as of 12720 This New Version of the it 4 Combines and Replaces the Following Forms it 4 Previous Version, it 4NR, it 4 MIL, and 2020-2026

Overview of the IT 4 Form

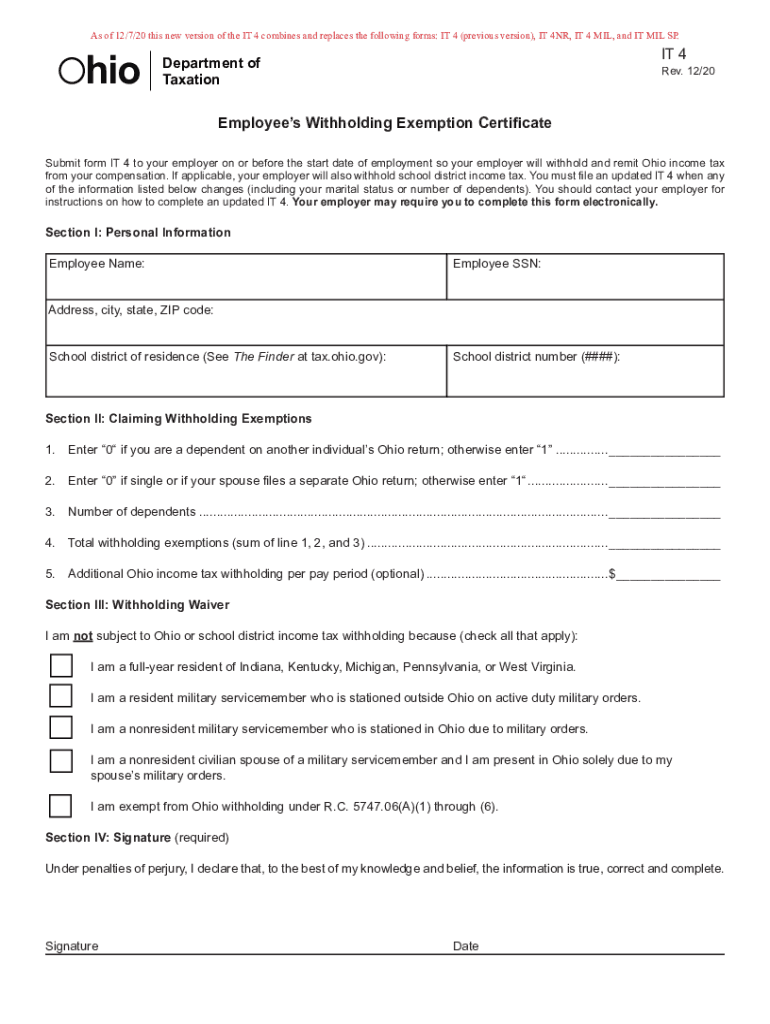

The IT 4 form is a crucial document used in Ohio for tax withholding purposes. As of January 1, 2020, this new version of the IT 4 combines and replaces previous forms, including the IT 4NR, IT 4 MIL, and IT MIL SP. This consolidation simplifies the process for taxpayers and employers alike, ensuring that all necessary information is captured in a single document. Understanding the specifics of this form is essential for compliance with state tax regulations.

Steps to Complete the IT 4 Form

Completing the IT 4 form involves several key steps to ensure accuracy and compliance. First, gather all necessary personal information, including your name, address, and Social Security number. Next, determine your filing status and the number of allowances you wish to claim. This will affect the amount of state income tax withheld from your paycheck. After filling out the form, review it for any errors before submitting it to your employer. Ensure that you keep a copy for your records.

Legal Use of the IT 4 Form

The IT 4 form serves as an official document that informs employers about the appropriate amount of state tax to withhold from employees’ wages. To be legally binding, the form must be filled out accurately and submitted in a timely manner. Compliance with state tax laws is essential, as failure to submit the form can result in incorrect withholding and potential penalties. Employers are required to maintain these forms for their records to demonstrate compliance with withholding regulations.

Filing Deadlines and Important Dates

It is important to be aware of the filing deadlines associated with the IT 4 form. Typically, employees should submit their completed form to their employer at the start of their employment or whenever they experience a change in their tax situation. Employers must ensure that they withhold the correct amount of state tax based on the information provided on the IT 4 form. Staying informed about deadlines helps prevent issues with tax compliance and potential penalties.

Eligibility Criteria for the IT 4 Form

Eligibility to use the IT 4 form generally applies to all employees working in Ohio. This includes full-time and part-time employees, as well as those who may be self-employed. However, specific eligibility criteria may vary based on individual tax situations, such as residency status or income level. It is advisable for taxpayers to review their circumstances to ensure that they are using the correct form for their tax withholding needs.

Examples of Using the IT 4 Form

Understanding how to use the IT 4 form can be clarified through practical examples. For instance, an employee who recently moved to Ohio from another state will need to complete the IT 4 form to adjust their tax withholding. Similarly, a parent who has had a child may wish to claim additional allowances to reduce their tax burden. Each scenario highlights the importance of accurately filling out the IT 4 form to reflect personal tax situations and ensure proper withholding.

Quick guide on how to complete as of 12720 this new version of the it 4 combines and replaces the following forms it 4 previous version it 4nr it 4 mil and it

Effortlessly Prepare As Of 12720 This New Version Of The IT 4 Combines And Replaces The Following Forms IT 4 previous Version, IT 4NR, IT 4 MIL, And on Any Device

Managing documents online has become increasingly favored by companies and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed papers, allowing you to access the necessary forms and securely store them online. airSlate SignNow provides you with all the tools required to swiftly create, modify, and eSign your documents without delays. Handle As Of 12720 This New Version Of The IT 4 Combines And Replaces The Following Forms IT 4 previous Version, IT 4NR, IT 4 MIL, And on any platform with the airSlate SignNow apps for Android or iOS and streamline any document-related task today.

How to Modify and eSign As Of 12720 This New Version Of The IT 4 Combines And Replaces The Following Forms IT 4 previous Version, IT 4NR, IT 4 MIL, And with Ease

- Find As Of 12720 This New Version Of The IT 4 Combines And Replaces The Following Forms IT 4 previous Version, IT 4NR, IT 4 MIL, And and click Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize relevant sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information, then click the Done button to save your changes.

- Choose how you wish to submit your form, via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or mislaid files, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign As Of 12720 This New Version Of The IT 4 Combines And Replaces The Following Forms IT 4 previous Version, IT 4NR, IT 4 MIL, And to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct as of 12720 this new version of the it 4 combines and replaces the following forms it 4 previous version it 4nr it 4 mil and it

Create this form in 5 minutes!

How to create an eSignature for the as of 12720 this new version of the it 4 combines and replaces the following forms it 4 previous version it 4nr it 4 mil and it

The way to make an e-signature for your PDF document online

The way to make an e-signature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

How to make an electronic signature straight from your smart phone

The way to make an electronic signature for a PDF document on iOS

How to make an electronic signature for a PDF document on Android OS

People also ask

-

What is the it4 2025 pricing model for airSlate SignNow?

The it4 2025 pricing model for airSlate SignNow provides various plans tailored to fit businesses of all sizes. Each plan is designed to offer maximum value, ensuring your investment leads to signNow savings in document management. You can choose a monthly or annual subscription based on your organizational needs.

-

What features does airSlate SignNow offer under the it4 2025 category?

Under the it4 2025 category, airSlate SignNow offers features such as document templates, in-person signing, advanced security settings, and workflow automation. These features streamline the eSigning process and enhance the overall efficiency of handling documents. You can also track document status and obtain real-time notifications.

-

How can airSlate SignNow benefit my business in 2025?

By utilizing airSlate SignNow in 2025, your business can signNowly reduce operational costs and increase productivity. The platform's intuitive design makes it easy for teams to collaborate, ensuring faster turnaround times for document approvals. This leads to enhanced customer satisfaction and improved business relationships.

-

Is airSlate SignNow integrable with other software in 2025?

Yes, airSlate SignNow is equipped with various integrations that make it compatible with popular business tools and software programs in 2025. It can seamlessly connect with CRM systems, cloud storage, and productivity apps to enhance your workflow. This versatility allows for a customized experience tailored to your business operations.

-

What kind of support does airSlate SignNow provide for it4 2025 users?

airSlate SignNow offers robust customer support for it4 2025 users, including live chat, email support, and an extensive knowledge base. Whether you have technical questions or need help navigating the platform, their dedicated support team is available to assist you. This ensures you can maximize the value of your eSigning experience.

-

Can I access airSlate SignNow on mobile devices in 2025?

Absolutely! airSlate SignNow is fully optimized for mobile access in 2025, allowing users to manage documents on the go. With apps available for both iOS and Android, you can easily send, sign, and track documents from your smartphone or tablet. This flexibility enhances your ability to work efficiently, regardless of your location.

-

What security measures does airSlate SignNow have in place for it4 2025?

Security is a top priority for airSlate SignNow, especially for it4 2025 users. The platform employs advanced encryption, multi-factor authentication, and compliance with industry standards such as GDPR and HIPAA. These measures ensure that your documents and sensitive information remain safe and secure while using the service.

Get more for As Of 12720 This New Version Of The IT 4 Combines And Replaces The Following Forms IT 4 previous Version, IT 4NR, IT 4 MIL, And

- Contractors forms package colorado

- Power of attorney for sale of motor vehicle colorado form

- Revocation of statutory power of attorney colorado form

- Wedding planning or consultant package colorado form

- Statutory durable power of attorney colorado form

- Hunting forms package colorado

- Identity theft recovery package colorado form

- Medical durable power of attorney colorado form

Find out other As Of 12720 This New Version Of The IT 4 Combines And Replaces The Following Forms IT 4 previous Version, IT 4NR, IT 4 MIL, And

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast