Form Cit 1 New Mexico Corporate Income and Franchise Tax

What is the Form CIT 1 New Mexico Corporate Income and Franchise Tax

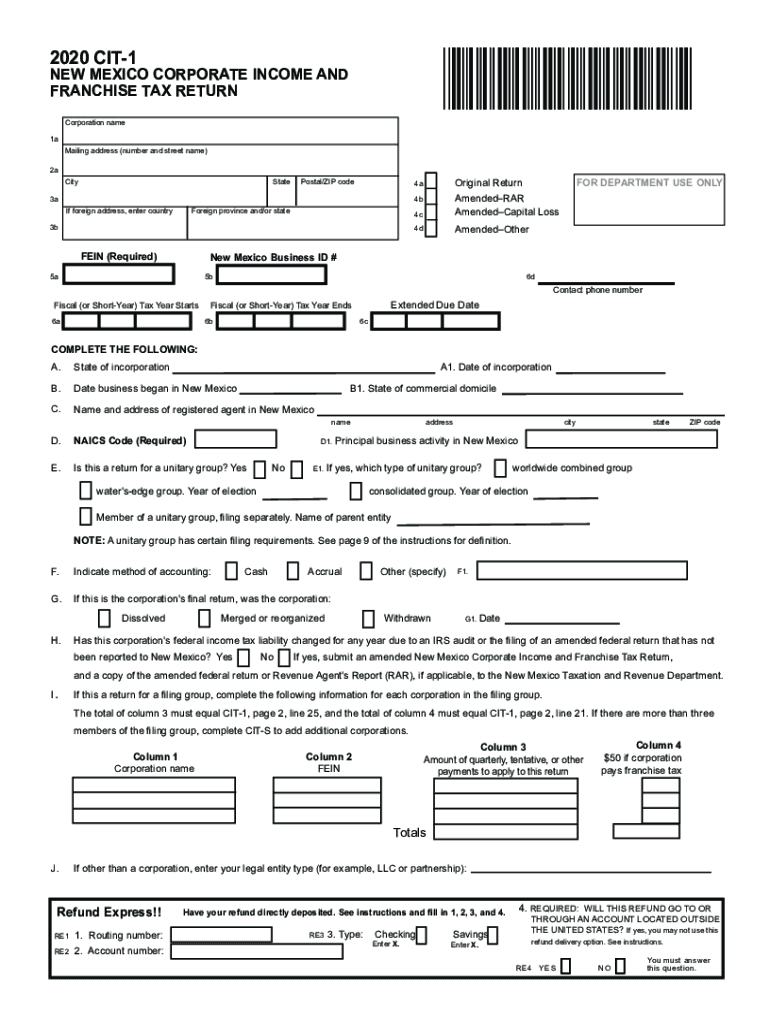

The Form CIT 1 is a crucial document for businesses operating in New Mexico. It is used to report corporate income and franchise taxes. This form is essential for corporations, limited liability companies (LLCs), and partnerships that elect to be taxed as corporations. The CIT 1 captures the necessary financial information to determine the tax liability for the business entity. Understanding the purpose of this form is vital for compliance with state tax laws.

How to Use the Form CIT 1 New Mexico Corporate Income and Franchise Tax

Using the Form CIT 1 involves several steps to ensure accurate reporting of corporate income and franchise taxes. First, gather all necessary financial documents, including income statements and balance sheets. Next, complete the form by entering the required information, such as gross receipts, deductions, and credits. It is important to review the instructions carefully to avoid errors. Once completed, the form can be submitted either electronically or via mail, depending on the preferences of the business.

Steps to Complete the Form CIT 1 New Mexico Corporate Income and Franchise Tax

Completing the Form CIT 1 requires careful attention to detail. Follow these steps:

- Obtain the latest version of the CIT 1 form from the New Mexico Taxation and Revenue Department.

- Fill in the business name, address, and federal employer identification number (EIN).

- Report total gross receipts and any allowable deductions.

- Calculate the net income and apply the appropriate tax rate.

- Include any applicable credits and determine the final tax due.

- Sign and date the form before submission.

Filing Deadlines / Important Dates

Filing deadlines for the Form CIT 1 are critical for compliance. Typically, the form is due on the 15th day of the fourth month following the end of the corporation's tax year. For most businesses operating on a calendar year, this means the due date is April 15. Late filings may incur penalties and interest, so it is essential to adhere to these deadlines to avoid additional costs.

Penalties for Non-Compliance

Failure to file the Form CIT 1 on time can result in significant penalties. The New Mexico Taxation and Revenue Department may impose a late filing penalty, which is typically a percentage of the tax due. Additionally, interest accrues on any unpaid taxes, increasing the overall liability. Businesses should be aware of these penalties and ensure timely submission of their tax forms to maintain compliance.

Digital vs. Paper Version

When completing the Form CIT 1, businesses have the option to file digitally or use a paper version. The digital form offers convenience and faster processing times, while the paper version may be preferred by those who are not comfortable with online submissions. Regardless of the method chosen, it is important to ensure that all information is accurate and complete to avoid delays or issues with the filing.

Quick guide on how to complete form cit 1 new mexico corporate income and franchise tax

Prepare Form Cit 1 New Mexico Corporate Income And Franchise Tax effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the appropriate form and securely keep it online. airSlate SignNow provides you with all the tools you need to create, modify, and electronically sign your documents swiftly without delays. Manage Form Cit 1 New Mexico Corporate Income And Franchise Tax on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign Form Cit 1 New Mexico Corporate Income And Franchise Tax with ease

- Obtain Form Cit 1 New Mexico Corporate Income And Franchise Tax and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight key sections of your documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method for sharing your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Form Cit 1 New Mexico Corporate Income And Franchise Tax and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form cit 1 new mexico corporate income and franchise tax

The best way to create an electronic signature for a PDF in the online mode

The best way to create an electronic signature for a PDF in Chrome

How to create an e-signature for putting it on PDFs in Gmail

The best way to generate an e-signature right from your smart phone

The way to create an e-signature for a PDF on iOS devices

The best way to generate an e-signature for a PDF on Android OS

People also ask

-

What is the significance of understanding new mexico income tax for businesses?

Understanding new mexico income tax is crucial for businesses to ensure compliance with state regulations. It helps in accurately calculating tax obligations and avoiding potential penalties. Additionally, it can assist in strategic financial planning and budgeting for your business.

-

How can airSlate SignNow help with new mexico income tax documentation?

airSlate SignNow simplifies the process of sending and signing important documents related to new mexico income tax. With our platform, you can easily create, share, and track tax documents online. This streamlines your workflow and reduces the time spent on administrative tasks.

-

Are there any specific features of airSlate SignNow that aid in handling new mexico income tax forms?

Yes, airSlate SignNow offers features like templates for new mexico income tax forms and secure electronic signatures. These tools ensure that you can efficiently manage all tax-related paperwork while adhering to state requirements. Our platform also provides audit trails for accountability.

-

What pricing options does airSlate SignNow offer for managing new mexico income tax documents?

airSlate SignNow provides affordable pricing plans tailored to different business needs, especially for managing new mexico income tax documents. You can choose a plan based on the number of users and features required. This flexibility ensures that you only pay for what you need.

-

Can airSlate SignNow integrate with other tools for managing new mexico income tax?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and finance software solutions, making it easier to manage new mexico income tax effectively. This integration allows you to streamline processes and eliminate data entry errors, enhancing overall efficiency.

-

What benefits can I expect when using airSlate SignNow for new mexico income tax?

Using airSlate SignNow for new mexico income tax provides numerous benefits, including time savings, increased accuracy, and enhanced security. Our platform protects sensitive information and simplifies the signing process, allowing you to focus on growing your business rather than getting bogged down by paperwork.

-

How does eSigning documents relate to new mexico income tax compliance?

eSigning documents with airSlate SignNow ensures that your agreements are legally binding and compliant with new mexico income tax regulations. This electronic signature solution facilitates quick and secure signing processes, reducing delays associated with traditional methods while maintaining compliance.

Get more for Form Cit 1 New Mexico Corporate Income And Franchise Tax

Find out other Form Cit 1 New Mexico Corporate Income And Franchise Tax

- Electronic signature Louisiana Real estate forms Secure

- Electronic signature Louisiana Real estate investment proposal template Fast

- Electronic signature Maine Real estate investment proposal template Myself

- eSignature Alabama Pet Addendum to Lease Agreement Simple

- eSignature Louisiana Pet Addendum to Lease Agreement Safe

- eSignature Minnesota Pet Addendum to Lease Agreement Fast

- Electronic signature South Carolina Real estate proposal template Fast

- Electronic signature Rhode Island Real estate investment proposal template Computer

- How To Electronic signature Virginia Real estate investment proposal template

- How To Electronic signature Tennessee Franchise Contract

- Help Me With Electronic signature California Consulting Agreement Template

- How To Electronic signature Kentucky Investment Contract

- Electronic signature Tennessee Consulting Agreement Template Fast

- How To Electronic signature California General Power of Attorney Template

- eSignature Alaska Bill of Sale Immovable Property Online

- Can I Electronic signature Delaware General Power of Attorney Template

- Can I Electronic signature Michigan General Power of Attorney Template

- Can I Electronic signature Minnesota General Power of Attorney Template

- How Do I Electronic signature California Distributor Agreement Template

- eSignature Michigan Escrow Agreement Simple