Form 3 Partnership Return of Income Mass Gov

What is the Form 3 Partnership Return of Income?

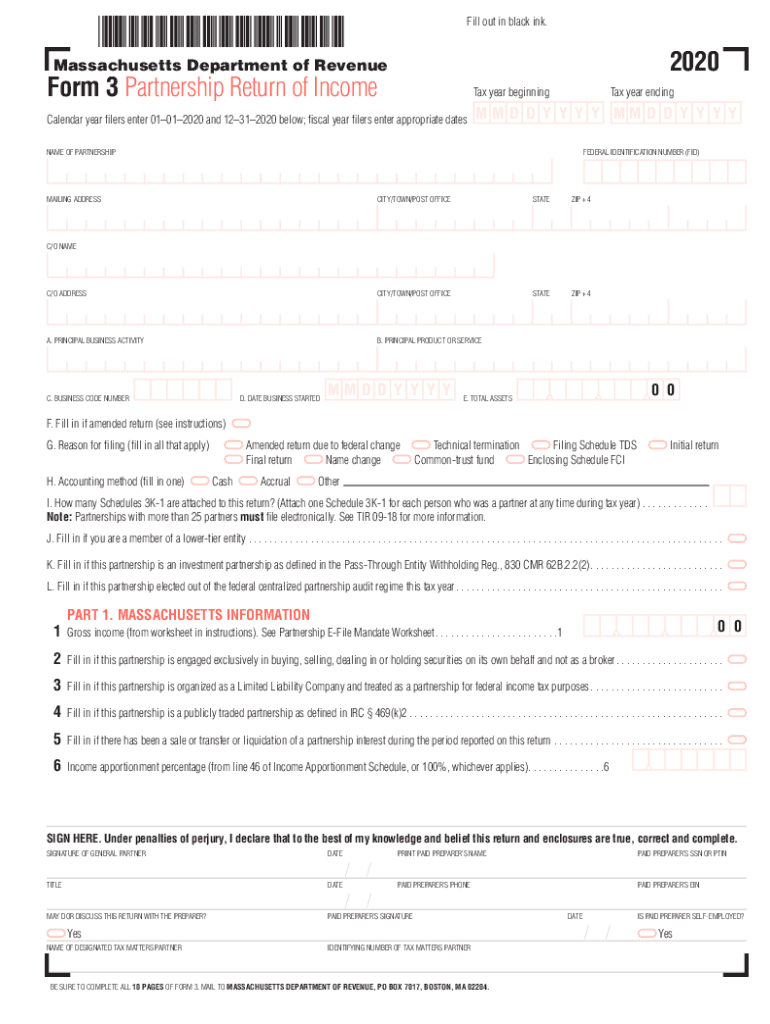

The Form 3 Partnership Return of Income is a tax document required by the Massachusetts Department of Revenue for partnerships operating within the state. This form is essential for reporting the income, deductions, and credits of a partnership. It facilitates the accurate assessment of tax obligations for partnerships, ensuring compliance with state tax laws. Each partner in the partnership must report their share of the income on their personal tax returns, making the Form 3 a crucial part of the overall tax process for partnerships in Massachusetts.

Steps to Complete the Form 3 Partnership Return of Income

Completing the Form 3 Partnership Return of Income involves several key steps:

- Gather necessary financial documents, including income statements, expense reports, and partner information.

- Fill out the form accurately, ensuring all income and deductions are reported correctly.

- Calculate the partnership's total income and each partner's distributive share.

- Review the completed form for accuracy and completeness.

- Submit the form to the Massachusetts Department of Revenue by the specified deadline.

Legal Use of the Form 3 Partnership Return of Income

The Form 3 Partnership Return of Income is legally binding when completed and submitted in accordance with Massachusetts tax laws. It must be signed by an authorized partner, ensuring that the information provided is accurate and truthful. Failure to comply with the legal requirements for this form can result in penalties, including fines and interest on unpaid taxes. Therefore, understanding the legal implications of this form is crucial for all partnerships operating in Massachusetts.

Filing Deadlines / Important Dates

Partnerships must be aware of the filing deadlines for the Form 3 Partnership Return of Income to avoid penalties. Typically, the form is due on the fifteenth day of the fourth month following the close of the partnership's tax year. For partnerships operating on a calendar year, this means the form is due by April 15. It's important for partnerships to mark their calendars and ensure timely submission to maintain compliance with state tax regulations.

Required Documents for Form 3 Partnership Return of Income

To complete the Form 3 Partnership Return of Income, several documents are required:

- Income statements detailing all sources of income for the partnership.

- Expense reports outlining all deductible expenses incurred by the partnership.

- Partner information, including names, addresses, and Social Security numbers or Employer Identification Numbers.

- Any supporting documentation for credits or deductions claimed on the form.

Form Submission Methods

The Form 3 Partnership Return of Income can be submitted in various ways, providing flexibility for partnerships. Options include:

- Online submission through the Massachusetts Department of Revenue's e-filing system.

- Mailing a paper copy of the completed form to the appropriate state address.

- In-person submission at local Department of Revenue offices, if necessary.

Quick guide on how to complete 2020 form 3 partnership return of income massgov

Effortlessly Prepare Form 3 Partnership Return Of Income Mass gov on Any Device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed forms, as you can obtain the appropriate template and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents promptly without any delays. Manage Form 3 Partnership Return Of Income Mass gov on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

The easiest way to edit and eSign Form 3 Partnership Return Of Income Mass gov seamlessly

- Find Form 3 Partnership Return Of Income Mass gov and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of your documents or obscure sensitive information using the tools that airSlate SignNow offers specifically for that purpose.

- Produce your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a standard wet ink signature.

- Review all the information and click the Done button to save your modifications.

- Choose how you wish to submit your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from your preferred device. Modify and eSign Form 3 Partnership Return Of Income Mass gov and ensure clear communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2020 form 3 partnership return of income massgov

The best way to make an e-signature for your PDF document in the online mode

The best way to make an e-signature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

The way to generate an electronic signature straight from your mobile device

How to make an electronic signature for a PDF document on iOS devices

The way to generate an electronic signature for a PDF document on Android devices

People also ask

-

What is the 3 partnership 2020 all about?

The 3 partnership 2020 refers to a collaboration aimed at enhancing document management solutions through airSlate SignNow. This partnership allows businesses to streamline their eSigning processes while ensuring compliance and security. By leveraging the strengths of this collaboration, users benefit from a more integrated and efficient workflow.

-

How does airSlate SignNow support the 3 partnership 2020?

airSlate SignNow supports the 3 partnership 2020 by providing an advanced eSignature platform that integrates seamlessly with various third-party applications. This allows users to easily send, sign, and manage documents while maintaining a smooth experience across different systems. It's a great way to enhance productivity and collaboration.

-

What pricing plans are available for the 3 partnership 2020?

Pricing plans for the 3 partnership 2020 are designed to be cost-effective and cater to different business sizes. airSlate SignNow offers various tiers, including both monthly and annual options to suit your needs. With competitive pricing, businesses can easily find a plan that fits their budget while maximizing their document management capabilities.

-

What are the key features of the airSlate SignNow solution as part of the 3 partnership 2020?

Key features of airSlate SignNow within the 3 partnership 2020 include customizable templates, robust security measures, and mobile compatibility. These features ensure that users can send and manage documents conveniently, securely, and efficiently. Additionally, the platform supports multiple file formats, enhancing versatility for users.

-

What benefits can I expect from the 3 partnership 2020?

The 3 partnership 2020 brings numerous benefits, including increased efficiency and reduced turnaround times for document signing. By utilizing airSlate SignNow, businesses can enhance customer satisfaction with faster document processing. Furthermore, the partnership ensures your transactions remain secure and compliant.

-

Can I integrate airSlate SignNow with other applications as part of the 3 partnership 2020?

Yes, airSlate SignNow offers seamless integration with a variety of applications as part of the 3 partnership 2020. This allows businesses to connect their existing workflows and enhance productivity by using familiar tools. The integrations make it easy to manage documents across platforms without any hassle.

-

How does the 3 partnership 2020 improve document security?

The 3 partnership 2020 enhances document security through airSlate SignNow's comprehensive security features, including encryption and access control. These measures ensure that your sensitive information is protected throughout the signing process. This partnership prioritizes compliance with regulatory standards, giving users peace of mind.

Get more for Form 3 Partnership Return Of Income Mass gov

- Termination conservatorship form

- Motion order notice form

- Order terminating conservatorship colorado form

- Waiver of hearing waiver of accountings waiver of audit and approval of schedule of distribution colorado form

- Colorado deposit form

- Heirs devisees form

- Notice of hearing as to determination of heirs or devisees colorado form

- Colorado notice hearing form

Find out other Form 3 Partnership Return Of Income Mass gov

- eSign Texas Insurance Affidavit Of Heirship Myself

- Help Me With eSign Kentucky Legal Quitclaim Deed

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free