Fillable Online Not Ready to File Your Taxes? Extension Form

Understanding the Nebraska Form 457

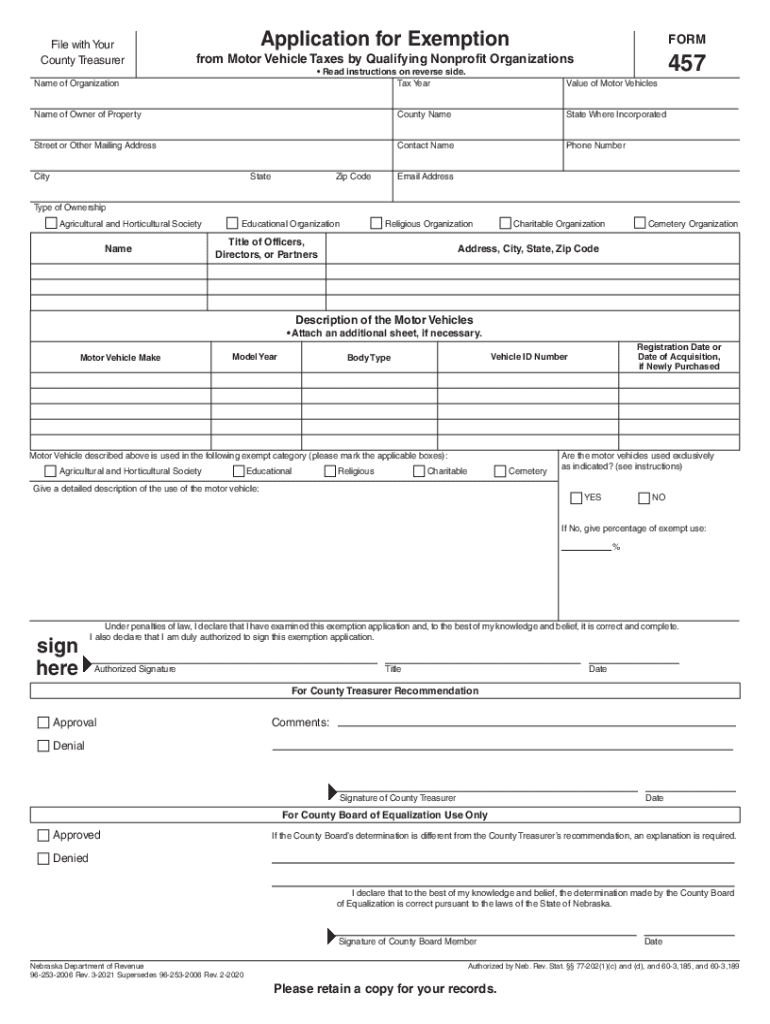

The Nebraska Form 457 is a crucial document used primarily for tax purposes within the state. This form is designed to help individuals and businesses report specific revenue and tax information accurately. It is essential for ensuring compliance with state tax regulations and can impact tax liabilities significantly. Understanding the requirements and implications of the 457 form can help taxpayers navigate their obligations effectively.

Steps to Complete the Nebraska Form 457

Filling out the Nebraska Form 457 involves several key steps that ensure accuracy and compliance. Begin by gathering all necessary financial documents, including income statements and previous tax returns. Next, carefully read the instructions provided with the form to understand the specific information required. Fill out the form completely, ensuring that all figures are accurate and match your supporting documents. After completing the form, review it for any errors before submission. Finally, choose your preferred submission method, whether online, by mail, or in person, to ensure timely processing.

Legal Use of the Nebraska Form 457

The Nebraska Form 457 holds legal significance as it is utilized for reporting tax information to the state. For the form to be considered legally binding, it must be completed accurately and submitted within the designated deadlines. Compliance with relevant tax laws, such as the Nebraska Revised Statutes, is essential to avoid penalties. Additionally, using a reliable eSignature solution can enhance the legal standing of the form by providing an electronic certificate that verifies the identity of the signer.

Filing Deadlines for the Nebraska Form 457

It is important to be aware of the filing deadlines associated with the Nebraska Form 457 to avoid late penalties. Typically, the form must be submitted by the established state tax deadlines, which may vary based on individual circumstances. Keeping track of these dates ensures that taxpayers remain compliant and can avoid unnecessary fines. It is advisable to check the Nebraska Department of Revenue’s official website for the most current deadlines and any updates regarding the filing process.

Required Documents for the Nebraska Form 457

To complete the Nebraska Form 457 accurately, several documents are typically required. These may include income statements, previous tax returns, and any relevant financial records that support the information being reported. Having these documents on hand will facilitate a smoother filing process and help ensure that all required information is provided. It is also beneficial to maintain organized records for future reference and compliance checks.

Form Submission Methods for the Nebraska Form 457

The Nebraska Form 457 can be submitted through various methods, providing flexibility for taxpayers. The options typically include online submission via the Nebraska Department of Revenue’s website, mailing a paper copy to the appropriate address, or delivering it in person at designated tax offices. Each method has its own processing times and requirements, so it is essential to choose the one that best suits your needs while ensuring compliance with submission guidelines.

Eligibility Criteria for the Nebraska Form 457

Eligibility for using the Nebraska Form 457 is generally based on the individual's or business's specific tax situation. Taxpayers must meet certain criteria related to income levels, type of revenue reported, and compliance with state tax laws. Understanding these eligibility requirements is crucial for ensuring that the form is used appropriately and that all necessary information is reported correctly. Taxpayers should consult with a tax professional if they have questions about their eligibility for this form.

Quick guide on how to complete fillable online not ready to file your taxes extension

Effortlessly Prepare Fillable Online Not Ready To File Your Taxes? Extension on Any Device

Digital document management has gained signNow traction among businesses and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed paperwork, allowing you to easily locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and electronically sign your documents quickly without delays. Manage Fillable Online Not Ready To File Your Taxes? Extension across any platform using airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

The Easiest Way to Edit and Electronically Sign Fillable Online Not Ready To File Your Taxes? Extension Without Effort

- Locate Fillable Online Not Ready To File Your Taxes? Extension and select Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of the documents or redact sensitive information using the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Choose your delivery method for the form: via email, SMS, invitation link, or download it to your computer.

Eliminate the hassles of lost or misplaced files, endless form searching, and errors that require reprinting document copies. airSlate SignNow addresses all your document management needs with just a few clicks from your device of choice. Edit and electronically sign Fillable Online Not Ready To File Your Taxes? Extension to ensure outstanding communication at any stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fillable online not ready to file your taxes extension

The best way to create an e-signature for a PDF file in the online mode

The best way to create an e-signature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

The way to generate an electronic signature straight from your smartphone

The way to generate an e-signature for a PDF file on iOS devices

The way to generate an electronic signature for a PDF document on Android

People also ask

-

What is airSlate SignNow and how does it relate to '457'?

AirSlate SignNow is an innovative eSignature solution that empowers businesses to streamline document signing processes. With the number '457' referring to our range of applications, SignNow offers tools that enhance productivity and secure electronic signatures efficiently.

-

What features does airSlate SignNow offer related to '457'?

AirSlate SignNow includes a variety of features geared towards improving document management, such as customizable templates, secure cloud storage, and real-time tracking. The functionality associated with '457' ensures that businesses can create, send, and eSign documents seamlessly and efficiently.

-

How can airSlate SignNow benefit my business based on '457'?

By utilizing airSlate SignNow, businesses can save time and reduce operational costs associated with traditional document signing. The insights provided through '457' show that companies leveraging our solution experience faster turnaround times and increased customer satisfaction.

-

What are the pricing plans for airSlate SignNow concerning '457'?

AirSlate SignNow offers competitive pricing plans designed to meet the needs of businesses of all sizes. With options tied to '457', you can choose a plan that best fits your organization's document signing requirements without breaking the bank.

-

Does airSlate SignNow integrate with other applications related to '457'?

Yes, airSlate SignNow provides seamless integrations with various applications, enhancing its functionality. The integrations associated with '457' allow businesses to connect SignNow with popular tools and workflows, making document signing even more convenient.

-

How secure is the document signing process with airSlate SignNow regarding '457'?

The security of your documents is our top priority at airSlate SignNow. Our processes incorporate advanced encryption and authentication measures, ensuring that all signed documents under '457' are safe from unauthorized access and potential bsignNowes.

-

Can I customize my documents in airSlate SignNow based on '457'?

Absolutely! AirSlate SignNow allows you to customize your documents to suit your specific requirements. This flexibility associates with '457', meaning you can create tailored templates that improve the consistency and professionalism of your documents.

Get more for Fillable Online Not Ready To File Your Taxes? Extension

- Legal last will and testament form for married person with adult children connecticut

- Ct civil union form

- Ct last will form

- Connecticut civil union form

- Legal last will and testament form for married person with minor children connecticut

- Connecticut partner form

- Codicil will form 497301405

- Mutual wills package with last wills and testaments for married couple with adult children connecticut form

Find out other Fillable Online Not Ready To File Your Taxes? Extension

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed

- eSign Alaska Legal Cease And Desist Letter Simple

- eSign Arkansas Legal LLC Operating Agreement Simple

- eSign Alabama Life Sciences Residential Lease Agreement Fast

- How To eSign Arkansas Legal Residential Lease Agreement

- Help Me With eSign California Legal Promissory Note Template

- eSign Colorado Legal Operating Agreement Safe

- How To eSign Colorado Legal POA

- eSign Insurance Document New Jersey Online

- eSign Insurance Form New Jersey Online

- eSign Colorado Life Sciences LLC Operating Agreement Now

- eSign Hawaii Life Sciences Letter Of Intent Easy

- Help Me With eSign Hawaii Life Sciences Cease And Desist Letter

- eSign Hawaii Life Sciences Lease Termination Letter Mobile

- eSign Hawaii Life Sciences Permission Slip Free

- eSign Florida Legal Warranty Deed Safe

- Help Me With eSign North Dakota Insurance Residential Lease Agreement

- eSign Life Sciences Word Kansas Fast

- eSign Georgia Legal Last Will And Testament Fast