are processed. It is essential for individuals to familiarize themselves with their state's specific laws to ensure compliance and proper enforcement of the order. Consulting state-specific legal resources or professionals can provide clarity on these regulations.

Quick guide on how to complete income withholding order for spousal support only vs form

Complete and submit your Income Withholding Order For Spousal Support Only Vs Form swiftly

Effective tools for digital document exchange and authorization are essential for streamlining processes and the continuous enhancement of your forms. When handling legal documents and executing a Income Withholding Order For Spousal Support Only Vs Form, the appropriate signature solution can conserve a signNow amount of time and paper with each submission.

Locate, complete, modify, sign, and distribute your legal documents with airSlate SignNow. This platform provides everything you require to create efficient paper submission workflows. Its extensive library of legal forms and user-friendly navigation will assist you in obtaining your Income Withholding Order For Spousal Support Only Vs Form quickly, and the editor featuring our signature functionality will enable you to complete and authorize it instantly.

Authorize your Income Withholding Order For Spousal Support Only Vs Form in a few straightforward steps

- Search for the Income Withholding Order For Spousal Support Only Vs Form you need in our library using the search function or browsing through catalog pages.

- Examine the form details and preview it to confirm it meets your requirements and legal standards.

- Click Obtain form to edit it.

- Complete the document utilizing the detailed toolbar.

- Review the information you have entered and click the Sign tool to validate your document.

- Choose one of three options to affix your signature.

- Finalize your edits and save the file, then download it to your device or share it right away.

Enhance every stage of your document preparation and approval process with airSlate SignNow. Explore a more effective online solution that comprehensively addresses all aspects of handling your documents.

Create this form in 5 minutes or less

FAQs

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

How long does it take for an income withholding order for child support to go into effect? Who do I notify if it is taking too long?

Usually four to six weeks once it gets to the employer properly, and if it is done properly. You should contact whoever prepared it and submitted it.

-

How do I respond to a request for a restraining order? Do I need to fill out a form?

As asked of me specifically;The others are right, you will likely need a lawyer. But to answer your question, there is a response form to respond to a restraining order or order of protection. Worst case the form is available at the courthouse where your hearing is set to be heard in, typically at the appropriate clerk's window, which may vary, so ask any of the clerk's when you get there.You only have so many days to respond, and it will specify in the paperwork.You will also have to appear in court on the date your hearing is scheduled.Most courts have a department that will help you respond to forms at no cost. I figure you are asking because you can't afford an attorney which is completely understandable.The problem is that if you aren't represented and the other person is successful in getting a temporary restraining order made permanent in the hearing you will not be allowed at any of the places the petitioner goes, without risking arrest.I hope this helps.Not given as legal advice-

-

How can I deduct on my Federal income taxes massage therapy for my chronic migraines? Is there some form to fill out to the IRS for permission?

As long as your doctor prescribed this, it is tax deductible under the category for medical expenses. There is no IRS form for permission.

-

For the amended tax return, the only thing I needed to correct was the filing status. Do I still need to fill out the rest of the form involving income, etc.?

Yes, it depends what kind of income. For social security incomes, there is a different threshold amount for single and Married Filing joint. Different filing status have a certain treatment and that tax rates are different for every filing status. The filing status change goes on the very top of the 1040X. When I was a Tax Auditor for the IRS, the 1040X was one of the hardest thing to calculate. Just a few years ago, the IRS decided to change but with disastrous results- people were more confused than the original. So IRS changed the 1040X to its original. Follow your program’s instruction or go to an Enrolled Agent. I found out throughout my career that a good majority of CPA’s do not know the mechanics of the 1040X. Chances are you may need to send the returns by mail.

-

How do very mixed race people fill out official documents and forms that ask for race if one is only allowed to choose one race?

None of the above?

Create this form in 5 minutes!

How to create an eSignature for the income withholding order for spousal support only vs form

How to create an electronic signature for the Income Withholding Order For Spousal Support Only Vs Form in the online mode

How to make an eSignature for your Income Withholding Order For Spousal Support Only Vs Form in Google Chrome

How to create an electronic signature for signing the Income Withholding Order For Spousal Support Only Vs Form in Gmail

How to create an eSignature for the Income Withholding Order For Spousal Support Only Vs Form from your smartphone

How to make an eSignature for the Income Withholding Order For Spousal Support Only Vs Form on iOS

How to create an electronic signature for the Income Withholding Order For Spousal Support Only Vs Form on Android

People also ask

-

What is a withholding spousal form?

A withholding spousal form is a tax-related document that allows individuals to designate withholding preferences from their income for spousal exemptions. It ensures accurate tax withholding on behalf of a spouse and can help avoid underpayment penalties. Using airSlate SignNow simplifies the process of completing and signing this form electronically, making it efficient and hassle-free.

-

How can I create a withholding spousal form using airSlate SignNow?

Creating a withholding spousal form with airSlate SignNow is straightforward. Simply choose a template, fill in the necessary information, and customize it to meet your needs. Once completed, you can send it for eSignature to ensure it's ready for submission.

-

Is airSlate SignNow secure for signing a withholding spousal form?

Yes, airSlate SignNow prioritizes security, employing advanced encryption protocols to protect your documents, including the withholding spousal form. You can confidently sign and send your form, knowing that your information is safeguarded against unauthorized access.

-

What are the costs associated with using airSlate SignNow for my withholding spousal form?

airSlate SignNow offers flexible pricing plans tailored to fit various needs, ensuring you get the best value. Monthly or annual subscriptions are available, and you can also take advantage of a free trial to evaluate whether it meets your needs for managing documents like the withholding spousal form.

-

Can airSlate SignNow integrate with other applications for managing my withholding spousal form?

Absolutely! airSlate SignNow integrates seamlessly with a variety of applications such as CRM, cloud storage, and project management tools. This functionality allows you to manage your withholding spousal form efficiently alongside your other business processes.

-

What features does airSlate SignNow offer for handling a withholding spousal form?

airSlate SignNow provides several features to enhance the handling of a withholding spousal form, including customizable templates, eSignature capabilities, and automated reminders. These features streamline the signing process, making it quicker and more reliable for users.

-

How does airSlate SignNow benefit small businesses getting a withholding spousal form?

For small businesses, airSlate SignNow offers a cost-effective solution to manage important documents like the withholding spousal form. Its easy-to-use interface and powerful automation tools help reduce administrative burdens, allowing owners to focus on their core business activities.

Get more for Income Withholding Order For Spousal Support Only Vs Form

- Use this form when recipient is not bcca or vch or cfri

- Card request form

- Secretary of state nameaddress change request form

- Esophageal thoracic oncology dsg referral guidelines form

- 1ces application form designate third party release information form des v1pdf

- Guardianship of incapacitated or disabled persons findlaw form

- Application 2020 forms and guidelines

- Form 511e medical information for excursions tdsb school

Find out other Income Withholding Order For Spousal Support Only Vs Form

- How Can I Sign Connecticut Plumbing LLC Operating Agreement

- Sign Illinois Plumbing Business Plan Template Fast

- Sign Plumbing PPT Idaho Free

- How Do I Sign Wyoming Life Sciences Confidentiality Agreement

- Sign Iowa Plumbing Contract Safe

- Sign Iowa Plumbing Quitclaim Deed Computer

- Sign Maine Plumbing LLC Operating Agreement Secure

- How To Sign Maine Plumbing POA

- Sign Maryland Plumbing Letter Of Intent Myself

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure